3 Worst Performing Dividend Aristocrats In 2025

Image Source: Pexels

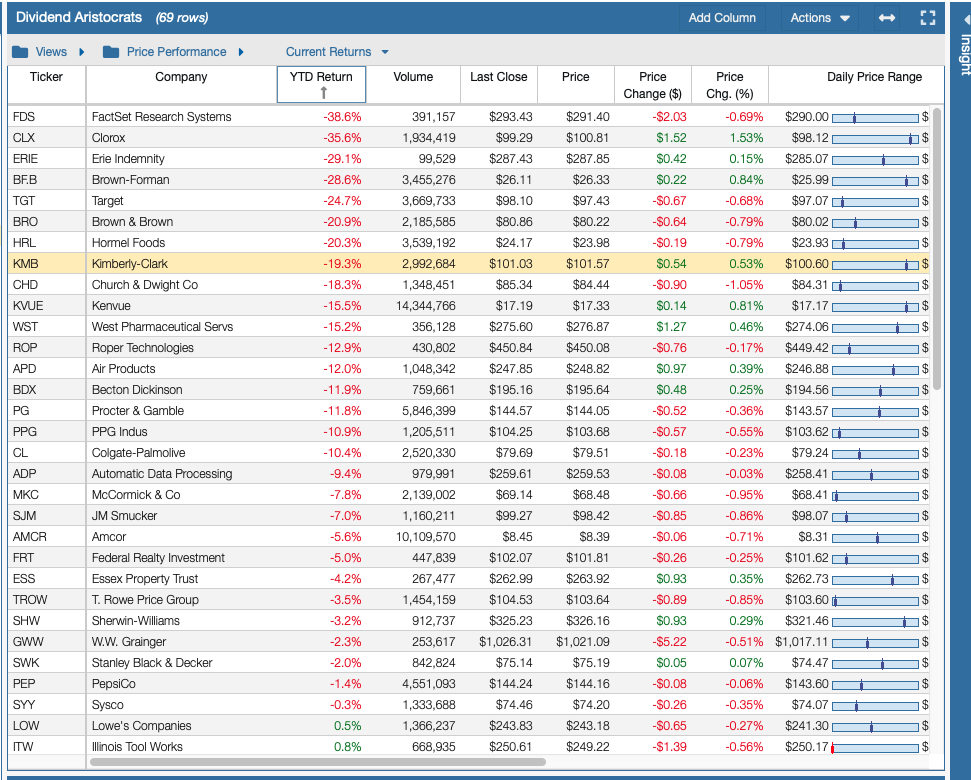

Dividend stocks struggled again this year, much like last year, compared to the Magnificent Seven and other tech stocks. However, the Dividend Aristocrats finished 2025 with a positive return of about 7.3% after accounting for dividend reinvestment. Last year’s return was approximately 7.9%.

Investor interest in AI-related stocks has led to reduced attention in value, income, and dividend growth equities. The 2025 Dividend Aristocrats did not do as well as the broader market because nearly 25% are in the Consumer Staples sector, which performed poorly. It was the worst performing sector in 2025 after a subpar 2024. The Dividend Aristocrats list contains few tech stocks. So, it will underperform when tech stocks do well.

