Blue Chip Stocks In Focus: Stanley Black & Decker

There is no exact definition for blue chip stocks. We define it as a stock with at least 10 consecutive years of dividend increases. We believe an established track record of annual dividend increases going back at least a decade, shows a company’s ability to generate steady growth and raise its dividend, even in a recession.

As a result, we feel that blue chip stocks are among the safest dividend stocks that investors can buy.

This installment of the 2022 Blue Chip Stocks in Focus series will analyze the tools and accessories company Stanley Black & Decker (SWK) in greater detail.

Business Overview

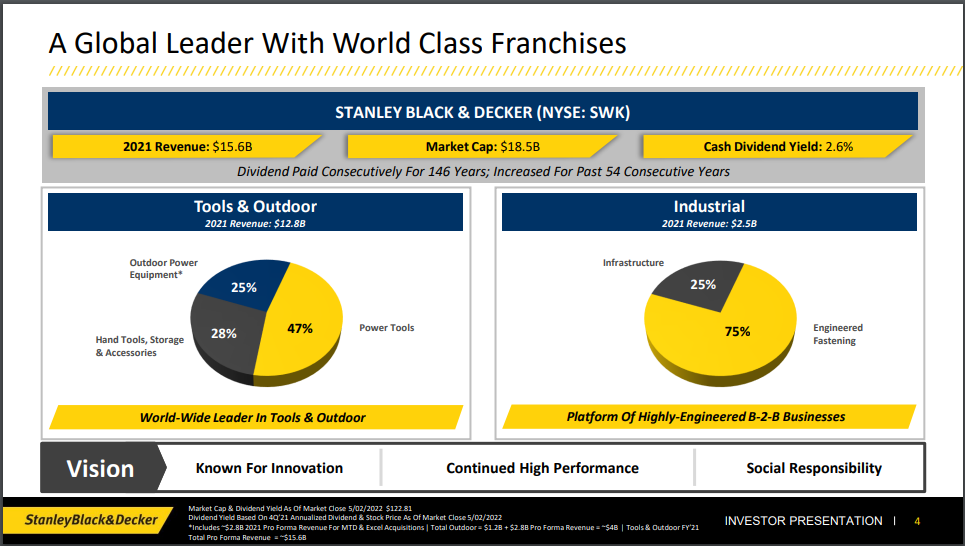

Stanley Black & Decker is a global leader in power tools, hand tools, and related products. The company maintains the top position in tools and storage sales worldwide.

Stanley Black & Decker has the number two position in commercial electronic security and engineered fastening. The current company was created when Stanley Works and Black & Decker merged in 2010.

Stanley Black & Decker generated revenue of $15.6 billion in 2021. The company consists of three segments: Tools & Storage, Industrial, and Security.

Source: Investor Presentation

On July 22nd, 2022, Stanley Black & Decker completed its sale of the Security Business to Securitas AB for $3.2 billion in cash. The cash was earmarked for debt reduction and the $2.3 billion share repurchase previously completed.

Stanley Black & Decker announced first quarter results on April 28th, 2022. Revenue grew 20% to $4.4 billion but was $220 million lower than expected. Adjusted earnings-per-share of $2.10 compared unfavorably to adjusted earnings-per-share of $3.13 in the prior year but came in $0.40 above expectations.

Organic growth was down 1% in the first quarter. Sales for Tools & Storage, the largest segment, fell 1% as a result of a decline in volume. Industrial organic growth was flat. And Infrastructure grew 4% due to strength in attachment tools. Finally, Engineered Fastening was down 1% due to a decline in automotive.

Stanley Black & Decker offered revised guidance for 2022. The company now expects adjusted earnings-per-share in a range of $9.50 to $10.50, down from $12.00 to $12.50 previously.

