Tesla's Strong FCF Margins Could Imply TSLA Stock Is Worth Over $500

/Tesla%20dealership%20with%20cars%20in%20lot%20by%20Jetcityimage%20via%20iStock.jpg)

by Jetcityimage via iStock

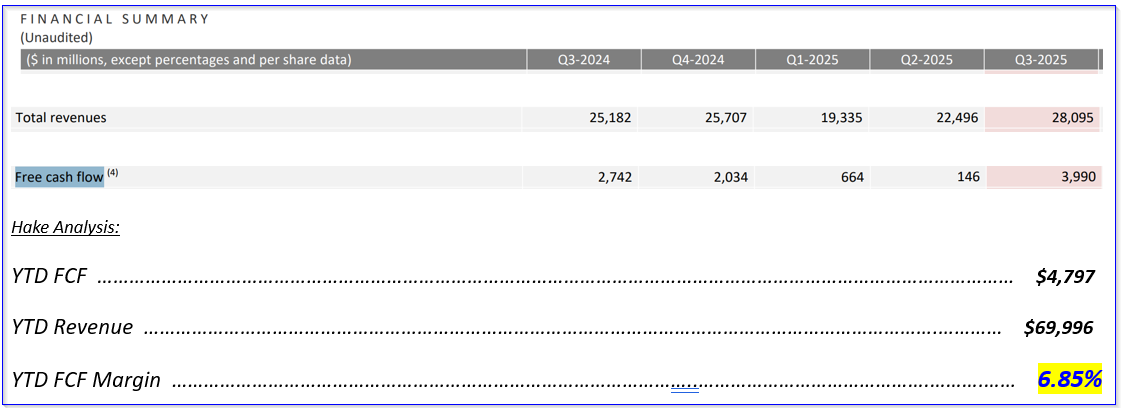

Tesla, Inc. (TSLA) generated $3.9 billion in free cash flow (FCF) in Q3, representing over 14% of its sales. YTD, its FCF margin was 6.86%, implying that TSLA stock could be over 15% undervalued ($502 per share) if FCF stays strong next year. This article will show why.

TSLA closed at $433.72 as of Friday, October 24, down from its recent peak of $459.46 on October 1 before the Oct. 22 Q3 shareholder deck release.

(Click on image to enlarge)

TSLA stock - last 3 months - Barchart - Oct. 24, 2025

But, based on my FCF margin and FCF yield analysis and estimates, TSLA stock could be worth almost $502 ($501.81) over the next year. Let's look at this.

Strong FCF Margins

Tesla's revenue rose +11.6% YoY to just over $28 billion ($28.095 b) and was up +24.9% QoQ. This was undoubtedly due to orders flooding in ahead of the $7,500 U.S. tax subsidy that expired at the end of September. For example, auto revenues rose 27.3% QoQ in Q3.

Nevertheless, although Tesla did not discuss its revenue outlook for 2026, analysts remain very optimistic. For example, Seeking Alpha shows that 49 analysts are forecasting an average $110.32 billion, up +15.6% from forecasts of $95.46 billion for this year.

The company also generated strong free cash flow (FCF), $3.99 billion in Q3. That represented 14.2% of its $28.1 billion in Q3 sales. Moreover, its trailing 12-month (TTM) FCF of $6.834 billion represented 7.15% of $95.633 billion in revenue. (TTM stats are from Stock Analysis).

Moreover, Tesla's FCF margin YTD has been strong. This can be seen from the table on page 4 in its Q3 shareholder deck:

(Click on image to enlarge)

TSLA FCF analysis - data from Q3 Shareholder Deck

It shows that YTD, the FCF margin has been 6.85%. Assuming its Q4 FCF margin can stay at half (50% x 6.85% = 3.425% FCF margin) of this level (to be conservative), and based on analysts' 2025 forecast of $95.633 billion, it could generate almost $900 billion FCF in Q4:

$95.633 b 2025 est. - $69.996 b YTD= $25.637 billion Q4 revenue

$25.637 x 0.03425 FCF margin = $878 million FCF in Q4

That would bring the 2025 FCF $5.675 billion:

$4.797b YTD + $0.878b Q4 = $5.675 billion FCF for 2025

And the FCF margin for 2025 would be almost 6.0%:

$5.675 billion FCF / $95.633 billion est. for 2025 = 0.0.593 = 5.93%

We can use that to forecast 2026 FCF and a price target for TSLA stock.

