High Dividend 50: Firm Capital Property Trust

Image Source: Pixabay

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Next on our list of high-dividend stocks to review is Firm Capital Property Trust (FRMUF).

Business Overview

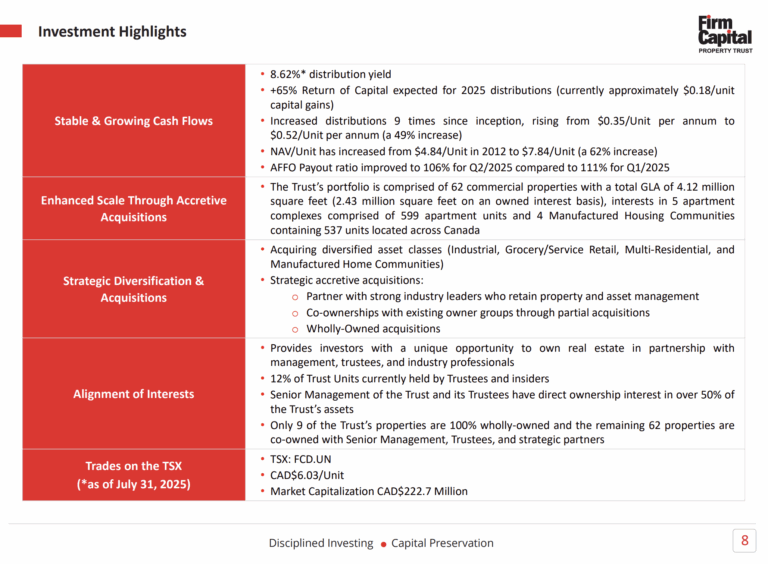

Firm Capital Property Trust is a Canadian REIT that owns and co-owns a diversified portfolio of income-generating real estate, including industrial properties, multi-residential and manufactured home communities (MHCs), and grocery-anchored and service-oriented retail.

The Trust emphasizes disciplined investing and capital preservation, often partnering with institutional-grade operators through joint ventures to enhance returns and manage risk. Its properties are located in necessity-driven markets across Ontario, Quebec, Alberta, and the Maritimes, ensuring stable demand and occupancy.

The Trust’s portfolio comprises roughly 2.4 million square feet of commercial space, 599 apartment units, and 537 MHC sites, with a wide geographic and tenant diversification.

By focusing on essential-use assets and maintaining high occupancy across its holdings, Firm Capital Property Trust provides investors with consistent income through monthly dividends.

Source: Investor Relations

The company reported Q2 and YTD 2025 results, highlighting a diversified portfolio of 62 commercial properties (2.43M sq. ft.), 599 multi-residential units, and 537 manufactured home communities (MHC) units.

Grocery-anchored retail and industrial assets account for the majority of NOI, with properties concentrated in Ontario and Quebec and targeting necessity-driven markets.

Q2 AFFO was $4.5 million ($0.123/unit), largely in line with last year, with an improved AFFO payout ratio of 106%. Same-property NOI grew 1.3%, and occupancy remained high: 93.8% commercial, 94.4% multi-residential, and 100% MHC. Rents showed growth, with industrial up 9% and multi-residential up 12% year over year.

The Trust completed property sales, generating $15 million in proceeds and a $1.8 million gain. Debt is conservative at 49.9% of gross book value, with an average interest rate of 4.2%.

Monthly distributions of $0.04333 per unit were declared, reflecting disciplined management, strong tenant diversification, and a focus on stable income and NAV growth.

Source: Investor Relations

Growth Prospects

Firm Capital Property Trust has shown resilience in its portfolio growth, focusing on essential and necessity-based assets such as grocery-anchored retail, industrial, and multi-residential properties.

While the Trust has expanded through joint ventures and diversified its holdings across Canada, historical FFO per unit has generally trended downward in USD terms, influenced by foreign exchange movements, higher interest rates, and the dilution effect of partial ownership in new properties.

The portfolio’s defensive nature, high occupancy rates, and conservative leverage have helped maintain stable cash flow despite these headwinds.

