Netflix Produces Strong FCF Q3 Margins - NFLX Looks 23% Too Cheap

/Netflix%20open%20on%20tablet%20by%20rswebsols%20via%20Pixabay.jpg)

Netflix, Inc. (NFLX) produced a 23% Q3 FCF margin, in line with its YTD margin. However, NFLX stock has fallen since the release, putting its value over 23% higher at $1,374 per share. This value is based on a 2.0% FCF yield, more conservative than my prior metric.

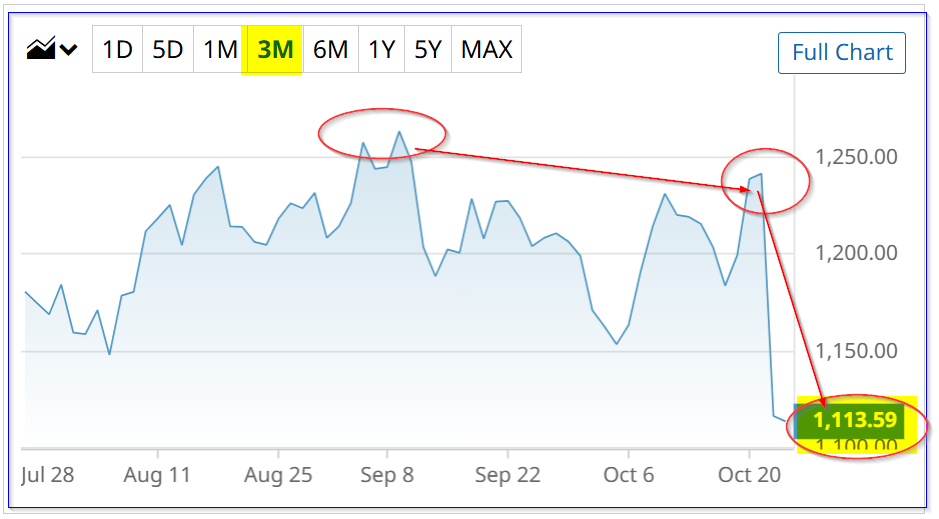

NFLX closed at $1,113.59 on Thursday, off its recent peak of $1,263.25 on Sept. 9, but still up from a recent low of $1,143.22 on Oct. 3.

(Click on image to enlarge)

NFLX stock - last 3 months - Barchart - As of Oct. 23, 2025

Strong FCF Margins

As a result of its Q3 results that were released on Oct. 21, analysts have raised their 2026 revenue estimates slightly. But its FCF margins are now significantly higher, which pushes its FCF estimates higher for next year.

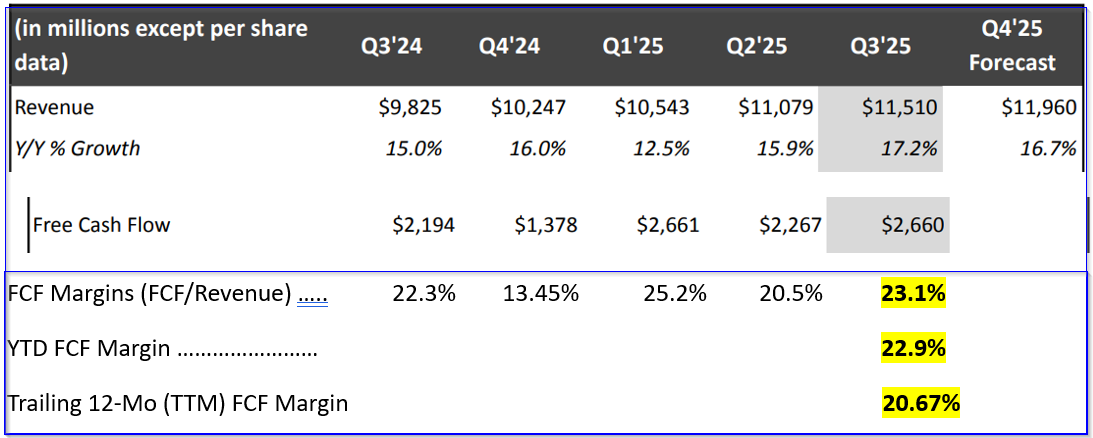

For example, the table below, released by Netflix (the margin analysis is mine), shows that its Q3 FCF margin (i.e., FCF/revenue) was 23.11%. That was after a 20.46% FCF margin in Q2 and 25.24%. That works out to a YTD FCF margin of 22.9%.

(Click on image to enlarge)

Netflix shareholder letter Oct. 21, 2025 - page 1 - with FCF margin analysis by Hake

As a result, it makes sense to use a 23% FCF margin to forecast 2026 free cash flow. Analysts raised their 2026 estimates, as I mentioned in my last article, to $50.91 billion (up +13% over $45.07 billion forecast for 2025).

As a result, we can estimate FCF for 2026:

0.23 FCF margin x $50.91 billion revenue = $11.71 billion FCF

Note that this is almost $1.1 billion higher than a “run-rate” (RR) estimate using Q3 FCF:

$2.66b FCF Q3 x 4 = $10.64 billion RR FCF

In other words, FCF is accelerating (up +10.3%) over the run rate level.

That could lead to a higher target value for NFLX over the next 12 months (NTM).