Forecasting TSLA Stock Target

For example, based on analysts' 2026 revenue forecasts, FCF could rise to $5.74 billion next year:

$95.633 billion x 0.06 = $5.738 billion FCF

To value this, we can theoretically assume that the company could pay out 100% of this to shareholders. The market might give the stock around a 0.34% dividend yield:

$5.738 billion / 0.0034 = $1,688 billion market cap

That is over +15.7% higher than its market cap today (i.e., $1.442 trillion, according to Yahoo! Finance).

That implies that TSLA stock could be worth over $500 per share:

$433.72 x 1.157 = $501.81

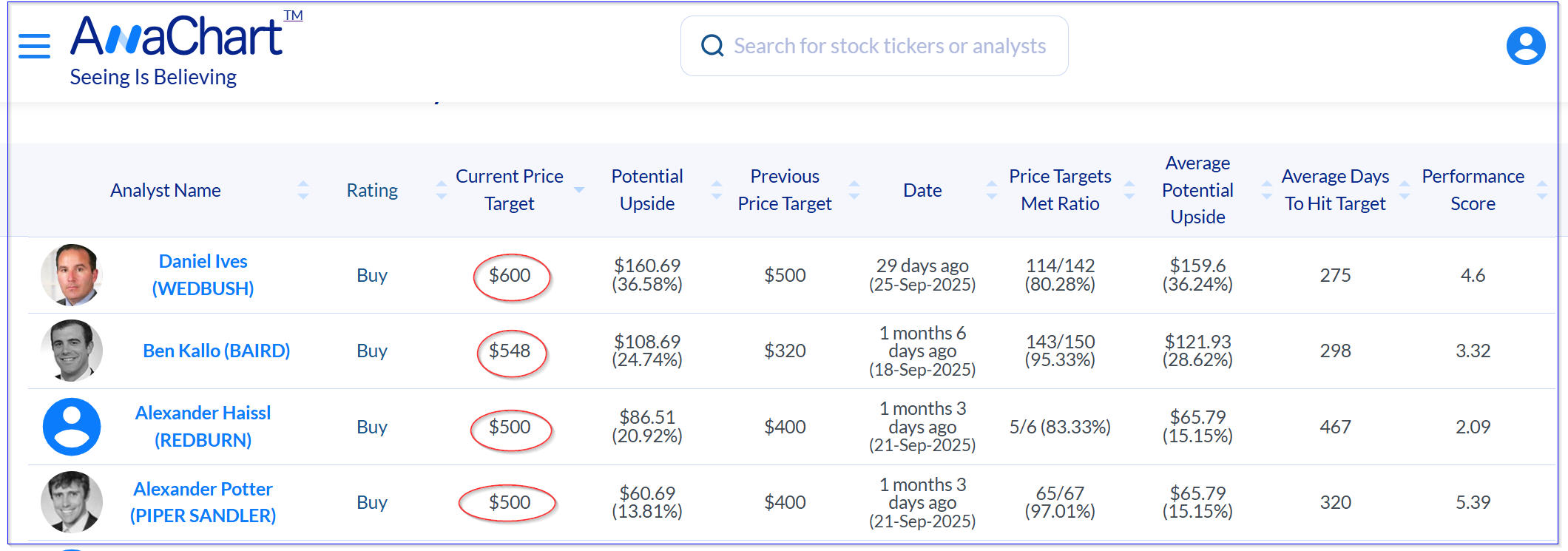

Note, almost no analyst has this high a target. Only 4 analysts, including Dan Ives, of Wedbush Securities, whose present target is $600, have similar or higher price targets, according to AnaChart:

(Click on image to enlarge)

AnaChart analysis of TSLA stock analysts - Oct. 25, 2025

The table above shows that these four analysts have recently raised their price targets.

But there is no guarantee this will happen over the next 12 months. Therefore, one way to play this is to set a lower buy-in price target by shorting out-of-the-money put options.

