3 Worst Performing Dow Jones Stocks In 2025

Image Source: Pexels

The Dow Jones Industrial Average (DJIA) will finish 2025 with a positive return. The index has climbed about 14.5% this year. This will be the fourth positive return in the last five years, with 2022 the only down year.

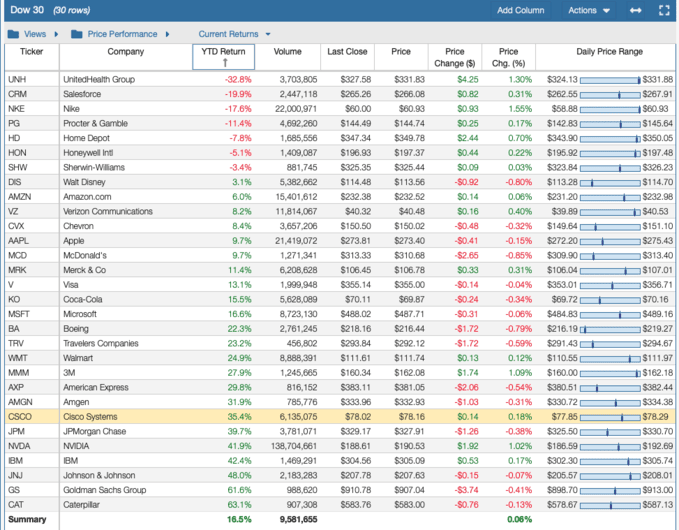

The three worst-performing Dow Jones Stocks in 2025 were UnitedHealth Group (UNH), Salesforce (CRM), and Nike (NKE), all of which posted negative returns. None of the equities were in the Dogs of the Dow 2025, but they will be on the list for 2026. The best performing DJIA stocks were Caterpillar (CAT), Goldman Sachs (GS), and Johnson & Johnson (JNJ).

Market Overview

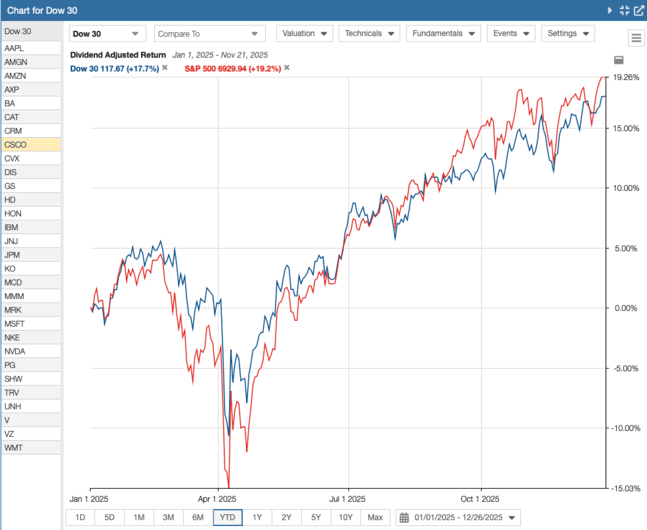

This year is another positive one for stocks, particularly those that are AI-related. However, the Dow Jones Industrial Average did not perform well relative to the market. This year, the DJIA climbed roughly 17.7%, with dividends reinvested, as seen in the chart from Stock Rover*. This is worse than the Nasdaq Composite (+22.9%), the S&P 500 Index (+19.2%), but on par with the Russell 2000 (+14.5%).

Overall, dividend stocks did not do as well as tech and growth stocks for the third year in a row. Investors again preferred the Magnificent 7 stocks and risk-based assets this year.

The U.S. Federal Reserve lowered rates three times between September and December in 2025. Inflation has declined substantially and was nearing 2% before tariffs and hesitant consumers created some upward pressure. Inflation is hovering around 3%, depending on the data. That said, the federal government shutdown interrupted the data, and the latest readings are incomplete and not completely accurate. The Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) Price Index are below 3%. The CPI is 2.7%, while the PCE is 2.8% for the last reported values.

Despite weakening employment and job growth, the past year contained good news for Gross Domestic Product (GDP) numbers. The GDP grew at 4.3% annualized rate in the most recent report and reached $31.1 trillion. Much of that is being fueled by investment in AI and data centers. Employment has weakened appreciably, and job growth is flat to slightly declining. The unemployment rate was 4.6% in the most recent report, up from 4.0% at the start of the year because of a slowing job market. Job growth was flat or negative in some months this year. Similarly, manufacturing and the housing market continue to struggle. Manufacturing has contracted for nine straight months, while housing starts and sales are severely depressed.

