3 Market-Crushing Stocks To Buy For Value And Growth In September

Is Stride Stock a Must Own for Long-Term Investors?

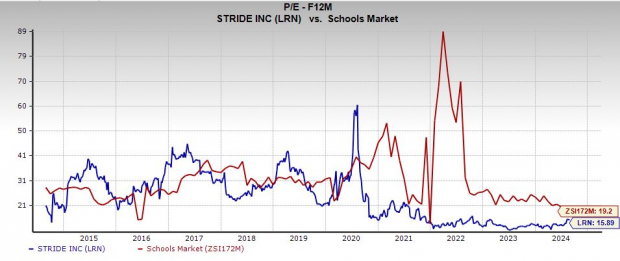

Stride’s (LRN) growing digital education services portfolio serves K–12 students and parents, adult learners, school districts, businesses, the military, and beyond. Stride is expanding as more people dive into digital education and reevaluate college amid skyrocketing costs.

Stride is gaining steam in its career learning segment, especially from its Middle-High School cohort. LRN is also capitalizing on the digitalization of the U.S. economy, offering courses to help people land jobs in healthcare, technology, and other growth areas.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Stride grew its revenue from $400 million in 2010 to $2 billion in its FY24 (period ended June 30), posting 11% sales growth last year and 58% EPS expansion. Stride posted another beat-and-raise quarter in early August, with its upward EPS revisions helping LRN land a Zacks Rank #2 (Buy). Stride is projected to expand its adjusted earnings by 8% in FY25 and 12% in FY26 on the back of roughly 7% revenue growth in both years.

The online education standout is not just a post-Covid success. Stride shares climbed 350% in the past decade, easily topping the S&P 500’s 190% and its highly-ranked Schools industry’s 23%. Stride stock has soared 95% in the past year and 35% YTD to trade near fresh highs.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Stride’s improving earnings outlook helps LRN trade at a 73% discount to its highs, 35% below its 10-year median, and 20% below its highly-ranked industry at 15.89X forward 12-month earnings. LRN also boasts a sturdy balance sheet that should support new growth efforts.

Why It’s Time to Buy and Hold KB Home Stock

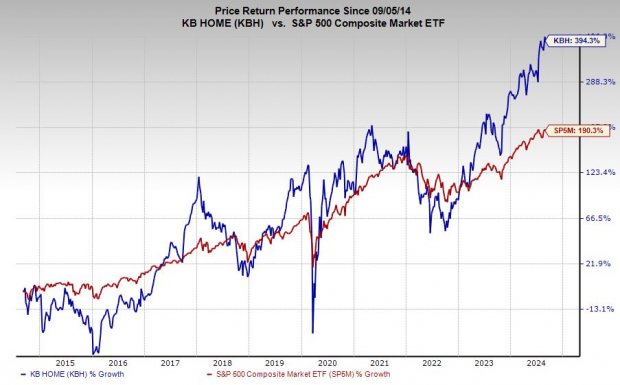

KB Home (KBH) is one of the largest U.S. homebuilders operating in nearly 50 markets across desirable areas within Colorado, Arizona, Texas, California, Nevada, Washington, and beyond. KB Home is well-known for its customization options, energy efficiency, and must-have features. KB Home’s revenue soared 37% in 2021 and another 21% in 2022, before slipping 7% last year as the housing market cooled amid soaring prices and high mortgage rates.

KB Home crushed our Q2 EPS estimate in June and raised its outlook, citing resilient buyers. KBH said the “pace of monthly net orders per community was one of our highest second quarter levels in many years.” KB Home is projected to grow its revenue by 7% in FY24 and 8% next year to help boost its bottom line by 19% and 7%, respectively. KB Home’s improving earnings outlook helps it earn a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

KB Home’s long-term outlook remains impressive since Millennials drive the housing market, and Baby Boomers are finally retiring and moving. More importantly, home builders didn’t overbuild during the Covid boom and supply remains far below overall demand. On top of that, mortgage rates will come down once the Fed starts cutting rates.

