3 Nuclear Energy Stocks To Buy And Hold Forever

Nuclear energy has become one of the hottest industries on Wall Street over the last year as investors realize its ability to power the growing global economy as the world attempts to curb fossil fuel use. On top of that, the energy-hungry artificial intelligence arms race sparked technology giants such as Amazon, Microsoft, and many others to commit to nuclear energy expansion and innovation.

Two of the top six performing S&P 500 stocks so far this year are nuclear energy companies. The buildout of the nuclear-powered economy will cost tens of trillions of dollars and take decades, even though nuclear energy has supplied around 20% of U.S. electricity for over 30 years running (and 10% of the current global total).

The U.S. and many other nations have done a 180-degree turn on nuclear energy technology over the last few years as key players across technology, finance, the government, and beyond finally throw their collective force behind nuclear energy. The U.S. government has rolled out multiple efforts to support the nuclear energy resurgence and pledged to help triple global nuclear energy capacity by 2050.

Outside of the U.S., China, India, and tons of other key economies are going all in on nuclear. Investors are pouring money into the largest nuclear power producers, uranium (nuclear fuel) miners, and other standout players.

Now let’s look at our three nuclear energy stocks to consider buying now.

Is Soaring Rolls-Royce a Great Nuclear Energy Stock?

Rolls-Royce (RYCEY) is a historic engine maker of complex power and propulsion solutions for aircraft, ships, and beyond. Rolls-Royce is utilizing its expertise in nuclear propulsion systems to design cutting-edge small modular nuclear reactor (SMR) technology and micro-reactors. Rolls-Royce’s SMR tech is making its way through the approval process to be rolled out in the U.K.

Rolls-Royce will be able to achieve these lofty nuclear energy goals because it is successfully revamping and streamlining its business to boost profitability after a disappointing decade.

Former oil industry executive Tufan Erginbilgic took over as CEO in January 2023, aiming to quadruple Rolls-Royce’s profits in the next five years and complete other key initiatives. Rolls-Royce raised its full-year guidance on August 1 and said it plans to reinstate its dividend.

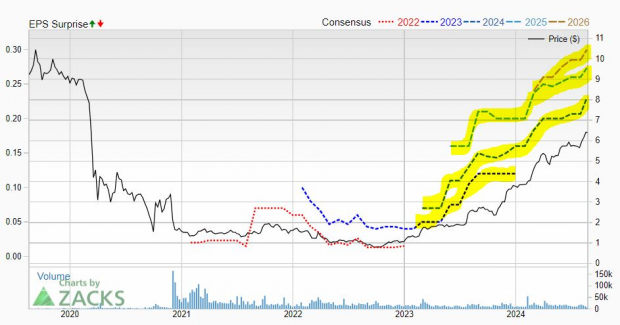

Image Source: Zacks Investment Research

Rolls-Royce is projected to grow its adjusted earnings by 35% in FY24 and 19% in FY25 on the back of 30% and 7%, respective revenue expansion.

Rolls-Royce’s recent upbeat EPS revisions help it earn a Zacks Rank #2 (Buy) and extend its impressive run of positive EPS revisions over the past year and a half.

Rolls-Royce stock soared over 750% off its 2022 lows, including its 155% YTD surge. Rolls-Royce stock hit new 52-week highs of $6.50 a share on Thursday. Despite the climb, Rolls-Royce trades 34% below its average Zack price target and 70% below its all-time highs.

On the valuation front, Rolls-Royce trades in line with its 10-year median and near its industry at 24.9X forward 12-month earnings.

Is BWX Technologies, Inc. an Under-the-Radar Nuclear Energy Stock?

BWX Technologies (BWXT) is a top supplier of nuclear technologies, components, and fuel to the U.S. government, including U.S. naval submarines and aircraft carriers. BWX Technologies is actively growing its commercial nuclear power segment and other non-defense units.

BWXT owns one of the largest commercial nuclear equipment manufacturing facilities on the planet. BWXT is expanding that operation to “support ongoing and anticipated customers’ investments in Small Modular Reactors, traditional large-scale nuclear and advanced reactors, in Canada and around the world.”

Image Source: Zacks Investment Research

BWX Technologies has landed deals and partnerships with GE Vernova, the Wyoming Energy Authority, Bill Gates-backed SMR company TerraPower, and beyond. BWXT’s beat-and-raise second quarter was supported, in part, by a growing “appetite for nuclear solutions across the global security, clean energy, and medical markets.”

BWXT is projected to post solid mid-single-digit sales and earnings growth in 2024 and 2025.

BWX Technologies stock has climbed 250% in the last 10 years to outpace the S&P 500’s 190% and its industry’s 110%. BWXT broke out to new highs last summer, with the stock up 38% the last 12 months.

BWXT is trading above its 21-week and 21-day moving averages while sitting 5% below its average Zacks price target.

Should Constellation Energy Stock be in Your Portfolio?

Constellation Energy (CEG) is the largest nuclear power plant operator in the U.S., helping it produce 10% of the country’s total clean energy. Constellation boasts over 20 nuclear reactors at roughly a dozen sites across the Midwest, the Mid-Atlantic, and the Northeast.

Constellation benefits from the nuclear energy-focused aspects of the Inflation Reduction Act. The U.S. government is helping provide a price floor for nuclear power to boost the expansion of the domestic nuclear industry.

Constellation is retrofitting its current nuclear power plants to help keep them running for a lot longer. The compnay is also expanding into next-gen nuclear power plant technologies.

Image Source: Zacks Investment Research

Constellation aims to grow through mergers and acquisitions and return capital to shareholders via buybacks and dividends. Constellation announced in early 2024 its plans to boost its dividend by 25% in 2024, exceeding its 10% annual growth target.

Constellation lifted its adjusted 2024 earnings guidance in early August and reaffirmed its ability to grow its adjusted EPS by at least 10% from 2024-2028. Constellation is projected to grow its adjusted earnings by 57% in 2024 and 18% in 2025.

Constellation shares soared since their 2022 IPO. CEG has climbed by 150% in the past two years and 70% YTD. Thankfully, for investors who ‘missed’ the run, Constellation trades 15% below its May records after falling alongside tech and other growth stocks.

CEG is attempting to retake its 50-day moving average. On top of that, CEG's improving EPS outlook, mixed with its recent downturn, has it trading at a 32% discount to Constellation's highs at 21.8X forward earnings.

More By This Author:

Bear of the Day:H&E Equipment Services, Inc.Top-Ranked Stocks to Buy in August Efficiently Generating Profits

2 Tech Stocks And AI Bets To Buy At Bargains Amid The Market Selloff

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more