That said, a bear market did not happen in 2025. However, after three years of gains and elevated valuations across most sectors, we may be due for one.

Source: Stock Rover*

3 Worst Performing Dow Jones Stocks in 2025

The three worst-performing Dow Jones Stocks in 2025 were UnitedHealth Group (UNH), Salesforce (CRM), and Nike (NKE), based on our watch list in Stock Rover*. Nike is on the list for the second year in a row.

Source: Stock Rover*

We summarize each equity’s challenges in 2025 and the positives as the basis for further research.

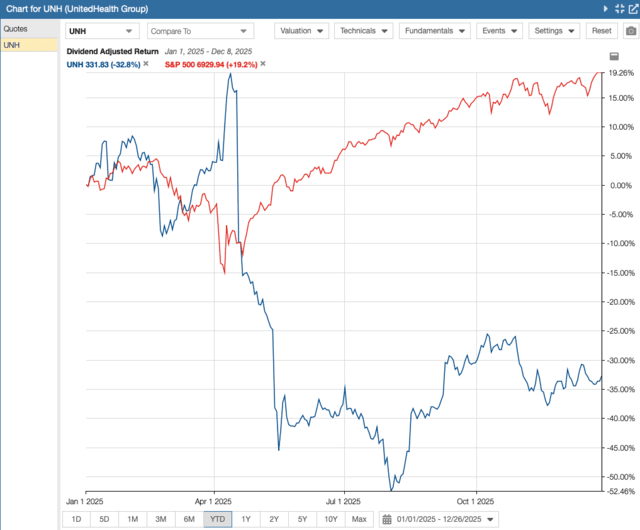

UnitedHealth Group

UnitedHealth Group (UNH) was founded in 1974 and is a health insurance, pharmacy benefits, and consulting firm. It operates through four segments: UnitedHealthcare, Optum Health, Optum Insight, and Optum Rx. The company offers private insurance, Medicare plans, pharmacy services, care delivery, consulting, software, and many other services. The firm has grown organically and through many acquisitions into the largest health insurance company in the United States.

Total revenue was $400,278 million in 2024 and $435,159 million in the last twelve months.

UnitedHealth has faced a few challenges in 2025, causing its share price to drop by nearly 50% in a short time. The main problem is that customers with Medicare Advantage began using their medical insurance at a much higher rate than before. Consequently, the medical care ratio (MCR) soared to nearly 90%, which significantly reduced profits. As insurance usage and claims increase, profitability declines. Next, UnitedHealth is now subject to increased regulatory scrutiny of its billing practices.

Next, the firm is facing operational difficulties with its Optum Health segment, which provides health services. It has transitioned to a new risk model and is growing, but this is pressuring revenue and costs because of increased usage. Hence, margins and profitability are being negatively affected.

The firm was forced to reduce its 2025 guidance by nearly 50%, resulting in a severe drop in share price. The CEO resigned, and the former CEO returned. The firm is clearly in turnaround mode, and the return of the former CEO is a step in the right direction. However, sentiment is negative, and the company has significant work ahead to return to consistent growth.

Source: Stock Rover*

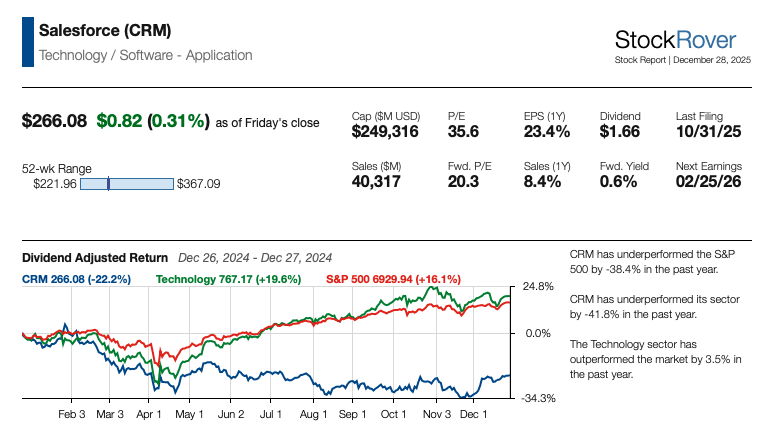

Salesforce

Salesforce, Inc. was founded in 1999 and is headquartered in San Francisco, CA. It is a leading customer relationship management (CRM) software company. It offers several cloud-based software tools and applications, including Agentforce, DataCloud, Slack, Tableau, and Agentforce Command Center. The company has grown organically and through M&A, having acquired Slack in 2021 for $27.7 billion.