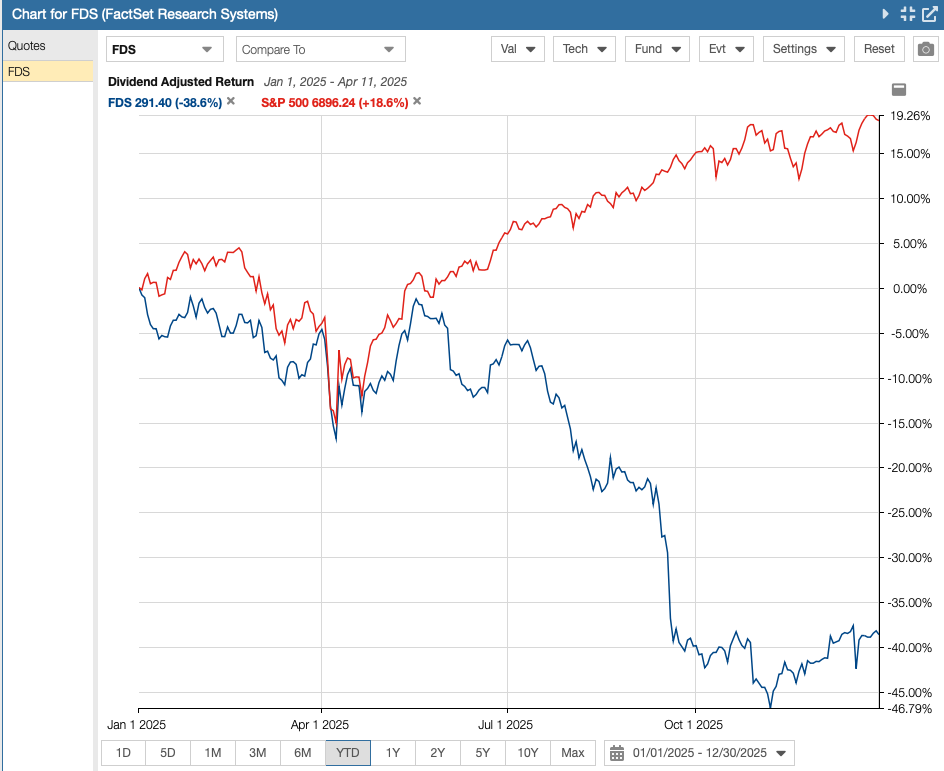

The three worst-performing Dividend Aristocrat Stocks in 2025 were FactSet Research Systems (FDS), Clorox (CLX), and Erie Indemnity (ERIE). This is the second time in four years that Clorox is on this list.

Market Overview

The 2025 Dividend Aristocrats did not perform well relative to the market. This year, the Dividend Kings have climbed roughly 7.3% with dividends reinvested, as seen in the chart from Stock Rover*, which is worse than the Nasdaq Composite (+22.9%), Dow Jones Industrial Average (+14.5%), S&P 500 Index (+19.2%), and the Russell 2000 (+14.5%).

Overall, dividend stocks did not do as well as tech and growth stocks for the third year in a row. Investors again preferred the Magnificent 7 stocks and risk-based assets this year.

The U.S. Federal Reserve lowered rates three times between September and December in 2025. Inflation has declined substantially and was nearing 2% before tariffs, and hesitant consumers created some upward pressure. Inflation is hovering around 3%, depending on the data. That said, the federal government shutdown interrupted the data, and the latest readings are incomplete and not completely accurate. The Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) Price Index are below 3%. The CPI is 2.7%, while the PCE is 2.8% for the last reported values.

Despite weakening employment and job growth, the past year contained good news for Gross Domestic Product (GDP) numbers. The GDP grew at 4.3% annualized rate in the most recent report and reached $31.1 trillion. Much of that is being fueled by investment in AI and data centers. Employment has weakened appreciably, and job growth is flat to slightly declining. The unemployment rate was 4.6% in the most recent report, up from 4.0% at the start of the year, due to a slowing job market. Job growth was flat or negative in some months this year. Similarly, manufacturing and the housing market continue to struggle. Manufacturing has contracted for nine straight months, while housing starts and sales are severely depressed.

That said, a bear market did not happen in 2025. However, after three years of gains and elevated valuations across most sectors, we may be due for one.

(Click on image to enlarge)

Source: Stock Rover*

3 Worst Performing Dividend Aristocrat Stocks in 2025

The three worst-performing Dividend Aristocrat Stocks in 2025, based on our watch list in Stock Rover*, were FactSet Research Systems (FDS), Clorox (CLX), and Erie Indemnity (ERIE).

(Click on image to enlarge)

Source: Stock Rover*

FactSet Research Systems

FactSet Research Systems (FDS) was founded in 1978 and is headquartered in Norwalk, CT. It operates a financial digital platform providing data, analytics, software applications, and other services to institutional investors. Clients include asset managers, wealth managers, hedge funds, private equity, and others. It has over 237,000 users. Total revenue was $2,322 million in fiscal year 2025 and $2,361 million in the last twelve months (“LTM”). The fiscal year ends on August 31st.

The firm’s share price plunged because of mixed results and weaker than expected guidance. FactSet has struggled with increased competition from platforms such as Bloomberg, Refinitiv, Morningstar, Moody’s, S&P Global, and MSCI. The firm is spending heavily to invest in AI and cloud infrastructure for the FactSet Mercury agent, an Amazon Web Services collaboration, and the creation of a combined front- and back-office platform. Next, the company’s user growth rate has slowed, which in turn is pressuring sales growth.

