Artificial Intelligence: Just How Disruptive Will It Be?

There’s no denying it — artificial intelligence (AI) is poised to revolutionize the digital world. Companies and investors alike are approaching it with enthusiastic optimism. And though no one is betting against it, whether it lives up to all the hype is the million-dollar question.

disruptive technology: an innovation that significantly alters the way that consumers, industries, or business operate. A disruptive technology sweeps away the systems or habits it replaces because it has attributes that are recognizably superior.1

The alluring potential of disruptive technology

A good example of the effects of disruptive technology was in the late 1990s, when the internet was about to take over the world. Companies and investors could tell we were on the brink of something extraordinary. And the technology sector exploded with new startups seeking to capitalize on the growth potential.

Then a new company called Google disrupted the new internet space by inventing an innovative internet search algorithm that ranked web pages based on relevance. We all watched as Google systematically overtook and outpaced the other search engines, like Yahoo, MSN Search (now Bing), and AltaVista. And Google was only getting started. Through calculated research and development, Google not only created a superior user interface and experience, but also introduced Google AdWords (now Google Ads), Google Maps, and Chrome.

Fast forward to present day, and the AI headlines are dominated by Nvidia, but other companies are vying for top spot. Meta unveiled Artemis, an accelerator chip designed to manage Facebook and Instagram. Intel released Gaudi3, reportedly twice as fast as the graphics processing unit (GPU) that trained ChatGPT. Google developed Axion, a central processing chip to enhance their data centers.

And there are countless other companies working to develop AI technology, as they anticipate that current and future stakes are high. In fact, the chart titled, “Average Price Increase by AI Mentions,” illustrates a correlation between AI mentions and pricing increases among S&P 500 companies.

