The Case For The Single Family Rental REITs

Last week, in an attempt to improve home affordability, President Trump announced a possible ban on institutional ownership of single family homes. This resulted in a selloff in the two leading single family rental (SFR) REITs: American Homes 4 Rent (AMH) and Invitation Homes (INVH).

(Click on image to enlarge)

While the possibility of legislation is a concern, the selloff further increased the value in these two REITs – which were already in a downtrend. The fundamentals remain stellar and the current price represents an excellent buying opportunity.

Let’s start with INVH. INVH owns more than 86,000 single family homes, with 71% of their 3Q25 revenue coming from the West Coast and Florida. They are guiding 2025 Same Store Net Operating Income (NOI) growth to +1.75-2.75% and Core FFO to $1.90-$1.94. That represents a 13.7x multiple on 2025 FFO. INVH also pays a 30 cent quarterly dividend which works out to 4.57% annualized.

AMH owns more than 60,000 single family homes, concentrated in the Sun Belt. They are guiding 2025 Same Store Net Operating Income (NOI) growth to +3.50-4.50% and Core FFO to $1.86-$1.88. That represents a 16.6x multiple on 2025 FFO. AMH also pays a 30 cent quarter dividend which works out to 3.87% annualized.

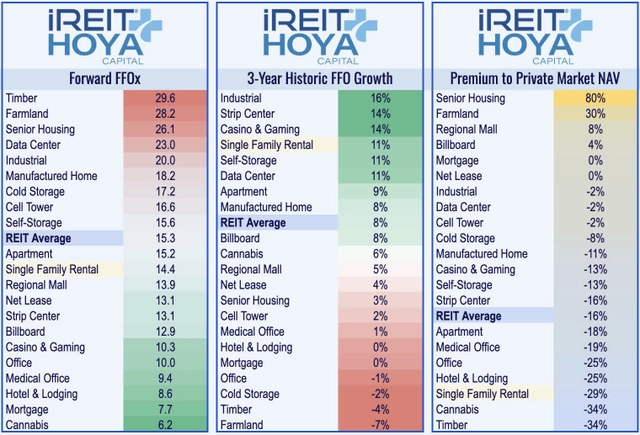

According to Hoya Capital, the SFR REITs are trading at a 29% discount to their market Net Asset Value while they have some of the best 3-year FFO growth (11%) in the REIT Space.

Real estate – as a hard asset – is also an inflation hedge if you are concerned about that as I am.

What if some sort of legislation against institutional ownership comes to pass? According to REIT expert David Auerbach in a long thread on Twitter, there is legal precedent for distinguishing REITs from private equity and therefore any legislation could have a carve out for REITs.

In a worst case scenario, since the SFR REITs are trading at a 29% discount to their market Net Asset Value, they could liquidate and still return more to shareholders than their current market price.

I used last week’s selloff to pick up a few shares of AMH and INVH on Monday.

More By This Author:

The Vision Of The Anointed And The Betrayal Of Value Investing

Investment Philosophies: Value Vs. Momentum

The State Of The Market: Can The S&P Keep Going Up Without Tech Participation?

Disclosure: Top Gun is long AMH and INVH.