Large Unusual Options Activity In Alphabet Options Shows The Stock Is Undervalued

/Alphabet%20(Google)%20Image%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Piotr Swat via Shutterstock

Positive news from a judge who is allowing Alphabet, Inc. (GOOG, GOOGL) to keep Chrome has spurred large, unusual options activity in GOOG and GOOGL put options. This highlights how undervalued GOOG and GOOGL shares are today.

GOOG is at $229.86, up over 8.43% today after a U.S. District judge ruled against a breakup of Alphabet, including not having to divest its Chrome division, according to CNBC. GOOGL stock is also up 8.49% to $229.30.

GOOG stock - last 3 months - Barchart - Sept. 3

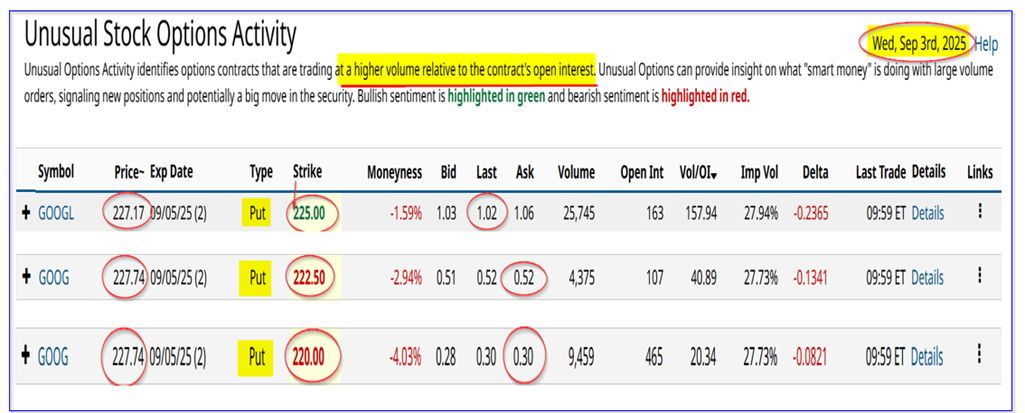

A Barchart report showed this heavy options activity. Today's Barchart Unusual Stock Options Activity Report shows that 25,745 put option contracts have traded in out-of-the-money (OTM) put options in GOOG stock.

It also shows other OTM puts in GOOGL shares have had unusual volume (see table below).

(Click on image to enlarge)

GOOG and GOOGL puts expiring Sept 5 - Barchart Unusual Stock Options Activity Report - Sept. 3

In both cases, the out-of-the-money puts are for expiration on Friday, Sept. 5. The heavy volume indicates that the buyers expect the Alphabet shares to retract from today's surge.

However, those shorting these puts are essentially willing to buy shares at the OTM strike prices. They are also getting paid good yields.

For example, the GOOGL puts at the $225.50 strike price have a $1.02 last premium price. That means short-sellers of these puts are making an immediate yield of 0.453% (i.e., $1.02/$225.00) for just 3 days left until expiration.

It this could be repeated each week for a month, the expected return is a 1.813% monthly yield. That is a very good expected return in this stock.

Moreover, the investor's breakeven point, assuming GOOGL falls to $225.00 by close on Friday, is $223.98 ($225-1.02), or -2.3% below today's price.

Similarly, the GOOG put options at the $222.50 strike have a 0.2337% 3-day yield (i.e., $0.52/$222.50), or an expected return of 0.935% monthly yield.

The point is that these investors feel strongly that GOOG and GOOGL shares may be undervalued here. Let's look at why.

Is Alphabet Stock Cheap Here?

Alphabet posted higher +14% revenue increase in Q2 year-over-year (Y/Y) with +19% higher net income and +22% Y/Y higher earnings per share.

However, its free cash flow (FCF) was lower, mainly due to significantly higher capex spending. This was due to its huge investments in AI-focused activities throughout its product line.

I discussed this in a recent July 27 Barchart article ("Alphabet Posts Lower Free Cash Flow and FCF Margins - Is GOOGL Stock Overvalued?). I suggested that GOOGL stock might be overvalued with a price target of $173.86.

It looks like I was wrong. In fact, other analysts have had price targets that are too low.

For example, Yahoo! Finance shows that the average price target of $221.45. That is already overtaken. I suspect that with the latest judge's news, these analysts will likely raise their price target, as will I.

However, AnaChart.com shows that the average of 41 analysts who cover GOOGL stock has an average price target of $235.98.

And why not? GOOGL stock trades on a forward multiple of just 21x for 2025 earnings per share (EPS) and 19x EPS, according to Seeking Alpha. Its average multiple has been 26x over the past 5 years.

Morningstar agrees. They have the average historical multiple has been 26x, although the forward P/E has been 21x.

The point is that analysts are likely to pivot on GOOGL stock (and GOOG) now that there is no risk of a breakup. In addition, depending on how strong its FCF comes in for Q3, its long-term value could be higher than today's price.

That may account for why so many out-of-the-money put options have traded today.

More By This Author:

Shorting UBER Put Options Yield 2.3% For One Month Out-Of-The-Money PlaysAdobe Looks Cheap Ahead Of Earnings - Short Put Yields Are Juicy

Uber Technologies Stock Looks Cheap

Disclosure: On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and ...

more