Blue Chip Stocks In Focus: Franklin Resources, Inc.

With market uncertainty resulting in significant moves up and down for much of the year, investors could be looking to invest in safer and more reliable investments instead of enduring a rollercoaster ride.

To that end, we suggest that investors focus on owning shares of blue chip stocks. The term “blue chip” can have a different meaning to different investors. To us, we view blue chips as those companies with at least 10 consecutive years of dividend increases.

An established track record of dividend growth of at least a decade means that a company has proven successful at increasing its distribution over a long period and that management teams are committed to growing the payout.

For companies that measure dividend growth streaks in the multiple decades, they have shown that they can raise their payments through all portions of the economic cycle. This includes recessionary periods, which are often the most difficult environment to grow dividends.

As a result, we feel that blue chip stocks are among the safest dividend stocks that investors can buy.

The next installment of the 2022 Blue Chip Stocks in Focus series will analyze Franklin Resources, Inc. (BEN)

Business Overview

Franklin Resources was founded in 1947 and is headquartered in San Mateo, CA. Franklin Resources is a global asset manager that has a long and successful history. The company offers investment management services, which contributes the majority of fees that Franklin Resources collects. In addition, the company provides sales, distribution, and shareholder services. The company is valued at close to $13 billion and generates annual revenue in excess of $8 billion.

Franklin Resources reported second quarter results on May 3rd. Revenue grew 0.2% to $2.1 billion while adjusted earnings-per-share of $0.96 compared favorably to $0.79 in the prior year.

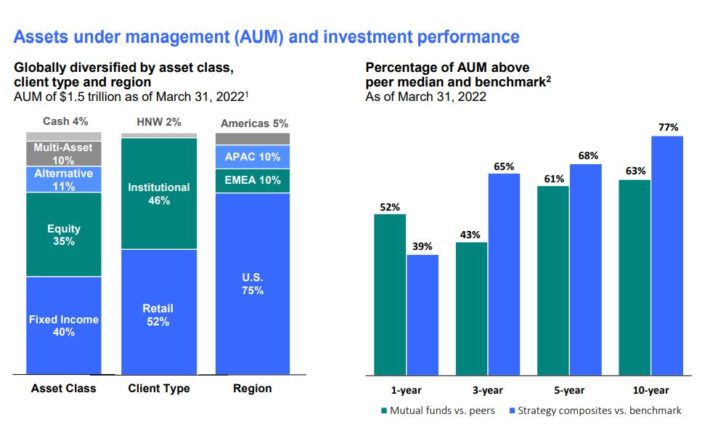

Franklin Resources’ assets under management (AUM) is one of the largest in the entire asset management space.

Source: Investor Presentation

As of the end of the first quarter of 2022, Franklin Resources had $1.5 trillion in AUM. The company’s AUM have greatly outperformed peers and benchmarks over multiple periods of time.

AUM did decline $100.6 billion compared to the last quarter, mostly due to $81.8 billion of net market change, distributions, and other items. The company also had $11.7 billion of long-term net outflows and $7.1 billion of cash management net outflows.

Growth Prospects

Franklin Resources has several avenues for growth. First, the emergence of exchange-traded funds has become a major source of strength in the asset management business. This is true for Franklin Resources as well. For example, the company had $12.7 billion of outflows during the last quarter, but the ETF business had $13 billion of net flows as this investment strategy remains very popular with investors even as the markets have seen violent swings in prices.

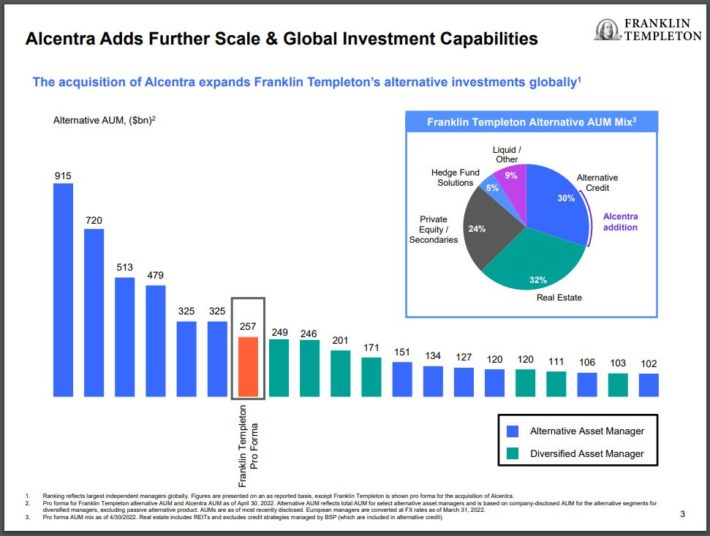

Next, Franklin Resources has augmented its core business through the use of acquisitions, especially in areas that the company doesn’t have as much of a presence. One such area is alternative investments, which includes private debt, structured credit, high-yield funds, commercial real estate, and collateralized loan obligations.

