The Ultimate Guide To The Broken Wing Butterfly With Calls

A broken wing butterfly is a long butterfly spread with long call strikes that are not equidistant from the short call strike. A broken wing butterfly carries more risk on one side of the spread than on the other. The trade consists of a combination of a bull call spread and a short call spread, and both spreads have the same strike in the short calls.

Alternatively, you can think of the trade as being a butterfly with a “skipped strike." The trade can be either bullish or bearish depending on the setup.

A broken wing butterfly with calls is usually created by buying one in-the-money (ITM) call, selling two out-the-money calls slightly out-the-money (OTM), and buying one out-the-money (OTM) call above the strike price.

An ideal setup of the trade is to create the broken wing butterfly for a net credit. This way, there is no risk on the downside, with the long ITM call closer to the short calls.

Broken wing butterflies are trades that benefit from time decay, as the short calls experience faster time decay than the long call legs in the spread. As long as the underlying asset stays inside the profit zone, the trade should do well. A call broken wing butterfly is a short volatility trade, so it tends to benefit from a drop in volatility after the trade is placed.

Below is an example of how a broken wing butterfly looks, and this is the type we will discuss in detail in this text.

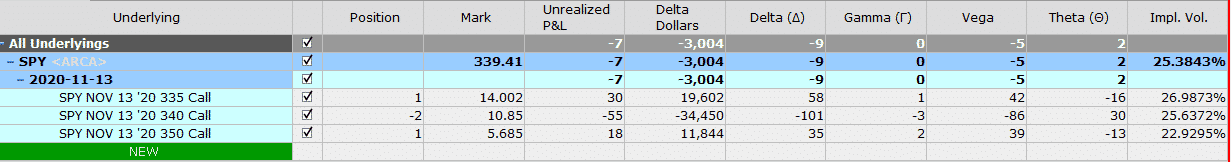

The trade date is October 5, 2020. The underlying price is 339.41. The net credit is $202. Trade Details:

- Buy 1 Nov 13 335 call @ 14.00.

- Sell 2 Nov 13 340 calls @ 10.85.

- Buy 1 Nov 13 350 call @ 5.68.

Maximum Loss

In a broken wing butterfly spread, the maximum loss is limited; it is the difference between the width of the wider and narrower call spreads minus the credit received when the trade was initiated.

In the SPY example above, the 340 and 350 legs of the bear call spread are $10 apart, the legs of the 335 and 340 bull call spread are $5 apart. There is a $10 – $5 =$5 difference between the width of the two spreads. The trade was created for a credit of $10.85 × 2 – $5.69 – $14.00 = $2.02, hence we have a total maximum potential loss of:

- Max Loss = 100 × (5 – 2.02) = $298.

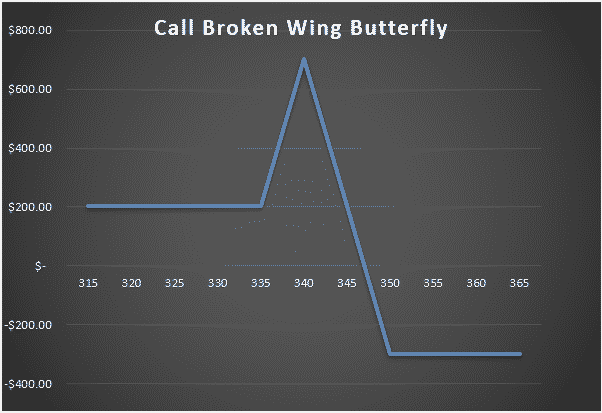

This maximum loss of $298 would occur if the SPY stock rallied above $350 at expiration date. There is no risk on the downside in our broken wing butterfly. If, at expiry, SPY traded below $335, the trade would make a net gain of $202. If the trade was created for a debit, the maximum loss would look like:

- Max loss = difference in width of the spreads + net debit.

Maximum Gain

The maximum gain on a broken wing butterfly occurs when the stock, at expiration, ends at the strike price of the short calls. In this case, the short calls are worthless, as well as the long call out-the-money (OTM).

In our SPY broken wing butterfly, the trade will make a maximum gain if, at expiry, SPY closed at $340. The maximum gain in this scenario would be:

- Max gain = Strike price short calls – Strike price long call (ITM) + Net credit received.

- Max gain = 100 × ($5 + $2.02) = $702.

Usually, the trader chooses to close to trade before expiry to avoid gamma risk.

Breakeven Price

If the broken wing butterfly is established for a credit, there is only one breakeven price at expiration; it is strike price of the skipped strike plus the credit we received. In our SPY trade, the skipped strike is 345, it is the value of the OTM long call that a regular call butterfly would have.

