“Foundation For A Comeback” Stock Market (And Sentiment Results)

Etsy Update

Whether it was PayPal last week with the Google deal or our Energy names (CRK and NOV) as covert AI plays, we continue to focus on the BENEFICIARIES OF AI. The way we see it, there are two options. Option 1 is to own the hyperscalers trading at nosebleed valuations with DECELERATING earnings growth, who are forced to shell out hundreds of billions in capex to build AI capabilities while eroding their earnings in the process. Option 2 is to own the “UNMAGNIFICENT 493,” trading at much lower multiples with ACCELERATING earnings, and let the hyperscalers pick up the tab and drink for free as an AI BENEFICIARY, i.e., capture all the upside without spending a dime. Unlike the rest of the market chasing shiny objects, for us, the choice is a no-brainer.

This week, ETSY joins the ranks of clear AI BENEFICIARIES. The company is partnering with OpenAI to give ChatGPT’s 700+ million weekly active users the ability to browse and purchase items through Etsy without leaving the app. Traffic to retail sites from generative AI has jumped 4,700% over the last year, and this deal positions Etsy at the forefront. Etsy’s GMV was already set for an inflection and return to growth. This partnership likely just sped it up and can be seen as a cherry on top.

Once again, another pick and shovel way to play AI, all while sitting back and letting the hyperscalers do the heavy lifting. Ladies and gentlemen, this is just the beginning…

Here’s what Barron’s had to say on the announcement:

And sure enough, opinion follows trend. What was a left-for-dead “sleepy” name just last week is now on the leading edge of AI and agentic commerce. Expect more headlines like this to follow as the story continues to play out.

