Bear Of The Day: Park National

Although stocks got off to a better start in 2023 than in 2022, the outlook isn’t bright for all.

One such company, Park National (PRK - Free Report), has seen its near-term earnings outlook drift lower across all timeframes over the last several months, pushing the stock into an unfavorable Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

Park National is a family of community banking teams delivering resources to individuals and businesses with a hands-on approach.

Let’s take a closer look at how the stock currently stacks up.

Quarterly Performance

Park National has struggled to exceed quarterly estimates as of late, falling short of the Zacks Consensus EPS Estimate in three consecutive quarters.

Just in its latest release, the company fell short of bottom-line expectations by nearly 23% and reported revenue 4.5% below the consensus estimate. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

The market didn’t take the recent miss lightly, with shares embarking on a downward plunge following the release. This is illustrated in the chart below.

Image Source: Zacks Investment Research

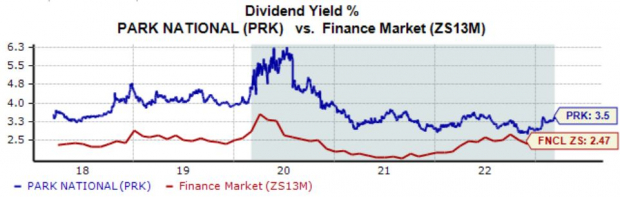

Dividends

The stock does pay an annual dividend, currently yielding a solid 3.5% annually and sitting well above the Zacks Finance sector average.

Image Source: Zacks Investment Research

And the company has shown a commitment to increasingly rewarding its shareholders, upping its payout six times just over the last five years.

Growth Estimates

PRK’s earnings are expected to get a nice boost in its current fiscal year, with the $8.67 Zacks Consensus EPS Estimate indicating a positive 6% year-over-year change.

Still, growth tapers off in FY24, with estimates calling for a 12% pullback year-over-year within earnings.

Bottom Line

Weak quarterly results and negative earnings estimate revisions from analysts paint a challenging picture for the company in the near term.

Park National (PRK - Free Report) is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook over the last several months.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

More By This Author:

Airline Stock Roundup: Gol Linhas & Azul's Q4 Loss, Delta's Deal With Pilots & More

3 Stocks To Buy For Consistent Dividend Growth

Keep These 3 Stocks On Your Buy List After The Market Selloff

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more