3 Worst Performing Dividend Kings In 2025

Image Source: Pixabay

The Dividend Kings have a positive return in 2025. However, it is the second year in a row they have underperformed the broader market. They are currently up about 4.7%, giving the group their fifth positive return in five years. That said, investor interest in AI-related stocks has led to reduced interest in value, income, and dividend growth equities.

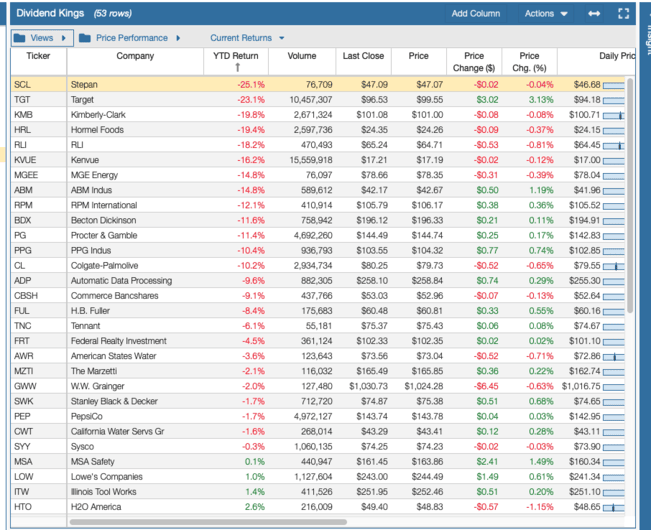

The three worst-performing Dividend King Stocks in 2025 were Stepan (SCL), Target (TGT), and Kimberly-Clark (KMB). This is the second year in a row that Stepan has been in the bottom three of this group, while it is the second time in the past five years that Target has been on this list.

Market Overview

The 2025 Dividend Kings did not perform well relative to the market. This year, the Dividend Kings have climbed roughly 4.7% with dividends reinvested, as seen in the chart from Stock Rover*, which is worse than the Nasdaq Composite (+22.9%), Dow Jones Industrial Average (+14.5%), S&P 500 Index (+19.2%), and the Russell 2000 (+14.5%).

Overall, dividend stocks did not do as well as tech and growth stocks for the third year in a row. Investors again preferred the Magnificent 7 stocks and risk-based assets this year.

The U.S. Federal Reserve lowered rates three times between September and December in 2025. Inflation has declined substantially and was nearing 2% before tariffs, and hesitant consumers created some upward pressure. Inflation is hovering around 3%, depending on the data. That said, the federal government shutdown interrupted the data, and the latest readings are incomplete and not completely accurate. The Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) Price Index are below 3%. The CPI is 2.7%, while the PCE is 2.8% for the last reported values.

Despite weakening employment and job growth, the past year contained good news for Gross Domestic Product (GDP) numbers. The GDP grew at 4.3% annualized rate in the most recent report and reached $31.1 trillion. Much of that is being fueled by investment in AI and data centers. Employment has weakened appreciably, and job growth is flat to slightly declining. The unemployment rate was 4.6% in the most recent report, up from 4.0% at the start of the year, due to a slowing job market. Job growth was flat or negative in some months this year. Similarly, manufacturing and the housing market continue to struggle. Manufacturing has contracted for nine straight months, while housing starts and sales are severely depressed.

That said, a bear market did not happen in 2025. However, after three years of gains and elevated valuations across most sectors, we may be due for one.

Source: Stock Rover*

Past Year’s Worst Performers

- The three worst-performing Dividend Kings in 2020 were Northwest Natural Holding (NWN), Federal Realty Investment Trust (FRT), and Black Hills Corporation (BKH).

- The three worst-performing Dividend Kings in 2021 were Lancaster Colony (LANC), Leggett & Platt (LEG), and MSA Safety (MSA).

- The three worst-performing Dividend Kings in 2022 were Stanley, Black & Decker (SWK), Target (TGT), and 3M Company (MMM).

- The three worst-performing Dividend Kings in 2023 were Hormel Foods Corporation (HRL), Tootsie Roll (TR), and Black Hills Corporation (BKH).

- The three worst-performing Dividend Kings in 2024 were SJW Group (SJW), Stepan (SCL), and Nucor (NUE).

3 Worst Performing Dividend King Stocks in 2025

The three worst-performing Dividend King Stocks in 2025 were: Stepan (SCL) at -25.1%, Target (TGT) at -23.1%, and Kimberly-Clark (KMB) at -19.8%, as of this writing, based on my watch list in Stock Rover*.

