OGI: My Favorite Canadian LP

Image Source: Unsplash

I have been following Organigram (OGI) since it went public in 2014. The company, based in New Brunswick, is a leading Canadian licensed producer of cannabis. II think the stock is relatively cheap, and it is my second-largest position in my model portfolio at 420 Investor. In this piece, I discuss its current fundamentals, assess the valuation and share my look at its chart.

FY2025 Was a Solid Year for Organigram

The Organigram fiscal year ends in September, and the company reported its fiscal Q4 in mid-December. The company's Q4 revenue and adjusted EBITDA were ahead of expectations. Net revenue of C$80.1 million grew 79%, aided by an acquisition, while adjusted EBITDA of C$9.8 million grew 69%.

The strong quarter helped improve the fiscal year results. In FY25, net revenue of C$259.2 million grew 62%. Adjusted EBITDA of C$21.9 million expanded by 160%. In February, ahead of its FY25-Q1 report and after the Motif Labs acquisition, analysts, according to Koyfin, had expected revenue of C$251 million with adjusted EBITDA of C$14 million, so the company did deliver better results than had been expected. Most of the company's revenue was in its home market, boosted by the acquisition of Motif Labs during the year, which increased gross revenue by C$138 million (55%). International sales grew 173% to C$26.3 million, 10% of net revenue.

OGI has an excellent balance sheet, ending with cash of C$28.2 million. Note that the company also had restricted cash of C$55.4 million. There is no debt. Operating cash flow for the year was -C$7.6 million, weighed down by rising inventory.

The strong balance sheet if due to the large investment made by British American Tobacco (BTI), which completed a reinvestment into the company in February. The strategic investor was a bit early in its initial investment in 2021, buying about 20% of the company for C$221 million.. The reinvestment, at a much lower price but a premium to the price when the deal was announced in late 2023 and to where it has traded subsequently, was done in three closings that settled from January 2024 until February 2025, totaling C$125 million. The last closing boosted the stake, which is now 40.1 million shares and 13.8 million preferred shares that convert to 14.6 million common shares currently. This is effectively a stake that represents 30% of the common stock and 45% of the overall economic interest of the company.

The BAT stake in Organigram is not the only large equity holding among the large Canadian LPs. Altria (MO) has a massive stake in Cronos Group (CRON), and Constellation Brands (STZ) owns Exchangeable Shares in Canopy Growth (CGC). What I like about BAT's involvement with Organigram is that they have recently upped the stake, while those rival investment stakes are quite old and extremely underwater. I also appreciate that the two companies do work closely together. In November, Organigram announced a new CEO, James Yamanaka effective in January 2026. The press release warned that Yamanaka, who worked for two decades at British American Tobacco,, most recently as its Global Head of Strategy, needed to complete some immigration matters before beginning the role. I do like this appointment, while I am not happy with the company's failure to provide any update at all despite the passage of the 1/15 date.

OGI Seems Attractively Priced

While OGI traded well below tangible book value during the downturn, it now trades at 1.4X. I follow 5 Canadian LPs closely, and this level is in the middle of the ratios of the group, with two LPs, Canopy Growth and Cronos Group, trading at just 1.0X. I do not think that investors should use this as a primary measurement of value, but it does help to form downside risk in my view. OGI and these two peers trade on the NASDAQ and have net cash.

Analysts expect OGI revenue to grow 19% in FY26 to C$309 million. Adjusted EBITDA is expected to increase 64% to C$35.8 million, a margin of 11.6%. While the market cap is smaller than CGC and CRON and the other two Canadian LPs that I cover closely, its projected adjusted EBITDA is higher than both.

Looking at the projected adjusted EBITDA levels for these companies, one can compare the enterprise value to them. OGI currently trades at 11.7X projected one-year forward (75% of FY26 and 25% of FY27), which is a lot better than the 89.7X for CGC. CGC has investments in the U.S. in American cannabis operators that it holds on its balance sheet due and doesn't run through its P&L to NASDAQ rules. CRON trades at a very low multiple because its enterprise value is so low due to so much cash relative to its market cap.

I have a large position in my model portfolio in Organigram, and I have shared a year-end 2026 target with my subscribers at 420 Investor of C$3.38 based on 15X projected FY27 adjusted EBITDAto enterprise value. This works out currently to $2.43, which would be a gain of 51%. While betting on a strategic investor to buy the rest of an investment is always a challenge, it has been a very big challenge among Canadian LPs. My target has nothing at all to do with the potential acquisition by BTI, but BTI could certainly afford to buy OGI for cash or for stock. BTI has a market cap of $126 billion and cash of about $6 billion at mid-year.

The OGI Chart Shows Potential Upside

In 2026 so far, OGI has declined 4.2%, which is slightly worse than the overall market as measured by the New Cannabis Ventures Global Cannabis Stock Index decline of 3.0% to 6.39. Since the end of 2024, though, it has rallied 2.6%, while the GCSI has dropped 7.1%. Here is the 3-year chart:

Readers should keep in mind that the company did a reverse-split (4 shares to 1 share) in July 2023. What I like about this time-frame is that it captures the reverse-split, includes the multi-year low of $0.85 in 2025 and covers the period where BTI announced its additional investment in late 2023 and the closings of those investments. Note that the price BTI paid was C$3.22, which is currently $2.31. Note that the stock ran up a lot in early 2024 but plunged when it reported its FY24 Q1 financial results in February, leaving a gap that remains open. My target for year-end of $2.43 would be a slight premium to the price that BTI paid and would not fill that gap.

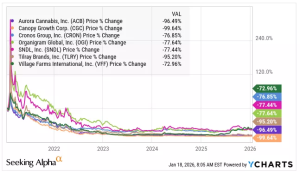

Looking at the price action compared to peers over the past five years, OGI has not been the worst, nor has it been the best:

These seven stocks, which are currently the Canadian LPs that are in the Global Cannabis Stock Index, have declined an average of 85.2%. For those who think BTI might buy the rest of OGI, its stock has increased by 53.7%.

Conclusion

I have been bullish on OGI for a while, but I don't always like the price. I do like it now, but my 15% weighting in my 420 Investor model portfolio is due less to my strong views for the company and more for its relative valuation and risk profile compared to American cannabis operators. My model portfolio currently has 32.3% exposure to the Canadian LPs compared to the Global Cannabis Stock Index having 26.1%. The other two names are Cronos Group and Canopy Growth. I have only 7.1% exposure to the American MSOs, substantially below the index exposure, and 40.7% exposure to ancillaries, substantially above the index exposure. I also currently have cash just below the maximum that the model portfolio permits, at 19.9%.

OGI has no exposure to state-legal cannabis in the U.S., though it does have U.S. cannabis exposure through its THC from hemp beverages. I don't think that the U.S. market is that meaningful to the company, though I had thought that it would do well potentially in the hemp-based beverages, which are currently facing outlaw in November by legislation approved late in 2025. My bullishness does not entail acquisition by BTI, but that could happen.

More By This Author:

Planet 13 Is A One-Hit Wonder So Far

Cannabis Now a Global Investment Opportunity

Pot Stocks: A Good Investment?

Disclosure: My model portfolio at 420 Investor holds a 15.0% position in OGI, its second-largest holding.

Subscribe to more