FactSet’s stock price is down about 39% in 2025, pushing the forward yield to around 1.51%, which is not much but higher than the 4-year average of 0.93%. The quarterly dividend rate grew at about 7.45% on average over the trailing 5 years and was even higher at 9.76% over the past decade. The dividend safety metrics are outstanding with a payout ratio of 25.4%, exceptional free cash flow (“FCF”) coverage, and a sound balance sheet.

The valuation has declined to 16.7 times earnings, which is appreciably less than the 5-year average of nearly 30 times earnings. Investors should look at this stock now because of the low earnings multiple and the strong dividend safety metrics. In addition, the payout ratio suggests future dividend increases, adding to the 26-year streak. If the company is successful with its AI and cloud infrastructure offerings, the share price may recover to its prior valuation.

(Click on image to enlarge)

Source: Stock Rover*

Clorox

The Clorox Company (CLX) was founded in 1913 and is headquartered in Oakland, CA. It is a global consumer products company that operates in four business segments: Health and Wellness, Household, Lifestyle, and International. The company owns many familiar brands such as Clorox, Pine-Sol, Formula 409, Glad, Kingsford, Brita, Burt’s Bees, and many more. Total revenue was over $7,104 million in the fiscal year 2025 and $6,771 million in the LTM. The company’s fiscal year ends on June 30th.

Clorox is facing significant headwinds to top and bottom line growth. All four operating segments have experienced lower sales in 2025 because of a cyberattack and the enterprise resource planning (“ERP”) transition, which is a major software change for the company. Revenue was also affected by the divestiture of the vitamin business. That said, organic volumes and sales are declining because of inflation and a hesitant consumer. Consumer packaged goods companies are not able to raise prices fast enough to counter rising input costs.

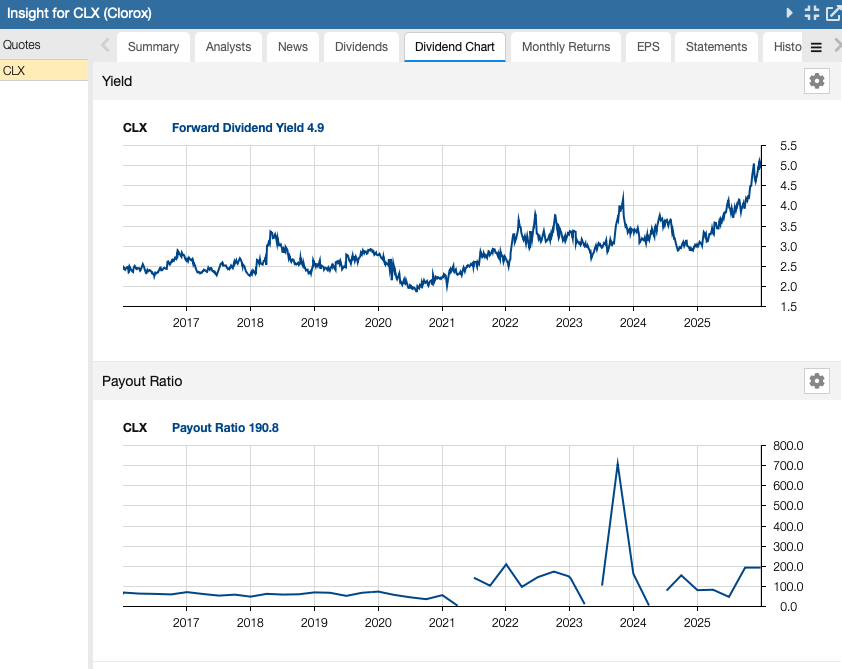

Clorox’s share price has been severely punished for weak revenue and earnings per share growth, as well as weak guidance. The share price has lost ~37.9% year-to-date (“YTD”), putting it clearly in bear market territory. Consequently, the company’s dividend yield has soared to 4.9%, a decade high, much greater than the 5-year average. The dividend safety metrics have weakened with an estimated forward payout ratio of 73% and less cash flow generation. However, leverage is still reasonable. Hence, I expect low-single-digit increases in dividend distributions over the next few years.