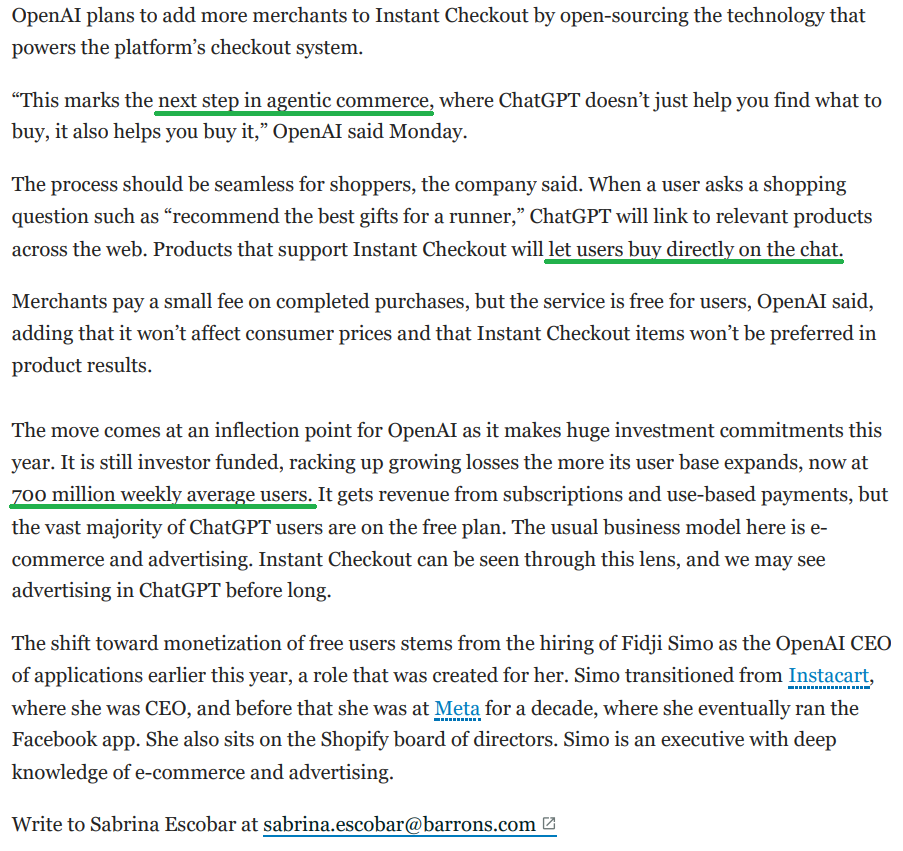

Estée Lauder (EL) Update

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

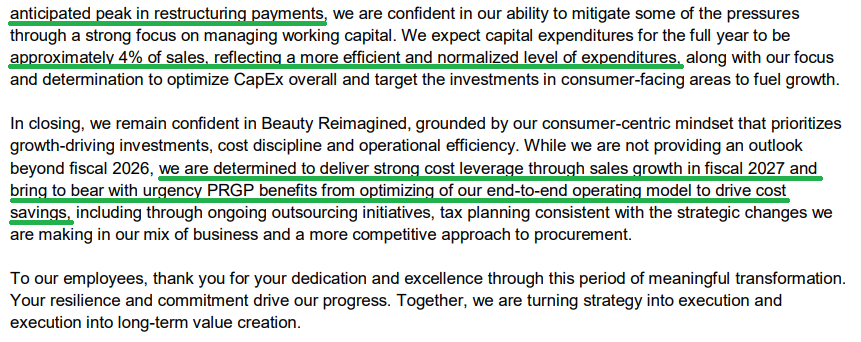

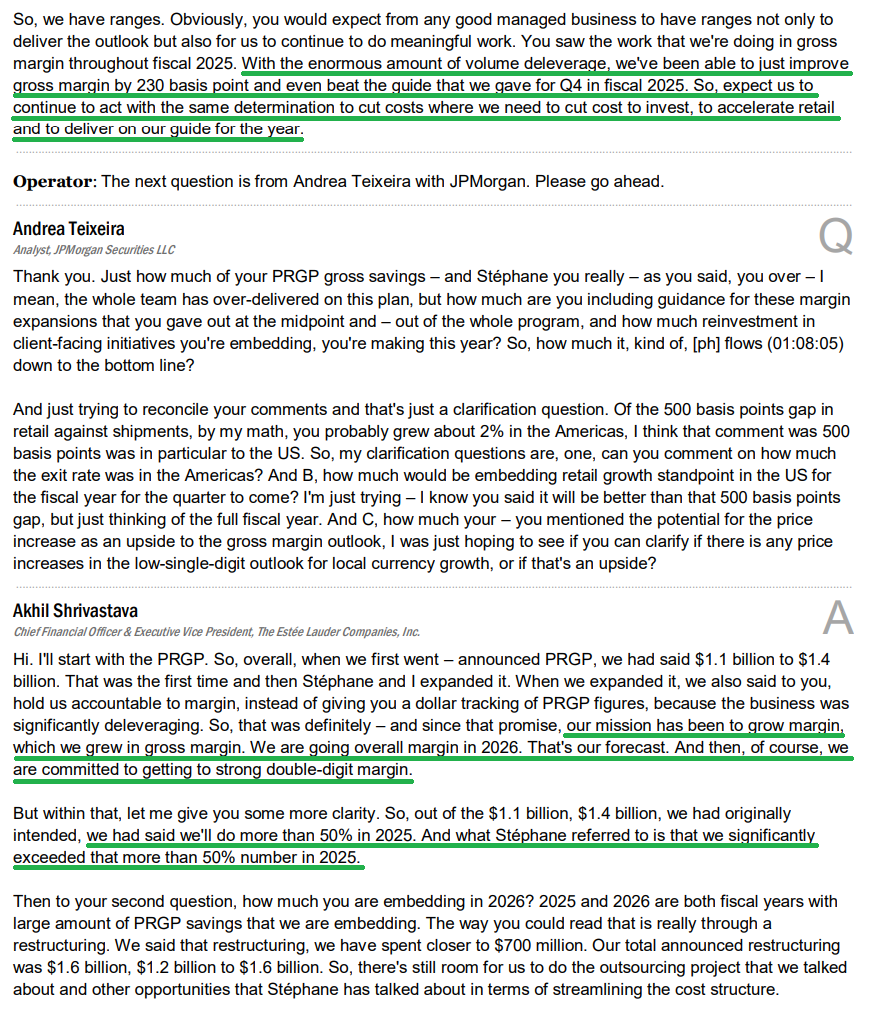

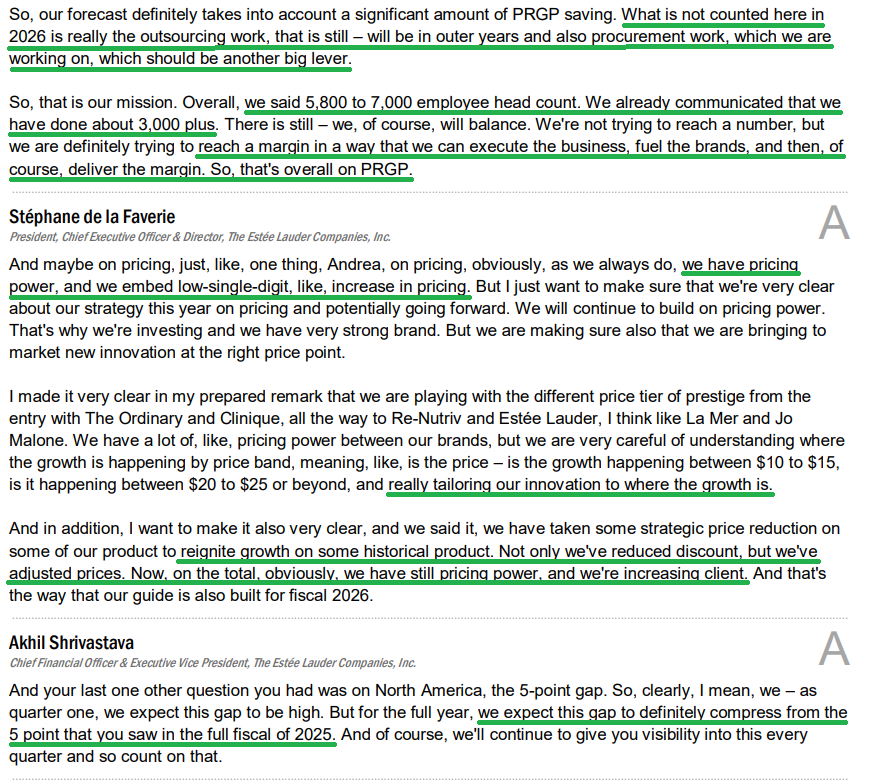

(Click on image to enlarge)