- Breakeven price = $345 + $2.02 = $347.02.

If the broken wing butterfly is established for a debit, there is also a lower breakeven price:

- Lower breakeven = Strike price long call (ITM) – net debit paid.

Payoff Diagram

Broken wing butterflies have a tent-shaped payoff diagram with the potential for very large profits around the short strike of the calls. It is important to keep in mind that it is very unlikely that the trade would achieve the maximum profit.

At expiry, if the stock is trading around, the short calls strike would suffer heavy fluctuations due to the high gamma of the at-the-money calls. Experienced traders usually close the position before expiry. A good aim for broken wing butterfly trade is to make a 20-25% return on capital at risk. In our SPY trade, this would mean closing the trade around $75 per contract.

Risk of Early Assignment

There is always a risk of early assignment when having a short option position in an individual stock or ETF. You can mitigate this risk by trading index options, but they are more expensive.

Usually, early assignment only occurs on call options when there is an upcoming dividend payment. Traders will exercise the call in order to take ownership of the stock before the ex-date and receive the dividend. Typically, early assignment only occurs on call options when the short calls are in-the-money and they have lost their extrinsic value.

To avoid this improbable case, one should close the position before expiration week, particularly if the short calls are in-the-money.

How Volatility Impacts Broken Wing Butterflies

Broken wing butterflies are short vega trades, so generally speaking, they benefit from falling volatility after the trade has been placed. Looking at the SPY example above, the position starts with a negative vega of 5. This means that for every 1% drop in implied volatility, the trade should gain $5.

The opposite is true if implied volatility rises – the position would lose $5. If the position has positive vega, it would benefit from rising volatility.

How Theta Impacts Broken Wing Butterflies

Broken wing butterflies are positive theta trades in that they make money as time passes, with all else being equal. (This also assumes the stock is below the upper breakeven point.)

This is because the short calls suffer faster time decay than the long calls. This is especially true if the short calls are at at-the-money or close to the trading price of the stock. This is the ideal setup of the trade as long as the broken wing butterfly is created for a credit.

In our SPY example, the trade has positive Theta of 2. This means that all else being equal, the trade would gain $2 per day due to time decay.

Other Greeks - Delta

Slightly bullish broken wing butterflies have a small negative delta, close to zero. This is because the width of the bull call spread is shorter than the width of the bear call spread.

The broken wing butterfly can also be placed with a bearish or a neutral bias, but in those cases, the position is usually created for a debit. Our initial SPY position above had a negative delta of 9. Thus the trade would make money if the stock price decreased and kept everything else equal.

Gamma

Broken wing butterflies are negative gamma. Generally, any trade that has a profit tent above the zero line will be negative gamma because they will benefit from stable prices.

In other words, you want the stock to stay relatively flat, small moves in the price of the stock will not dramatically affect the position unless close to expiry. In our SPY example, the position had 0 gamma. The initial impact of gamma on a broken wing butterfly is low, but that can change as time passes and the stock starts to move.

Assignment Risk

Although this does not happen often, it can theoretically occur at any point during the trade. The risk is higher when the short calls are in-the-money and have very little time value left. Another assignment risk happens when there is an upcoming dividend payment.

One way to avoid assignment risk is to trade indexes that are European style and cannot be exercised early. The risk is also very low if the short calls are out-of-the-money. To reduce assignment risk, consider closing a trade if the short calls are close to being in-the-money, particularly if it is nearing expiry.

Expiration Risk

Leading into expiration, if the stock is trading just above or just below the short calls, the trader has expiration risk. The risk here is that the trader might get assigned and then the stock makes an adverse movement before the trader has had a chance to cover the assignment. In this case, the best way to avoid this risk is to simply close out the spread before expiry.

While it might be tempting to hold the broken wing butterfly spread and hope that the stock stays below the short calls, there is always a risk when assignments happen close to expiry.

Gamma Risk

Close to expiration, the gamma of near at-the-money options increases, and the price of the short calls will heavily fluctuate. One way of protecting the trade against gamma risk is to close the position at least one week prior expiration.

Broken Wing Butterflies vs Butterflies

The main difference between a broken wing butterfly and regular butterfly is that in the broken wing butterfly, the long calls are not located at the same distance from the short positions. When it is created for a credit, the broken wing butterfly transfers all the risk to the upside. In a regular butterfly, there is equal risk on the downside and upside.

By moving the out-of-the-money call option further away from the strike price of the underlying, the broken wing butterfly can be created for a credit. The maximum profit in a broken wing butterfly is higher than a regular butterfly. The maximum loss in a broken win butterfly is higher than in a regular butterfly. The maximum loss in a regular butterfly is the cost of initiating the trade.