Total revenue was $28,190 million in 2023 and $32,534 million in the last twelve months.

The share price is down because of slowing top-line growth as the company becomes larger, fears of disruption because of AI, and increased competition as it enters new markets through M&A. Salesforce was early to the cloud and software-as-a-service (SaaS), but it is not yet a major player in AI or agentic applications. That said, the firm is moving rapidly to expand in the area with its own applications and tuck in acquisitions.

Salesforce is not yet a well-known dividend growth stock because it began paying dividends only last year. The most recent increase was small at only 5%. However, the very conservative earnings payout ratio of about 14.3% and outstanding free cash flow coverage should give investors confidence about the dividend safety. Additionally, the firm usually has a net cash position or a minuscule amount of net debt.

Investors may want to consider this equity because of the dividend growth potential, potential growth from AI, and reasonable valuation for a software stock.

(Click on image to enlarge)

Source: Stock Rover*

Nike

Nike, Inc., founded in 1964, is a global leader in athletic footwear, apparel, and equipment. Its iconic “Just Do It” slogan and Swoosh logo have become synonymous with sports and athletic performance. The slogan and logo are among the most well-known in retail. Nike’s product portfolio includes footwear, apparel, and accessories for various sports and activities, including running, basketball, soccer, and cross training. Besides Nike, the company owns several subsidiary brands, including Converse, Air Jordan, Chuck Taylor, and Hurley.

Total revenue was $46,309 million in 2024 and $46,514 million in the last twelve months.

In 2025, Nike faced several challenges continuing from 2024 that impacted its share price performance, causing it to drop by about 18%. Increased competition in athletic footwear from Hoka and On, and in apparel from Adidas, Under Armour, and Lululemon, has affected sales and earnings per share. Next, inflation has also caused headwinds because consumers have reduced discretionary spending. Nike’s well-publicized attempt to shift to a direct-to-consumer (DTC) model adversely impacted relationships and its wholesale business. Lastly, tariffs are now having a significant impact on margins, as essentially all of Nike’s products are made overseas.

That said, Nike is still the market leader with extremely well-known brands. The firm also continues to innovate for shoe models. Lastly, it spends a large sum of money on marketing and brand sponsorships with famous athletes. These strengths should allow Nike to overcome recent difficulties.

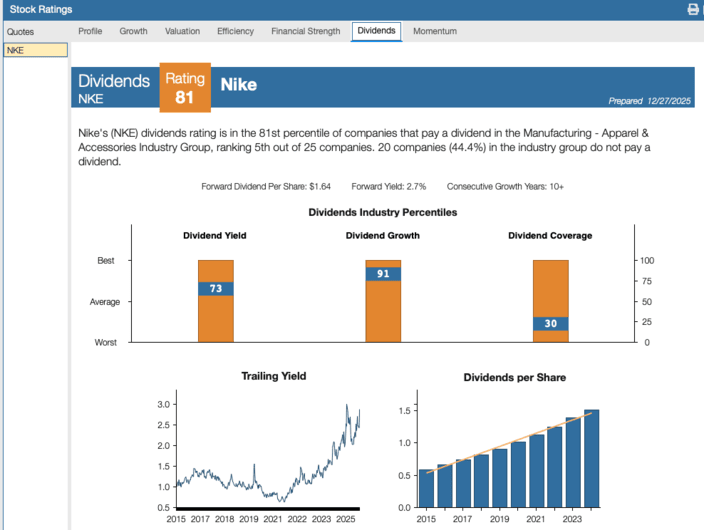

Nike has increased its dividend for 24 years in a row, making the equity a Dividend Contender. The dividend yield is the highest in a decade and nearly 3%. However, lower earnings per share have caused the payout ratio to soar. However, Stock Rover’s* calculated dividend score of 81, dividend yield, streak of increases, and historical cash flow are positive. Additionally, despite a recent downgrade, the A+/A2 investment credit rating indicates a safe dividend with a low chance for a cut.

Given the share price decline and the long-term dividend growth potential, investors should assess Nike for their portfolios.

Source: Stock Rover*

More By This Author:

Dine Brands Cut Dividend Because Of Debt

3 Top Dividend Stocks To Buy In The Fall Of 2025

Analyzing The Dow Dividend Cut: Causes, Effects, And Outlook

Disclosure: Long NKE.

Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. We are not providing you with individual investment advice on this ...

more