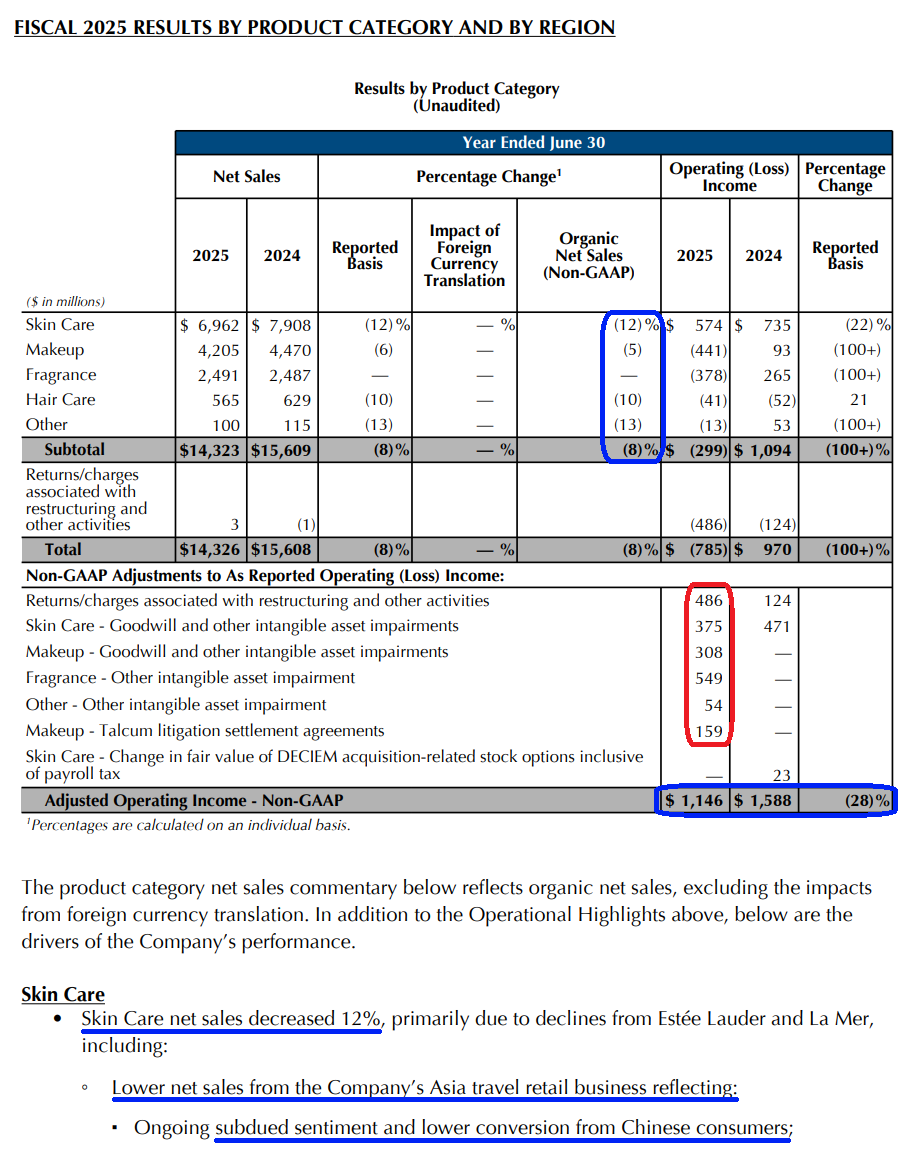

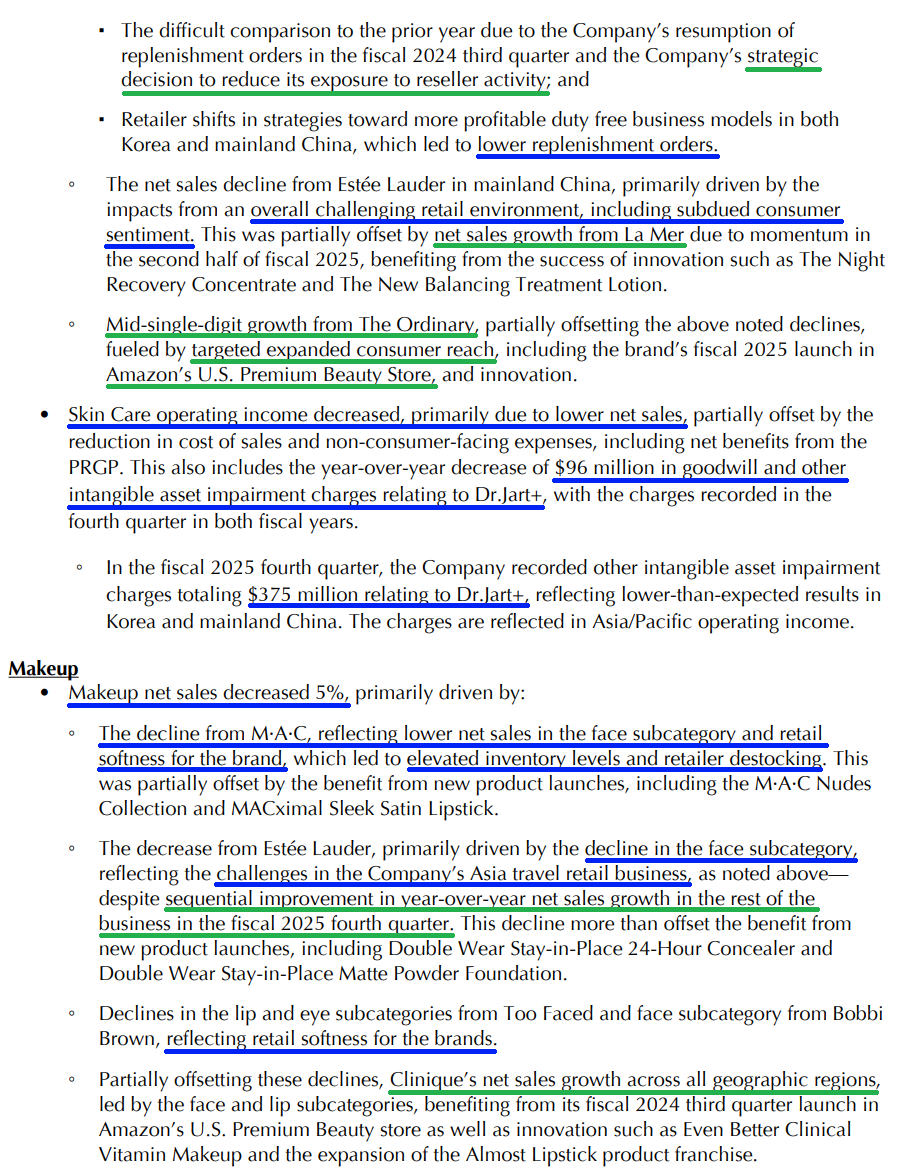

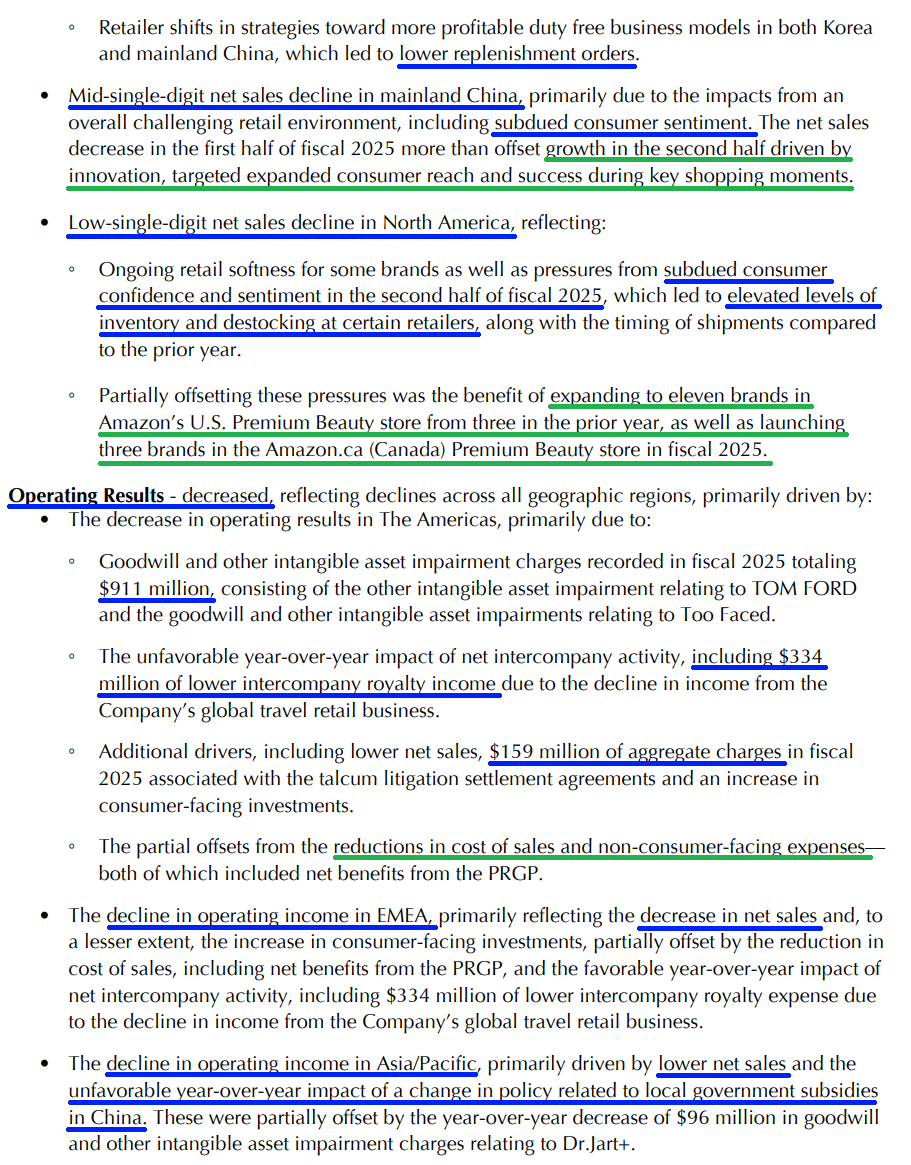

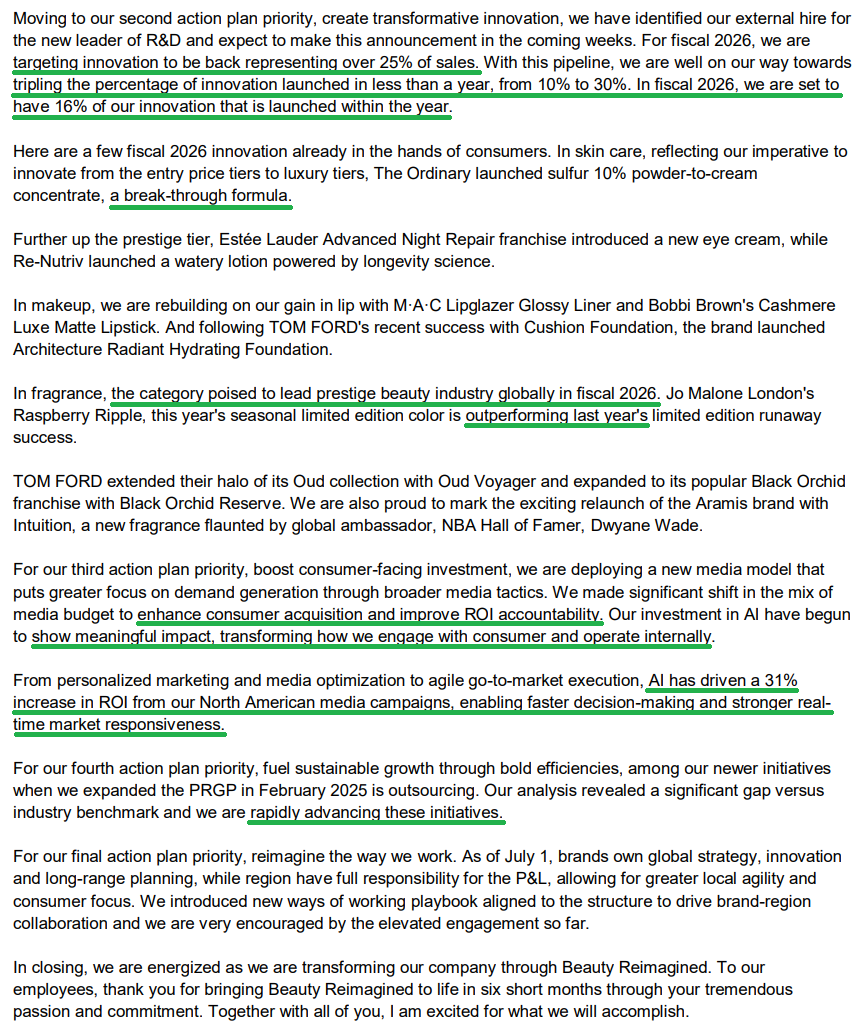

