Consider These ETFs To Diversify

Image Source: Pixabay

The most widely followed index for American stocks is the S&P 500, which trades as an ETF under SPY. State Street manages this ETF, which is known as the SPDR S&P 500 ETF Trust but is changing its name next week to State Street SPDR S&P 500 ETF Trust/ State Street hosts a page on its website for the ETF, which was launched in 1993 and has $702 billion in assets.

SPY has extreme concentration now, with the top 10 yesterday representing 37.8%. Here is the list:

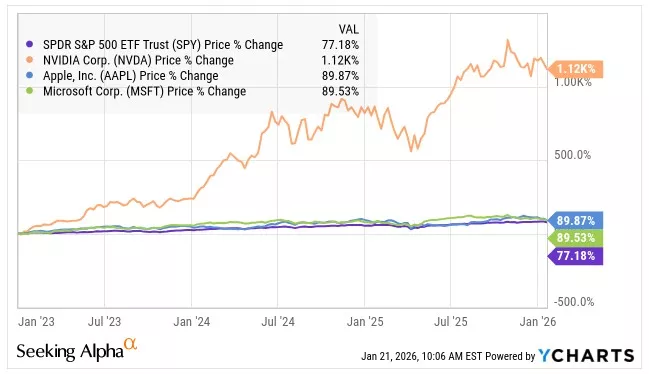

The top 3 names represent almost 20% of SPY, which is over half of the exposure of the top 10. If one owns SPY, one has big exposure to NVIDIA (NVDA), Apple (AAPL) and Microsoft (MSFT). Is this bad? Not necessarily, but it has been so far in 2026. Through 1/20, all of these stocks are down, and SPY is down too, falling 0.6%. The concentration of the S&P 500 leaves SPY with 33.5% exposure to the Information Technology sector. This is well above the other sectors.

Going back to the end of 2022, SPY has rallied in price by 77.2%, and each of these three mega-cap names has done better, especially NVDA:

For those who like these stocks, there is no reason to read on. At least you know what you own!

Alternatives to SPY

I follow 80 ETFs, and many of them are good alternatives to SPY or some of the larger ETFs like QQQ, which is extremely concentrated too.

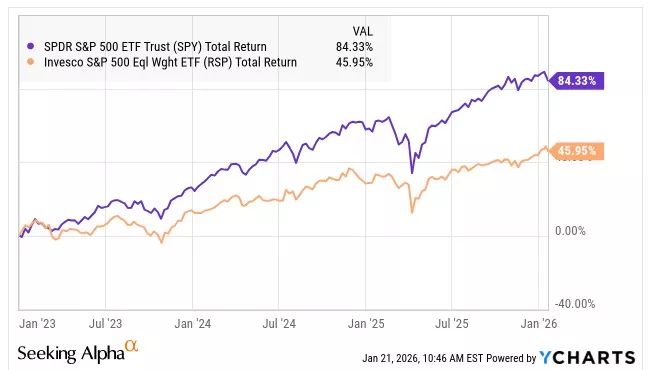

The easiest solution, in my view, is to buy Invesco's ETF, RSP. The Invesco S&P 500 Equal Weight ETF holds all of the names that are in the index. You can learn more about this unique ETF on the page it hosts for RSP on its website or the Fact Sheet as of 12/31. The ETF, which does have a higher management fee of 0.2% compared to SPY having one of 0.09%, owns all of the names that are in the S&P 500 but at equal weights when it rebalances on a quarterly basis. Owning RSP instead of SPY leaves owners more diversified. The Information Technology weighting at year-end was 13.5%, substantially lower than the S&P 500.

RSP should ultimately track SPY well, but it has lagged badly in recent years. Here is the perspective since the end of 2022:

RSP has lagged terribly since the end of 2022, but if one goes back to the launch of RSP in 2004, it has returned about the same as SPY since then.

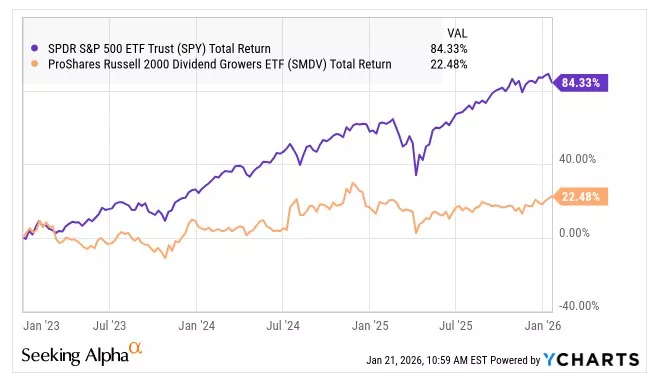

Another way to diversify is to go beyond the S&P 500. I created an ETF model portfolio at year-end that had six ETFs in it. My largest position in an ETF focused on stocks in that model portfolio was ProShares Russell 2000 Dividend Growers ETF (SMDV), which was higher than the weighting as RSP at 12%. I did boost the ETF on 1/16, taking profits on another position, one that was focused on Small-Cap Value. Both RSP and SMDV are up in 2026 and are slightly higher than 15% of my model portfolio currently.

SMDV is focused on the Russell 2000 (Small-Caps) and aims to beat the Russell 2000 Dividend Growth Index. The ProShares website for SMDV discusses the uniqueness of the ETF, saying that it is the only ETF to focus exclusively on dividend growers in the Russell 2000. The expense ratio of the fund is higher at 0.4%, but I think it is a very reasonable expense. There are 104 stocks in it currently. Like RSP, it weighs stocks equally when it rebalances. Unlike RSP, it has no exposure to any names in the S&P 500. Like RSP, it has substantially underperformed SPY since 2022:

What to Do Now

I have discussed just two of my the ETFs that I follow and like currently, but there are many other ideas. Most should be okay with RSP, which is all Large-Caps names. These are the exact same companies but with different weightings due to being equal-weighted rather than market-cap weighted.

SMDV is a bit tougher for many. Not only is the ETF much smaller, it is focused on a different universe. I think that Small-Caps in general have underperformed Large-Caps for quite some time, though they have done well relatively very recently. But, SMDV is very different from the overall Small-Cap universe due to its focus on dividend growers.

I am cautious on stocks, as we have had a huge bull market since stocks bottomed after the pandemic hit. I think going to cash makes a lot of sense, and those who are bearish should consider doing so. I do like these two ETFs and believe that they could keep advancing, but some may want to buy the next dip. Just because Large-Caps have done so well does not mean that this will reverse, but it also does not mean that SPY will continue to soar.

So, what you should do now really depends upon you! My goal in writing this is to make sure that investors in large ETFs like SPY understand more about what they own and to share potential alternatives for those who don't like such concentration in the Magnificent 7 or in the Information Technology sector. My view is that investors should sell SPY and buy RSP and SMDV.

More By This Author:

OGI: My Favorite Canadian LP

Planet 13 Is A One-Hit Wonder So Far

Cannabis Now a Global Investment Opportunity

Disclosure: My wife includes SMDV in her IRA. I have no position in SPY, RSP or SMDV