3 Top Dividend Stocks To Buy In The Fall Of 2025

Image Source: Pixabay

The S&P 500 has rebounded from a weak start to the year and is now up 16% year-to-date. This is a strong year-to-date return. But with potential negative catalysts on the horizon, such as elevated market valuations, stocks may be overvalued right now.

Stocks with low P/E ratios can offer attractive returns if their valuation multiples expand. And when a low P/E stock also has a high dividend yield, investors get ‘paid to wait’ for the valuation multiple to increase.

In this article, we will discuss 3 undervalued high-dividend stocks with yields above 4% that could be attractive buys in the fall of 2025.

Top Dividend Stocks

Comcast Corp. (CMCSA)

Comcast is a media, entertainment, and communications company. As of Q1 2023, Comcast began reporting in two key business segments: Connectivity & Platforms (Residential Connectivity & Platforms and Business Services Connectivity), and Content & Experiences (Media, Studios, Theme Parks). It is our first top dividend stocks in the fall of 2025.

Comcast reported its Q3 2025 results on 10/30/2025. Revenue fell 2.7% year over year to $31.2 billion, operating income fell 5.5% to $5.5 billion, adjusted earnings fell 4.9% to $4.1 billion, while adjusted earnings-per-share (EPS) were flat at $1.12. Adjusted EBITDA (a cash flow proxy) remained resilient, falling 0.7% to $9.7 billion, and free cash flow came in at $4.9 billion.

The Connectivity & Platforms segment’s revenues fell by 1.4% to $20.2 billion. The segment’s adjusted EBITDA fell 3.7% to $8.0 billion. The Content & Experiences segment’s revenue dropped by 6.8% to $11.7 billion, primarily reflecting stronger results last year driven by the Olympics, while its adjusted EBITDA rose 8.4% to $2.0 billion.

For the quarter, Comcast repurchased $1.2 billion worth of common stock at an average price of $26.09 per share, reducing its shares outstanding by 5% versus a year ago.

Comcast generates substantial cash flow. From 2021 to 2024, it allocated just over 50% of its operating cash flow to capital spending to support long-term business growth, leaving ample free cash flow to cover the dividend.

Comcast has had 17 consecutive years of dividend increases through two recessions, making it a Dividend Contender. Its 15-year compounded dividend growth rate was 14%. This fast dividend growth was made possible through solid earnings growth and the firm’s conservative dividend payout ratio. Its dividend is well-covered by earnings and cash flows.

(Click on image to enlarge)

Source: Stock Rover

Sanofi SA (SNY)

Sanofi, a global pharmaceutical leader, develops and markets a variety of therapeutic treatments and vaccines. Pharmaceuticals account for the majority of sales, with vaccines making up the remainder. About half of sales come from the U.S., about a quarter each coming from Europe and emerging markets/rest of the world. Sanofi produces annual revenues of about $51 billion.

Sanofi is incorporated in France, but U.S. investors have access to the company through an American Depositary Receipt, or ADR. Two ADR shares equal one share of the underlying company.

On October 24th, 2025, Sanofi announced its third-quarter results for the period ending September 30th, 2025. Unless otherwise noted, all figures are listed in U.S. dollars and at constant exchange rates. For the quarter, revenue decreased 0.3% to $14.5 billion, but this was $18.5 million ahead of expectations. Earnings-per-share per ADR of $1.69 compared favorably to $1.54 in the prior year and beat estimates by $0.12.

Dupixent, which treats patients with moderate-to-severe asthma, reported 26.2% revenue growth during the period, driven by additional launches and gains across indications and geographies. The product is approved for use in adults in more than 60 countries and in adolescents in ~20 countries. Sanofi estimates that the product can be launched in ~50 additional countries. More than 1 million patients worldwide have been prescribed the product.

Sanofi also reaffirmed its prior outlook for 2025. The company still expects earnings per share to grow at least in the low double digits.