Learning from past disasters: The dot-com era

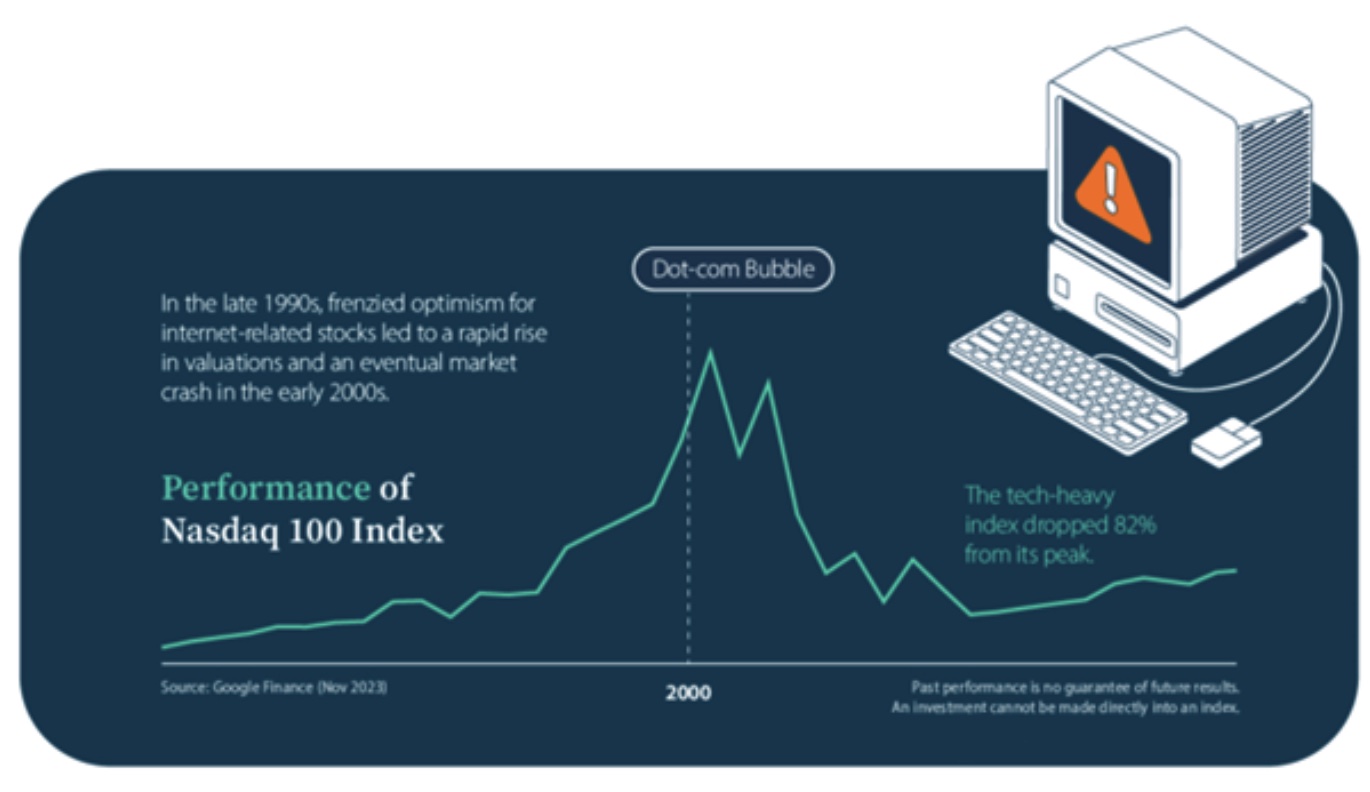

In the 1990s, everyone expected the internet to revolutionize life. But the anticipation overtook common sense as internet-based companies began to boom and their stock values soared, despite a lack in revenue. Between 1995 and 2000, the Nasdaq rose 400%,2 and venture capital funds raised more money than ever before.

During the dot-com era, the significant overvaluing of the sector eventually led to its sharp correction and subsequent collapse as the Nasdaq dropped 82% from its peak.3 The chart titled, “Performance of Nasdaq 100 Index,” offers a visual representation of the rise and fall of the technology sector during the dot-com era. And the dot-com crash was the primary cause of the deep recession we experienced in 2000 and 2001.

Closely monitoring market-bubble indicators

Just saying the phrase “dot-com era” is enough to evoke negative reactions among financial professionals, or anyone who invested in technology during the 1990s. And that’s why it’s no surprise that some are concerned that all the excitement and interest in AI could lead to another market bubble.

So, how will we know if AI is creating a market bubble? The leading indicator of a market bubble is forward price-to-earnings (P/E) ratios. In March 2000, the height of the dot-com era, the forward P/E ratio of the Nasdaq was 60.1.3 But as of June 13, 2024, the forward P/E ratio for the Nasdaq was only 31.16.4 This lower forward P/E ratio suggests that investors are approaching AI more judiciously — focusing on earnings, instead of speculating on price.

As investment professionals, we are eager to watch it all play out. And we’re continually monitoring the technology sector in search of investment opportunities, while keeping a close watch on any indicators of a potential market bubble.

AI will undoubtedly influence the future

At Potentia Wealth, we expect AI to enhance our day-to-day lives. We expect the market excitement to continue to propel the major players toward AI innovation. And we expect the potential possibilities within AI to spill over to the many smaller companies seeking to make a name through AI.

One thing is certain — AI will shape the future. But the extent of the influence is yet to be seen. It’s our job to guide clients through this unknown space, as the AI hype will undoubtedly bombard us with significant levels of artificial noise.

1. Investopedia.com. (2022, April 2). Disruptive Technology: Definition, Example, and How to Invest. Retrieved June 13, 2024, from https://www.investopedia.com/terms/d/disruptive-technology.asp#:~:text=What%20Is%20Disruptive%20Technology%3F,attributes%20that%20are%20recognizably%20superior.

2. Scholarly Community Encyclopedia. (2022, November 1). Dot-Com Bubble. Retrieved June 14, 2024, from https://encyclopedia.pub/entry/31800.

3. Visual Capitalist. (2023, November 30). 3 Reasons Why AI Enthusiasm Differs from the Dot-Com Bubble. Retrieved June 14, 2024, from https://www.visualcapitalist.com/sp/3-reasons-why-ai-enthusiasm-differs-from-the-dot-com-bubble/.

4. Macrotrends. Nasdaq PE Ratio 2010-2024 | NDAQ. Retrieved June 14, 2024, from https://www.macrotrends.net/stocks/charts/NDAQ/nasdaq/pe-ratio.

More By This Author:

2023 Mid-Year Investment OutlookAll Recessions Are Not Created Equal

How You Might Benefit From SECURE 2.0 Act

The provided information is for educational purposes only and does not consider any individual personal, financial, legal, or tax considerations. The information contained herein is not intended to ...

more