Looking ahead, growth in FFO per unit and dividends per unit (DPU) is expected to remain limited, as interest rate pressures and FX fluctuations could continue to weigh on profitability.

Past trends show recovery following market disruptions—such as a modest rebound during the COVID-19 pandemic—but overall, the Trust appears better positioned for steady, defensive income than for aggressive FFO growth.

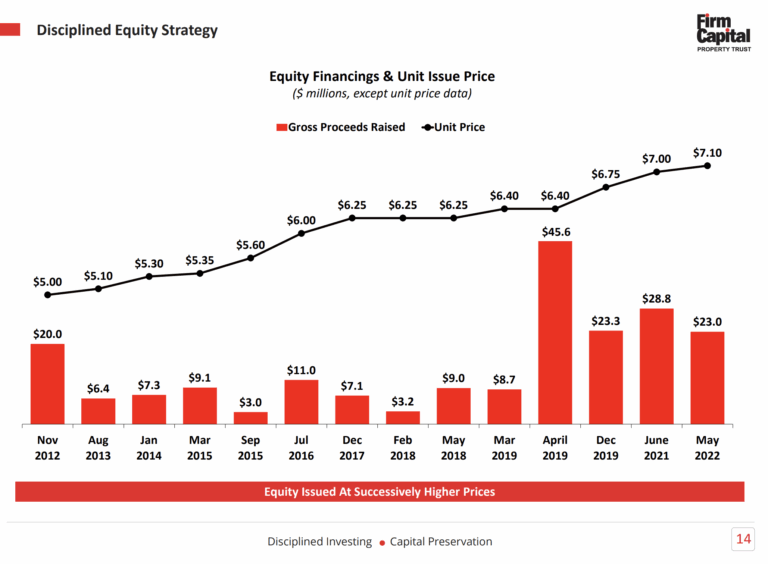

Dividends, which grew annually from 2015 to 2022, have remained stable in CAD terms, reflecting a focus on consistent payouts over rapid expansion.

Source: Investor Relations

Competitive Advantages & Recession Performance

Firm Capital Property Trust benefits from a highly diversified portfolio across industrial, multi-residential, and grocery-anchored retail properties, concentrated in necessity-driven markets across Canada.

Its focus on essential-use assets provides stable cash flow and high occupancy rates, while partnerships with institutional-grade operators through joint ventures enhance operational efficiency and risk management.

Tenant diversification is also a key strength, with no single tenant accounting for more than 13% of net rent and the top 10 tenants comprising large national companies, thereby reducing exposure to individual tenant defaults.

The Trust has demonstrated resilience during economic downturns, including the COVID-19 pandemic, due to its emphasis on essential and defensive asset classes.

While FFO per unit has experienced fluctuations, the portfolio’s composition—particularly grocery-anchored retail, industrial, and multi-residential holdings—has helped maintain occupancy and income stability even in challenging market conditions.

Conservative leverage and disciplined investment strategies further support the Trust’s ability to navigate recessions while preserving capital and providing consistent monthly distributions to unitholders.

Dividend Analysis

The company’s annual dividend is $0.38 per share. At its recent share price, the stock has a high yield of 8.8%.

Given the company’s 2025 earnings outlook, EPS is expected to be $0.28 per share. As a result, the company is expected to pay out roughly 100% of its EPS to shareholders in dividends.

Final Thoughts

Firm Capital delivers attractive distributions supported by essential-use assets and strong occupancy levels. However, constrained growth, elevated interest expenses, and a relatively high AFFO payout ratio raise concerns about the long-term sustainability of its current yield.

Despite projecting mid-single-digit annual total returns—driven primarily by the starting yield but partially offset by valuation headwinds—we maintain a sell rating, given the absence of dividend growth in recent years.

More By This Author:

High Dividend 50: Plains GP Holdings, L.P.

High Dividend 50: Apple Hospitality REIT Inc.

High Dividend 50: Atrium Mortgage Investment Corporation

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more