Growth Prospects

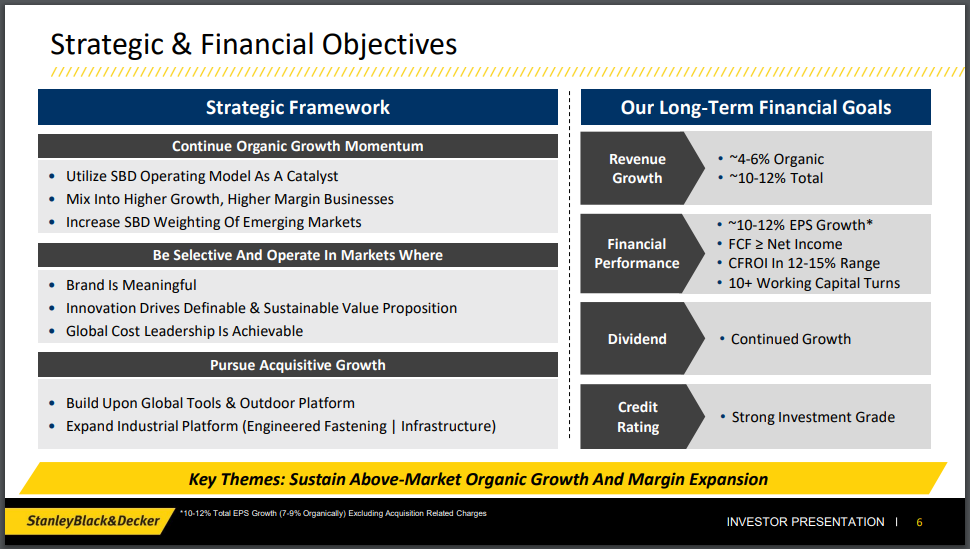

Stanley Black & Decker is targeting 10% to 12% total revenue growth over the long-term, with 4% to 6% revenue growth being organic. The company is also aiming to grow earnings per share by 10% to 12% over the long-term.

For the time being, we expect the company to continue to grow earnings-per-share at a rate of 8% annually due to organic revenue growth and acquisitions. This is more in-line with the three-year compound annual adjusted EPS growth rate of 9%.

Source: Investor Presentation

Concerning acquisitions, Stanley Black & Decker lists their areas of interest to be in tool industry consolidation, outdoor expansion, and industrial segment expansion.

The company’s past acquisitions were strategic and benefited the company. For example, Stanley Black & Decker added Newell Brands’ Tools business for nearly $2 billion in 2017. This purchase added the high-quality and well-known Irwin and Lenox brand tools to the company’s product portfolio. In 2017, the company also purchased the Craftsman brand from Sears Holdings for $900 million.

In August 2021, Stanley Black & Decker purchased the remaining 80% of MTD Products, a manufacturer of outdoor power equipment, that it did not already own. The purchase increased the company’s exposure to the outdoor power equipment space, adding the Troy-Bilt, Remington and MTD Genuine Parts brands to Stanley Black & Decker’s product portfolio.

We expect Stanley Black & Decker will grow earnings-per-share at a rate of 8% annually in the intermediate term.

Competitive Advantages & Recession Performance

Stanley Black & Decker’s primary competitive advantage is its well-known brand portfolio which has an immense worldwide reach. The company is a leader in its industries and its strong brands afford it pricing power.

This brand strength stems largely from the company’s heavy investment on research and development. Stanley Black & Decker must continuously innovate and create new products.

The company’s earnings declined significantly in the great financial crisis, demonstrating that Stanley Black & Decker is not immune to recessions. In fact, the company does not appear to have strong recession resilience.

Stanley Black & Decker’s earnings-per-share during the Great Recession and just after are below:

- 2007 adjusted earnings-per-share: $4.00

- 2008 adjusted earnings-per-share: $3.41 (14.8% decrease)

- 2009 adjusted earnings-per-share: $2.72 (20.2% decrease)

- 2010 adjusted earnings-per-share: $3.96 (45.6% increase)

- 2011 adjusted earnings-per-share: $5.24 (32.3% increase)

Adjusted EPS decreased more than 30% from 2007 to 2009. However, adjusted EPS recovered strongly in 2010 and 2011 and continued increasing since.

Amid the coronavirus pandemic, however, Stanley Black & Decker performed well, which is likely due to the nature of the crisis. As people stayed home, the home improvement market boomed, which the company benefited from.

Valuation & Expected Returns

Shares of Stanley Black & Decker have traded for an average price-to-earnings multiple of around 17.0. Shares are now trading far below this average, which indicates that shares could be undervalued at the current 11.6 times earnings.

Our fair value estimate for Stanley Black & Decker stock is 16.5 times earnings. If this proves correct, the stock will benefit from a 7.4% annualized gain in its returns through 2027.

Shares of Stanley Black & Decker currently yield 2.8%, which is above its average yield of 2.0%. On a dividend yield basis, SWK shares seem to be trading below fair value.

Putting it all together, the combination of valuation changes, EPS growth, and dividends produces total expected returns of 17.8% per year over the next five years. This makes Stanley Black & Decker a buy.

The current dividend payout is adequately covered by earnings, with room to grow. Based on expected fiscal 2022 earnings, SWK has a payout ratio of 32%. We anticipate continued mid-to-high single-digit dividend increases in the years to come.

Final Thoughts

Stanley Black & Decker is a dividend king with fifty-four years of consecutive dividend growth. The company also holds a top position in its industry. Its expanding product portfolio as a result of both innovation and acquisitions affords the company pricing power.

With strong total return expectations of 17.8% per year over the next five years, Stanley Black & Decker stock is a buy for long-term dividend growth investors.

More By This Author:

Blue Chip Stocks In Focus: Franklin Resources, Inc.

Blue Chip Stocks In Focus: Parker-Hannifin Corporation

Blue Chip Stocks In Focus: Fresenius Medical Care AG