High Dividend 50: Atrium Mortgage Investment Corporation

Image Source: Pixabay

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Next on our list of high-dividend stocks to review is Atrium Mortgage Investment Corporation (AMIVF).

Business Overview

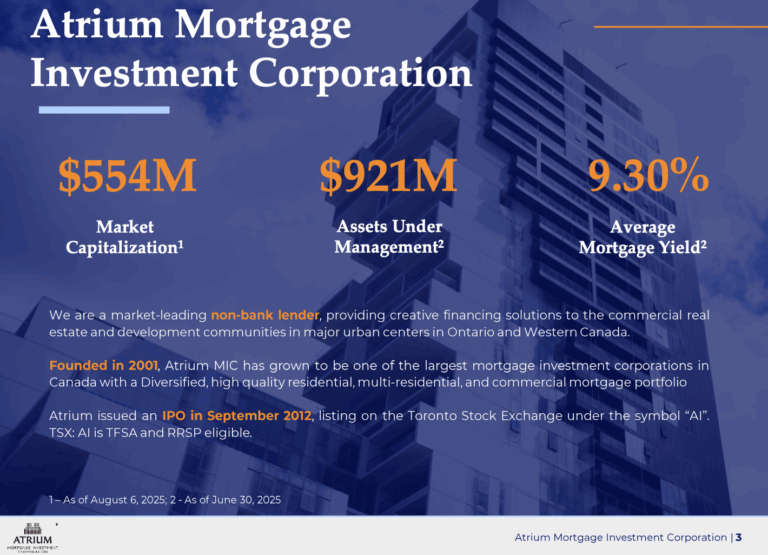

Atrium Mortgage Investment Corporation is a Canadian non-bank lender, founded in 2001 and headquartered in Toronto, that provides residential and commercial mortgage financing.

The company specializes in loans for clients who cannot access traditional bank funding, offering land and development financing, construction and mezzanine loans, as well as commercial term and bridge mortgages for residential, multi-residential, and commercial properties.

Atrium maintains a diversified mortgage portfolio with disciplined underwriting, typically offering loans with 6.99%–12.99% interest rates and one- to two-year terms. Its portfolio consists of 88% residential and 12% commercial mortgages, with a weighted average interest rate of 10.93%.

The company focuses on stable dividends, cost efficiency, and low volatility, and has consistently delivered strong returns, demonstrating resilience even during economic disruptions like the COVID-19 pandemic.

Source: Investor Relations

Atrium Mortgage Investment Corporation reported strong financial results for the second quarter and first half of 2025. For the three months ended June 30, 2025, the company posted net income of $13.1 million, up 13.7% from the prior year, with basic and diluted earnings per share of $0.28 and $0.27, respectively.

For the first six months, net income reached $25.0 million, a 6.1% increase year-over-year. The company also extended its credit facility to May 15, 2027, maintaining a high-quality mortgage portfolio with 96.8% of loans as first mortgages and an average loan-to-value ratio of 61.3%.

Atrium’s mortgage portfolio totaled $921.2 million as of June 30, 2025, with 88% allocated to residential and 12% to commercial properties. During the first half of the year, $223.5 million of mortgage principal was advanced and $180.4 million repaid.

The weighted average interest rate on the portfolio was 9.30%, reflecting the company’s conservative underwriting approach. Atrium’s allowance for mortgage losses stood at $28.9 million, or 3.14% of the portfolio, slightly lower than at the end of 2024, underscoring effective risk management.

CEO Rob Goodall highlighted that the company continues to generate earnings above its dividend while maintaining a disciplined, low-risk lending strategy. Atrium focuses on conventional mortgages with loan-to-value ratios below 75%, ensuring stability even amid weak real estate markets and a stagnant economy.

The company’s prudent management and diversified portfolio position it to deliver consistent shareholder returns while navigating market fluctuations.