Shorting OTM Puts

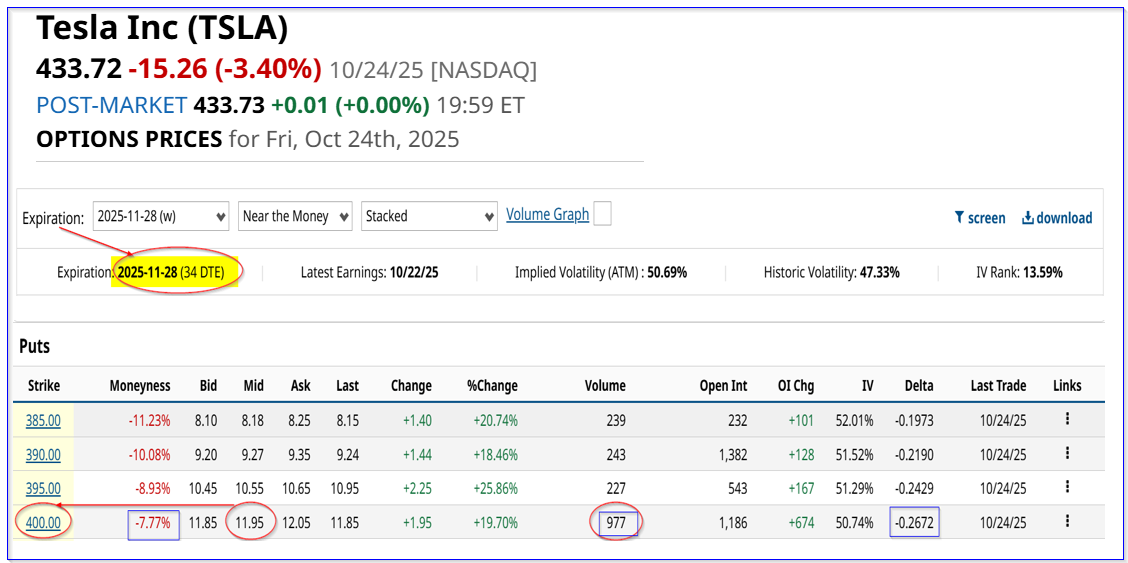

For example, the Nov. 28 expiry period shows that the $400.00 strike price, 7.77% below the closing price on Friday, Oct. 24, still has a $11.95 midpoint premium. That represents a short-put yield of almost 3.0% for one month to the short-seller:

$11.95 / $400.00 = 0.029875 = 2.9875% 1-mo yield

(Click on image to enlarge)

TSLA puts expiring Nov. 28 - Barchart - As of Oct. 25, 2025

That means that an investor who secures $40,000 in cash or buying power with their brokerage firm as collateral can enter an order to “Sell to Open” this put option. This strike price is very liquid, with over 900 options already under contract, and the delta ratio is low at 26.7%.

That implies that there is a low chance that TSLA will fall to $400 on or before Oct. 28. But, even if it does, the short-seller of these puts has a lower breakeven point:

$400 - $11.95 = $388.05, or -10.5% below the trading price

Moreover, if TSLA rises to $502, my target price, the upside is attractive:

$502 / $388.05 breakeven = 1.2936 -1 = +29.36% upside

However, if TSLA rises from here, the investor only makes the 3.0% yield, and does not gain any upside in TSLA. In addition, not everyone can afford to secure $40K as collateral to short this OTM put.

