3 Stocks To Buy For Consistent Dividend Growth

Image: Bigstock

One way to avoid some of the volatility in the stock market is to buy old companies that have a long history of raising dividends. Some of these companies have been around for over 100 years and have seen all kinds of economic environments. These are companies with iconic brands, lasting products, and committed management.

Their commitment to shareholders is evident from long histories of consistently raising dividends. These companies have well-established business models, with regular, slowly growing cash flows, conservative reinvestment, and regular distribution of excess cash.

One of these stocks has been raising dividends every year for more than 50 years. Forget dividend aristocrat, that one is a dividend king. Another is famous for its 100-year-old candies, and the last is an insurance company which is well known for its animal mascot.

Hershey

As one of the most iconic brands in the world, Hershey (HSY - Free Report) has been paying dividends since 1930. Founded in 1894, Hershey manufactures and sells a wide range of snacks, candy, and confectionery foods through some 80 well-known brands.

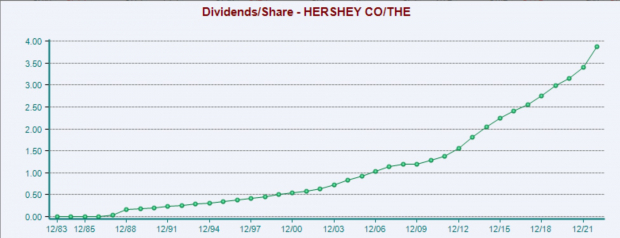

Although there were a few years since 1930 in which the dividend didn’t increase, the company has raised the payment every year since 2009. Over the last five years, dividends have grown an average of 8.7% annually. Currently, the stock has a dividend yield of 1.7%.

Image Source: Zacks Investment Research

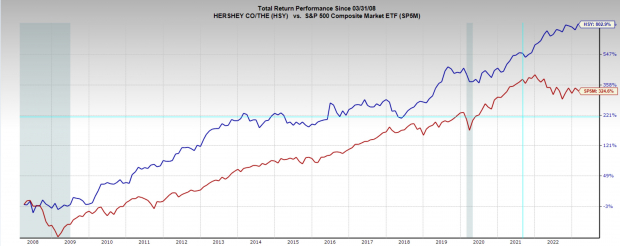

Hershey’s stock price has performed extremely well over the last 15 years, appreciating by an average of 16% annually, outperforming the S&P 500’s average of 10%.

Image Source: Zacks Investment Research

Additionally, over the last two years, which have been particularly volatile, HSY has been a steady performer, returning 60% in excess of the index. All of this comes along with low volatility and a quarterly dividend payout.

Image Source: Zacks Investment Research

Hershey is a Zacks Rank #2 (Buy) stock, indicating upward trending earnings revisions. Current year sales are projected to grow 8% year-over-year to $11.2 billion, and earnings are expected to climb 10% to $9.39 per share. Earnings expectations have been revised higher across all time frames, with the current year being revised 10% over the last 60 days.

HSY is about as steady as they come. Over the last 10 years, its one-year forward earnings multiple has stayed within a relatively tight range compared to many other stocks. HSY has recently been seen trading at 25x one-year forward earnings, which is just above its 20-year median of 24x.

Image Source: Zacks Investment Research

Becton, Dickinson and Company

Becton, Dickson and Company (BDX - Free Report) has been raising its dividend every year for the last 51 years. BDX is a medical technology company engaged in the development, manufacting, and selling of medical devices, instrument systems, and reagents.

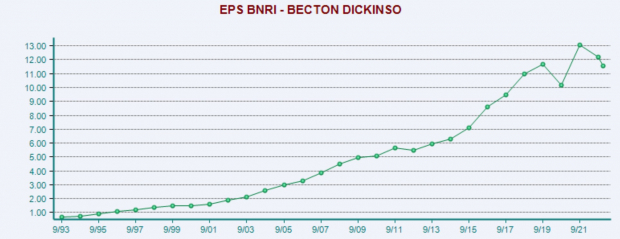

The impressive consistency with which BDX increased its dividends is powered by an equally remarkable growth in earnings per share. Between 1993 and 2023, EPS has grown from $0.68 per share to $12.23 per share. That is a 10% CAGR.

Image Source: Zacks Investment Research

BDX stock has been consolidating in a range for nearly five years, which is not something seen very often. Although that may concern some investors, it is worth noting that both sales and earnings have increased over that time.

Image Source: TradingView

Beckton, Dickson and Company boasts a Zacks Rank #2 (Buy), indicating an upward earnings revision trend. The current quarter earnings have been revised lower over the last 60 days, but current year and next year earnings have both been revised higher over the last 60 and 30 days.

Image Source: Zacks Investment Research

The stock has recently been seen trading at a one-year forward earnings multiple of 19x, which is just below its five-year median of 20x. BDX has a dividend yield of 1.6%, which has increased by an average of 4% annually over the last five years.

Image Source: Zacks Investment Research

Aflac

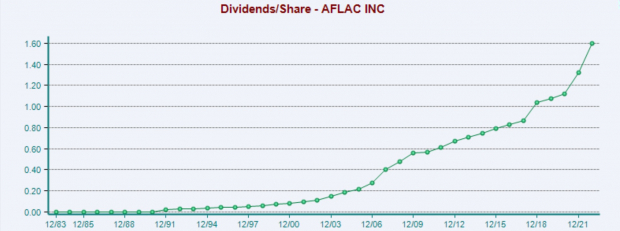

Aflac (AFL - Free Report), a supplementary life and health insurance company, has raised its dividend every year for the last 39 years. Not only has AFL raised its dividend consistently, the size of the increase has accelerated over the last few years. An average of 10% in the last five years, 14% the last three years, and 21% this last year. The dividend yield is 2.6%.

Image Source: Zacks Investment Research

Like other dividend growth stocks, AFL has outperformed the market considerably over the last two challenging years.

Image Source: Zacks Investment Research

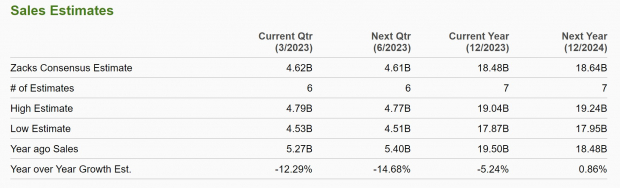

Analysts are expecting sales to shrink over the coming year, but AFL stock still boasts a Zacks Rank #2 (Buy), as earnings revisions are trending higher on all time frames.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Aflac is a stock with very steady and consistent valuation. Excluding the COVID-19 crash, its one-year forward earnings multiple has been in just a four-point range over the last 10 years. At 11x one-year forward earnings, it is in line with its 10-year median of 11x.

Image Source: Zacks Investment Research

Conclusion

Dividend growth investing may not be the most exciting trading strategy, but what is exciting is rarely ever profitable. Boring is a good way to slowly compound and grow wealth. Regular dividend payouts provide investors with steady returns along with the option to use the cash for expenses or to reinvest into more stocks.

More By This Author:

Keep These 3 Stocks On Your Buy List After The Market Selloff

FedEx To Report Q3 Earnings: What's In The Offing?

Buy These 3 Energy Mutual Funds For Spectacular Returns

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more