Price Targets for NFLX Stock

In my last Barchart article on Oct. 12 ("Netflix Stock Still Looks 15% Too Cheap, Especially If It Keeps Producing 20% FCF Margins"), I valued Netflix using a 1.75% FCF yield metric.

That means that, assuming the company were to pay out 100% of its FCF to shareholders, the market would give the stock a 1.75% dividend yield.

It's also the same as multiplying FCF by 57.1x (i.e., 1/0.0175 = 57.1x).

But, just to be conservative, it might make more sense to use a 2.0% FCF yield metric, i.e., a 50x multiple (1/0.02 = 50x).

The reason is a little complicated, but here it is. First, let's use Thursday's market cap, as measured by Yahoo! Finance (i.e., $474.375 billion). Next, using the "run-rate (RR) FCF estimate of $10.64 billion:

$10.64b RR FCF / $474.375b = 0.02265 = 2.265% RR FCF yield

But, using its TTM FCF of $8.967 billion (from Stock Analysis):

$8.967b TTM FCF / $474.375b = 0.0189 = 1.89% TTM FCF yield

So, the average is 2.0775%, or a rough, rounded FCF yield of 2.0%.

So, let's apply this to the 2026 FCF forecast:

$11.71b FCF 2026 / 0.02 = $585.5 billion market value

That is +23.4% higher than Thursday's close:

$585.5b 2026 mkt value est. / $474.375b 10/23 = 1.234 -1 = +23.4% upside

In other words, NFLX stock is worth at least 23.4% more:

1.234 x $1,113.59 price 10/23 = $1,374 per share

(Note: this is slightly lower than my prior $1,399 price target, using a 1.75% FCF yield metric).

Analysts tend to agree. For example, 47 analysts have an average price target of $1,341.62, and Barchart's survey is $1,338.55.

Shorting OTM Puts

One way to play this, as noted in my last article, is to sell short out-of-the-money (OTM) puts. That way, an investor can set a lower buy-in price and get paid while waiting.

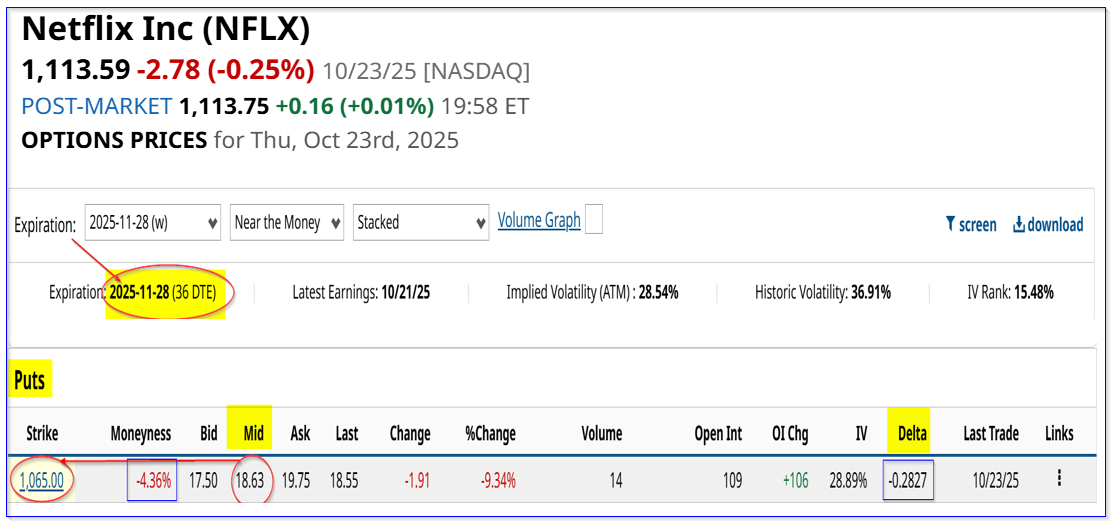

For example, the Nov. 28 expiry put option chain shows that the $1,065.00 strike price put option has a midpoint premium of $18.63.

(Click on image to enlarge)

NFLX puts expiring Nov. 28 - Barchart - As of Oct. 23, 2025

That provides a short-seller a good yield:

$18.63/$1,065.00 = 0.01749 = 1.75% yield for 1 month

Moreover, even if the stock falls below $1,065.00, the investor's breakeven point if lower:

$1,065 - $18.65 = $1,046.35 breakeven point

That is 6.0% below Thursday's close of $1,113.59, so it provides good downside protection.

Therefore, the investor can make a good yield over the next month by shorting OTM puts. Repeating this over 6 months, the potential expected return (ER) is over 10%:

1.75% short-put 1-mo yield x 6 = 10.5%

And, if the stock falls 4.36% to $1,065, the potential upside is over 31%:

$1,374 target / $1,046.35 = 1.313 -1 = +31.3% upside

The bottom line is that NFLX stock looks too cheap here, and shorting OTM puts is one way to play the stock.

More By This Author:

Heavy Activity In Energy Fuels Inc Call Options - A Speculative Play On Rare Earth Elements

Nasdaq Inc Produces Strong Earnings And Cash Flow - NDAQ Could Be Cheap

Alphabet Stock Is Still Below Price Targets - Shorting OTM Puts And Calls Works