“Early Innings” Stock Market (And Sentiment Results)

Key Market Outlook(s) and Pick(s)

On Monday, I joined Liz Claman on Fox Business “Claman Countdown” to discuss markets, the economy, Alibaba, Nvidia, Comstock Resources, Energy, and a lot more. Thanks to Liz and Brooke Haliscak for having me on:

On Monday, I joined Julie Hyman on Yahoo! Finance to discuss markets, picks, outlook, and more. Thanks to Julie and Justin Oliver for having me on:

On Wednesday I joined Stuart Varney on Fox Business for the full hour – as company. We discussed markets, economy, headlines, stock picks and a lot more. Thanks to Stuart, Peyton Jennings and Cristian Dagger for having me on:

Quick PayPal Update

Despite Mr. Market’s rather muted reaction, last week PayPal delivered exactly the type of “shock the world” move Alex Chriss first promised when he took the reins as CEO, signing a multiyear deal with Google on Digital Commerce:

The partnership cements PayPal as a “key” PSP across products like Google Ads, Google Cloud, and Google Play. What exactly “key” means, we do not fully know yet. But we do know this. Last quarter, Google Ads generated $71.3 billion in revenue. Google Cloud brought in $13.6 billion. Whether this means PayPal will now process 10% or 40% of payments, either way it likely represents a significant uplift to TPV. In other words, if you are part of the multi-billion user Google ecosystem using any of their products, chances are PayPal is now your payment processor.

On top of that, PayPal can leverage Google’s AI capabilities to enhance payment services and build out Agentic shopping — with the added bonus of not having to shell out tens of billions in capex to develop it from scratch. AKA, PayPal is another example of playing the BENEFICIARIES of AI without owning the companies forced to pick up the tab and erode earnings in the process.

Meanwhile, you still can’t give the stock away. For us, there is nothing to overthink with PYPL. Alex Chriss is a proven winner and continues to execute on everything he promised from the very beginning — and then some. The only problem is the market just can’t wait, at least not until the story is so obvious it hits them over the head.

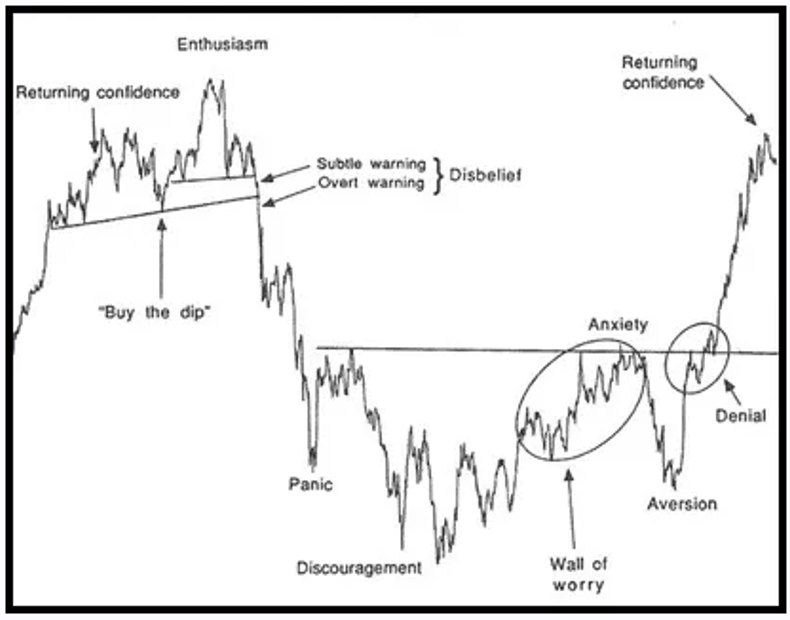

If you’re wondering when we’ll see that play out in real time, look no further than the Justin Mamis sentiment cycle:

Here’s where we stand with PayPal:

After climbing the wall of worry all the way up to $90 a share, we reached the anxiety stage and are now knocked back into aversion. It won’t be long from here before we move into denial and then quickly break out, working our way back to confidence, by which point we’ll likely be sitting at a double from our cost basis. Tomorrow’s newspaper, today.

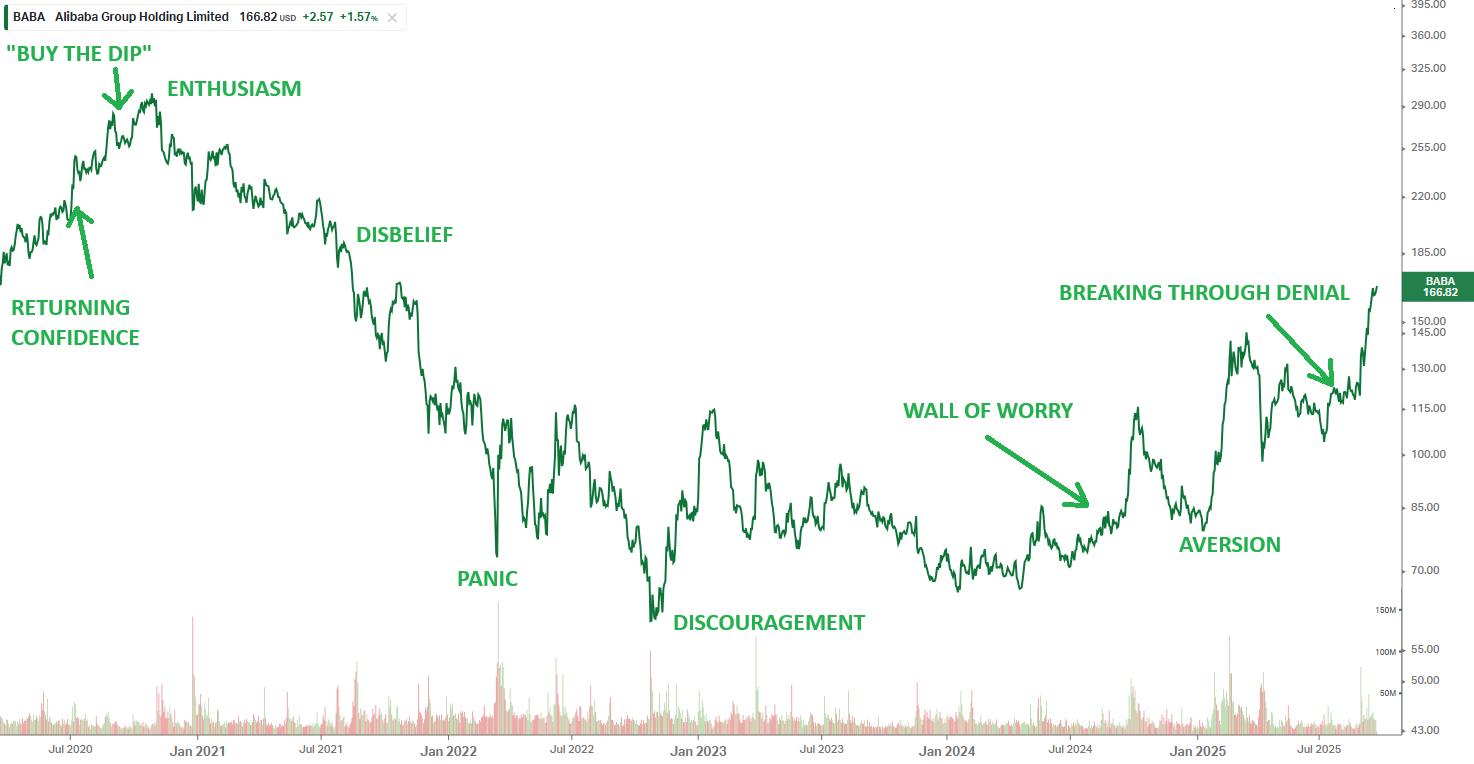

PayPal actually reminds us a lot of Alibaba, which is likely just a few months ahead on the sentiment cycle. With Alibaba, we’ve just broken through denial and are starting the parabolic move back toward new highs:

Both stocks have been grinding sideways for the past three years. But as we like to say, you can only hold a beach ball underwater for so long. Alibaba is just beginning to break the surface, and we don’t expect PayPal to be much farther behind…

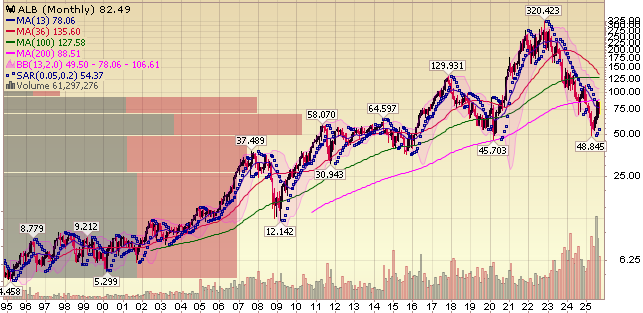

Albemarle Update

There’s been a lot of noise over the past couple of months surrounding Albemarle, the world’s largest and lowest-cost lithium producer, whipsawing both its share price and the broader lithium market. After grinding sideways near multi-year lows in the wake of the Liberation Day sell-off, the stock began to catch a bid on the news of China’s “anti-involution” campaign and efforts to curb overcapacity. This was welcome news for Albemarle shareholders and the overall lithium market, which has been in surplus since late 2022, largely due to small-scale, subsidized producers in China, now seemingly being taken offline.