Q4 Earnings Breakdown

10 Key Points

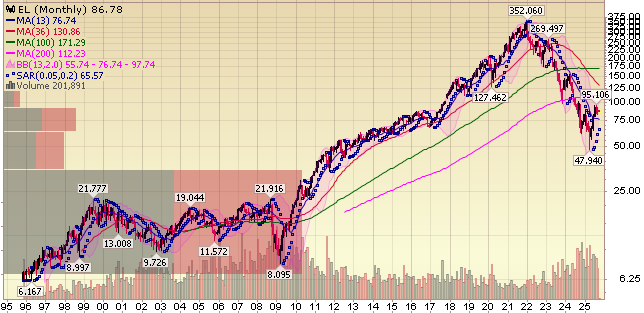

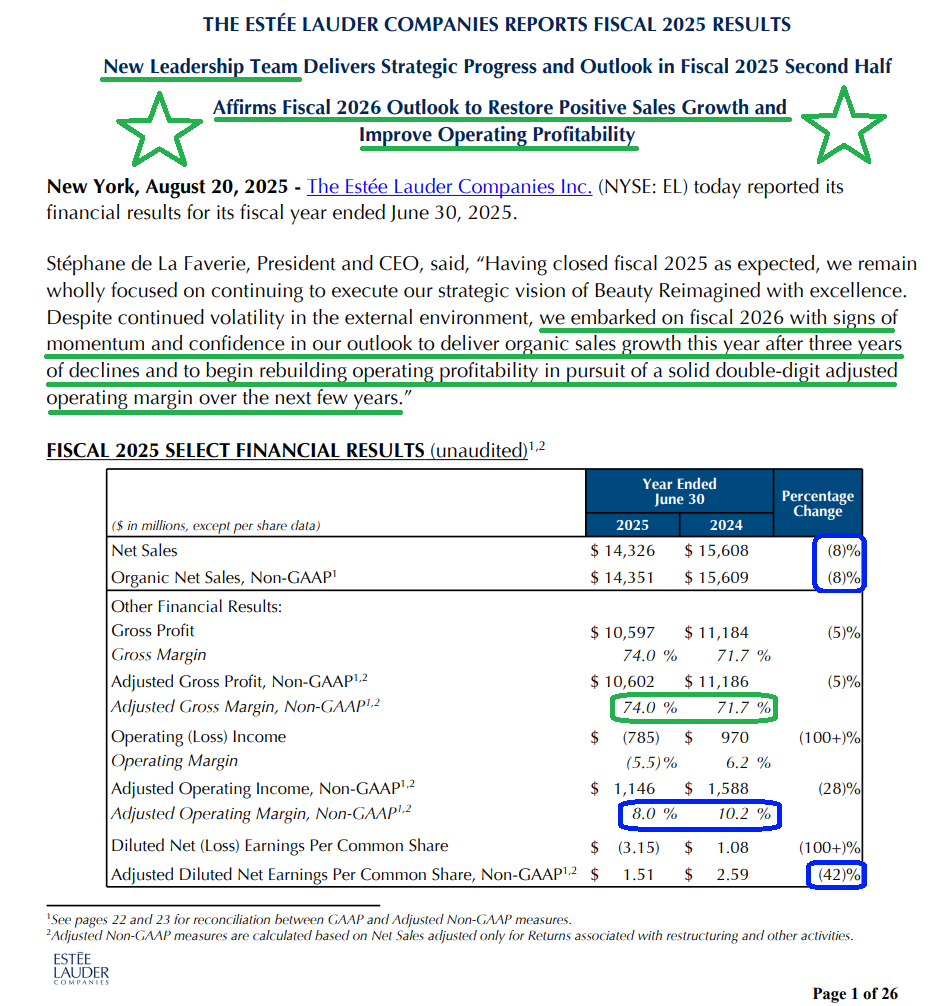

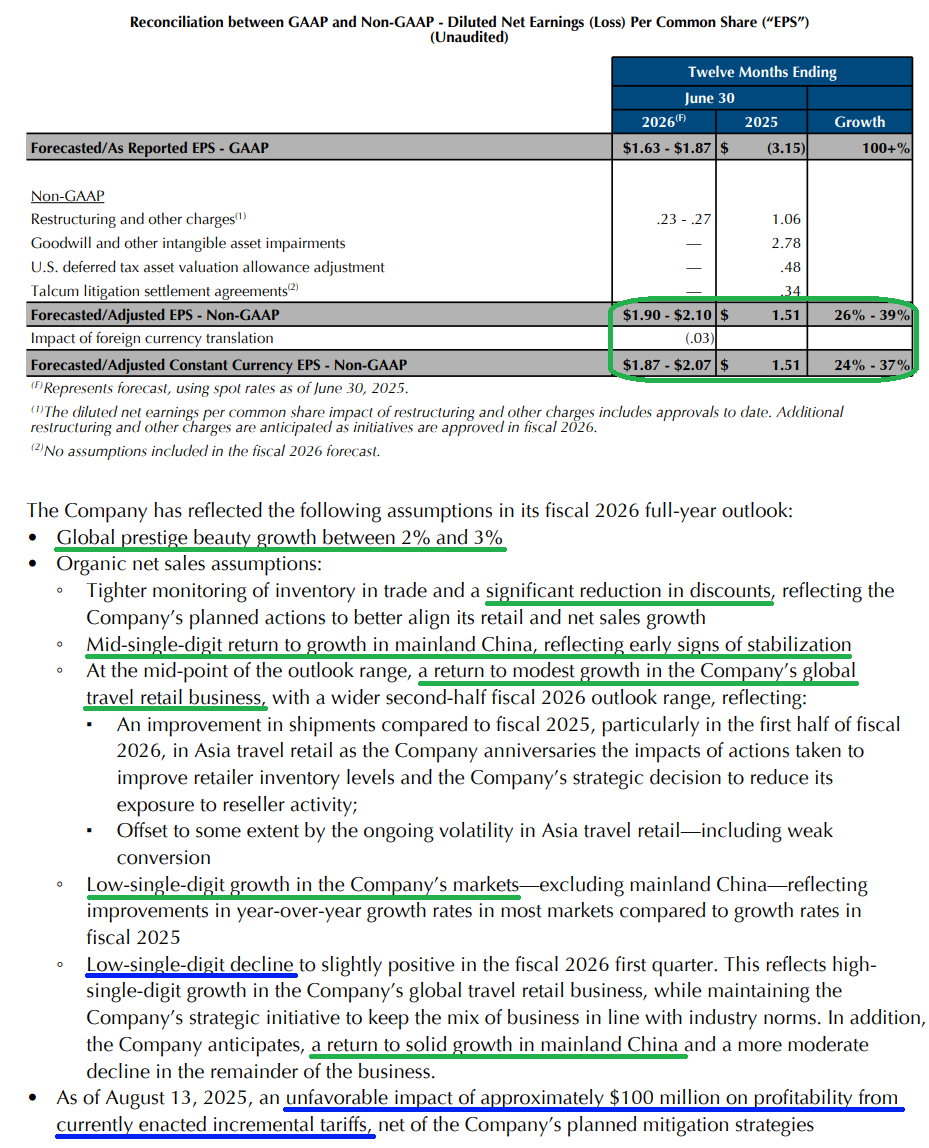

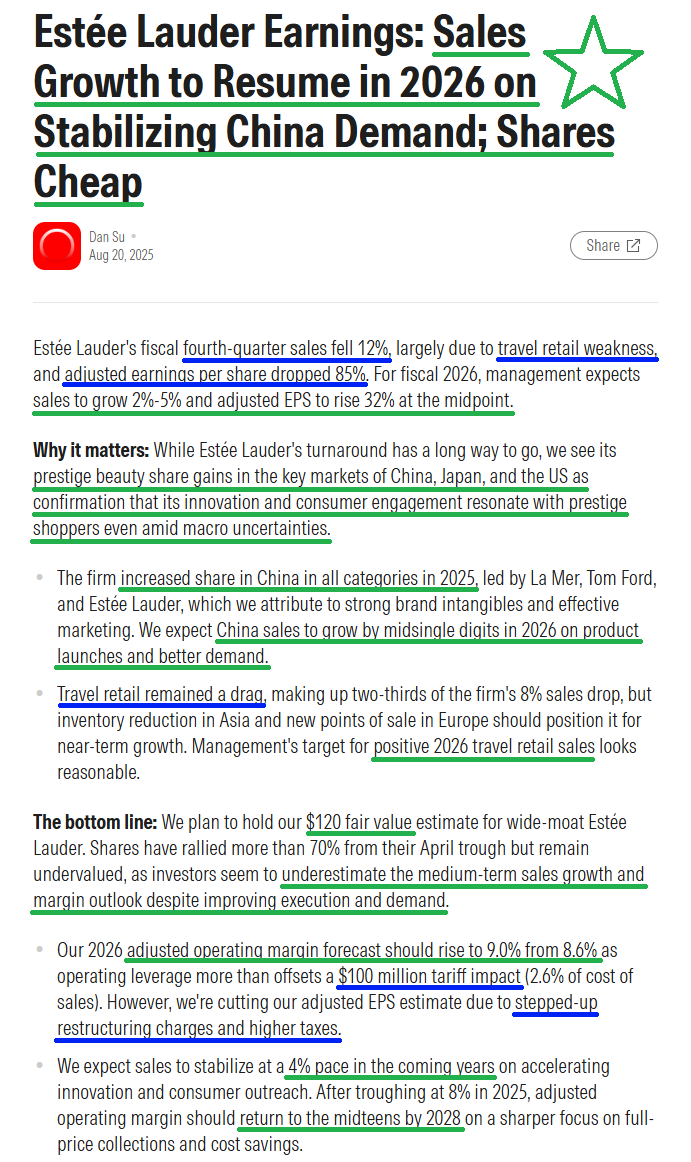

1) Estee Lauder reported Q4 revenue of $3.41 billion (-11.9% Y/Y), topping estimates by ~$10 million, with adjusted EPS of $0.09 beating consensus by $0.13. For FY2025, revenue was $14.33 billion (-8% Y/Y), landing at the high end of management’s prior guidance of -9% to -8%, while adjusted EPS of $1.51 came in ahead of guidance of $1.46.