Growth Prospects

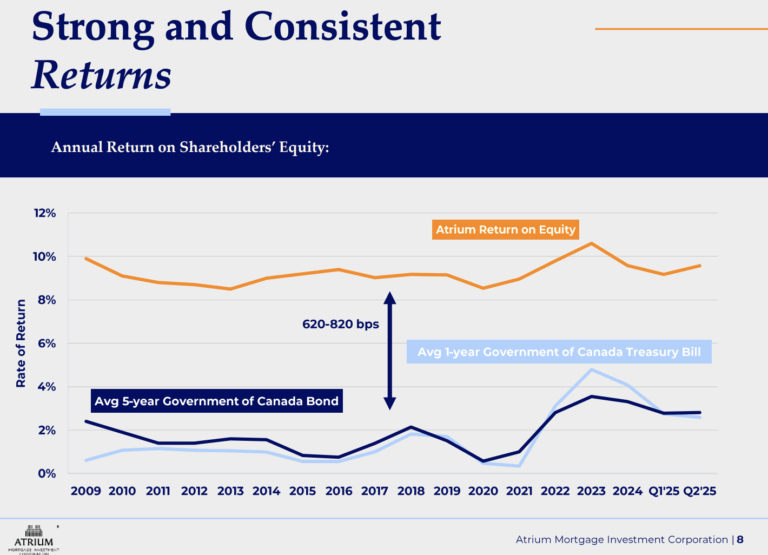

Atrium Mortgage Investment Corporation has demonstrated strong performance over the past nine years, with management’s emphasis on controlling operating costs and delivering consistent returns to shareholders clearly yielding results.

However, the company’s earnings per share have remained essentially flat over the same period, suggesting limited potential for significant growth. In other words, Atrium’s dependable performance comes with the trade-off of modest growth prospects.

Considering the company’s resilient business model and historical performance, earnings per share are likely to remain relatively flat over the next five years.

Source: Investor Relations

Competitive Advantages & Recession Performance

Atrium Mortgage Investment Corporation benefits from a conservative and well-diversified mortgage portfolio, a disciplined underwriting approach, and experienced management.

These factors create a competitive advantage by minimizing risk and ensuring consistent returns, even in a market where traditional banks are less willing to lend. The company’s focus on first mortgages and maintaining low loan-to-value ratios further strengthens its position and protects shareholder capital.

The company has also demonstrated resilience during economic downturns, including the COVID-19 pandemic, when many borrowers faced financing challenges.

Atrium’s defensive business model, combined with a high-quality mortgage portfolio, has enabled it to maintain stable earnings and dividend payouts, demonstrating its ability to weather recessions while delivering reliable returns to investors.

Dividend Analysis

Atrium Mortgage Investment Corporation currently offers an exceptionally high dividend yield of 9.6%, far exceeding the 1.2% yield of the S&P 500, making it an attractive option for income-focused investors. U.S. shareholders, however, should note that dividends are subject to fluctuations in the Canadian dollar relative to the U.S. dollar.

The company has an elevated payout ratio of over 93%, yet it remains in a strong financial position, with interest expenses accounting for less than 25% of its total interest and dividend income. This suggests that Atrium is unlikely to reduce its dividend significantly in the near term.

Over the past decade, the company has maintained a consistent dividend record, and it is likely to continue paying both base and special dividends regularly. That said, U.S. investors should anticipate minimal dividend growth due to the long-term depreciation of the Canadian dollar and the company’s modest single-digit growth in Canadian dollars.

From a valuation perspective, Atrium has traded at roughly 10.2 times its trailing twelve-month earnings. Considering its stable business model but limited growth prospects, a fair price-to-earnings ratio is estimated at 12.0. This implies a potential -2% annualized compression from valuation.

Combining flat earnings per share, the 9.6% dividend yield, and modest valuation compression, Atrium could deliver an approximate 5% average annual total return over the next five years. While this represents a weak expected return, investors will benefit from waiting for a lower entry point to improve the margin of safety and further enhance potential returns.

Source: Investor Relations

Final Thoughts

Atrium Mortgage Investment Corporation is defined by prudent management and a conservative, defensive business model. The stock currently offers a very high dividend yield of 9.6%, supported by a strong balance sheet and a consistent dividend history.

While the payout ratio is elevated at 93%, the dividend is considered secure; however, investors should not anticipate significant dividend growth in the near term. Overall, the stock appears undervalued at present.

One factor to consider is Atrium’s extremely low trading volume, which may make it difficult for investors to establish or liquidate large positions without affecting the stock price.

More By This Author:

10 Best Dividend Stocks For Reducing RiskHigh Dividend 50: Cardinal Energy

3 Stocks Yielding Over 3% To Help Reduce Portfolio Risk

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more