Source: Stock Rover*

Stepan Company

Stepan Company (SCL) was founded in 1932 and is headquartered in Northbrook, IL. It operates through three segments: Surfactants, Polymers, and Specialty Products. It is a global leader in specialty and intermediate chemicals. The company produces a diverse range of products, including surfactants, polymers, and other specialty chemicals, serving various industries such as personal care, home care, agriculture, and industrial. Stepan operates through a network of manufacturing facilities across North and South America, Europe, and Asia.

Total revenue was $2,180 million in fiscal year 2024 and $2,304 million over the past 12 months. The fiscal year ends on September 30th.

In 2025, Stepan faced challenges similar to what it experienced in 2024, namely high interest rates, input inflationary pressures, and low demand for manufacturers. These factors, as well as increased competition, contributed to generally poor results throughout the year. Hence, the company’s share price declined. However, most chemical companies are facing similar pressures and will probably not recover until manufacturing does.

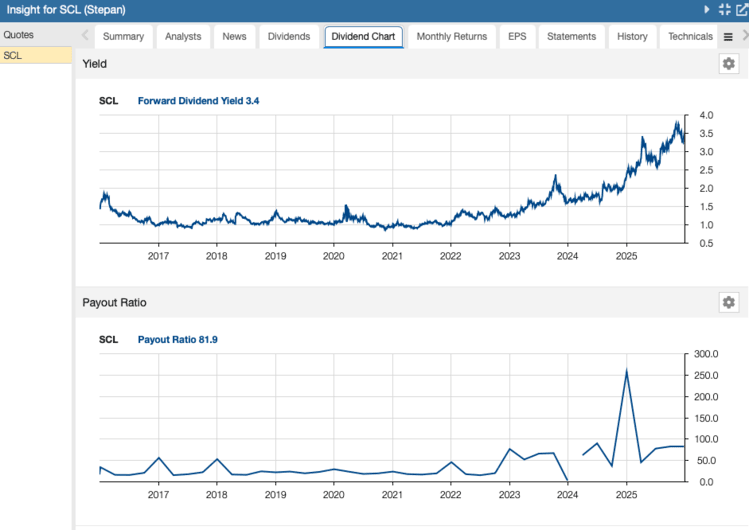

Stepan has a 58-year history of paying dividends, and the share price decline this year on top of last year’s has caused the dividend yield to reach 3.4%. This value is nearly a decade high and much greater than the 4-year average of 1.9%. The challenges the firm has faced, and its low earnings per share, have caused the payout ratio to climb to 79%.

Stepan’s valuation is still elevated at 21 times earnings. The stock usually trades at a price-to-earnings ratio (P/E ratio) ranging from 15X to 20X.

Source: Stock Rover*

Target

Target was founded in 1902 and is headquartered in Minneapolis, MN. Today, it is one of the largest general merchandise retailers in the United States. The company sells groceries, clothing, toys, furniture, jewelry, sporting goods, electronics, bed and bath, beauty products, and more. It derives significant revenue from its own private-label brands. Target operates approximately 1,995 stores across all 50 states and Washington, DC.

Total revenue was $106,566 million in fiscal year 2024 and $105,242 million in the last twelve months.

Target’s struggles are well documented. Although it has scale and efficiencies, Target is much smaller than Walmart and Costco, with lower sales per square foot. The company is also facing challenges from stores such as Dollar General, Aldi, and Lidl. Similarly, the retailer is under pressure from online competition from Amazon and smaller brands. Additionally, the firm is experiencing margin pressure due to higher labor and other costs. Consequently, Target has lost market share in several categories, is experiencing lower traffic, and has declining organic sales.