The price-to-earnings ratio is only 16.9X, which is below the range in the past five and ten years. While the company faces challenges, its strong brands, global reach, and focus on innovation should allow it to recover. Hence, investors may want to consider this Dividend Aristocrat with a 48-year streak of dividend increases.

(Click on image to enlarge)

Source: Stock Rover*

Erie Indemnity

Erie Indemnity Company (ERIE) was founded in 1925 and is headquartered in Erie, PA. It is an insurance company that primarily offers homeowners, automobile, multiperil, workers’ compensation, and commercial automobile insurance. Total revenue was $3,795 million in 2024 and $4,040 million in the LTM.

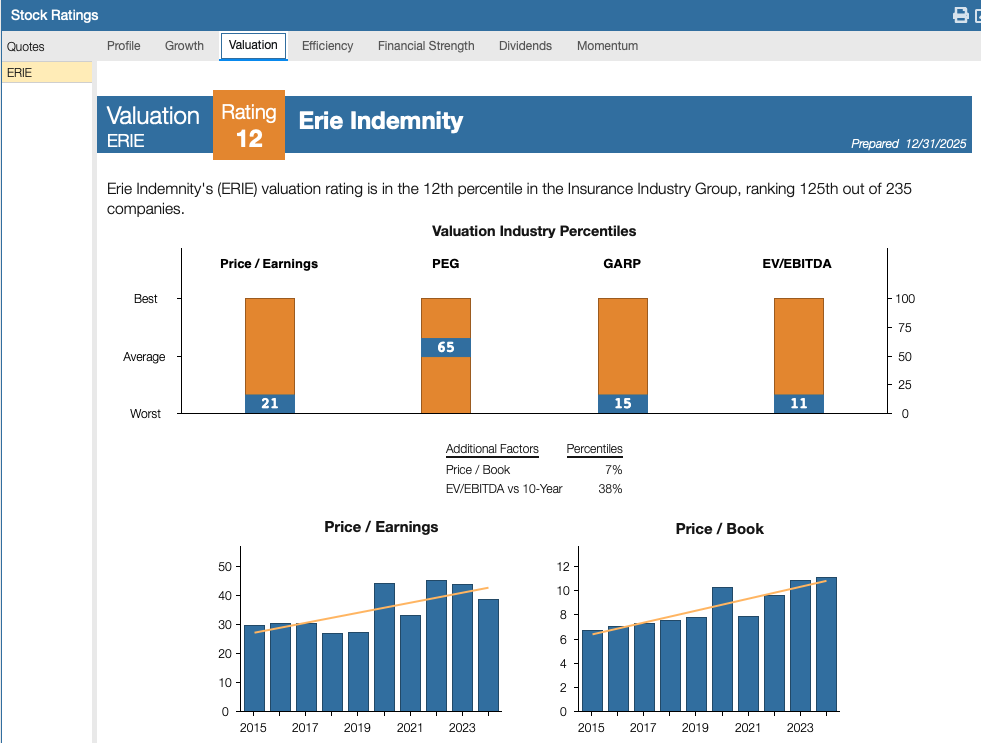

Despite premium growth and decent retention metrics, the share price has fallen about 30.1% in 2025. The main reasons are weather-related losses, inflation, and an elevated valuation. As an insurer, Erie Indemnity faces risk due to weather that can lead to high customer claims for homes and autos. Inflation has the effect of increasing input costs, such as labor. Lastly, the valuation has been elevated. Although the earnings multiple has declined to 22.8X, the short interest is still nearly 5%.

However, despite the steep share price decline, the dividend yield is only 2.0%, compared to the 5-year average of 1.7%. The equity has a 34-year dividend increase streak, with an average annual growth rate of about 7.2% over the past 10 years. Erie Indemnity recently increased its quarterly dividend by 7% to $1.4625 per share. The dividend safety is solid, with a 44% payout ratio and strong FCF coverage.

Despite the decline in share price, Erie Indemnity is not appreciably undervalued. It trades at a P/E ratio of ~22.9X. Also, the dividend yield is relatively low.

(Click on image to enlarge)

Source: Stock Rover*

More By This Author:

3 Worst Performing Dividend Kings In 2025

3 Worst Performing Dow Jones Stocks In 2025

Dine Brands Cut Dividend Because Of Debt

Disclosure: Long CLX.

Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. We are not providing you with individual investment advice on this ...

more