Dine Brands Cut Dividend Because Of Debt

Image Source: Pixabay

Dine Brands Global (DIN) cut its dividend last month due to excessive debt, high leverage, and rising interest expense. Another contributor was the company’s miss of third-quarter estimates due to negative organic growth in two of its three brands. Management has also indicated a preference for share buybacks over dividend distributions. The firm’s dividend has been constant since the second quarter of 2022, and it was eventually cut this year.

The share price has fallen dramatically since early April 2021. That said, it has gained 14.1% this year. Investors sold this dividend stock due to the previously-mentioned concerns. Depending on economic and business conditions, another dividend reduction may occur.

Overview of Dine Brands Global

Dine Brands Global, Inc. traces its history to 1958 and is headquartered in Pasadena, CA. It was previously known as DineEquity before changing its name. It owns, franchises, and operates approximately 3,500 restaurants worldwide.

The firm operates through four segments: Franchise operations, Rental operations, Financing operations, and Company restaurant operations. The three main restaurant chains are Applebee’s Neighborhood Grill + Bar (1,571 restaurants), IHOP (1,803 restaurants), and Fuzzy’s Taco Shop (109 restaurants).

Total revenue was $812 million in 2024 and $867 million in the last twelve months.

Dividend Cut Announcement

During its third-quarter earnings results on Wednesday, Nov. 5, Dine Brands Inc. cut its dividend. The company’s quarterly dividend rate was $0.51 per share before the announcement. The dividend is now $0.19 per common share, a 62.7% reduction. In the announcement, the company stated the following:

“The Company is updating its capital return framework to re-allocate its quarterly dividend in support of a larger share repurchase program. As part of the updated capital return framework, the Company is committed to repurchase $50 million of shares over the next two quarters and today, the Board of Directors declared a quarterly cash dividend of $0.19 per share of common stock. The dividend will be payable on January 7, 2026, to the Company’s stockholders of record at the close of business on December 23, 2025. This decision reflects our confidence in our strategic initiatives and our belief that our shares are undervalued.”

Later, in the second quarter earnings call transcript, the CFO stated:

“Current time, however, we believe our stock price is currently undervalued, which represents a unique opportunity to be more aggressive with share repurchases to create long-term shareholder value. As a result, the Board has declared the reduction of our dividend from $0.51 per share per quarter to $0.19 per share per quarter, which would imply an annual dividend yield of approximately 3% based on today’s stock price. This will continue to generate one of the highest yields amongst our peers.”

He also said:

“I want to reiterate that the dividend reduction, increased share repurchases and investments into our business are proactive changes we’re making to our shareholder return strategy to drive increased shareholder value. It demonstrates confidence in our plan and our principal view that the stock is undervalued, affirming the Board’s alignment with investors. With the momentum that we continue to see in the business and the alignment and shared excitement from our franchisees, now is the right time to be aggressive in investing in our own stock.”

Effects of the Change

By cutting the dividend by nearly 63%, Dine Brands sought to reduce its quarterly and annual dividend distributions to repurchase shares. The firm’s revenue and net income have also fluctuated. Additionally, inflation and broader economic uncertainty have impacted results. Furthermore, the balance sheet is highly leveraged with very low interest coverage.

The company’s dividend rate has been constant since the second quarter of 2022, so it did not have a streak of increases. It was not a dividend growth stock. The result is that less free cash flow (“FCF”) is required for the dividend distribution, allowing the company to pay down debt and repurchase shares.

Challenges

Dine Brands is facing a challenging economic environment. The company’s consumers are under pressure from inflation and significant job-market uncertainty. Hence, they are generally spending less and eating at home more often. Additionally, the balance sheet is highly leveraged, and interest coverage is weak.

Inflation and Consumers

Inflation affects both Dine Brands’ input costs and consumers. Customers are spending less because incomes are not keeping up with inflation. The company missed estimates in the third quarter of 2025 on declines in IHOP and Fuzzy Taco organic sales. Also, the firm’s revenue has declined for three consecutive years.

Debt and Leverage

Dine Brands is a very leveraged firm with over $1.46 billion in net debt. Although not much in absolute terms, net debt is three times the market capitalization. It has approximately 1.84X interest coverage and a leverage ratio of 8.2X, both of which are poor and are likely to reduce financial flexibility.

Moreover, it has a speculative or junk credit rating of B2. This suggests that the credit rating agencies expect significant credit risk and that the company is vulnerable to adverse conditions, but that it has the capacity to meet its financial commitments.

Dividend Safety

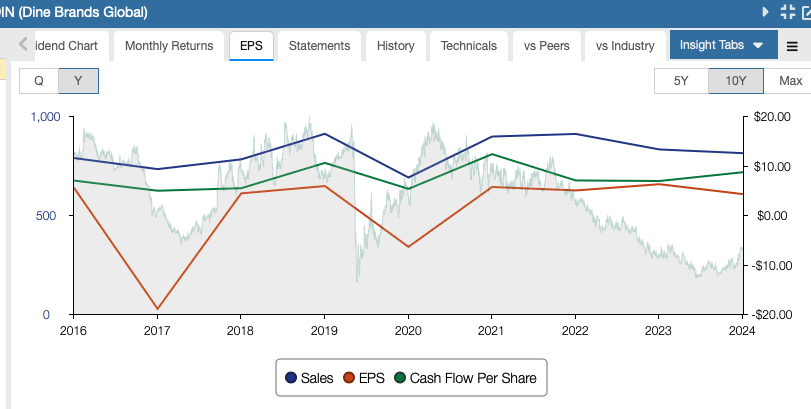

Dine Brands’ dividend safety metrics were weak because of inconsistent revenue and earnings per share (“EPS”). EPS has fluctuated and was negative in 2017 and 2020. This indicated that the restaurant company was struggling to sustain consistent growth. Consensus estimates indicate $4.02 per share for 2025, down from last year.

