Be Careful With The Stock Of Curaleaf

Image Source: Unsplash

Curaleaf (CURLF) is the leading American cannabis operator in terms of revenue and market cap. I have been following the company closely since it went public in 2018. The stock is down slightly in 2026, but it is up a lot from its all-time low set at $0.68 in April. I do not like this stock at the current price of $2.43 and explain why in this piece.

The CURLF Chart Is Frightening

While it has dropped 3.6% to begin 2026, the stock has soared over the last year, rising 55.8% since the end of 2024. In comparison, the New Cannabis Ventures Global Cannabis Stock Index has declined 4.9% in 2026 so far and has dropped 8.9% since the end of 2024. The MSOS ETF has dropped 4.2% so far this year, and it is up 18.6% since the end of 2024. Curaleaf is performing better than cannabis stocks overall and better than other MSOs. Here is the one-year chart of CURLF:

(Click on image to enlarge)

While many may be looking at the very recent action, which is a very large decline from its 52-week high set in December, the stock is way above the all-time low of $0.68 set in April.

Investors should focus on the longer-term action. Over the past five years, CURLF has dropped 84.0%, while MSOS is down 90.2%. The rally over the past year has been aided by talks of rescheduling cannabis, though that remains very uncertain with respect to timing or if it will take place after the Executive Order from over a month ago. Looking at the action from the peak of 2024, which was on April 30th, the day that the DEA announced it was moving forward with rescheduling cannabis, CURLF has dropped 61.3%, slightly more than the 59.9% plunge in MSOS.

Curaleaf Has a Big Debt Problem

One of the key things that I have been watching at Curaleaf is its debt, which I wrote about in the New Cannabis ventures weekly newsletter published on January 1st, discussing how it was going to become a short-term obligation. The company had said it would be refinancing this debt, which is due in December 2026, but it has not done so. At the end of Q3, Curaleaf had $456.8 million due 12/15/26, and it had suggested in August on the Q2 conference call that it would get this refinanced by the end of the year. Well, three weeks into the year with 5 press releases issued so far, nothing has been said.

There is still time to refinance, and perhaps cannabis will be rescheduled such that 280E taxation is wiped out. Of course, if it is not, this could be a problem! The Curaleaf balance sheet is much worse than its peers, with negative tangible equity. If Curaleaf is not able to refinance the debt, it could sell stock to cover its debt that is due in 2026.

CURLF Is Overvalued Relative to Peers

I cover 8 MSOS at 420 Investor, 7 of which are Tier 1 or Tier 2. Most of these have balance sheet problems. Only one has positive tangible book value, Green Thumb Industries (GTBIF), which I do like relative to its peers. This is a measure that I think helps investors identify downside risk limitation. Curaleaf has the most negative tangible book value, currently at -$840.6 million compared to GTI at +$791.2 million.

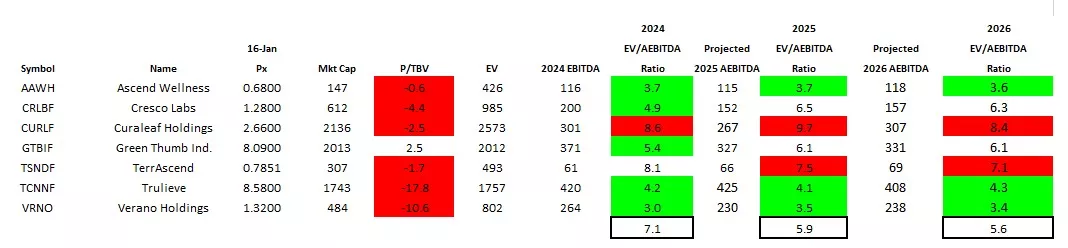

For valuation purposes, analysts and investors tend to compare the enterprise value to the adjusted EBITDA. I keep this table for my subscribers, and here is the one I shared last week as of 1/16:

(Click on image to enlarge)

8.4X projected adjusted EBITDA for 2026 is not that high historically, though it is a big premium to peers! If 280E taxation goes away, I think the stock could go up, but some other stocks do have more upside. If 280E sticks around, Curaleaf could get cut in half. It could face the risk of MSOS, which currently controls 79.5 million shares that represent 21.9% of the ETF, facing more redemptions. It would hurt CURLF if MSOS were to reduce exposure.

Conclusion

If you agree that Curaleaf looks expensive relative to peers, you can replace it with a peer. If you own MSOS, you own a lot of CURLF, and you can sell it. The cannabis market is a global one, and Curaleaf is very different from its peers in that it has some international exposure. So do some other companies, like Organigram, a company that I really like, with a stock that seems like a better deal than Curaleaf. Here is how these to stocks have performed over the last year:

Organigram has no debt, and a large company owns a large stake. There are other ways to invest in cannabis too, and investors can find better balance sheets, better valuations and stocks that don't trade OTC.

More By This Author:

Consider These ETFs To Diversify

OGI: My Favorite Canadian LP

Planet 13 Is A One-Hit Wonder So Far

Disclosure:I do not own any CURLF or any other stock mentioned in this article, nor do I have a short in CURLF. My model portfolio at 420 Investor does include some of the stocks mentioned.