To that end, Franklin Resources has made several acquisitions over the years to improve the company’s positioning in this arena.

On April 1st, Franklin Resources announced that it had completed its previously announced purchase of Lexington Partners, a leading global manager of secondary private equity and co-investment funds, for $1.75 billion. This added $34 in AUM to Franklin Resources and extended the company’s footprint in alternative investments.

More recently, Franklin Resources announced on May 31st that it had agreed to acquire Alcentra Group Holdings from The Bank of New York Mellon Corporation (BK) for up to $700 million. Alcentra has $38 billion in AUM and will double Franklin Resources’ alternative credit capabilities in Europe. Following the close of this transaction, the company will be one of the larger names in alternative investments, a space Franklin Resources had limited scope just a few years ago.

Source: Investor Presentation

In addition, Franklin Resources has reduced its share count by an average of 2.5% per year over the last decade. The company repurchased almost 3 million shares of stock in the most recent quarter as it remains committed to returning capital to shareholders.

Given the size of the company’s AUM, bolt on acquisitions, and share repurchases, we project that Franklin Resources will grow earnings-per-share at a rate of 3% per year over the next five years. This growth rate is nearly in-line with the average for the last decade.

Competitive Advantages & Recession Performance

Asset management is a very competitive space that doesn’t afford a specific company any major competitive advantages.

That said, Franklin Resources does appear to have a leg up on the competition given its name and fund performance over the long-term.

The company has the AUM that it does because its funds have outperformed peers, which attracts new investors. Franklin Resources’ long-term mutual funds have had strong returns over the last one-, five-, and 10-year periods of time relative to competing funds, showing that Franklin Resources’ methodology for investing works over multiple time frames. Nearly half of Franklin Resources’ funds are rated four or five stars by Morningstar.

Performances like this are likely a driving force behind the company’s ability to attract capital.

The downside to the asset management business is that recessionary periods can be difficult for firms to navigate. Below are Franklin Resources’ annual earnings-per-share results before, during, and after the last recession:

- 2006 earnings-per-share: $1.85

- 2007 earnings-per-share: $2.37 (28% increase)

- 2008 earnings-per-share: $2.24 (5.5% decrease)

- 2009 earnings-per-share: $1.30 (42% decrease)

- 2010 earnings-per-share: $2.12 (63% increase)

- 2011 earnings-per-share: $2.89 (36% increase)

Earnings-per-share for Franklin Resources declined 45% peak to trough from 2007 to 2009, which wasn’t unusual for a company in the asset management industry. The company did see a quick rebound the very next before setting a new high for earnings-per-share in 2011, pointing to the strength of Franklin Resources’ business model.

Importantly for income investors, Franklin Resources continued to grow its dividend throughout the last recession, with shareholders receiving a total dividend increase of 47.4% for the period. The company has a dividend growth streak of 42 consecutive years, which has earned Franklin Resources the title of Dividend Aristocrat.

And with a projected payout ratio of just 31% for 2022, Franklin Resources is poised to continue raising its dividend for years to come. Shares yield 4.6%, which is nearly three times the average yield for the S&P 500 Index.

Valuation & Expected Returns

Franklin Resources is currently trading at just 6.8 times expected earnings-per-share of $3.71 for the year. For much of the last decade, the stock has traded with a low double-digit price-to-earnings ratio.

Given the competitiveness of the asset-managed business, we believe that a target price-to-earnings ratio of 9 for the stock is appropriate as this takes into account Franklin Resources’ name and performance with the competitiveness of the industry.

If the valuation were to expand to meet our target by 2027 then Franklin Resources would see a 5.7% annual tailwind from multiple expansion.

Therefore, we project that Franklin Resources will have total annual returns of 12.3% over the next five years, stemming from a 3% earnings growth rate, a starting yield of 4.6%, and a mid-double-digit contribution from multiple expansion.

Final Thoughts

In times of market volatility, we suggest investors consider owning blue chip stocks. Franklin Resources, with a dominate leadership position in its industry and more than four decades of dividend growth, has all the makings of blue chip name.

Just as important, the stock could provide annual returns in the low double-digit range based on modest earnings growth, a safe high yield, and the potential for an expanding multiple. As a result, Franklin Resources earns a buy recommendation from Sure Dividend due to projected returns.

For these reasons, we view Franklin Resources as a high-quality blue chip stock that could provide investors excellent total returns.

The Blue Chips list is not the only way to quickly screen for stocks that regularly pay rising dividends.

More By This Author:

Blue Chip Stocks In Focus: Parker-Hannifin Corporation

Blue Chip Stocks In Focus: Fresenius Medical Care AG

Blue Chip Stocks In Focus: Ameriprise Financial Inc.