Source: Stock Rover

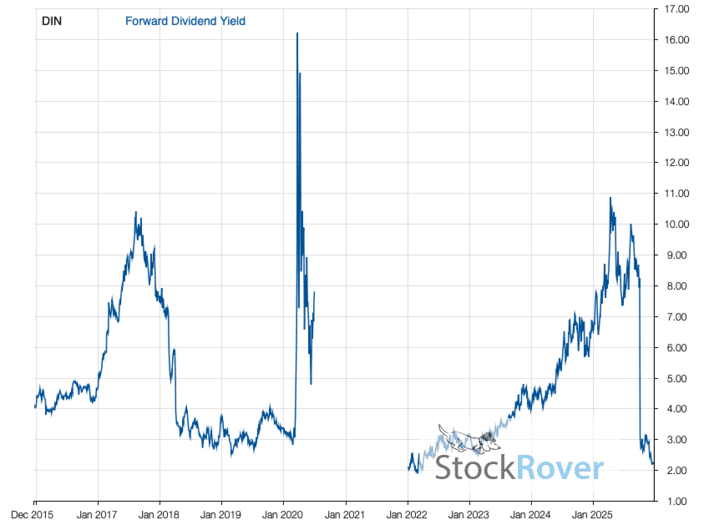

As shown in the chart below, the dividend yield has been rising since it was restarted in 2022. The value exceeded 10% in early 2025, peaking at 10.2%. High values over 10% are often associated with companies facing operating and financial difficulties. Also, it was much greater than the four-year average of around 4.7%.

After reducing the dividend by approximately 63%, the forward dividend yield is now around 2.2%. The quarterly rate is $0.19 per share. This dividend yield is probably more sustainable.

Source: Stock Rover

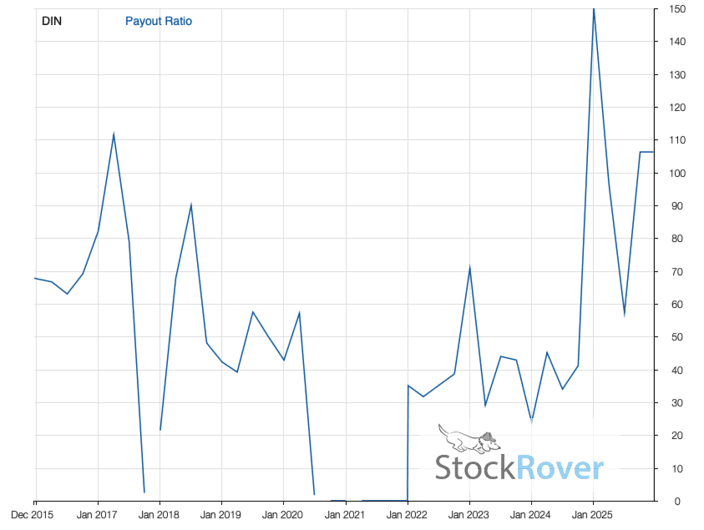

The annual dividend now requires about $11 million ($0.76 yearly dividend x 14.5 million shares), compared to $31.3 million in 2024. The lower rate will improve the payout ratio, which was negative in some years and reached over 100% in 2025 before the cut, indicating that earnings were not covering the dividend.

Additionally, FCF was negative in two of the past three years and did not cover the dividend. We expect the yearly difference in cash flow requirements to allow Dine Brands to pay down debt. That said, management indicated they are focusing on repurchasing shares, which may not be the best use of funds.

Source: Stock Rover

Although the dividend is more secure now, it is still not entirely safe, as seen by the weak credit rating. Persistent inflation, an uncertain consumer, and a soft economy are risks to the dividend. Thus, we view Dine Brands as at risk for another dividend reduction.

Final Thoughts on Dine Brands' Dividend Cut

Too much debt, high leverage, rising interest expense, and weak cash flow have been affecting Dine Brands. Additionally, inflation and uncertain consumer demand have contributed to inconsistent results at IHOP and Fuzzy Taco, despite a recent uptick at Applebee’s. The combined effect resulted in declining dividend safety metrics. As a result, Dine Brands cut its dividend. However, we still view the company as at risk for another future reduction.

More By This Author:

3 Top Dividend Stocks To Buy In The Fall Of 2025

Analyzing The Dow Dividend Cut: Causes, Effects, And Outlook

2025 Canadian Dividend Aristocrats: Analysis, Performance, And Insights

Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. We are not providing you with individual investment advice on this site. Please consult with ...

more