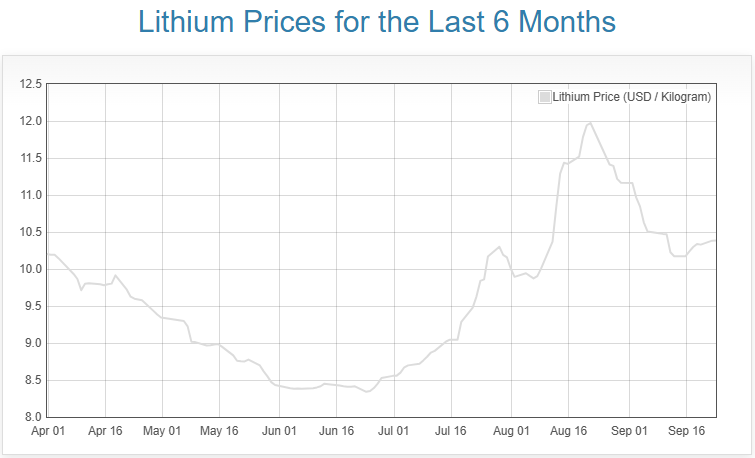

The rally continued when CATL, the world’s largest battery maker, suspended production at one of its largest lithium mines (~4% of global supply in 2024) for six to 12 months because of an expired mining permit. That news helped push lithium prices from multi-year lows of $8,500 per metric ton to around $12,000 by late August. The gains proved short-lived, however, with CATL reopening the mine after only one month, sending prices back to ~$10,400 per metric ton, though still well above the summer lows.

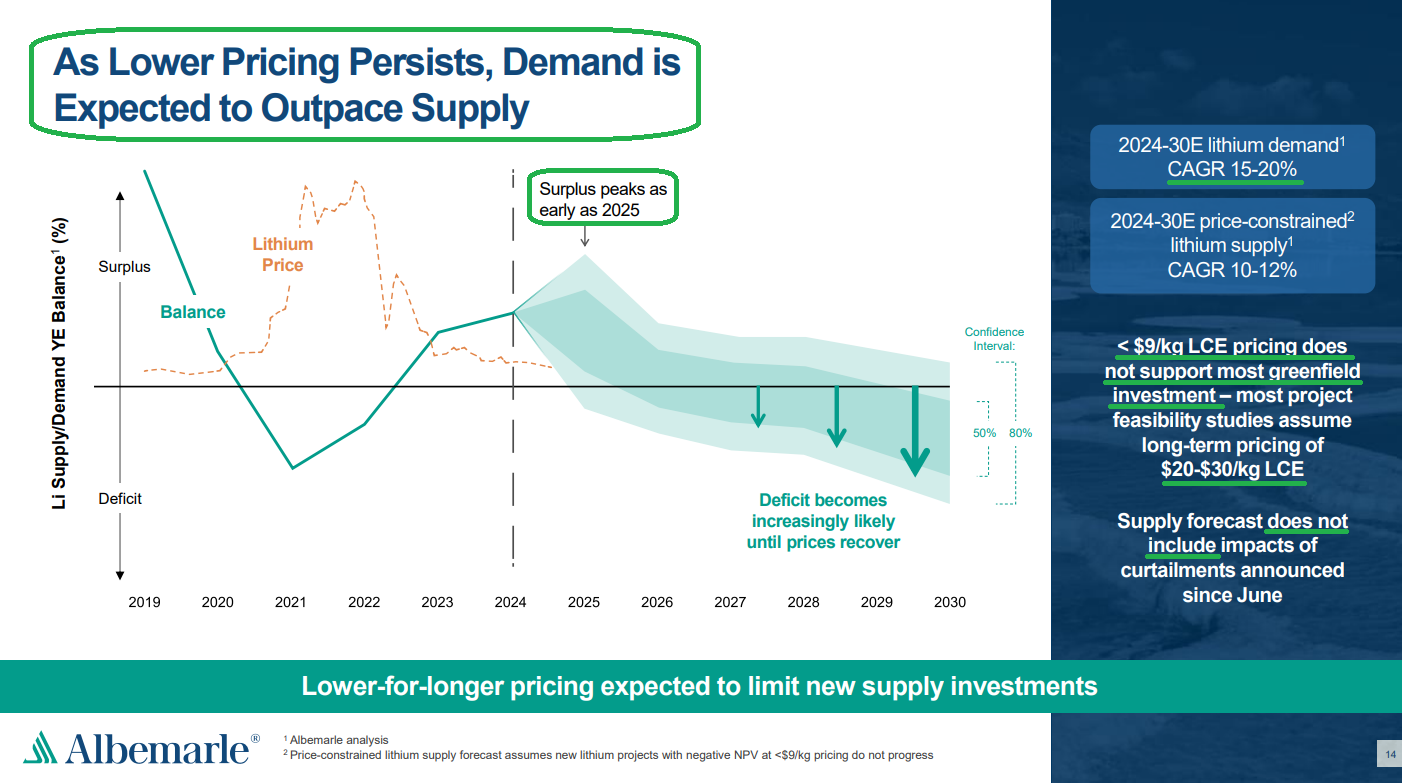

At the end of the day, all of the recent headlines and volatility are really just noise for Albemarle. The short-term supply and demand swings are merely fits and starts in what we continue to view as the very beginning of a multi-year secular cycle. The only thing that truly matters and moves the needle is the chart below:

