Keep These 3 Stocks On Your Buy List After The Market Selloff

Image: Bigstock

This week’s selloff was intensified by economic concerns stemming in the financial sector after the collapse of SVB Financial Group’s (SIVB - Free Report) Silicon Valley Bank. However, the broader selloff in markets has been creating opportunities, and here are three stocks that investors should keep an eye on amid this market environment.

Salesforce (CRM - Free Report)

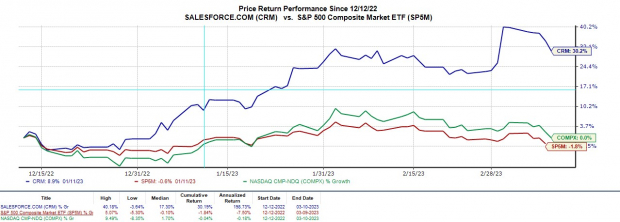

We’ll start the list with a Zacks Rank #1 (Strong Buy), as Salesforce’s stock has been looking very intriguing recently. After crushing its Q4 top and bottom line expectations last week, Salesforce stock has been seeing some nice momentum.

The wrench that was thrown at the rally from broader economic concerns may offer investors a better buying opportunity. Furthermore, a small correction can be healthy and may even offer longer-term support.

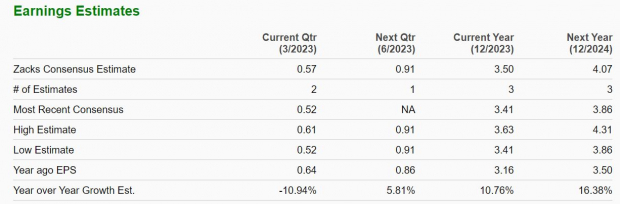

Plus, earnings estimate revisions have been trending higher following Salesforce's stellar fourth-quarter results. This should continue to be a catalyst for Salesforce stock after the smoke clears from this week’s market decline.

Image Source: Zacks Investment Research

Throughout the quarter, Salesforce’s fiscal 2023 and FY24 earnings estimates have soared approximately 23% and 29%, respectively. Fiscal 2023 earnings are now expected to climb 33%, and jump another 26% in FY24 at $8.75 per share.

Even better, Salesforce stock is still up +31% year-to-date to largely outperform the S&P 500’s +2% and the Nasdaq’s +6%.

Image Source: Zacks Investment Research

Sterling Infrastructure (STRL - Free Report)

Next up is Sterling Infrastructure, which sports a Zacks Rank #2 (Buy). It also gained some nice momentum after the company recently announced it was awarded a site development project for Hyundai’s EV battery facility.

This is on top of stellar growth in 2022, with earnings estimate revisions continuing to trend higher for fiscal 2023. Sterling’s earnings are now expected to jump 11% in FY23 and climb another 16% in FY24 at $4.07 per share.

Image Source: Zacks Investment Research

Sterling stock is still up +18% year-to-date to largely outperform the broader indexes, and its attractive valuation and stellar performance over the last few years indicate there could be more upside ahead.

Shares of STRL have recently been seen trading at around $38 and just 11.6X forward earnings, which is nicely below the industry average of 19.9X and the S&P 500’s 17.9X. Plus, Sterling stock trades much more reasonably than its decade high of 298.8X and at a slight discount to the median of 12.6X.

Image Source: Zacks Investment Research

EPR Properties (EPR - Free Report)

Rounding out the list is EPR Properties, which sports a Zacks Rank #3 (Hold). Many REITs are becoming attractive after the massive selloff among the broader financial sector, and EPR may be worth considering for its attractive valuation, diverse portfolio, and lucrative monthly dividend.

EPR’s properties include megaplex theaters, entertainment retail centers, lodging properties, and early childhood education centers, among others.

Recently trading around 33% from its 52-week highs, EPR’s valuation has been starting to stand out. EPR has recently been seen trading at around $37 per share and 8X forward earnings, which is nicely beneath the industry average of 12.5X and the benchmark.

Image Source: Zacks Investment Research

EPR also trades 68% below its decade high of 25.2X and at a 40% discount to the median of 13.2X. In addition to this, EPR’s 8.44% dividend yield blows away the REIT and Reality Trust – Retail Markets 4.22% and the S&P 500’s 1.62%. This should certainly support patient investors and income seekers as shares of EPR are down -9% year-to-date, but they are very enticing at their recent levels.

Image Source: Zacks Investment Research

Bottom Line

Salesforce, Sterling Infrastructure, and EPR Properties all look like strong buy-the-dip candidates following this week’s selloff. There could be plenty of upside ahead for these stocks as volatility subsides and we get back to what hopefully continues to be a rebound year for many equities.

More By This Author:

FedEx To Report Q3 Earnings: What's In The Offing?Buy These 3 Energy Mutual Funds For Spectacular Returns

Reap Monthly Income With This Combination Of 3 Stocks

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more