Heavy Activity In Energy Fuels Inc Call Options - A Speculative Play On Rare Earth Elements

William Potter via Shutterstock

Speculators have piled into short-term call options of a rare earth elements (REE) stock - Energy Fuels Inc. (UUUU). The volume of call options traded is over 26x the prior number outstanding. They must be looking for more good news. But using probability analysis, as this article will show, shorting calls is a much better play here.

This was after Energy Fuels announced a joint deal with Astron Limited (ASX: ATR), following the Australian government's announcement on Monday, Oct. 20, of a “conditional” Letter of Support for a REE project in Australia, known as the Donald Project (after its location in Victoria's Murray Basin, near Minyip and Donald).

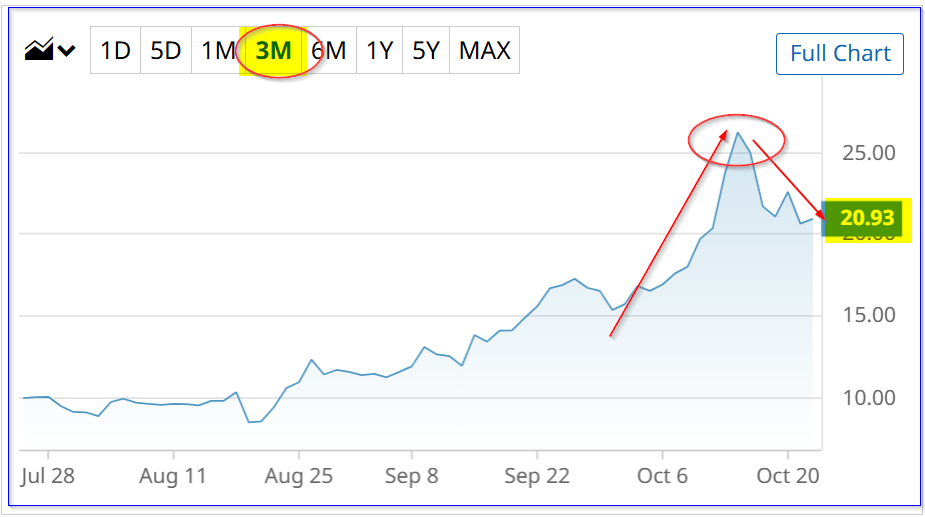

UUUU stock is at $20.80 today, up over $5 from the end of September before the deal announcement ($15.35). This is after it peaked at $26.23 on Oct. 14, likely in anticipation of some good news.

UUUU stock - last 3 months - Barchart - As of Oct. 22, 2025

The project will ship REE to Energy Fuels' U.S. minerals processing facility after investing over AUD $520 million in production. The production is expected to happen by the second half of 2027.