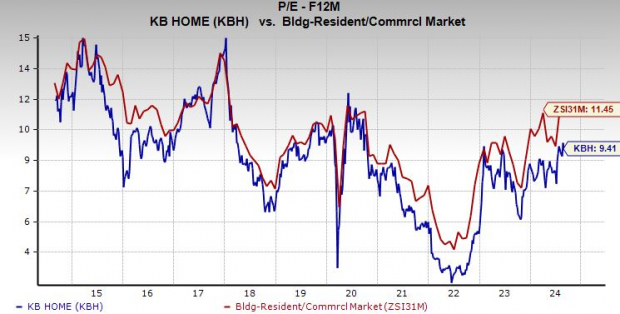

KB Home stock has climbed 400% in the past 10 years to match its Building Products - Home Builders industry (top 8% of over 250 Zacks industries). KBH’s run includes a 65% surge to fresh highs in August. KB Home might face some near-term selling pressure that could take it back to its 21-day or 21-week moving averages.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Even though KBH is trading near its all-time highs, KB Home's valuation marks a 40% discount to its 10-year highs and 18% value compared to its industry at 9.4X forward 12-month earnings. On top of that, KB Home’s dividend yields 1.2% with a 13% payout ratio enabling KB Home to keep boosting its returns to shareholders.

Why Blue Bird is a Top-Ranked Under-the-Radar Stock to Buy

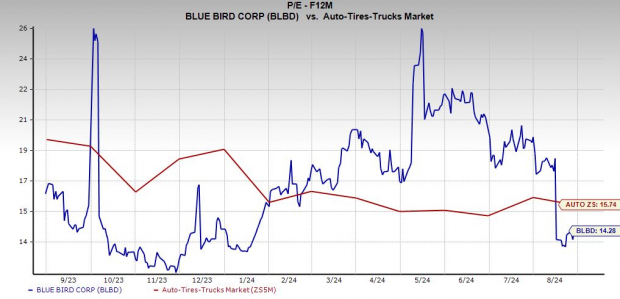

Blue Bird (BLBD) is a school bus power that’s been in business for roughly 100 years. Blue Bird has pushed forward into new areas of automotive technology, including alternative fuel and EV buses.

Blue Bird roared back in a big way after Covid crushed its business, posting 17% revenue growth in 2022 and 42% sales expansion in 2023. BLBD benefits directly from the U.S. government’s push to transition more public schools to EV buses and other non-fossil fuel offerings.

BLBD posted blowout Q3 FY24 earnings results in early August, citing increased demand for school buses and EV models. Blue Bird closed the quarter with a 5,200-unit backlog, helping it raise its earnings outlook significantly.

BLBD’s fiscal 2024 EPS estimate has climbed by 24% since its release, with its FY25 consensus 28% higher to help it earn a Zacks Rank #1 (Strong Buy).

(Click on image to enlarge)

Image Source: Zacks Investment Research

Blue Bird is projected to expand its revenue by 18% in FY24 and another 12% in FY25. Meanwhile, it is expected to boost its adjusted earnings by 216% from $1.07 to $3.38 a share in FY24 before posting 10% EPS expansion next year.

Blue Bird shares have skyrocketed 150% in the last 12 months and 95% YTD. The stock has climbed 440% in the last 10 years, crushing the Auto-Tires-Trucks sector’s 8% climb and the S&P 500’s 190%. BLBD slipped from its recent peaks to trade 15% below its average Zacks price target. Blue Bird found support at its 21-week moving average and it surged on Thursday.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Blue Bird’s booming earnings outlook has it trading near its 10-year median and 85% below its highs at 14.3X forward 12-month earnings. Blue Bird also trades at a 9% discount to its sector despite blowing away the group over the past year and the last decade. Wall Street understands BLBD’s bull case, with six of the seven brokerage recommendations Zacks has at “Strong Buys.”

More By This Author:

3 Nuclear Energy Stocks To Buy And Hold ForeverBear of the Day:H&E Equipment Services, Inc.

Top-Ranked Stocks to Buy in August Efficiently Generating Profits

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more