Strategy, Inc. Shows Huge, Unusual Call Options Activity - Speculators Abound In This Bitcoin Play

NanoStockk via iStock

Strategy, Inc. (MSTR) is showing a large volume of trading in deep out-of-the-money (OTM) call options of MSTR stock. These calls expire in one week. It seems to be indicative of speculative trading in MSTR, a Bitcoin treasury reserve stock play.

MSTR is trading at $330.68, up almost 1%. The heavily traded call options are for a strike price of $382.50 and expire on Sept. 12.

(Click on image to enlarge)

MSTR stock - last 3 months - Barchart - Sept. 5, 2025

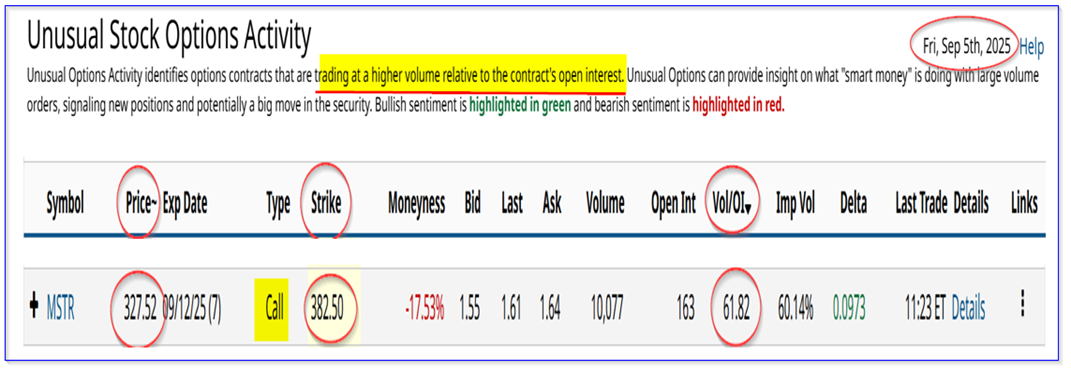

This unusual call options activity in MSTR can be seen in today's Barchart Unusual Stock Options Activity Report.

It shows that over 10,000 calls have traded for expiration on Sept. 12 at the $382.50 strike price. That is over +15.67% higher than today's price. Note that this is over 61x the prior number of options outstanding at this exercise price.

(Click on image to enlarge)

MSTR calls expiring Sept. 12 - Barchart Unusual Stock Options Report - Sept. 5, 2025

How Speculators Play This

This implies that the buyers of these calls hope that MSTR will make a big reversal in the next week. They might not necessarily expect MSTR to rise over 15% to get to breakeven.

That is because the premium is just $1.61. In other words, for just $161, a speculator can control 100 shares, rather than having to pay $33,068 to buy 100 shares outright.

The play here is this: hope that another trader will eventually pay a higher price if MSTR starts to rise over the next week.

On the other hand, existing shareholders who already own 100 shares can sell 1 call and collect $161. That works out to a 1-week yield of 0.487% (i.e., $161/$33,068). That seems like a low return for a large cash outlay.

Most likely, the play here is this. A speculator can buy an in-the-money (ITM) call and sell the OTM call, known as a Poor Man's Covered Call (PMCC).

Poor Man's Covered Call

For example, the $320 Sept. 12 call option, which is in the money by $10.68 (i.e., $330.68-$320.00), trades for $16.45. The investor's cash outlay is just $1,645. By selling the $382.50 call, the investor can collect a premium of $1.61, for a 1-week investment return of 9.787%:

$161 income/$1,645 outlay -1 = 0.0987 = 9.87%

The advantage here is that the investment is much lower than $33,068 for 100 shares. The downside is this, the $1,645 investment is worth only $1,068.

So, unless MSTR rises to $336.45 (i.e., $320.00 strike + $16.45 premium paid), there won't be enough intrinsic value in the call option to cover the premium. However, that is just 1.74% higher than today's trading price:

$336.45/$330.68 = 1.01745 -1 = 1.745% higher

The bottom line is that this PMCC play is a heavy speculation in MSTR stock. Let's look at why investors might think it will work, especially in one week.

Strategy, Inc - a Bitcoin Play

Strategy, Inc. (previously known as MicroStrategy, Inc.) is now self-describing as a Bitcoin Treasury company. It has adopted Bitcoin as its primary reserve treasury asset.

Apparently, it is still able to evade mutual fund company regulations given that it has an underlying operating software company that provides cash flow to the company. For example, last quarter it made $114.5 million in revenue and $10 million in net income.

However, its operating cash flow (FCF) was negative $37.3 million for the 6 months ending June 30. So, the company is not generating any free cash flow (FCF).

However, it seems clear that it wants investors to think of MSTR stock as an alternative to owning Bitcoin outright.

That is because of the large number of Bitcoin (BTC) that Strategy, Inc. presently holds. As of July 31 the company held 597,325 Bitcoin as of June 30. However, in its Q2 earnings release, the company said it owned 628,791 BTC as of July 29.

Today, Bitcoin is trading for $110,595. That means its holdings are worth $69.541 billion. MSTR is trading for a market value of $93.757 billion, so this is far in excess of its Bitcoin valuation.

Moreover, it does not take into account the large amount of debt the company has (over $8.1 billion on a net basis as of June 30 and likely more since then).

The point is that the market is willing to overpay for the value of Strategy Inc's holding in Bitcoin (not including the value of the underlying software company).

The bottom line is that Strategy, Inc. (MSTR) stock is still a speculative play and so are investments in these out-of-the-money (OTM) call options. Investors should be careful to fully study the situation when considering following these speculators in MSTR calls.

More By This Author:

Broadcom's Free Cash Flow Surges With Higher FCF Margins, Implying A 25% Higher Value For AVGO Stock

Unusual Put Options Activity In NiSource Stock Signals Buying Opportunity

Large Unusual Options Activity In Alphabet Options Shows The Stock Is Undervalued

Disclosure: On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and ...

more