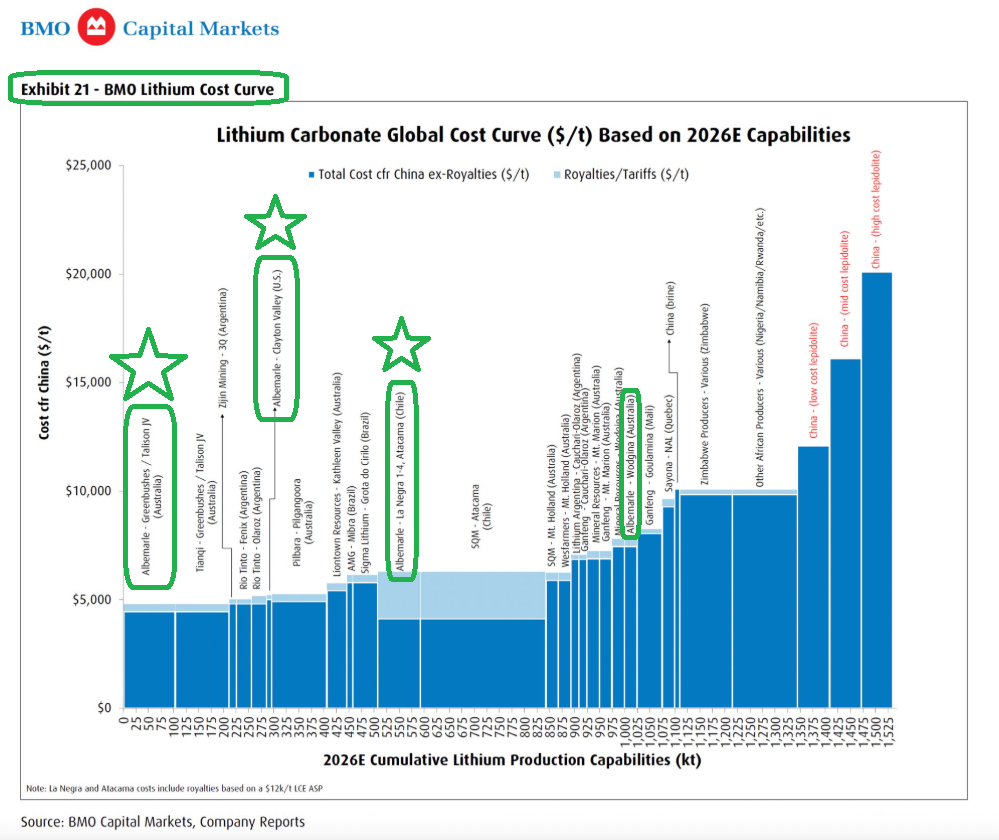

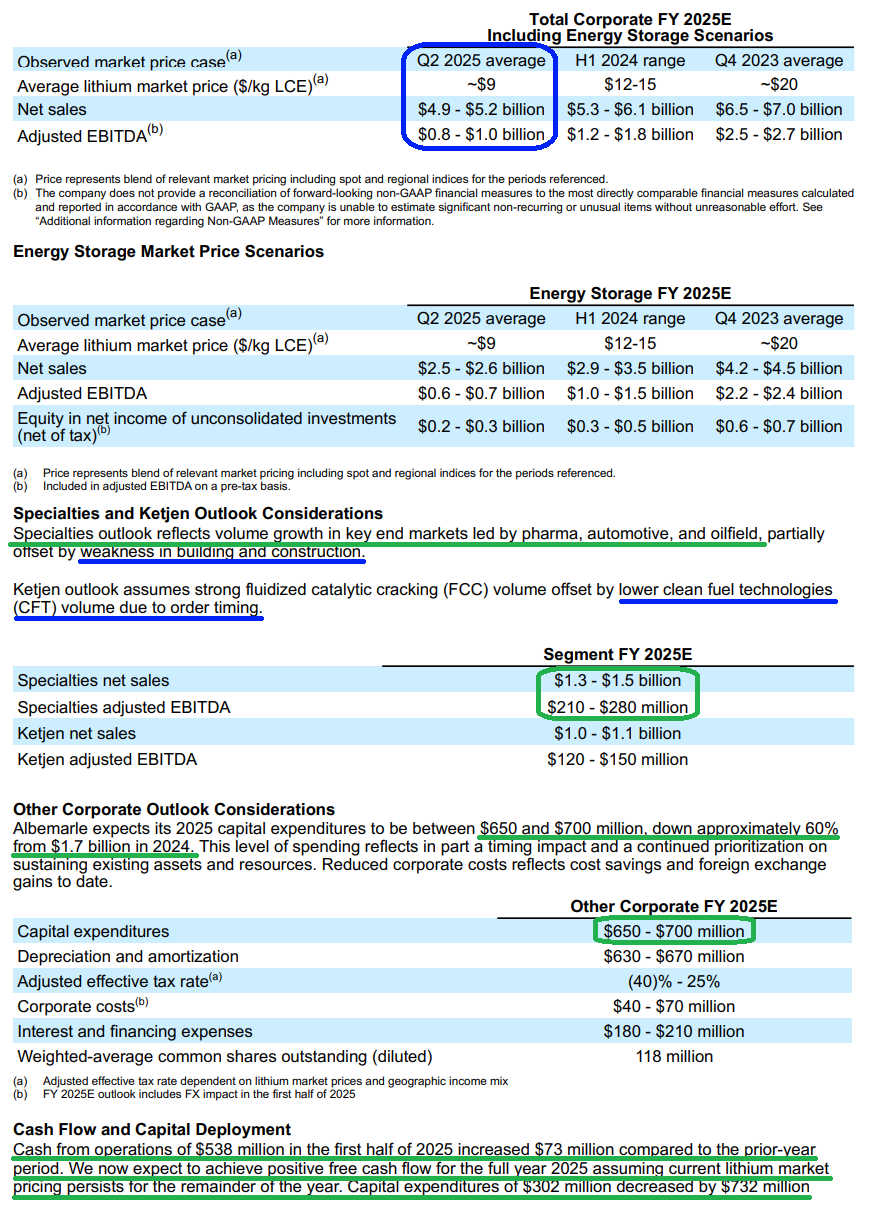

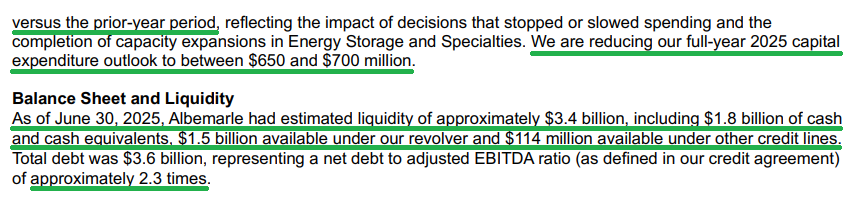

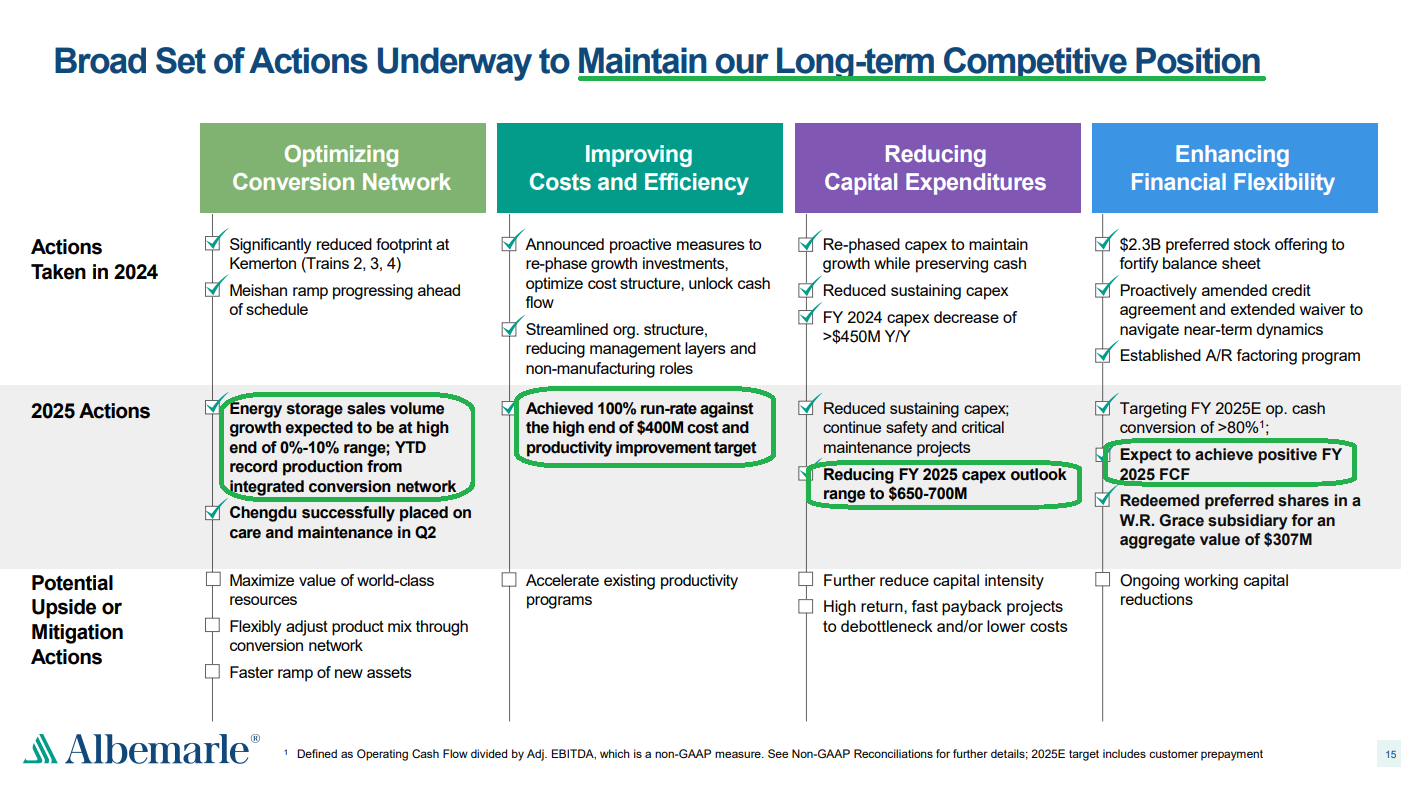

Because Albemarle sits at the very bottom of the cost curve, it has been able to do what any best-in-class operator does in a downturn: cut costs ($400 million in savings), dial back capex ($650 to $700 million this year versus $2.1 billion in 2023), and sit on their hands and wait for the cycle to inevitably turn. Meanwhile, the johnny-come-latelies that rushed in chasing record-high lithium prices in late 2021 are still huddled under their desks in the fetal position, hoping prices bail them out. The longer lithium prices stay in the pain zone, the more of these low-quality, marginal producers will get carried out on a stretcher, with or without the added push from China’s “anti-involution” campaign. And even after a handful of Chinese mines have been taken offline, Albemarle’s management still sees 40% of global lithium capacity at or below breakeven, with only about one-third of that supply removed so far. At these prices, it’s only a matter of time before the rest (i.e., the players on the far right of the cost curve with production costs 2x Albemarle’s) start dropping like flies.

This should continue to support Albemarle and lithium prices from the supply side, with management expecting the current surplus to peak as early as this year, the market returning to balance in 2026, and potentially swinging into deficit by 2027 and beyond.