Speculators Push Up Call Premiums

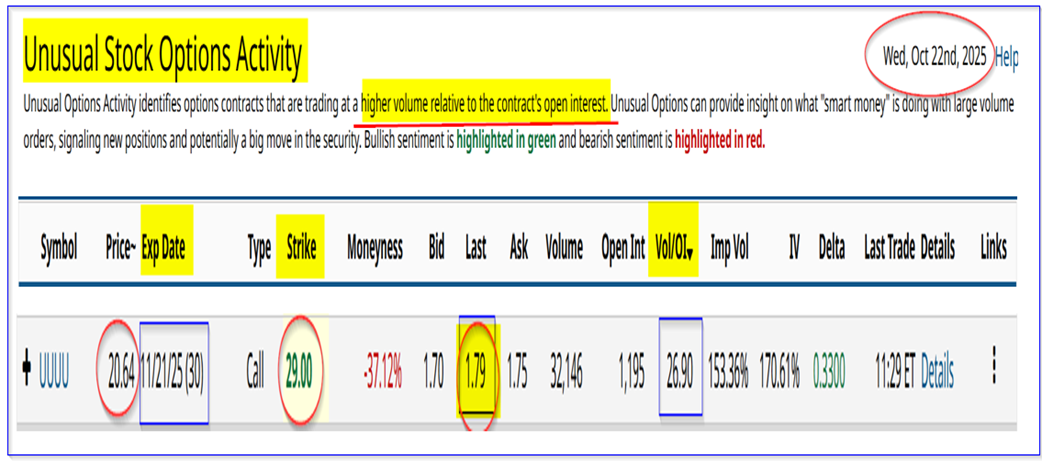

The speculative activity in UUUU call options can be seen in Barchart's Unusual Stock Options Activity Report today. It shows that over 32,00 call options have traded at the $29.00 strike price for expiry on Nov. 21 - one month away.

(Click on image to enlarge)

UUUU calls expiring Nov. 21 - Barchart Unusual Stock Options Activity Report - Oct. 21, 2025

Moreover, the premium for the call option is between $1.70 - $1.75 per call option. That implies buyers expect the stock to rise over $30 (i.e., $29.00 +$1.75 = $30.75), or almost +48% higher:

$30.75 / $20.80 today = 1.478 -1 = +47.8% higher

That implies heavy speculative trading in this stock. In fact, its prior peak was only $26.23.

So, investors expect that some major announcement will be made in the next 30 days that will propel the stock even higher. Speculation is that both companies will receive the financing needed to launch the project on time.

The problem is that this call option has almost no time to work out well, just 30 days for it to rise 48% to have minimal intrinsic value. In effect, speculators must be hoping that it will double.

Or maybe they are playing a “greater fool” game, where they expect to sell these calls at a higher price sometime in the next 30 days.

The reality is that it makes much more sense to short these calls, especially on a covered call basis. That provides investors a decent yield:

$1.73 / $20.80 = 0.08317 = 8.317%

That 8.3% covered call yield for one month could also produce a higher return is the stock rises to $29.00 over the next month:

$29.00 / $20.80 = 1.394 -1 = 39.4%

So, the total potential return to the covered call investor in UUUU shares is almost 48%:

8.3% +39.4% = 47.7%

And if the stock rises from here, the investor keeps the 8.3% yield plus any gain in UUUU shares.

That makes it a much safer play than buying these speculative shares.

Using Probability To Assess the Expected Returns

Buying Calls. Let's say that there is a 20% possibility that UUUU will double over the next month. We can use probability to assess the expected returns.

For example, the call option buyer will have net intrinsic value:

$40 - $30.75 strike = $9.25 net value

So, 0.20 x $9.25 = $1.85 expected return

On the other hand, there is an 80% chance of a $1.75 loss:

0.80 x -$1.75 = -$1.40

So, the net expected return is $0.45, (i.e., $1.85-$1.40) per call. Given the cost of $1.75, that is an expected profit of

$0.45 / $1.75 = 0.257 = 25.7% net expected return buying calls.

Shorting Covered Calls. Let's say there is a 100% chance of making an 8.3% covered call yield, but just a 25% chance that the stock rises to over $25.00 in the next month, i.e., up +20%.

That provides the following return:

8.3% + (0.20 x .20 = 4.0%) = 12.3% expected return

Summary. That shows that it may make sense to buy the calls as the expected return is potentially higher. Unless, of course, there is a lower than a 20% possiblity that UUUU will double in the next 30 days.

For example, with just a 15% chance, this happens, the expected return with buying calls is negative 10 cents (i.e., 1.3875-$1.4875 = -$0.10), or a -5.7% return (i.e., -$0.10/$1.75 cost). That makes shorting covered calls here much more attractive.

More By This Author:

Nasdaq Inc Produces Strong Earnings And Cash Flow - NDAQ Could Be CheapAlphabet Stock Is Still Below Price Targets - Shorting OTM Puts And Calls Works

How To Make A 4.2% Yield By Shorting Palantir Put Options Over The Next Month