Nasdaq Inc Produces Strong Earnings And Cash Flow - NDAQ Could Be Cheap

Bull on Wall Street by Alexander Naumann via Pixabay

Nasdaq, Inc. (NDAQ) reported today an adjusted +11% YoY increase in Q3 net revenue and a +19% YoY net earnings per share gain. Moreover, it generated over $2 billion in operating cash flow in the past year. NDAQ stock could be undervalued if this continues and could be worth $100 per share.

NDAQ is at $91.70 after the news today, up over 3%. This is after hitting a recent low of $86.73 on Sept. 25. But it's still well off recent highs in the mid-$90s in August.

(Click on image to enlarge)

NDAQ stock - last 3 months - Barchart - Oct. 21, 2025

However, it could be worth much more, up to $100 per share, if its earnings and cash flow stay strong. This article will delve into this.

Strong Revenue and Recurring Cash Flow

Nasdaq provides Saas (software as a service) services to capital markets, financial technology, and data buyers. Its revenue is divided into three segments, but a majority of its revenue is now recurring.

For example, Nasdaq reported that its annualized recurring revenue (ARR) is not over $3 billion, or 10% higher than last year. Compare this to the $5.19 billion in 2025 net revenue forecasts (after gross margin costs) from analysts :

$3.0b ARR / $5.19 b net 2025 rev forecast= 59% recurring revenue

On a gross revenue basis, it represents about 36.7% of $8.168 billion over the trailing 12 months (according to Stock Analysis gross revenue data).

Both of these stats imply that its cash flow will also be recurring and grow exponentially (as fixed costs associated with ARR revenue stay flat).

Management has not yet provided a cash flow statement. However, they indicated that its operating cash flow (OCF) was now over $2 billion for the trailing 12 months.

That means it represents 38.5% of net revenue forecasts for this year. Let's assume it reaches 39% next year on analysts' forecasts of $5.57 billion in 2026 revenue:

0.39 x $5.57 billion 2026 revenue = $2.1723 billion operating cash flow (OCF)

We can use that to value NDAQ stock.

Price Targets for NDAQ Stock

For example, here is the OCF yield for NDAQ stock, which has a $52.52 billion market capitalization today (Yahoo! Finance):

$2b TTM OCF / $52.52b mkt cap = 0.038 = 3.8% OCF yield

Therefore, if we apply this to the 2026 operating cash flow forecast:

$2.1723b / 0.038 = $57.17 billion mkt cap target

That target mkt cap is +8.85% higher than today's mkt value of $52.52 billion. In other words, NDAQ stock is worth 8.9% more than today's price of $91.70:

$91.70 x 1.089 = $99.86, or about $100 per share target price

Analysts Agree NDAQ Is Cheap

Analysts (20) surveyed by Yahoo! Finance have an average price target of $101.89. That is +11% higher than today's price. Similarly, Barchart's mean analyst survey price is $104.50, +14.0% higher. AnaChart's survey is $98.40 for 13 analysts, and Stock Analysis says 16 analysts have an average price of $97.93.

As a result, the average survey price target is $100.68, or just about at my $100.00 price target level using a cash flow analysis.

The bottom line is that NDAQ looks cheap here.

One way to play this is to set a lower buy-in price by shorting out-of-the-money (OTM) puts. That way, an investor can get paid while waiting to potentially buy in at a lower strike price.

Shorting OTM NDAQ Puts

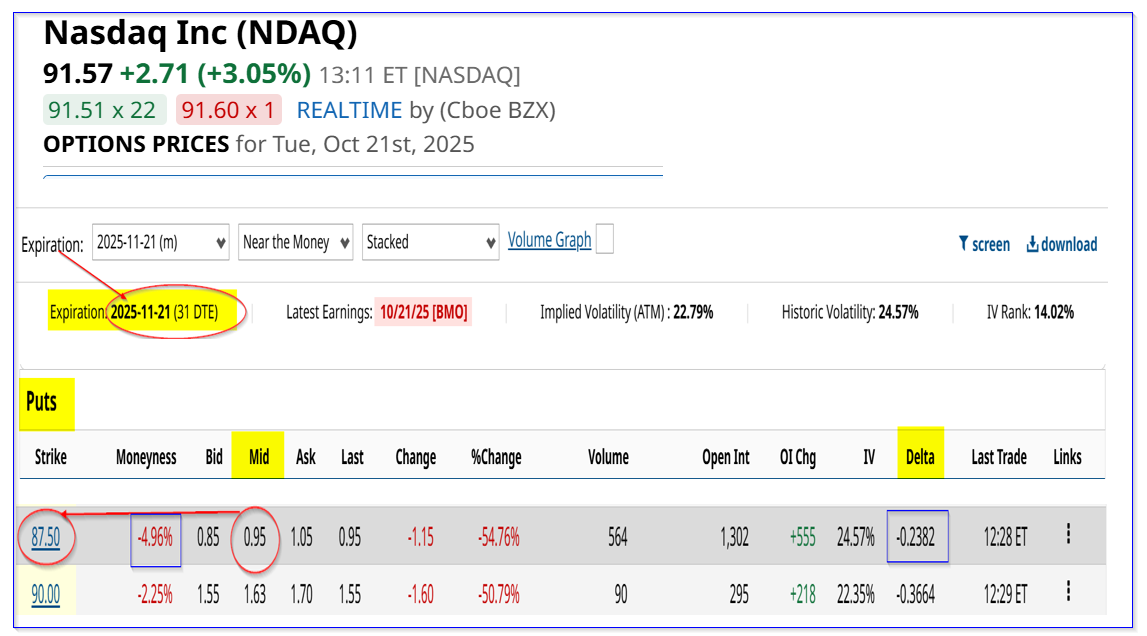

For example, the Nov. 21 expiry period shows that the $87.50 put option strike price has a midpoint premium of $0.95. That provides a short-put yield of 1.086% (i.e., $0.95/$87.50) for a strike price that is about 4.4% below today's price (i.e., out-of-the-money or OTM).

(Click on image to enlarge)

NDAQ puts expiring Nov. 21, 2025 - Barchart - As of Oct. 21, 2025

This means that an investor who secures $8,750 in cash or buying power with their brokerage firm can earn $95 by entering an order to “Sell to Open” 1 put contract at $87.50.

The delta ratio is low at 23.8%, implying a low chance that NDAQ will fall to this strike price.

But, even if it does, the investor has a lower breakeven point:

$87.50 - $0.95 = $86.55

That is 5.5% below today's price. Therefore, this is a good way to set a lower buy-in point for an investment in NDAQ. Meanwhile, the investor makes over 1% while waiting for the next month. That is an attractive long-term alternative to holding cash.

And if the stock eventually rises to $100, the investor who has a breakeven investment at $86.55 has an expected return (ER) of 15.5%:

$100/$86.55 -1 = 1.155 -1 = +15.5% upside

The bottom line is that NDAQ looks cheap here and shorting OTM puts is one way to play the stock.

More By This Author:

Alphabet Stock Is Still Below Price Targets - Shorting OTM Puts And Calls WorksHow To Make A 4.2% Yield By Shorting Palantir Put Options Over The Next Month

Domino's Pizza Shows Strong Q3 FCF - But DPZ Stock Is Still Cheap