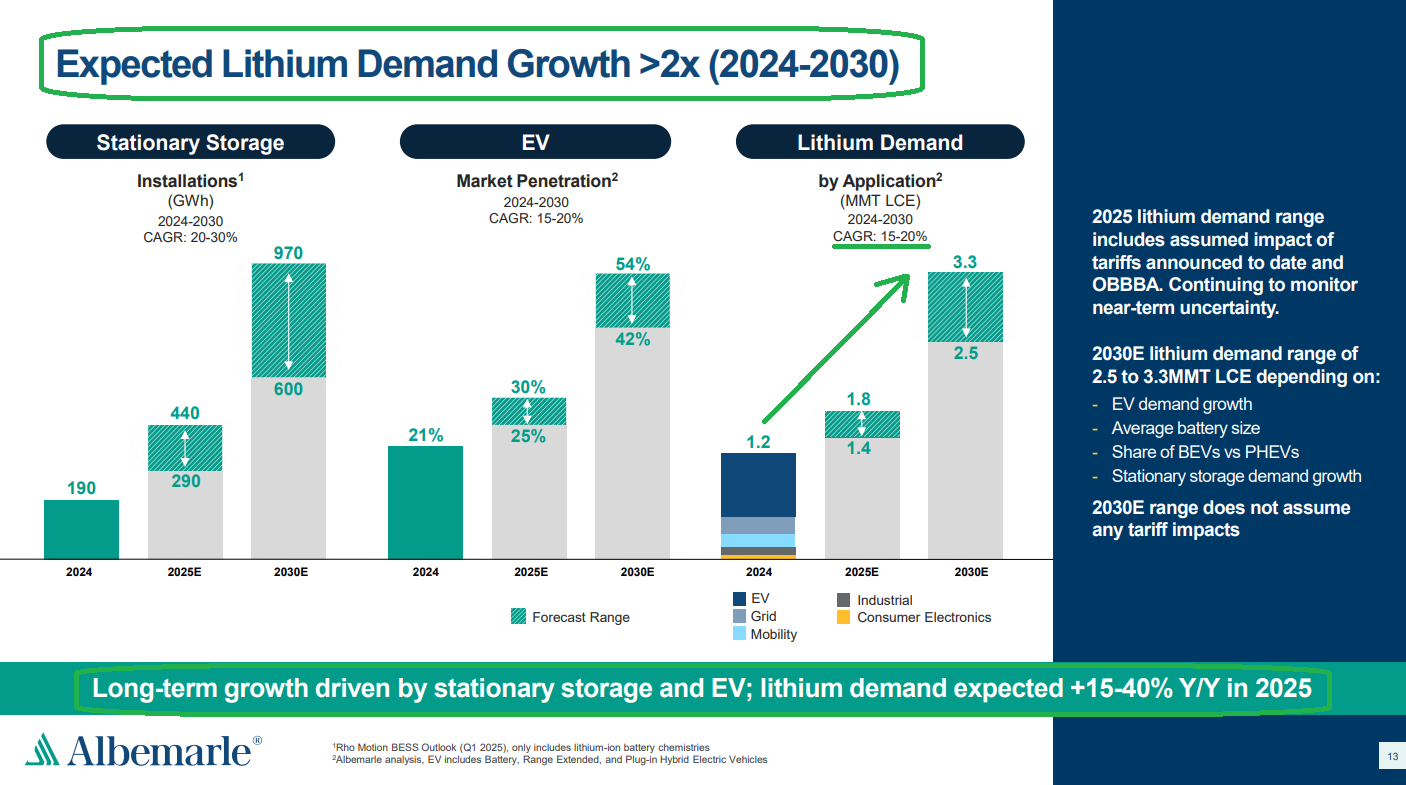

Meanwhile, while the supply side tends to dominate headlines, what doesn’t get nearly enough attention — and is arguably even more consequential — is demand. Lithium consumption is already up 35% YTD, and at current prices, demand is outpacing supply by nearly 20%. And there’s no slowdown in sight. By 2030, lithium demand will more than 2x, driven by EVs and stationary storage, hitting 2.5–3.3 MMT LCE versus 1.2 MMT in 2024 (15–20% CAGR).

Even if these estimates prove only half right, Albemarle won’t be able to keep up with the demand curve in the coming years. So while Mr. Market remains fixated on short-term supply noise, we see one of the clearest secular plays in the market. Rather than overthinking it, we are happy to sit on our hands, add on any weakness, and watch the story play out.

Here’s everything you need to know from Q2 earnings.