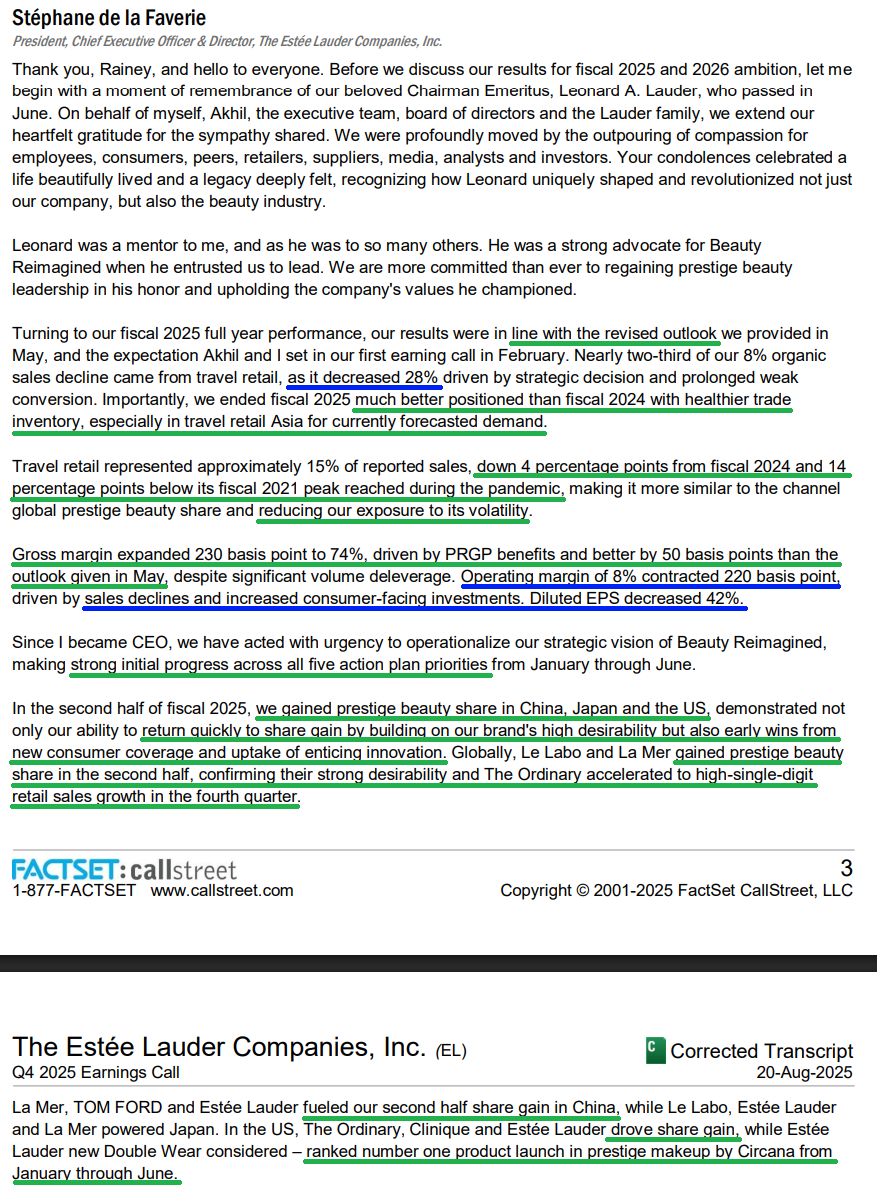

2) During Q4, Estee Lauder gained market share in prestige beauty across several key markets, including mainland China, Japan, and the U.S., with 10 brands growing at retail and driving share gains across every category and channel. In mainland China, share gains were achieved in every category, led by continued strength in La Mer and Le Labo, with brands ranked #1 or #2 in prestige beauty and luxury during both the 618 Shopping Festival and 11.11 Global Shopping Festival. In Japan, Estee Lauder gained share in every quarter and strengthened its #1 position in fragrance. In the U.S., the company made meaningful progress throughout the year, returning to market share gains in the second half for the first time in many years.

3) Management continues to lean into higher-growth, higher-margin digital channels, reducing department store exposure to less than one-third of overall sales. Online sales now account for an all-time high of 31%, up 300 bps Y/Y and well above 13% in 2018 and the low-20s industry average. During the year, Estee Lauder launched 8 brands in Amazon’s U.S. premium beauty store, expanding its total to 11, with 3 brands also on Amazon Canada, alongside continued expansion on platforms such as TikTok Shop, Tmall, and Shopee. This expansion drove an acceleration in organic online sales growth from low single digits in the first half to mid-single digits in the second half, with management expecting this momentum and online mix to continue climbing higher.

4) Despite sales declines, management continues to improve margins, with full-year adjusted gross margin at 74%, up 230 bps Y/Y and 50 bps ahead of prior Q3 outlook. For the upcoming year, management expects adjusted gross margin to be flat to positive, with a long-term goal of returning to the historical mid-70s range. Adjusted operating margin came in at 8% for the full year, down 220 bps Y/Y due to sales volume deleverage and increased consumer-facing investments (+400 bps Y/Y). Looking ahead, management expects operating margin expansion to 9.4–9.9% in the upcoming year, with a medium-term goal of returning to solid double-digit levels, in line with the historical mid-teens average.

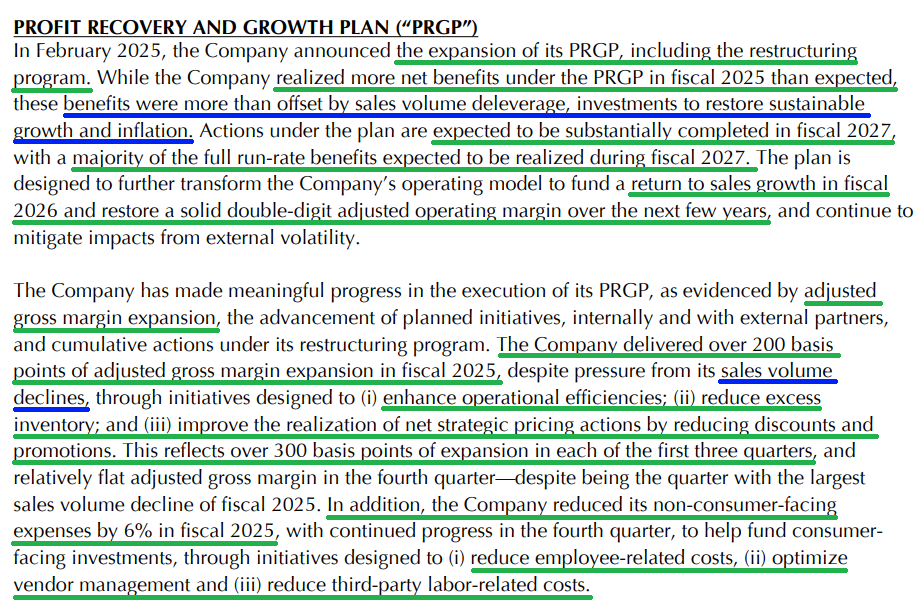

5) The Profit Recovery and Growth Plan (PRGP) continues to perform ahead of expectations, delivering a 6% reduction in non–consumer-facing costs in FY2025. Management expects the program to be substantially completed by FY2027, with the majority of full run-rate benefits realized that year. The PRGP is projected to yield annual gross benefits of $0.8 to $1.0 billion, against total restructuring and other charges of $1.2 to $1.6 billion. To date, management has already approved initiatives covering more than 60% of expected gross benefits, well ahead of the 50% guidance for 2025, and expects the net reduction in positions of 5,800–7,000 (with more than 3,200 already completed) to be achieved by the end of FY2026.

6) After three consecutive years of organic sales declines, Estee Lauder expects to return to growth in FY2026, guiding to reported revenue growth of 2–5% (including a 200 bps FX tailwind) and organic sales growth of 0–3%. The rebound is expected to be led by mid-single-digit growth in mainland China, where management is already seeing stabilization and improved consumer sentiment, alongside modest gains in global travel retail and broad-based improvements across other regions. By year-end, management expects all four geographic segments to be back in positive territory.

7) Travel Retail, the segment where prior management got caught offside during the pandemic, continues to decline as a percentage of overall sales, now representing just 15% of reported sales versus the FY2021 peak of 29%. The segment remains under pressure, down 28% and accounting for roughly two-thirds of Estee Lauder’s 8% full-year sales decline. Most importantly, management expects global travel retail to return to modest growth in FY2026, with the key Hainan market already turning positive.

8) Current tariff mitigation strategies are expected to offset more than half of the impact, with management forecasting net tariff-related headwinds of ~$100 million (2.6% of cost of sales) to FY2026 profitability. Estee Lauder maintains the lowest exposure in the industry given its nine manufacturing sites worldwide and continues to evaluate additional mitigation strategies, including further optimization of its regional manufacturing footprint and pricing opportunities.