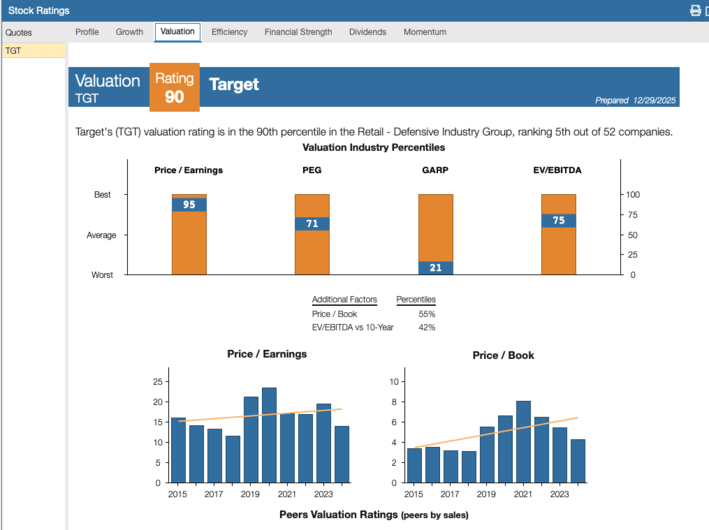

The company’s 57-year dividend streak and status as a Dividend King are impressive. The falling share price has caused the dividend yield to surge to 4.6%, which is attractive. However, the dividend safety is still acceptable. The forward payout ratio is around 60%, and free cash flow covers the dividend distribution. Additionally, leverage is under 2X, while interest coverage is over 11X.

That said, Target’s stock price has been punished severely, but with a CEO in waiting and no near-term catalysts, investors may want to stay on the sidelines even with a low earnings multiple of 13.5 times earnings.

Source: Stock Rover*

Kimberly-Clark

Kimberly-Clark (KMB) was founded in 1872 and is headquartered in Dallas, TX. It operates through three segments: North America, International Personal Care, and International Family Care and Professional. The company sells disposable diapers, toilet paper, napkins, paper towels, soaps, and many more products. It owns familiar brand names like Huggies, Kleenex, Scott, Pull-Ups, Depends, Cottonelle, etc.

Total revenue was $20,058 million in the fiscal year 2024 and $19,724 million in the past twelve months. The fiscal year ends on September 30th.

In 2025, Kimberly-Clark faced challenges similar to those faced by most consumer staples companies. The soft economy and hesitant consumer spending have led to weak results. Moreover, with no switching costs, private-label brands are making inroads because of the soft economy, where prices are increasing faster than wages. Beyond these items, Kimberly-Clark is acquiring Kenvue in a cash-and-stock deal valued at $48.7 billion. Investors have been largely negative about this deal because it will move the firm outside of its core markets. Additionally, debt and leverage will rise substantially.

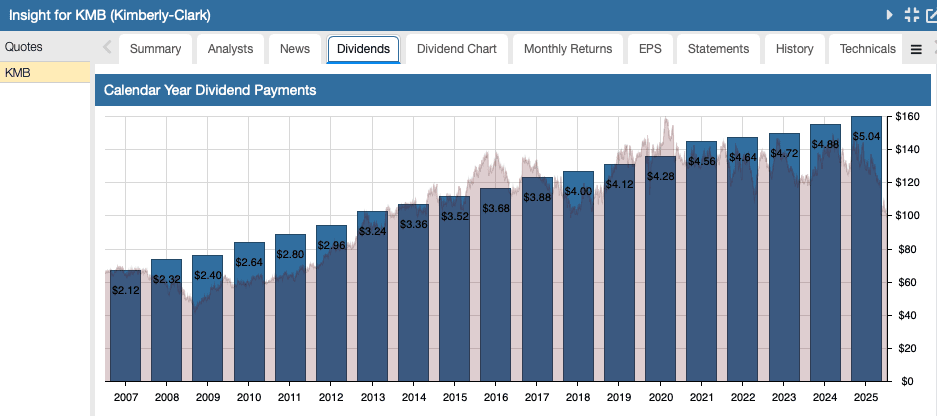

Given the considerable share price decline, the dividend yield is about 5%, above the 4-year average of 3.68%. The equity has a 53-year dividend increase streak, with average growth rates of about 3.32% over the trailing 5 years and 3.65% over the past 10 years. Kimberly-Clark recently increased its quarterly dividend by a penny. That said, the dividend safety is acceptable, but the metrics bear watching, with a 73% payout ratio and an investment-grade rating. However, additional debt will limit flexibility for future dividend increases.

Despite the decline in share price and the low P/E ratio of 13.5X, Kimberly-Clark’s acquisition is resulting in negative sentiment about the company. Investors may want to wait and see with this equity.

Source: Stock Rover*

More By This Author:

3 Worst Performing Dow Jones Stocks In 2025Dine Brands Cut Dividend Because Of Debt

3 Top Dividend Stocks To Buy In The Fall Of 2025

Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. We are not providing you with individual investment advice on this site. Please consult with ...

more