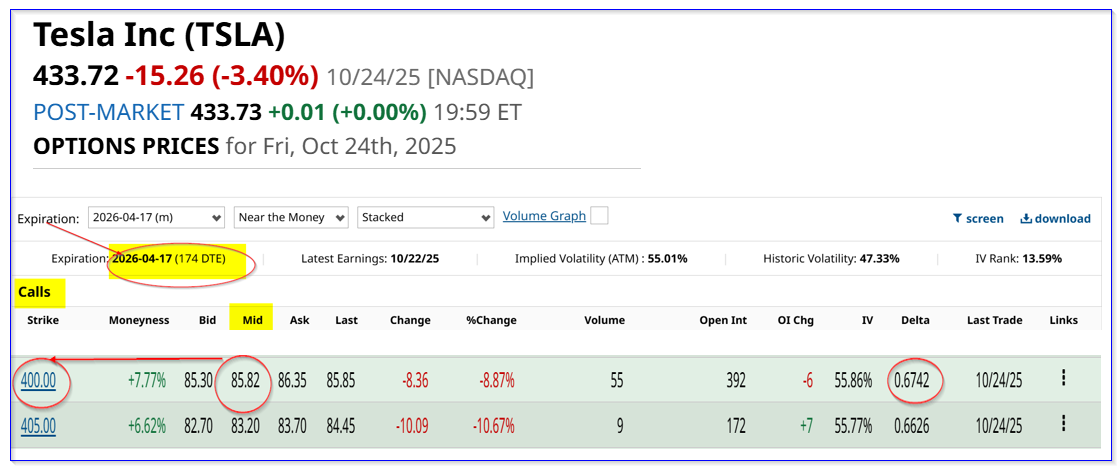

Therefore, an alternative play is to do a poor-man's covered call (PMCC). This entails buying an in-the-money (ITM) long-term call and then shorting a nearer-term OTM call at a higher strike price.

Poor Man's Covered Call (PMCC) TSLA Play

For example, an investor could buy the $400 call option expiring in almost six months (April 17, 2026), or 176 days from now. The midpoint premium is only $85.82, meaning an outlay of $8,582 to control 100 shares in TSLA. This allows the investor to short OTM calls in near-term expiry prices.

That's why it's called a “poor-man's covered call” (PMCC).

(Click on image to enlarge)

TSLA calls expiring April 17, 2026 - Barchart - As of Oct. 24, 2025

Note that this is an in-the-money (ITM) call option, with $33.72 (i.e., $3,372) of intrinsic value (i.e., $433.72 trading price - $400.00 strike). That helps provide some downside protection.

But if TSLA rises to $500 by April 17, the intrinsic value rises to $100 (i.e., $500-$400). So, the profit would be quite attractive:

$100 - $85.82 cost = $14.18 profit

$14.18 / $85.82 cost = +16.5%

That is better than the +15.7% expected return (ER) by owning TSLA shares, as seen above.

And, note also, that as TSLA rises, the premium price will rise as well, allowing the investor to benefit from extrinsic value. It's very possible that the investor could make at least a 20% return or more before expiration.

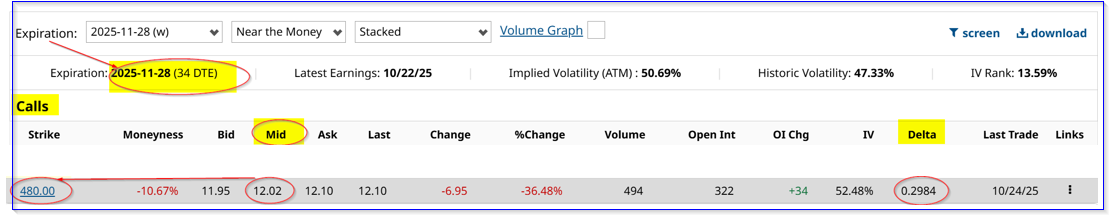

Moreover, the investor can sell short out-of-the-money (OTM) calls for extra yield income each month. For example, the Nov. 28 expiry period shows that the $48.00 call price has a midpoint premium of $12.02.

(Click on image to enlarge)

TSLA calls expiring Nov. 28, 2025 - Barchart - As of Oct. 24, 2025

That represents a covered call yield of 2.77% (i.e., $12.02 / $422.72), based on the trading price.

But, actually, the PMCC yield is much higher, since the cost is much lower:

$12.02 / $85.82 cost of 100 calls = 0.14 = 14% per month.

So, if this play can be repeated each month for six months, the expected return is very attractive:

0.14 x 6 = 0.84 = 84.00%, or $12.02 x 6 = $72.12 cumulative income/ $85.82 = 0.84

Therefore, even if TSLA were to stay flat over the next six months, the expected return, despite the loss in premium, would be as follows:

Intrinsic value: $433.72 - $400.00 = $33.72

$33.72 - $85.82 = -$52.10 +$72.12 cum income = $20.12

That still represents a 23.3% expected return (i.e., $20.12/$85.82) even if TSLA stays flat over the next six months.

This shows that OTM shorting puts and doing PMCC plays (i.e., buying ITM calls and shorting OTM calls) are attractive ways to play TSLA stock.

More By This Author:

Netflix Produces Strong FCF Q3 Margins - NFLX Looks 23% Too Cheap

Heavy Activity In Energy Fuels Inc Call Options - A Speculative Play On Rare Earth Elements

Nasdaq Inc Produces Strong Earnings And Cash Flow - NDAQ Could Be Cheap