Airline Stock Roundup: Gol Linhas & Azul's Q4 Loss, Delta's Deal With Pilots & More

Image: Shutterstock

In the past week, Latin American carriers Gol Linhas (GOL - Free Report) and Azul (AZUL - Free Report) reported their respective fourth-quarter 2022 results. Both carriers incurred losses in the quarter, mainly due to high fuel costs. The top line, however, benefited from the rosy scenario in air-travel demand. The fourth-quarter 2022 earnings of another Latin American carrier were discussed in detail in the previous write-up.

Delta Air Lines (DAL - Free Report) pilots inked a four-year pay-related deal with the company. JetBlue’s (JBLU - Free Report) impending acquisition of Spirit Airlines (SAVE - Free Report) has run into rough weather, with the Department of Justice suing to block the deal.

Recap of the Latest Top Stories

Azul incurred a loss (excluding $1.14 from non-recurring items) of 83 cents per share in the fourth quarter of 2022, larger than the Zacks Consensus Estimate of a loss of 26 cents. The airline had reported a loss per share of 58 cents in the fourth quarter of 2021.

Total revenues of $846.3 million missed the Zacks Consensus Estimate of $899 million, but increased 26.6% year-over-year due to the upbeat air-travel demand. Fuel cost per liter increased 42.5% year-over-year, with oil prices moving north. Currently, Azul carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Gol Linhas incurred a loss of 35 cents per share in the fourth quarter of 2022, wider than the Zacks Consensus Estimate of a loss of 19 cents. In the year-ago quarter, Gol Linhas had incurred a loss of 62 cents per share. Net operating revenues of $898 million lagged the Zacks Consensus Estimate of $916 million. With people again taking to the skies, the company’s top line improved year-over-year.

In first-quarter 2023, GOL expects capacity to increase 11-13% year-over-year. GOL estimates the load factor (the percentage of seats filled by passengers) to be 82% in the March quarter. The fuel price per liter is predicted to be R$5.7 in the current quarter.

Delta received encouraging tidings on the labor front when the Delta Master Executive Council, represented by the Air Line Pilots Association, announced the ratification of a four-year deal pertaining to wage increase. Evidently, 96% of the eligible pilots participated in the voting procedure, with 78% of them voting in favor of the deal.

The approval makes DAL’s 15,0000 pilots eligible for a 34% pay raise over the next four years. This will increase DAL’s costs to the tune of about $7 billion. The pay raise apart, the deal includes provisions aimed at improving pilots’ quality of life.

The contract took effect on March 2 and will become amendable on Dec. 31, 2026. The CEO of American Airlines (AAL - Free Report) is also reportedly ready to give the company's pilots pay raises matching those of Delta.

The number of passengers ferried on Ryanair (RYAAY - Free Report) flights in February registered an impressive figure of 10.6 million. This compared favorably with the year-ago figure of 8.7 million. The load factor was 92% in February 2023 compared with 86% a year ago. Ryanair expects its traffic in fiscal 2023 to be 165 million, indicating 11% growth from pre-COVID-19 traffic numbers.

The Department of Justice has sued to block the impending takeover of SAVE by JBLU. The lawsuit has been filed on concerns that the merger, upon taking effect, will be anti-competitive. The lawsuit alleges that the $3.8-billion deal, on materialization, will lead to higher fares and a reduced number of seats, resulting in an unfavorable scenario for passengers traveling on the flights.

JetBlue had plans to remove 10-15% of seats from every Spirit plane, per the complaint. Per U.S. senator Elizabeth Warren, "Americans want more choices and lower prices for airline tickets, not another giant merger." The roadblock pertaining to the impending merger comes at a time when U.S. airlines are struggling with high labor and fuel costs.

A merger is looked at as a way to save costs. Making matters worse as far as the future of the deal is concerned, the U.S. Department of Transportation is supporting the lawsuit.

Performance

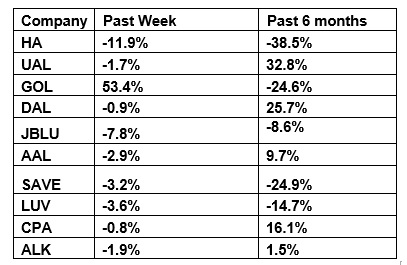

The following table shows the price movement of the major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that most airline stocks have traded in the red over the last week. However, most losses were muted in nature. The NYSE ARCA Airline Index has increased 3.5% to $63.6. Over the course of the past six months, the NYSE ARCA Airline Index gained 1.8%.

What's Next in the Airline Space?

Stay tuned for the usual news and updates on the space.

More By This Author:

3 Stocks To Buy For Consistent Dividend Growth

Keep These 3 Stocks On Your Buy List After The Market Selloff

FedEx To Report Q3 Earnings: What's In The Offing?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more