9) Capital expenditures fell 34% YoY to $602 million from $919 million, as management continues to prioritize returns on capital and free cash flow. With the new Japan factory now complete, capex as a percentage of sales is expected to normalize to ~4%, down from the 6% average of the past three years.

10) Operating cash flow for the full year came in at $1.27 billion, down from $2.36 billion in the prior year. This was largely driven by higher restructuring payments, which are expected to peak in FY2026, and FY2024 benefitting from a significant reduction in inventories. For FY2026, management expects operating cash flow of $1.0–$1.1 billion. Estee Lauder’s balance sheet remains in solid shape, with $2.9 billion in cash as of June 2025 against $7.3 billion in short- and long-term debt.

Morningstar Analyst Note

Earnings Call Highlights

General Market

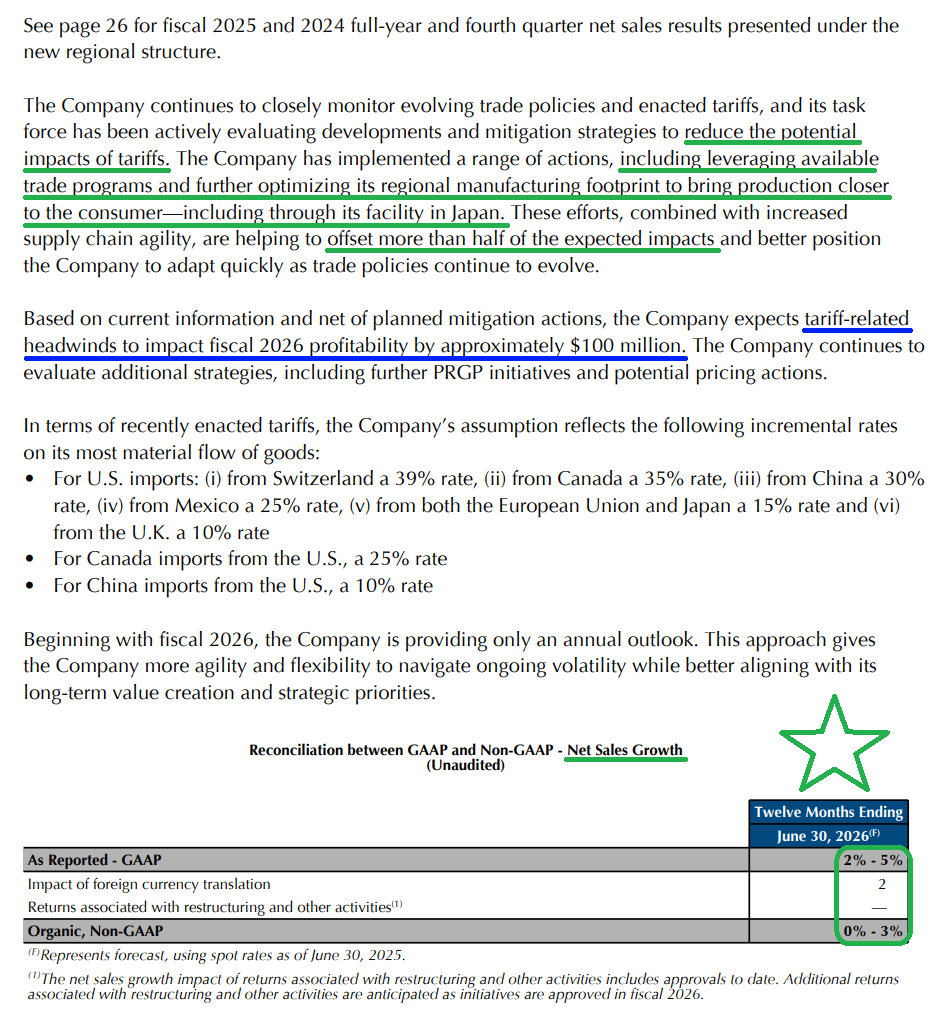

The CNN “Fear and Greed Index” ticked down to 51 this week from 63 last week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

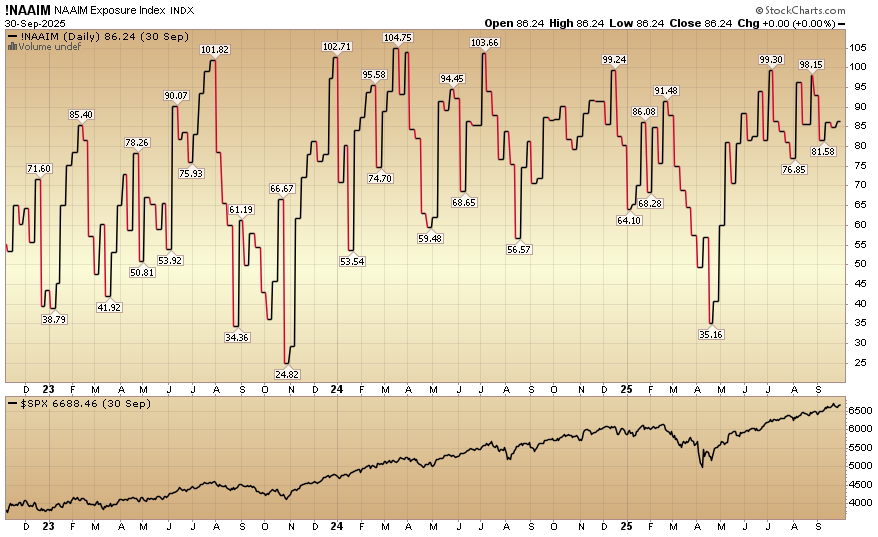

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 86.24% this week from 84.76% equity exposure last week.

(Click on image to enlarge)

More By This Author:

“Early Innings” Stock Market (And Sentiment Results)

“The Fuel Behind The Future” Stock Market (And Sentiment Results)

“Don’t Count The Staples Out” Stock Market (And Sentiment Results)

Long all mentioned tickers.

Disclaimer: Not investment advice. For educational purposes only: Learn more at more