Trade Management

As with all trading strategies, it is important to plan out in advance exactly how you are going to manage the trade in any scenario. What will you do if the stock rallies? What about if it drops? Where will you take profits? Where and how will you adjust? When will you get stopped out?

Let us consider the basics of how to manage broken wing butterflies.

Profit Target

It is important to have a profit target. That might be 20-25% of the maximum profit of the trade. If you decide to keep the position closer to expiration because the position shows a profit, it is a good idea to move the out-of-the-money call leg closer to the short calls. This way you mitigate the risk of an unexpected move of the stock.

Stop Loss

Having a stop loss is also important, perhaps more so than a profit target. With broken wing butterflies, you can set a stop loss based on a percentage of the capital at risk. Some traders like to set a stop loss at 20% of capital at risk. Others might set it at 30%. Whatever you decide, make sure it is written down and mapped out in your trading plan.

A Broken wing Butterfly Example

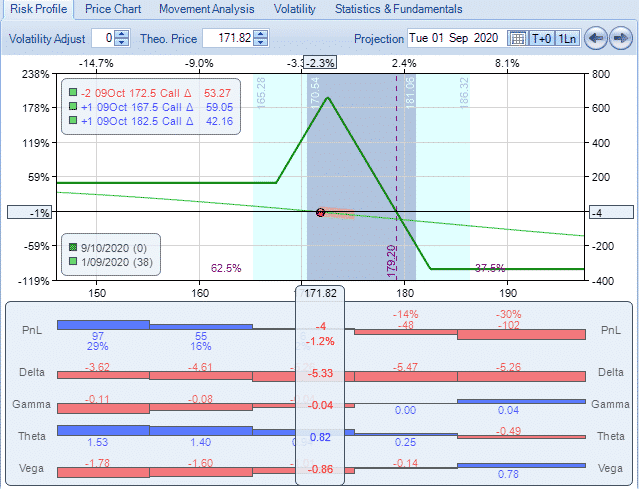

Let us go through an example of a broken wing butterfly and see how it progressed throughout the trade. This trade was on Boeing (BA). Here are the details:

- Date: September 1, 2020

- Current Price: $171.82.

Trade Set Up:

- Long 1 October 09 $167.5 call @ $15.725.

- Short 2 October $172.5 calls @ $13.45.

- Long 1 October $182.5 call @ $9.50.

- Premium: $167.50 Net Credit.

The total net credit is $167.50, which means the maximum profit is $677.50. This is calculated as the difference between the width of the spread of the bear and bull calls ($5) plus the premium received $1.675. This would occur if the stock closed exactly at $172.50 at expiration.

The theoretical maximum loss of the trade is 100 × (5 – 1.675) = $332.50 on the upside if, at expiry, the BA finished above the price of 182.5. The position had an initial delta of -5.33 and a positive theta of 0.82, and the position benefited from time decay and dropping prices.

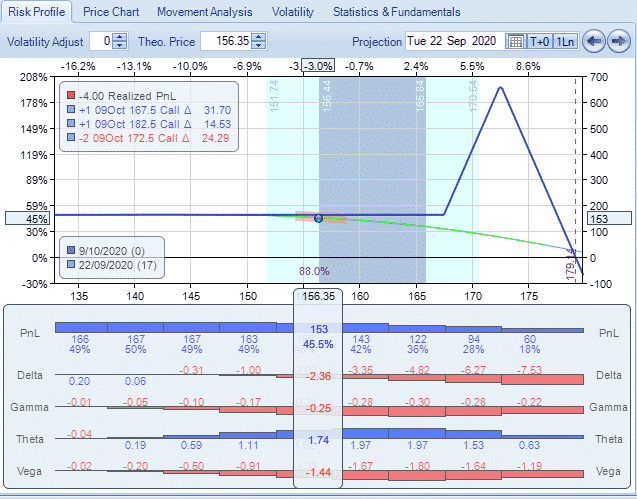

By September 22, BA dropped to 156.36, a price far below the long call at 167.50. The trade showed a gain of $153 -- a nice profit after three weeks in the position.

An important thing to notice here is that the trade was profitable because the position was initiated for a credit, and we were able to collect almost all of it because BA dropped more than 8% in during the trade.

Summary

Broken wing butterflies are neutral to bullish trades and are a very handy tool for any option income trader’s portfolio. The nice thing about them is that they are defined-risk trades that benefit from time decay.

Given that the position contains options across multiple legs, it is important to keep in mind that the bid-ask spreads can be significant and therefore make it difficult to initiate a trade for a decent price. You should be patient getting it filled.

Broken wing butterflies are generally very slow moving early in the trade. They are easy to maintain when volatility is low and the stock does not move too much on the upside.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more