3 Tech Stocks With Impressive Dividend Growth

Image: Bigstock

When thinking of dividends, common sectors that come to the minds of many include utilities, finance, and consumer staples. However, it could surprise some that several technology companies also reward their investors handsomely. Technology stocks are generally not targeted by income-focused investors, as it’s common for these companies to utilize cash to fuel growth.

Still, several large-cap tech stocks – Microsoft (MSFT - Free Report), Texas Instruments (TXN - Free Report), and Oracle (ORCL - Free Report) – have no issue paying their investors. And they’ve grown their payouts quite significantly over the last five years.

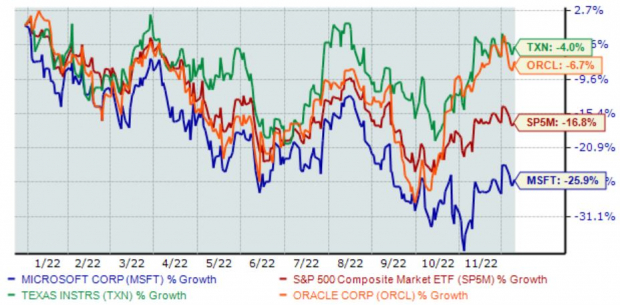

Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, TXN and ORCL have outperformed the general market year-to-date, whereas MSFT has lagged. Let’s take a closer look at each one.

Microsoft

We’re all familiar with Microsoft, the mega-cap titan that’s one of the largest broad-based technology providers in the world. Currently, MSFT is a Zacks Rank #3 (Hold).

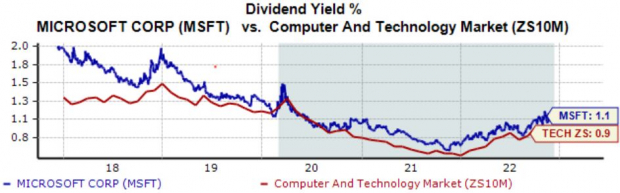

The company’s annual dividend currently yields 1.1%, a tick above its Zacks Computer and Technology sector average. Impressively, MSFT has upped its dividend payout five times over the last five years, translating to a nearly 10% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

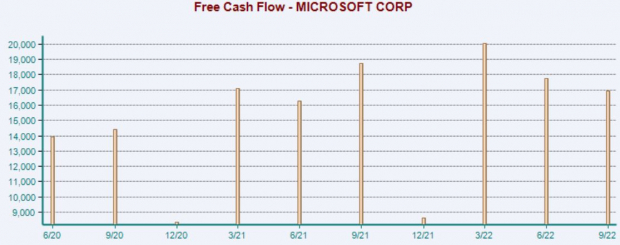

Microsoft is one of the biggest cash-generating machines in the S&P 500; in its latest release (2023 Q1), the company reported free cash flow of a sizable $16.9 billion.

Image Source: Zacks Investment Research

Texas Instruments Inc.

Texas Instruments is an original equipment manufacturer of analog, mixed-signal, and digital signal processing (DSP) integrated circuits. Currently, TXN carries a Zacks Rank #3 (Hold).

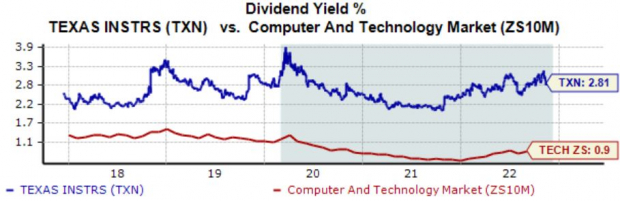

TXN’s annual dividend currently yields a solid 2.8% paired with a payout ratio sitting sustainability at 49% of its earnings. As we can see, the company’s current yield handily surpasses its Zacks sector average. TXN’s payout has grown by an inspiring 15% over the last five years.

Image Source: Zacks Investment Research

Further, the company has been on a strong earnings streak as of late, exceeding earnings and revenue estimates in four consecutive quarters.

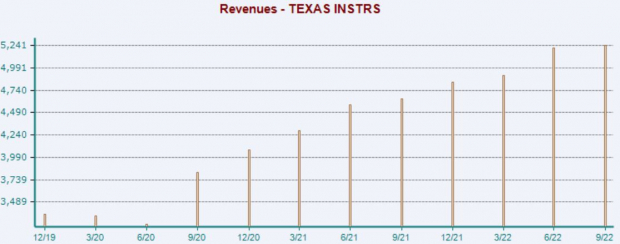

In TXN’s latest print (2022 Q3), the company registered a 3.4% bottom-line beat paired with a 2.7% sales surprise. Below is a chart illustrating the company's revenue on a quarterly basis.

Image Source: Zacks Investment Research

Oracle

Oracle is one of the largest enterprise-grade database, middleware, and application software providers, offering cloud solutions and services that can be used to build and manage various cloud deployment models. ORCL has witnessed positive earnings estimate revisions over the last several months, helping land the stock into a favorable Zacks Rank #2 (Buy).

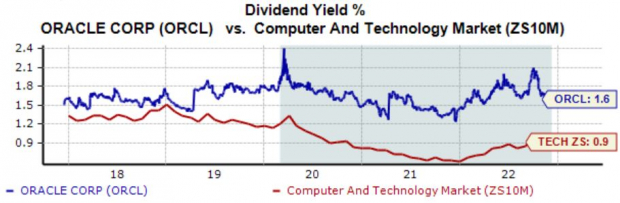

As it stands, ORCL’s annual dividend yield comes in at 1.6%, nicely above its Zacks sector average. In addition, Oracle has increasingly rewarded its shareholders, carrying a 14% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Oracle’s growth profile is also solid; earnings are forecasted to climb a modest 1.2% in its current fiscal year (FY23) and a further 11% in FY24. The projected earnings upticks come paired with forecasted year-over-year revenue growth of 17% in FY23 and 6.8% in FY24.

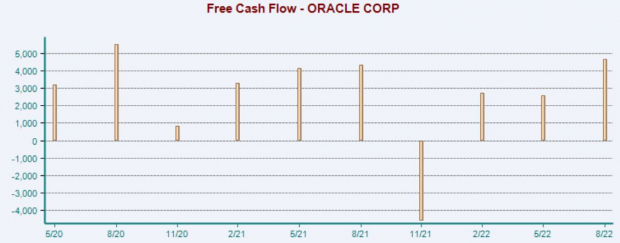

Like MSFT, it’s hard to ignore the company’s cash-generating abilities; in its latest earnings release (2023 Q1), Oracle reported free cash flow of $4.6 billion.

Image Source: Zacks Investment Research

Bottom Line

Technology isn’t a typical sector that income-focused investors flock to. Generally, stocks within the utilities, finance, and consumer staples sectors are a common target of these investors.

Still, there are several tech stocks – Microsoft (MSFT - Free Report), Texas Instruments (TXN - Free Report), and Oracle (ORCL - Free Report) – that reward their shareholders, and their payouts have been growing.

For those that seek income paired with exposure to tech, all three precisely fit the criteria.

More By This Author:

Buffett's Buys; 3 Stocks Catching His Attention In 20223 Winning Financial Mutual Funds That Still Have Room To Run

3 Small-Cap Value Mutual Funds For Spectacular Returns

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more