Q2 Earnings Breakdown

10 Key Points

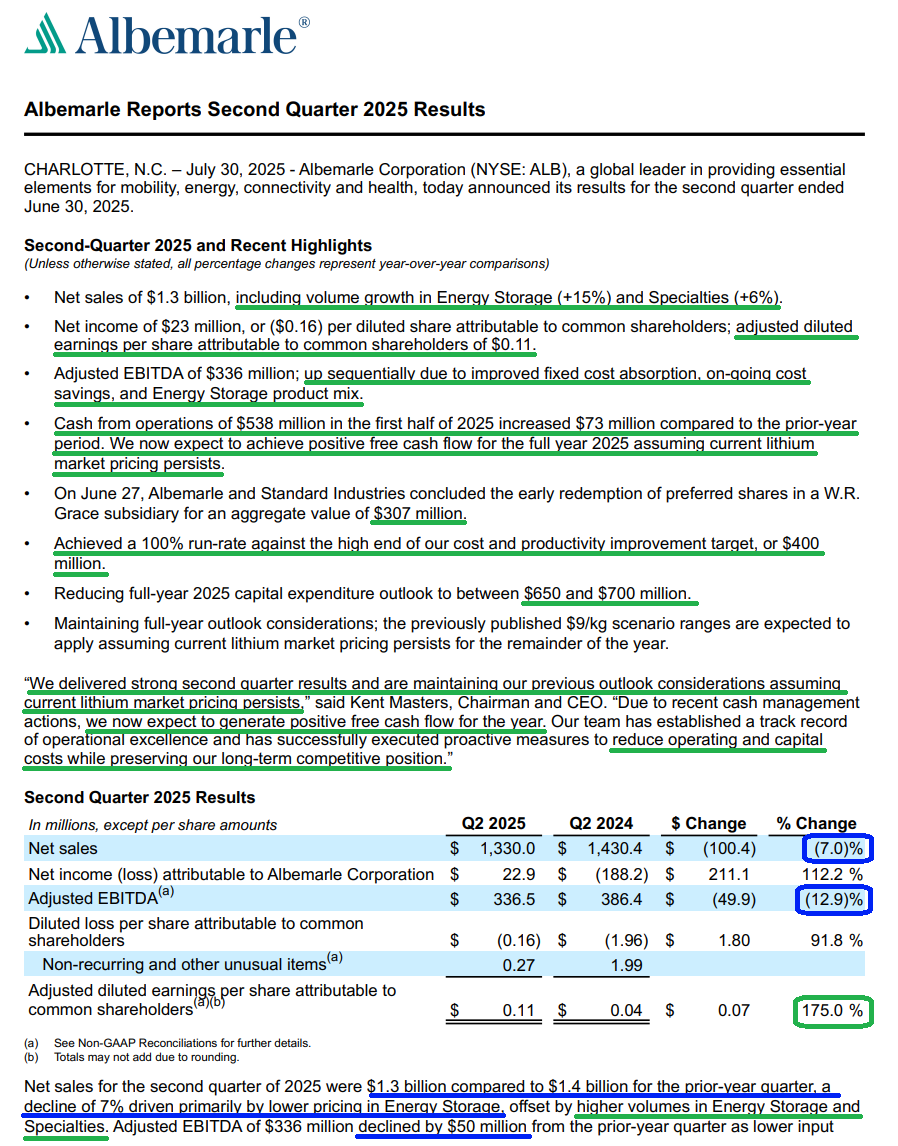

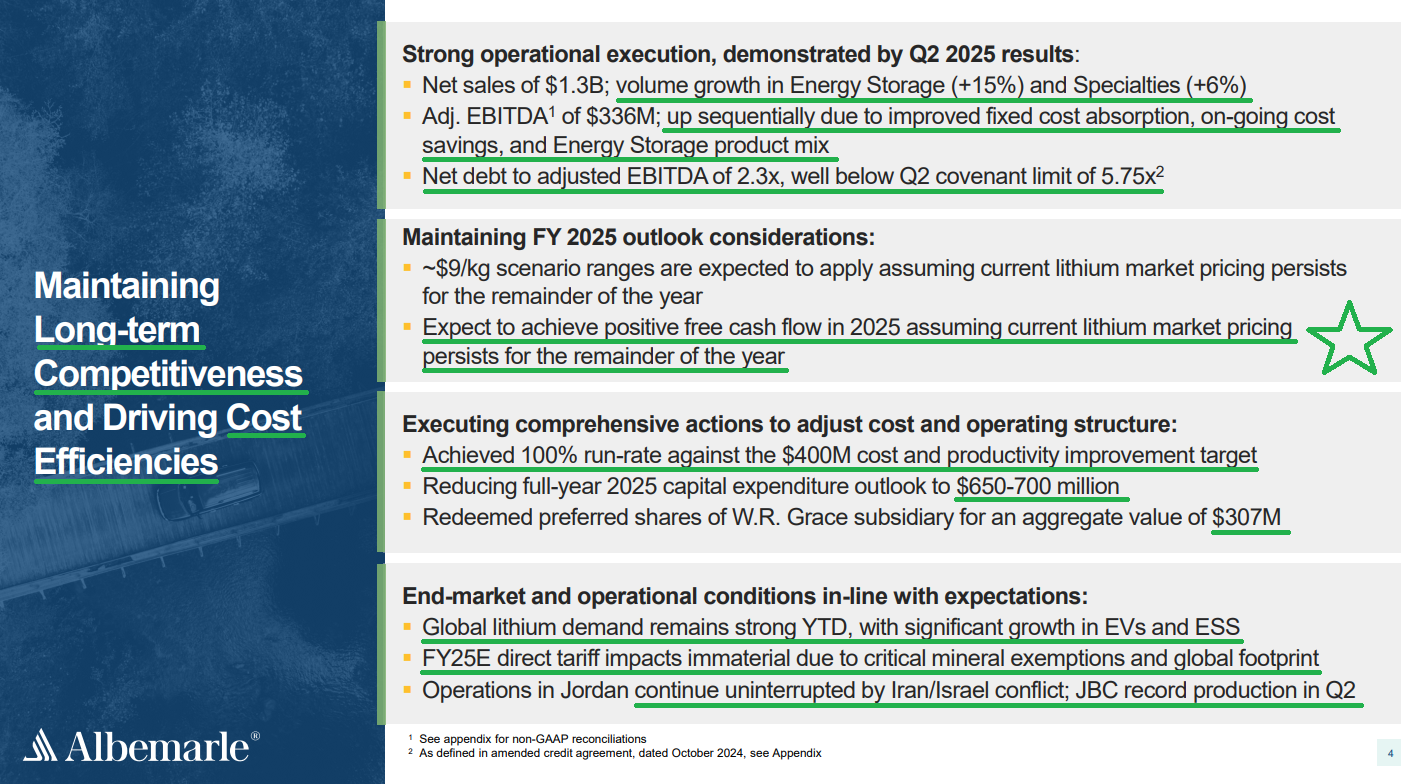

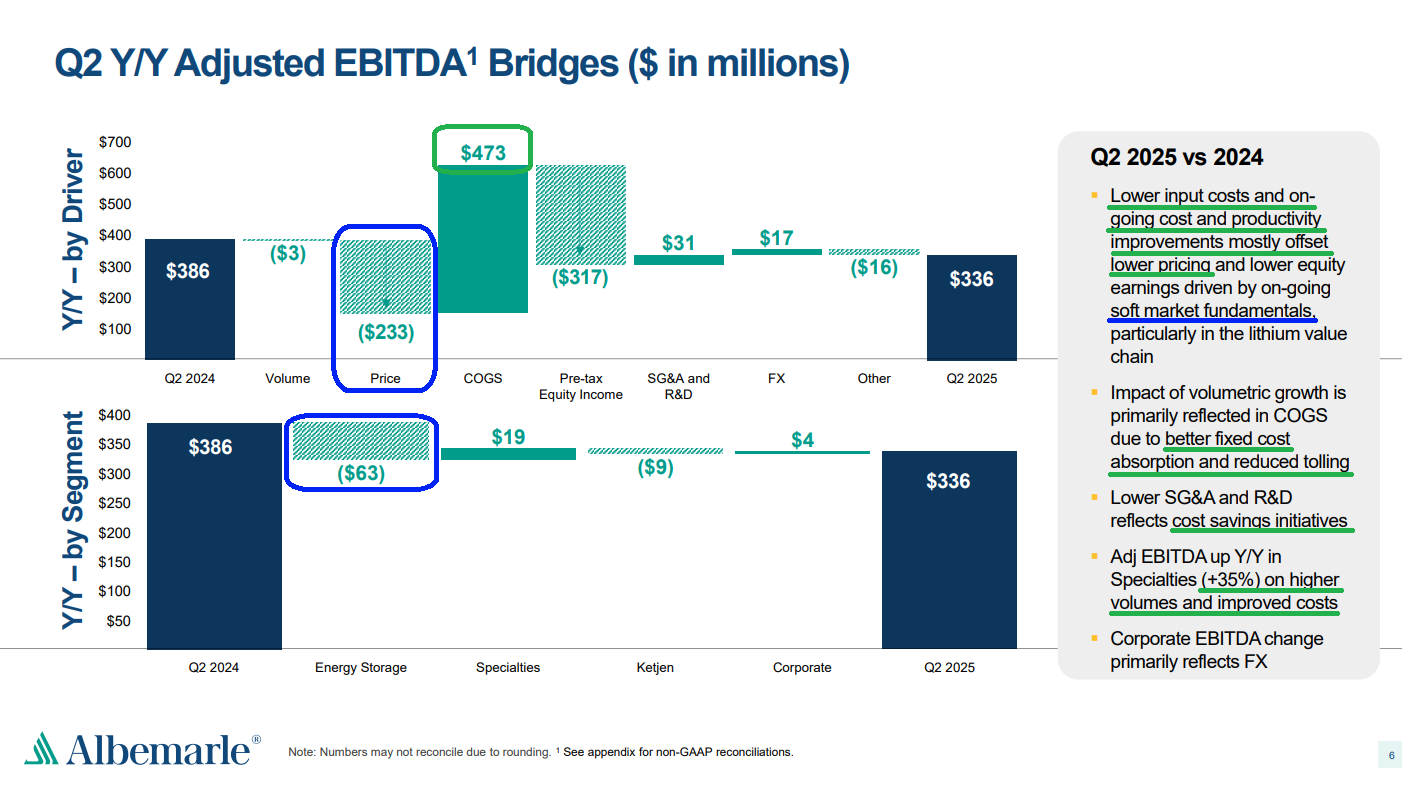

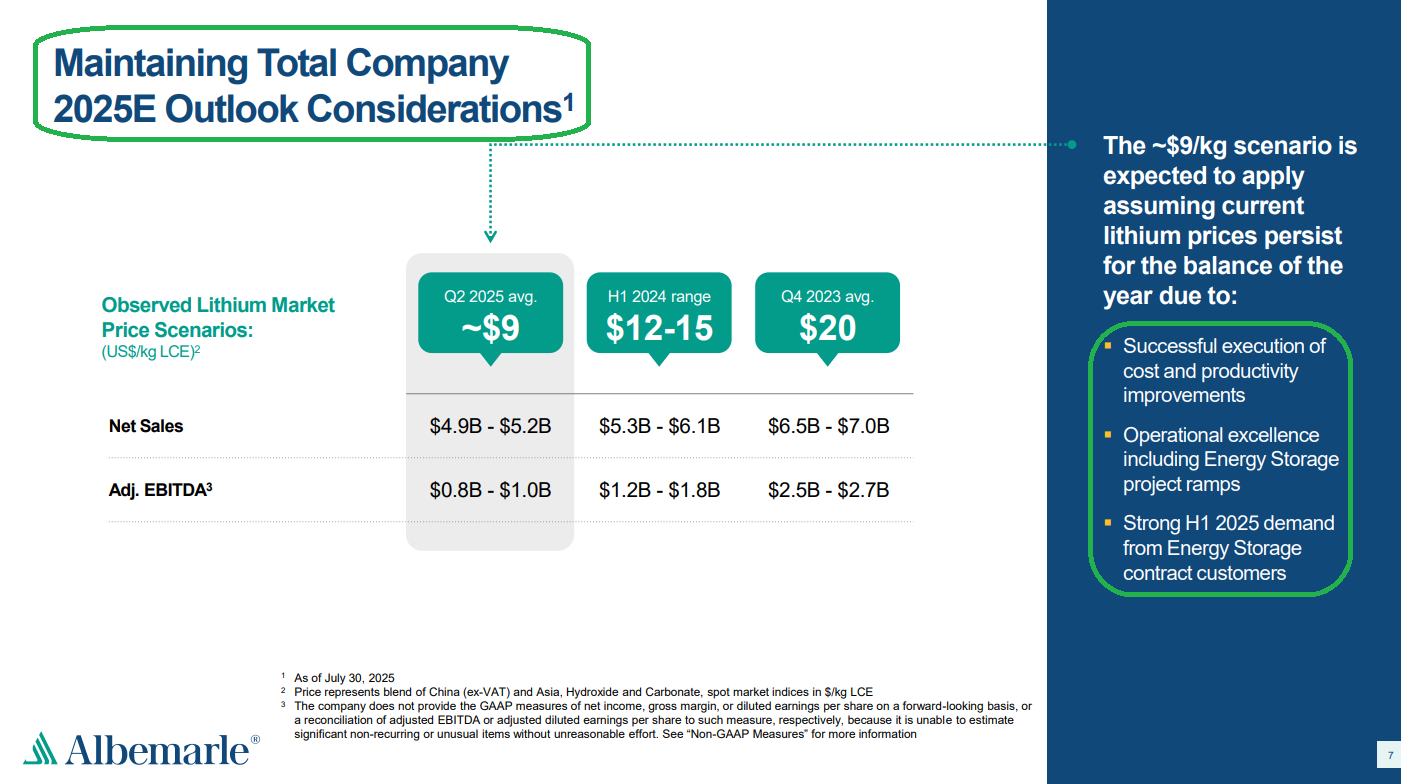

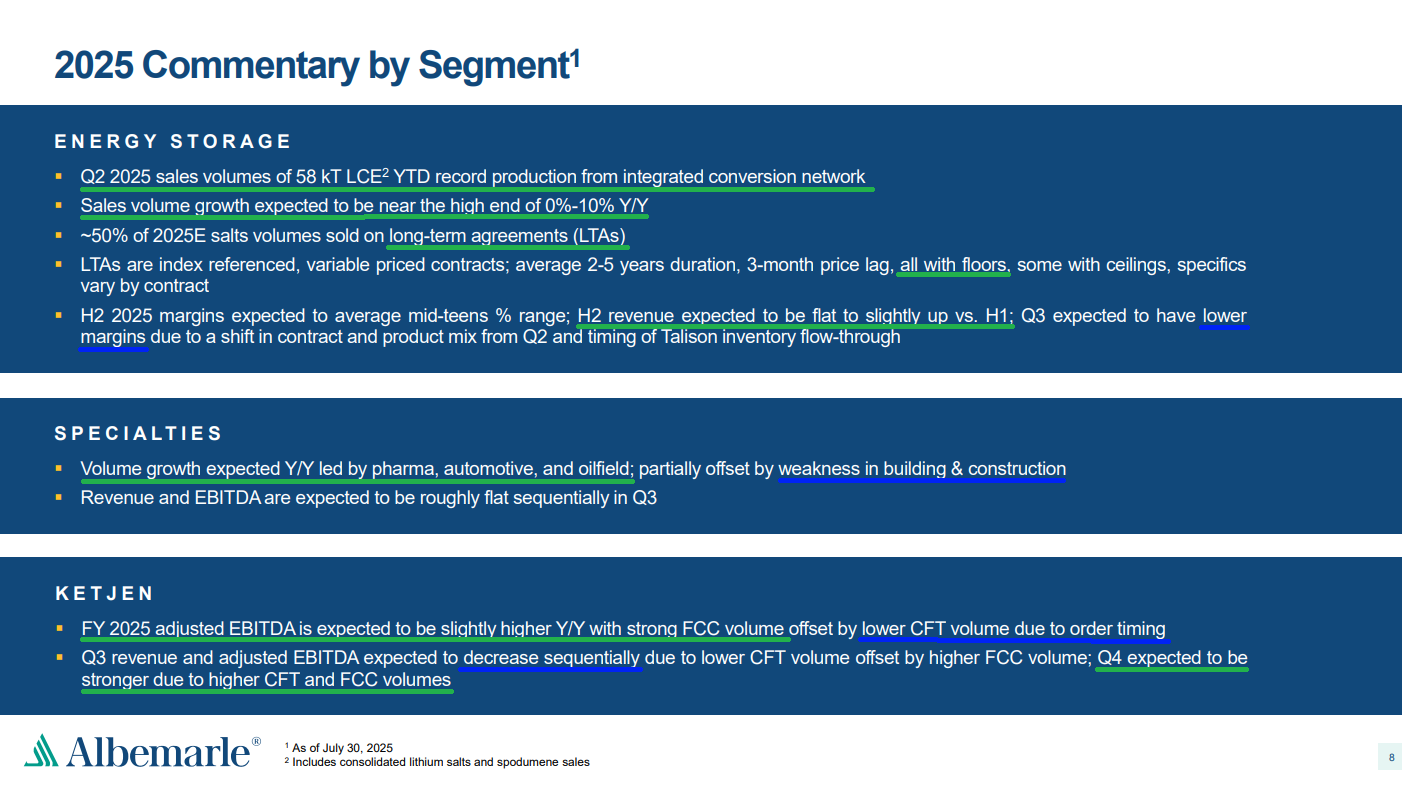

1) Q2 net sales of $1.33 billion, down 7% YoY but up sequentially, beat Street estimates by $102.8 million. Energy storage volumes rose 15%, and Specialties grew 6%, though these gains were more than offset by lower lithium pricing. Adjusted EBITDA came in at $336 million, down 12.9% YoY but up sequentially, as lower input costs and cost savings initiatives were mostly offset by weaker pricing.

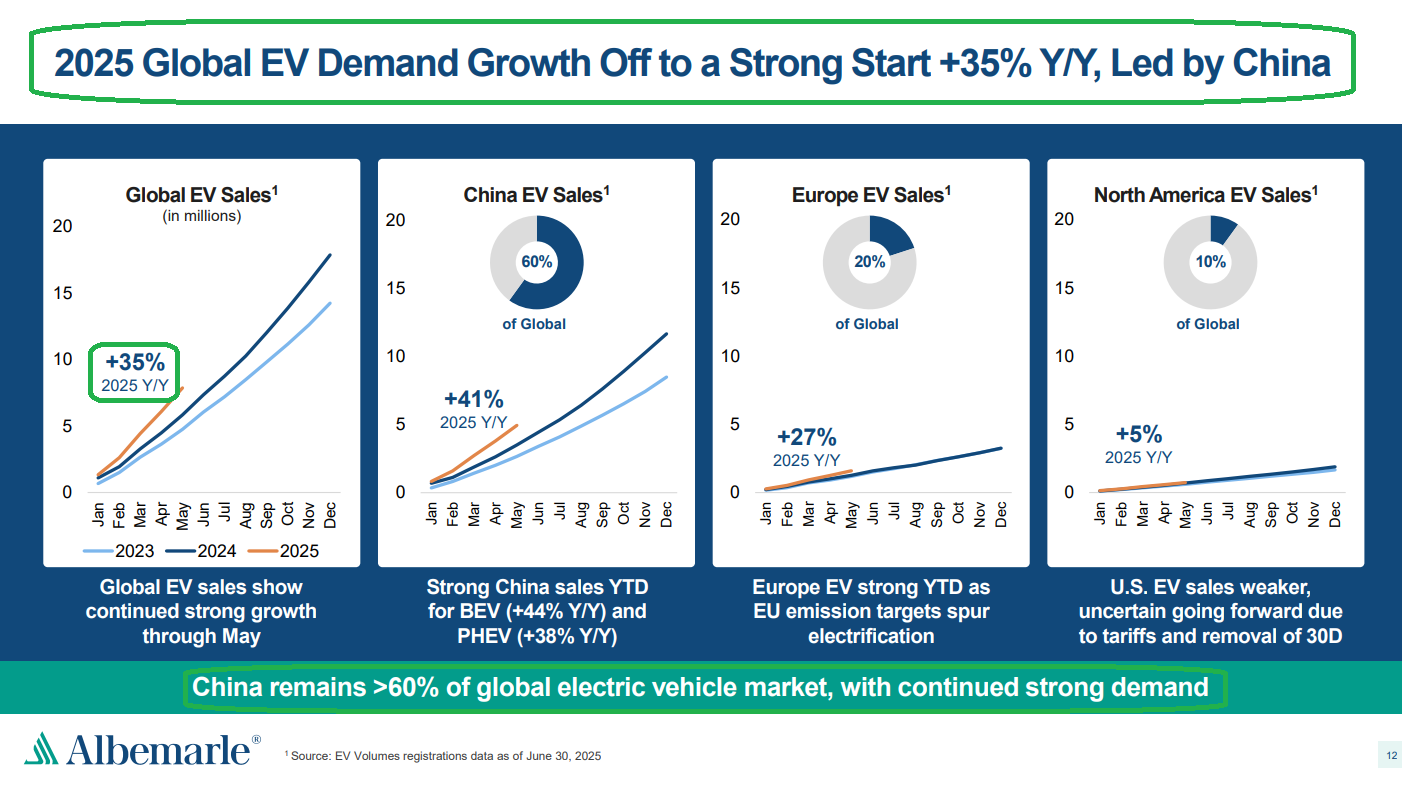

2) End-market demand for lithium remains strong, with global consumption up 35% YTD. Growth has been driven by a 126% surge in global stationary storage battery production through May, with all three major regions showing strength (China +80%, Europe +150%, North America +160% YoY). EV demand has also remained robust, up 35% YTD, with China accounting for over 60% of the global market and growing 41% YTD.

3) Management continues to believe more capacity needs to come offline, noting little change in global capacity since last quarter aside from a few sites in China (last quarter estimate: 40% of global capacity at or below breakeven, with only about one-third offline). Year to date, Albemarle estimates lithium demand has outpaced supply by nearly 20%, and if current pricing holds, expects demand to outstrip supply by ~10% through 2030. Most importantly, management expects the current surplus, which has persisted since late 2022, to peak as early as this year, with the market likely more balanced in 2026 and potentially returning to deficits in 2027 and beyond.

4) For the full year, management continues to expect 15–40% lithium demand growth, driven by strength in stationary storage and EVs. Sales volume growth is now expected near the high end of the 0–10% YoY range. Looking longer term, management expects lithium demand to more than double by 2030, reaching 2.5–3.3 MMT LCE versus 1.2 MMT in 2024, implying a 15–20% CAGR.

