High Dividend 50: Plains GP Holdings, L.P.

Image Source: Pixabay

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Next on our list of high-dividend stocks to review is Plains GP Holdings, L.P. (PAGP).

Business Overview

Plains GP Holdings, L.P. is a leading midstream energy company based in Houston, Texas, specializing in the transportation, storage, and marketing of crude oil and natural gas liquids (NGLs).

The company operates an extensive network of pipelines and terminals across North America, with a strong presence in key production areas, including the Permian Basin. Plains provides critical infrastructure that connects energy producers to refineries, petrochemical plants, and export facilities, ensuring reliable delivery of energy products to end markets.

The company’s strategy focuses on maintaining a strong balance sheet, improving cash flow stability, and enhancing returns to unitholders.

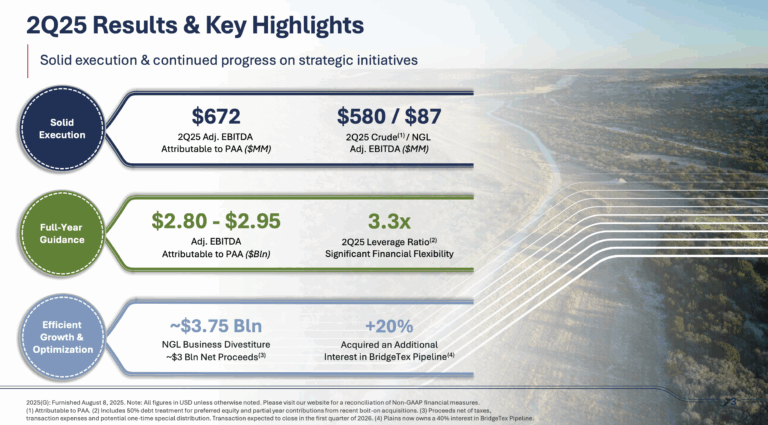

Plains continues to streamline its operations by divesting non-core assets, such as its planned $3.75 billion USD sale of its Canadian NGL business to Keyera Corp., while expanding its crude oil footprint through bolt-on acquisitions, such as its increased stake in the BridgeTex Pipeline.

With disciplined capital management and a focus on operational efficiency, Plains aims to generate steady earnings growth and long-term value in the midstream energy sector.

The company reported second-quarter 2025 net income of $210 million and operating cash flow of $694 million. Adjusted EBITDA was $672 million, and leverage stood at 3.3x, near the low end of the company’s target range. Plains increased its quarterly distribution by 20% year over year and maintained steady financial performance despite a volatile market.

The company agreed to sell nearly all of its Canadian NGL business to Keyera Corp. for $5.15 billion CAD ($3.75 billion USD), with the deal expected to close in early 2026. Plains plans to use the roughly $3 billion in proceeds for acquisitions, preferred unit redemptions, and unit buybacks.

It also acquired an additional 20% interest in the BridgeTex Pipeline, boosting its Permian Basin presence to 40%. CEO Willie Chiang said these moves strengthen financial flexibility, streamline operations, and support long-term cash returns.

Crude oil operations remained stable, with Adjusted EBITDA up 1% year-over-year due to higher volumes and tariffs. NGL results declined 7% on weaker pricing spreads. Quarterly revenue fell to $10.6 billion from $12.8 billion last year, mainly from lower commodity prices.

Plains ended the quarter with $27.2 billion in assets and a debt-to-capitalization ratio of 47%, underscoring its solid balance sheet and continued focus on disciplined growth.

Source: Investor Relations

Growth Prospects

Plains GP Holdings, L.P. is positioned for steady long-term growth supported by disciplined capital allocation and a focus on strengthening its crude oil and NGL segments. The company evaluates its performance through segment-adjusted EBITDA, emphasizing operational efficiency and cash flow generation.

In 2024, Plains increased its shares outstanding through equity issuances tied to strategic acquisitions and growth initiatives aimed at improving financial flexibility and expanding its asset base. These investments aim to enhance transportation capacity in key regions, such as the Permian Basin, while maintaining a balanced approach to leverage and shareholder returns.

Looking ahead, Plains is expected to deliver consistent earnings growth despite operating in a cyclical energy environment. Analysts forecast earnings per share (EPS) of $1.27 in 2025, with an estimated 5% annual EPS growth rate through 2030, reaching approximately $1.62.

The company has also built a solid track record of dividend payments over the past four years, reflecting its commitment to returning value to shareholders.

While dividend growth may moderate in the near term, the long-term trend remains positive, with projections suggesting a 2% annual increase and a dividend per share (DPS) of about $1.68 by 2030.

These steady growth prospects, supported by strong cash flows and strategic asset optimization, position Plains GP Holdings for sustainable performance in the evolving energy market.

Source: Investor Relations

Competitive Advantages & Recession Performance

Plains GP Holdings’ competitive advantage stems from its large, integrated midstream network and its strategic presence in key production regions, such as the Permian Basin.

Its scale, long-term contracts, and operational efficiency provide stable cash flows, cost advantages, and strong customer relationships, supporting growth and shareholder returns.

The company has proven resilient during economic downturns due to its fee-based business model and essential infrastructure assets.

Long-term contracts and strong liquidity help maintain earnings and distributions even in volatile markets, allowing Plains to navigate recessions while sustaining its competitive position.

Dividend Analysis

The company has an annual dividend of $1.52 per share. At its recent share price, the stock has a high yield of 8.9%

Given the company’s 2025 earnings outlook, EPS is expected to be $1.27 per share. As a result, the company is expected to pay out roughly120% of its EPS to shareholders in dividends.

Final Thoughts

Plains GP Holdings operates essential crude oil and NGL infrastructure, and rising energy demand combined with upstream underinvestment should support EPS growth.

However, dividend growth may remain modest due to the current payout ratio. We maintain a hold rating, reflecting expected medium-term total returns of 10% annually, based on projected 5% EPS growth, an 8.9% dividend yield, and valuation pressures.

More By This Author:

High Dividend 50: Apple Hospitality REIT Inc.High Dividend 50: Atrium Mortgage Investment Corporation

10 Best Dividend Stocks For Reducing Risk

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more