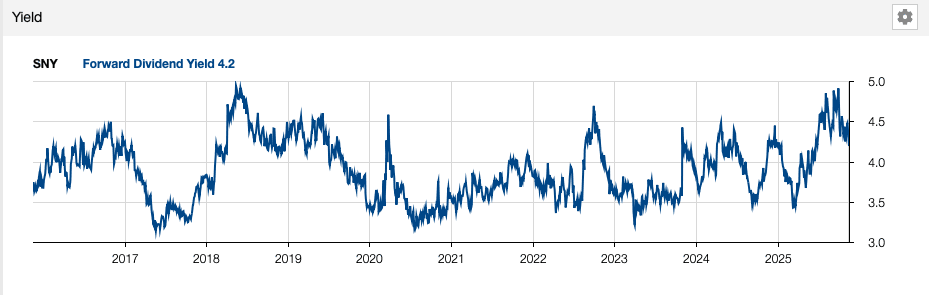

Sanofi has increased its dividend for 30 consecutive years in its local currency and currently yields 4.3%.

(Click on image to enlarge)

Source: Stock Rover

United Bankshares (UBSI)

United Bankshares was formed in 1982 and, since that time, has acquired more than 30 separate banking institutions. This focus on acquisitions, in addition to organic growth, has enabled United to expand into a regional powerhouse in the Mid-Atlantic, with about $30 billion in total assets and annual revenue of about $1 billion. United Bancshares is our last choice as a top dividend stock in the fall of 2025.

United posted third-quarter earnings on October 23rd, 2025, and results were better than expected on both the top and bottom lines. Earnings came to 92 cents, which was 11 cents ahead of estimates. On a dollar basis, earnings rose from $95 million to $131 million year-over-year. Revenue was up 23% year-on-year to $323 million, beating estimates by $13.5 million.

Noninterest income was $43 million, up 35% year-over-year. The gain was driven primarily by gains on investment securities. The year-ago period saw a loss on investment securities that was more than reversed into a substantial profit this year. Net interest income was higher by $50 million, or 22%, from the year-ago period. The gain was due to higher average earning assets, lower deposit rates paid, and higher acquired loan accretion income. Net interest margin was 3.80%, which was up 28 basis points from the year-ago period.

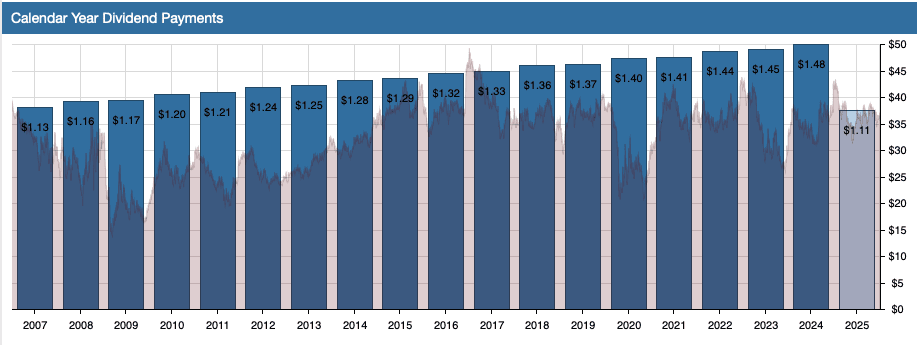

The company has a long dividend history, with a very impressive 51 consecutive years of dividend increases, making it a Dividend King. United’s dividend payout ratio is now 46% of earnings, and we expect it will remain there. We see United’s dividend as safe and able to weather an economic downturn, as it did during the Great Recession. The higher share count makes the dividend more costly, but United has raised its payout for an extremely impressive five decades.

(Click on image to enlarge)

Source: Stock Rover

More By This Author:

Analyzing The Dow Dividend Cut: Causes, Effects, And Outlook2025 Canadian Dividend Aristocrats: Analysis, Performance, And Insights

Kohl’s Dividend Cut: A Symptom Of Broader Retail Industry Challenges

Disclosure: No positions in any stocks mentioned.

Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. We are not providing you with individual ...

more