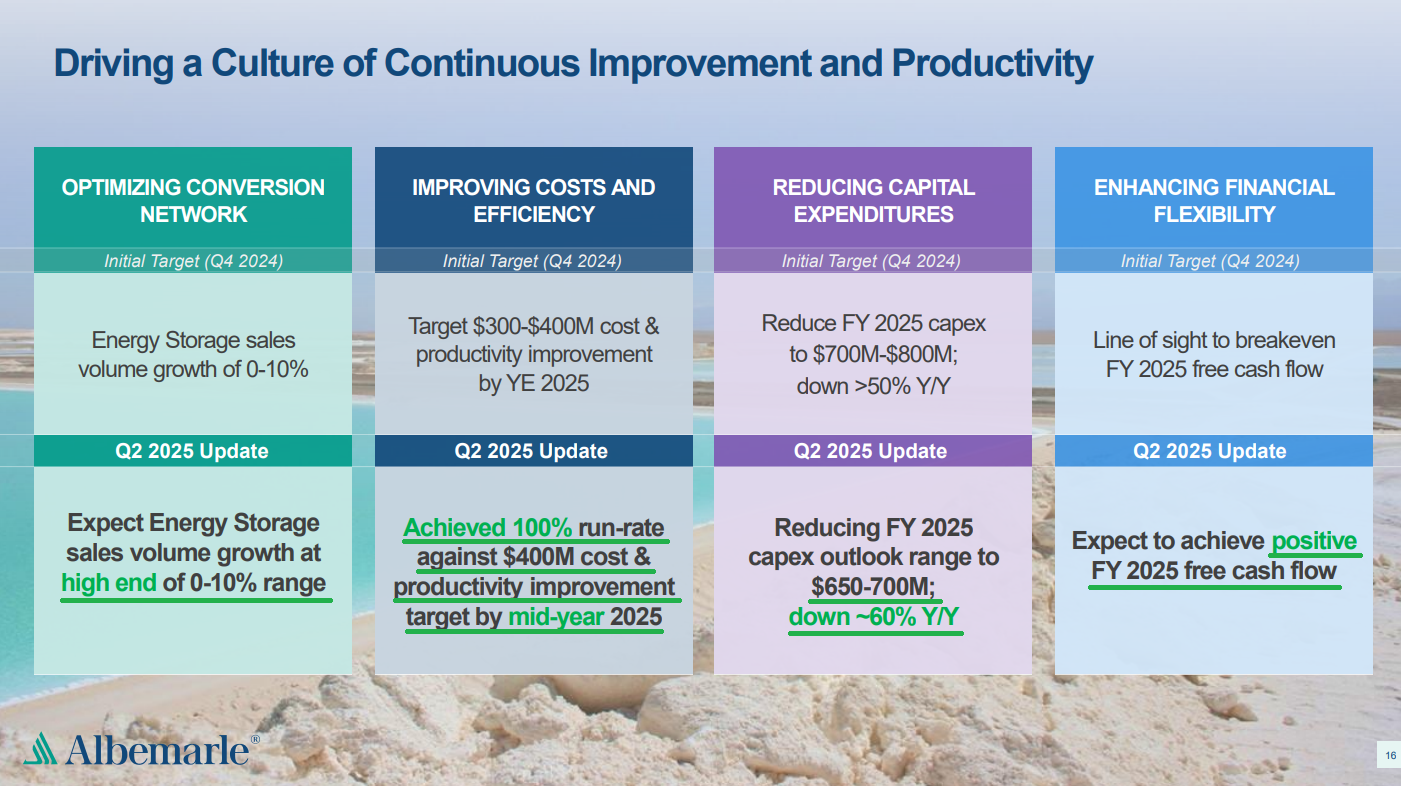

5) Management has achieved 100% of the high end of its cost and productivity improvement target, hitting $400 million six months ahead of the original plan, which aimed for $300–$400 million in savings by year-end. These improvements have already driven over a 20% reduction in SG&A costs YTD, with full benefits expected in 2026.

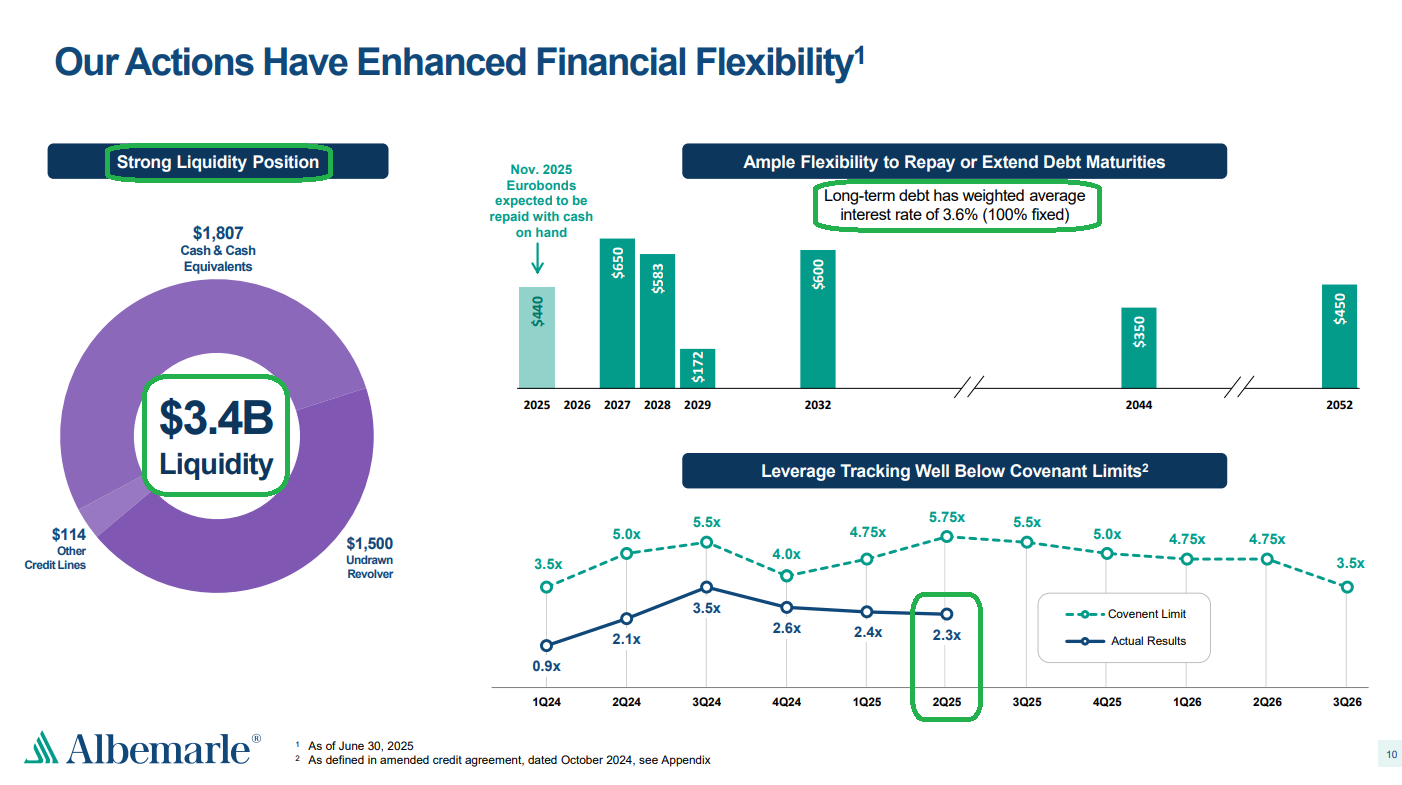

6) Albemarle’s balance sheet remains very strong, with $1.8 billion in cash and cash equivalents and total liquidity of ~$3.4 billion. Total debt stands at $3.6 billion, 100% of which is at fixed rates with a 3.6% weighted average interest rate. Net leverage is just 2.3x, well below the Q2 covenant limit of 5.75x. Deleveraging remains a top priority, with the $440 million debt maturing in Q4 expected to be paid off using cash on hand.

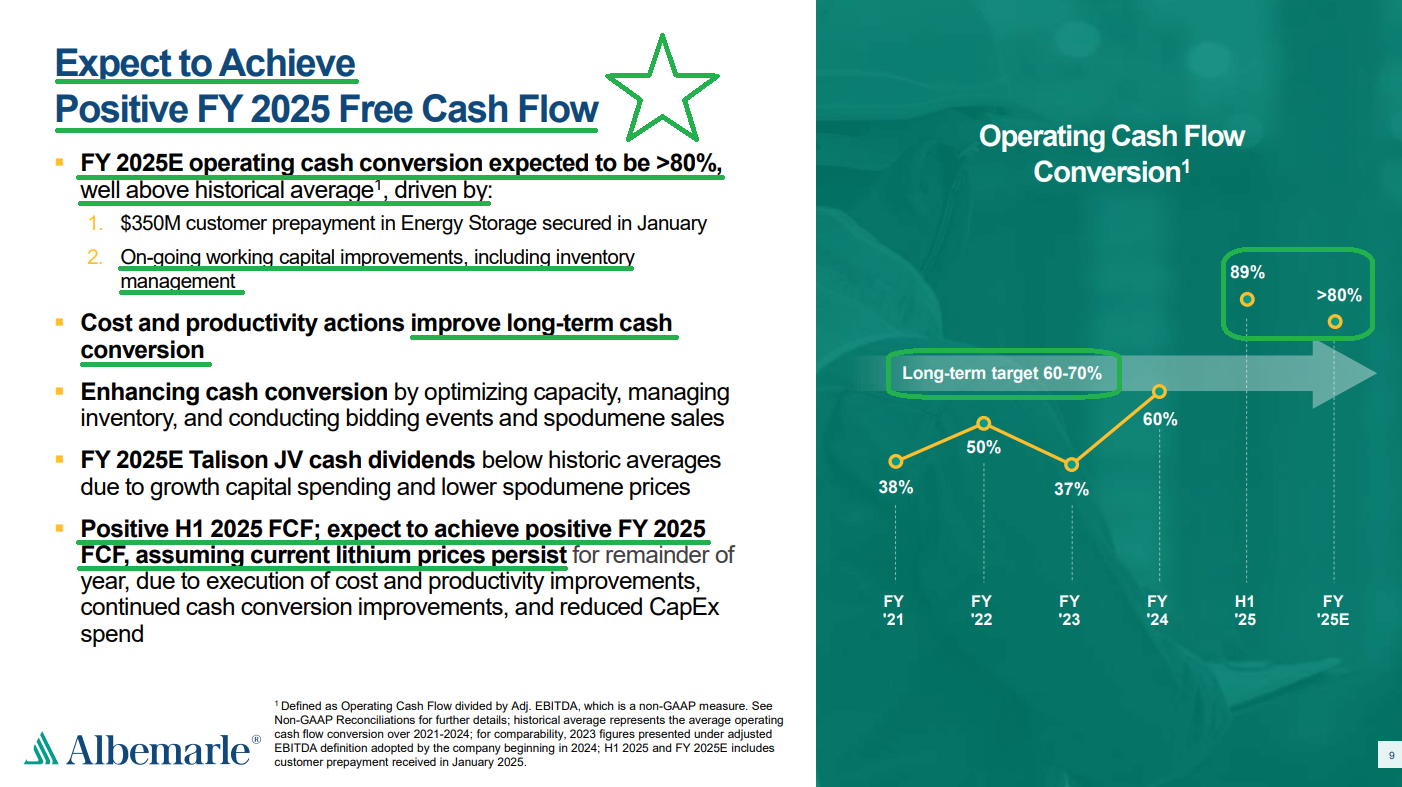

7) In the first half of 2025, Albemarle generated $538 million in operating cash flow, up $73 million YoY, with an 89% cash conversion rate. Management expects conversion above 80% for the full year, well ahead of its long-term 60–70% target, driven by a $350 million customer prepayment and continued working capital improvements. Most importantly, management now projects positive free cash flow for 2025, versus prior expectations of only breakeven.

