Time To Buy These 3 REITs For 2023?

Inflation has been very strenuous on the housing industry with mortgage rates soaring this year. Rates have started to simmer down lately, and those that have the patience to wait out the fed’s tightening cycle may reap hefty long-term rewards.

Short-term opportunities may be approaching as well with many of these equities looking very attractive from a valuation standpoint in addition to their solid dividends.

Let’s take a look at three REITs investors might want to consider for the new year.

Blackstone Mortgage Trust (BXMT)

Starting with Blackstone Mortgage Trust the 10.45% annual dividend yield here is the highest on the list at $2.48 per share. Not bad for a stock that trades around $23 per share with earnings estimate revisions starting to rise despite a tougher operating environment for most REITs.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Blackstone Mortgage operations are in real estate finance and investment management mostly centered around loans and securities backed by commercial real estate assets.

BXMT’s earnings are now expected to rise 4% in 2022 and another 8% in FY23 at $2.94 per share. Sales are projected to jump 14% this year and climb 9% in FY23 to $641.70 million. However, FY23 sales would represent a -27% decrease from pre-pandemic levels with 2019 sales at $883 million.

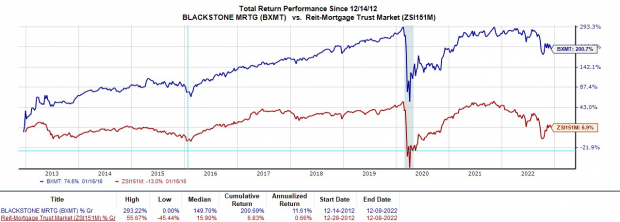

Blackstone Mortgage’s stock is down -22% YTD to underperform the S&P 500’s -18%. This is not as steep as the Reit-Mortgage Trust Markets -33%. Over the last decade, BXMT ‘s total return is +201% when including its dividend. While this lagged the benchmark’s +254% it has crushed its Zacks Subindustry.

(Click on image to enlarge)

Image Source: Zacks Investment Research

At its current levels, Blackstone Mortgage stock trades at 9.4X earnings. This is slightly above the industry average of 7.6X but BXMT’s return has been considerably better. BXMT also trades well below its decade-high of 73.7X and beneath the median of 13.6X.

BXMT currently lands a Zacks Rank #3 (Hold) and patient investors have a lofty dividend to reward them while they wait for the stock to turn around. The average Zacks Price Target also suggests 22% upside from current levels.

Invitation Home (INVH)

Another name amongst REITs that will be gaining more attention as we head into 2023 is Invitation Home. Shares of INVH are starting to look more attractive from a valuation perspective with the single-family home operator recently hitting 52-week lows in November.

(Click on image to enlarge)

Image Source: Zacks Investment Research

In addition to its solid 2.74% annual dividend yield, INVH trades 37% below its five-year high P/E of 31.2X. INVH also trades below the median of 22.3X during this period but currently above the industry average of 16.9X.

Invitation Home earnings are expected to rise 13% in 2022 and another 10% in FY23 to $1.86 per share. It is important to note that earnings estimate revisions are slightly down over the last quarter. On the top line, sales are projected to be up 11% this year and rise 8% in FY23 to $2.40 billion.

Pivoting to performance, INVH is down -30% YTD Vs. the S&P 500’s -18%. This is on par with the Reit-Equity Trust Residential Markets decline. However, over the last two years, INVH’s total return is +14% to beat the benchmark and its Zack Subindustry’s +8%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

INVH currently lands a Zacks Rank #3 (Hold) with the average Zacks Price Target suggesting 23% upside from current levels.

MidAmerica Apartment Communities (MAA)

Sporting a Zacks Rank #2 (Buy) MidAmerica Apartment Communities is a REIT that investors may want to consider in December and into 2023. MidAmerica owns, acquires, and operates apartment communities in the Southeast, Southwest, and Mid-Atlantic regions of the United States.

MAA is enjoying favorable earnings estimate revisions in addition to its generous 3.06% annual dividend yield at $5.00 a share.

This year’s earnings are now projected to jump 20% to $8.43 per share, up from $8.28 a share 90 days ago. FY23 earnings are expected to climb another 9% and have also trended higher over the last quarter.

Sales are forecasted to climb as well, up 13% this year and another 7% in FY23 to $2.16 billion. FY23 sales would be a 32% increase from pre-pandemic levels with 2019 sales at $1.61 billion.

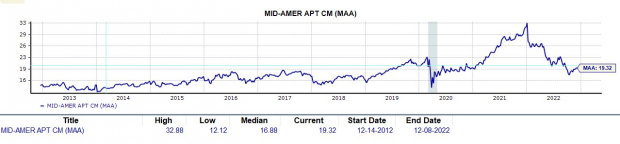

MidAmerica is down -28% YTD to underperform the S&P 500. This is near the Reit-Equity Trust Residential Markets -31% decline. However, over the last decade, MAA’s total return is +262% to beat the benchmark and its Zacks Subindustry’s +68%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

With such a stellar historical performance, this year’s decline could be buying opportunity. This appears to be especially plausible long-term.

Trading around $161 per share, MAA has a forward P/E of 19.3X. This is above the industry average of 16.9X but MidAmerica has been a leader in its space. Plus, MAA trades at a 41% discount to its decade high of 32.8X and closer to the median of 16.8X.

Even better, the average Zacks Price Target offers 18% upside from current levels.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

There may be more short-term weakness ahead among REITs, but long term these equities are attractive at some of their lowest valuations in years. These three REITs in particular have very suitable dividends that will support investors who have the patience to wait on a longer-term recovery.

More By This Author:

Buy These 2 Popular Internet Software Stocks3 Tech Stocks With Impressive Dividend Growth

Buffett's Buys; 3 Stocks Catching His Attention In 2022

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more