Bear Of The Day:H&E Equipment Services, Inc.

H&E Equipment Services, Inc. (HEES) is a U.S. rental equipment giant that’s experiencing a wave of negative earnings revision as the economic environment changes.

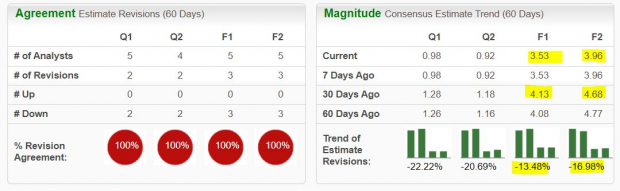

H&E Equipment missed our Q2 EPS estimate on July 30. H&E Equipment’s earnings estimates for 2024 and 2025 have tumbled since its report, extending its recent string of downward revisions, which help it earn a Zacks Rank #5 (Strong Sell) right now.

H&E Equipment Overview

H&E Equipment rents, sells, and provides parts and services across a range of rental equipment of all shapes that are utilized throughout the entire construction sector. HEES has expanded within a critical part of the wider construction sector through organic growth and acquisitions.

H&E Equipment grew its sales by roughly 18% in the last two years, driven by a wave of residential building, commercial construction, and infrastructure spending.

The company is still projected to post 4% sales growth in 2024 and 2025. But H&E Equipment’s outlook has faded as “higher project financing costs and more stringent lending standards have led to curtailed spending, especially among smaller contractors.”

Image Source: Zacks Investment Research

H&E Equipment’s FY24 and FY25 earnings estimates have fallen by roughly 13% and 17%, respectively since its July 30 report, helping it land a Zacks Rank #5 (Strong Sell).

H&E Equipment’s recent downward revisions extend a rough stretch for the company. H&E Equipment’s earnings outlook began to tumble in early 2024 (see the nearby chart).

Image Source: Zacks Investment Research

Bottom Line

H&E Equipment’s adjusted 2024 earnings are projected to fall 26% YoY. HEES shares have been volatile during the past 12 months and the last 10 years. HEES is still up 14% in the trailing decade and 1% in the last 12 months. But those performances significantly lag the Zacks Industrial sector.

HEES remains “encouraged by the continued growth in mega projects and increased infrastructure project funding.” Still, investors might want to look to other companies in the broader industrial sector until H&E Equipment proves that its earnings outlook isn’t going to deteriorate further.

More By This Author:

Top-Ranked Stocks to Buy in August Efficiently Generating Profits2 Tech Stocks And AI Bets To Buy At Bargains Amid The Market Selloff

Bear Of The Day: Carter's, Inc.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more