8) Management further lowered its full-year capex outlook to $650–$700 million, down from a prior target of $700–$800 million. This implies a ~60% reduction from 2024’s $1.7 billion, already a low base compared to 2023’s $2.1 billion, as management continues to focus on projects with the highest returns and fastest payback in the face of cyclically low prices.

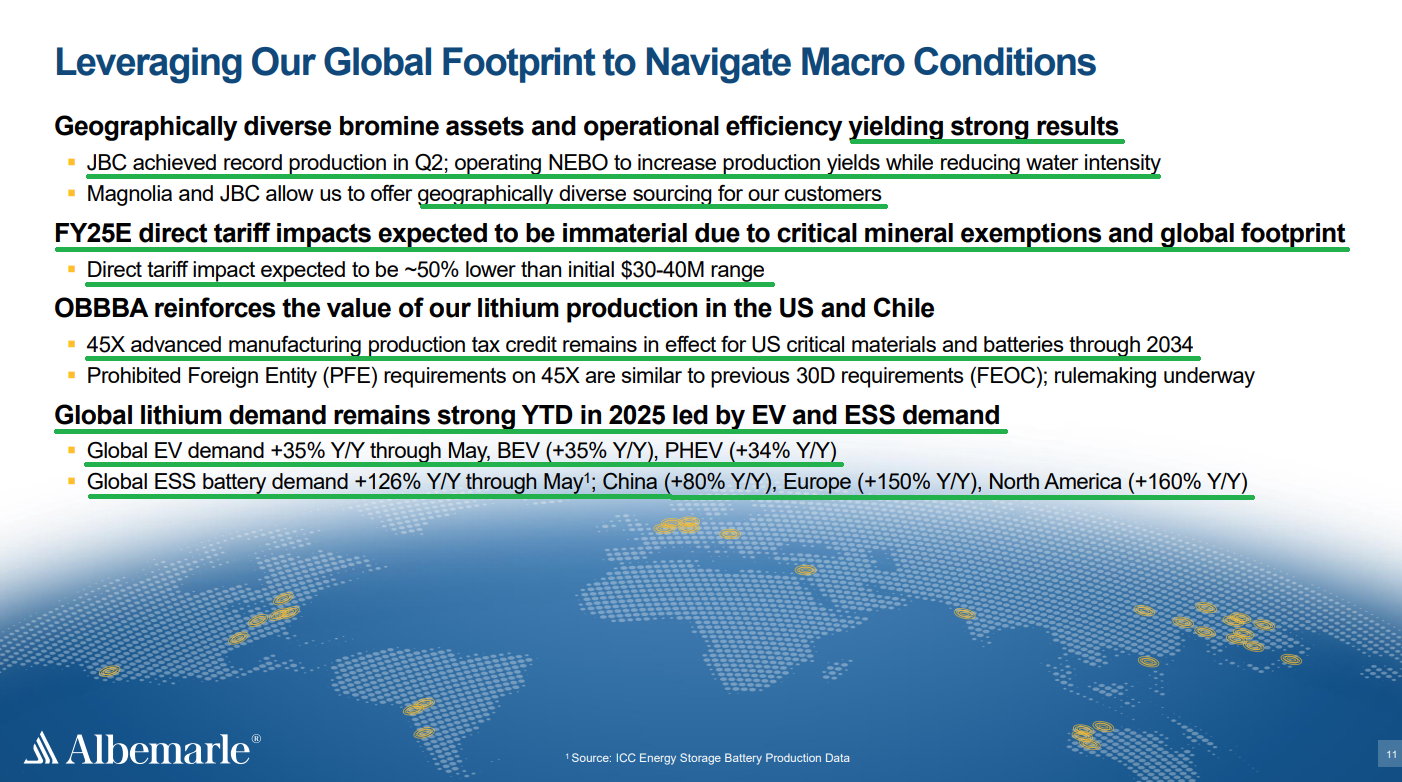

9) Full-year direct tariff impacts remain immaterial to Albemarle thanks to critical mineral exemptions and its global sourcing footprint. Management now expects the impact to be roughly 50% lower than the initial $30–$40 million range, implying a $17.5 million hit at the midpoint.

10) About 50% of the overall mix is now sold under long-term agreements, all of which include floors and have an average duration of 2–5 years. No significant contracts are up for renewal in 2025, while two contracts are scheduled for renegotiation toward the end of 2026, with management expecting both to be extended rather than expire.

Morningstar Analyst Note

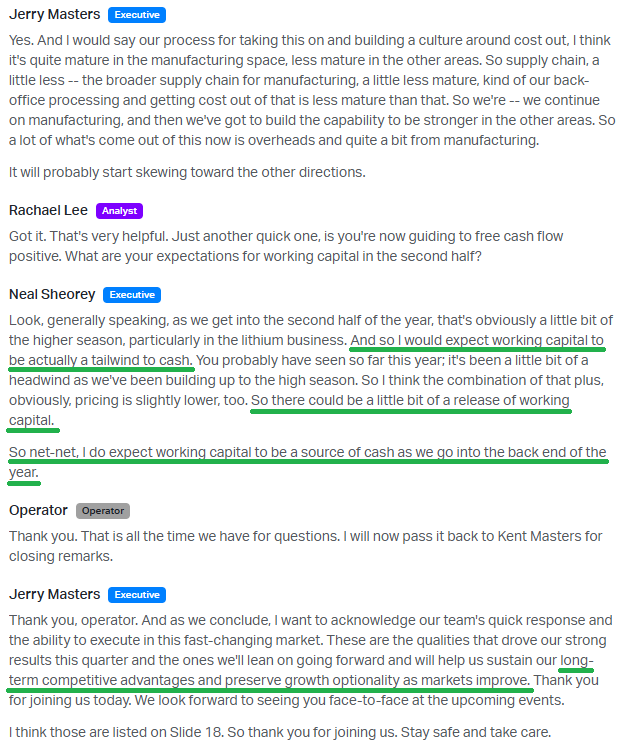

Earnings Call Highlights

General Market

The CNN “Fear and Greed Index” ticked up to 63 this week from 58 last week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

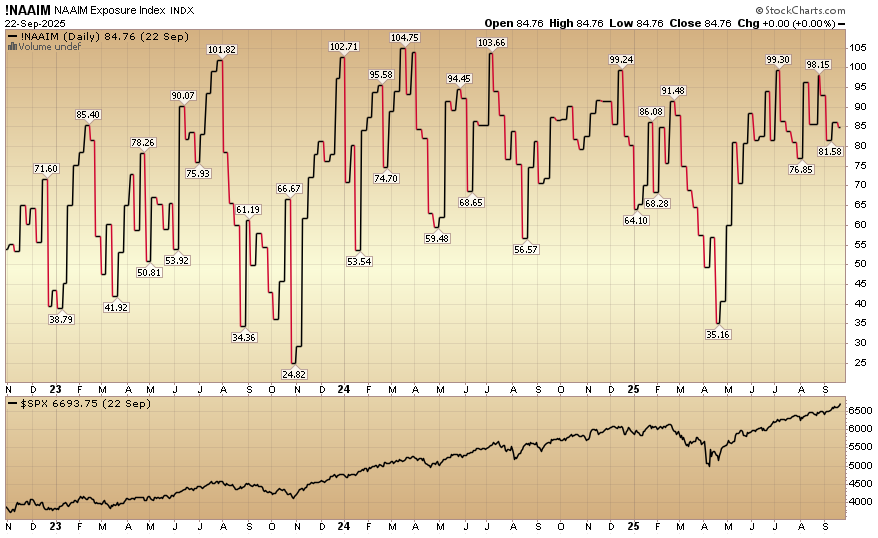

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 84.76% this week from 86.11% equity exposure last week.

Our podcast|videocast will be out sometime today. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in intra-quarter (Q3) with larger sized accounts, and to those existing clients who upsized their contributions to their accounts.

We will re-open to smaller accounts $1M+ again starting October 1st.

Those interested in “going-live” on October 1 can begin the on-boarding and application process ahead of time.

To see if you qualify and to take advantage of this opening click here. Larger accounts $5-10M+ can access bespoke service anytime here.

Not a solicitation.

*Opinion, Not Advice. See Terms

More By This Author:

“The Fuel Behind The Future” Stock Market (And Sentiment Results)

“Don’t Count The Staples Out” Stock Market (And Sentiment Results)

“The Capitulation Rally” Stock Market (And Sentiment Results)

Long all mentioned tickers.

Disclaimer: Not investment advice. For educational purposes only: Learn more at more