Buy These 2 Popular Internet Software Stocks

There is always an abundance of stocks to choose from but investing is often more fruitful and rewarding when investors understand the company’s business model and believe in the company themselves.

Here are two well-known companies from the Internet-Software Industry that investors may be feeling optimistic about as we head into the new year. The Internet-Software Industry is currently in the top 24% of over 250 Zacks Industries.

Chegg (CHGG)

Chegg is a meaningful investment on most fronts. Many investors are putting money aside for their children/grandchildren's future education or even trying to finish up a higher level of schooling themselves and are familiar with Chegg’s social education platform.

Chegg is a popular option for students and learners to study and understand their course material. The company rents and sells textbooks, and provides eTextbooks in addition to homework help and college admissions and scholarship services.

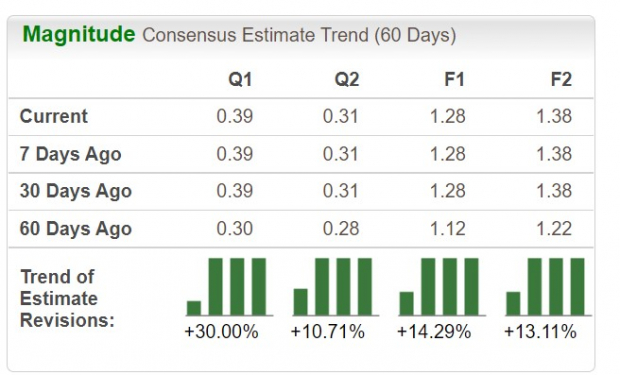

CHGG currently lands a Zacks Rank #2 (Buy) with earnings estimates on the rise for FY22 and FY23.

(Click on image to enlarge)

Image Source: Zacks Investment Research

CHGG earnings are now expected to decline -1% in 2022 to $1.28 per share but this is up 14% from $1.12 a share 90 days ago. FiY23 earnings are projected to climb 7% to $1.38 per share with earnings estimates also going up over the last quarter.

Sales are forecasted to be down -1% this year but rise 7% in FY23 to $816.84 million. FY23 sales are on pace to grow an impressive 199% over the last five years.

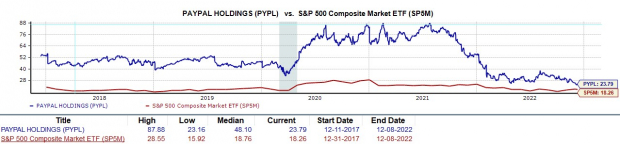

Chegg stock is down -9% YTD Vs. The S&P 500’s -18%. This has also outperformed the Nasdaq’s -29%. Since going public almost, a decade ago, CHGG is up +205% to also beat the broader indexes.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Trading around $27 per share, Chegg shares trade at 21.9X forward earnings. This is nicely below the Internet-Software industry average of 45.4X. Even better, this is well below its decade high of 501X and a 79% discount from its decade median of 106.2X.

PayPal (PYPL)

Another popular Internet-Software stock that looks attractive at current levels is PayPal. PayPal has become one of the largest online payment solutions providers following its independent spinoff from eBay (EBAY) in 2015.

PayPal is responsible for making payment solutions much easier for consumers during the rise of the internet as the frequent use of the checkbook became outdated and incompatible with online purchases.

PayPal’s stock may have reached oversold territory. Wall Street questioned the premium paid for PYPL earlier in the year amid rising inflation but the stock looks attractive at current levels. PYPL currently sports a Zacks Rank #2 (Buy).

Trading around $73 per share and roughly 62% from its 52-week highs PYPL has a P/E of 23.7X. This is well below the Internet-Software industry average of 45.4X. PYPL trades 170% beneath its five-year high of 87.8X and at a 50% discount to the median of 48.1X.

(Click on image to enlarge)

Image Source: Zacks Investment Research

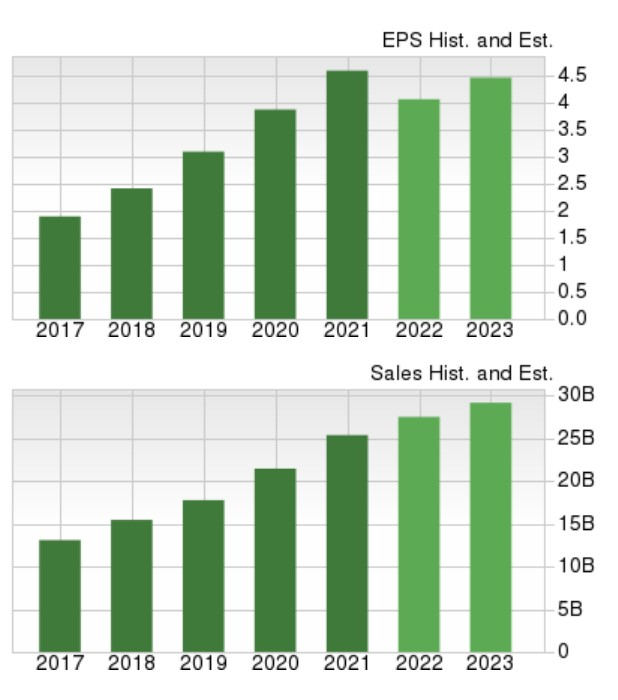

In addition to this, earnings estimates have gone higher. Earnings are now projected to decline -11% to $4.08 per share in 2022 but this is up from EPS estimates of $3.93 a share 90 days ago. Fiscal 2023 EPS is expected to rebound and pop 17% to $4.78 a share. This is also up from estimates of $4.70 a share last quarter.

(Click on image to enlarge)

Image Source: Zacks Investment Research

On the top line, sales are forecasted to rise 8% this year and another 8% in FY23 to $29.88 billion. Fiscal 2023 sales would represent 68% growth from pre-pandemic levels with 2019 sales at $17.77 billion.

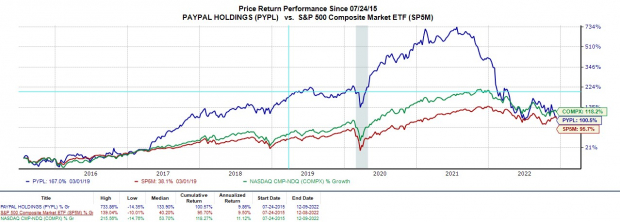

With solid growth still expected, this year’s drop in the stock is looking more and more like a buying opportunity. PYPL is down -60% YTD to underperform the benchmark and the Nasdaq.

However, since its spinoff from eBay eight years ago, PYPL is still up +100% to beat the benchmark and slightly trail the Nasdaq.

Image Source: Zacks Investment Research

Bottom Line

Trading attractively relative to their past, Chegg and PayPal could see their stocks rise as we head into 2023. These popular tech companies have businesses that are well-known, beneficial, and helpful to consumers. The rising earnings estimate revisions and top line growth indicate this should continue.

More By This Author:

3 Tech Stocks With Impressive Dividend GrowthBuffett's Buys; 3 Stocks Catching His Attention In 2022

3 Winning Financial Mutual Funds That Still Have Room To Run

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more