Broadcom's Free Cash Flow Surges With Higher FCF Margins, Implying A 25% Higher Value For AVGO Stock

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

Poetra_ RH via Shutterstock

Broadcom, Inc. (AVGO), a direct competitor to Nvidia in AI chip making, saw its Q3 free cash flow surge again, along with a rise in its FCF margins on strong AI-related chip demand.

Moreover, Broadcom increased its revenue forecasts for the upcoming quarter and fiscal year-end. That could push AVGO stock over 25% higher.

AVGO closed at $306.10 on Thursday, September 4, just before releasing its fiscal Q3 earnings (ending August 3, 2025) results after hours.

(Click on image to enlarge)

AVGO - last 3 months - Barchart - As of Sept. 4, after hours

The stock is up after hours and is likely to do well over the next few weeks as investors and analysts review its strong results. They are likely to increase their revenue forecasts.

It also implies higher FCF and FCF margins as a result. That could lead to a stock price target of $386.30 per share, up 25.2% from Thursday's close, as this article will show.

Strong Revenue and FCF

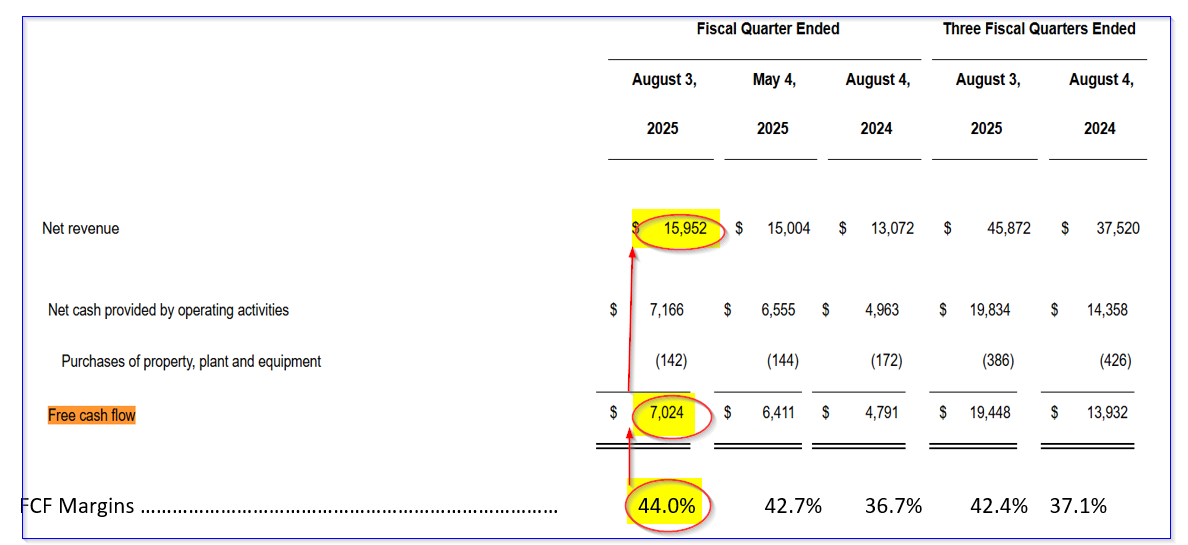

Broadcom's fiscal Q3 revenue rose +22.0% Y/Y to almost $16 billion from $13 billion a year ago, and was up +6.3% Q/Q on strong AI-related demand for its chips.

According to Reuters, the market sees Broadcom as a generative artificial intelligence (gen AI) semiconductor chip supplier alternative to Nvidia, Inc. (NVDA). Many of its clients use Broadcom chips (including its Tomahawk Ultra networking chip) to invest in data centers and machine learning applications.

As a result, the company raised its outlook for Q4 revenue to $17.4 billion. Given its $45.872 billion Q1-Q3 revenue, that would bring its fiscal year revenue to over $63.272 billion.

This is 0.7% higher than analysts' present market expectations of FY 2025 revenue of $62.83 billion today (according to Seeking Alpha). As a result, analysts are likely to raise their FY 2025 and FY 2026 revenue forecasts.

Moreover, even after heavy capex spending, Broadcom's free cash flow (FCF) skyrocketed to $7.024 billion, up +46.6% from $4.791 billion a year ago. This is also up +9.56% from last quarter.

(Click on image to enlarge)

Broadcom's FCF and FCF margins - Q3 earnings release, Sept. 4 - (Hake analysis of FCF margins)

That resulted in a very high FCF margin (FCF/revenue), as can be seen in the table above. Note that the margins seem to be increasing as revenue rises.

That is a sign of improving operating leverage. It means the company is keeping costs under control even as revenue moves higher. That's a sign of good management and a great business.

As a result, we can forecast a higher FCF based on higher FCF margins.

Forecasting FCF for Broadcom

For example, let's assume that analysts raise their FY 2025 revenue targets to management's figure of $63.3 billion and raise their existing FY 2026 revenue forecast of $76.22 billion to $76.75 billion.

Using a FCF margin of at least 43.5% (i.e., slightly lower than the Q3 figure), we can estimate that the FY 2026 FCF will be:

0.435 x $76.75 billion = $33.386 billion FCF

That is +33.9% higher than $24.93 billion FCF Broadcom has made in the last 12 months, according to Stock Analysis. (Its trailing 12-month FCF margin was just 33.64%.)

As a result, the value of AVGO stock over the next 12 months will likely be significantly higher. Here's why.

Target Price for AVGO Stock

For example, if we assume the market will give AVGO stock at least a 1.85% FCF yield, its valuation can be set. That is the same as using a FCF multiple of 54x.

For example, AVGO has a market cap today of $1,440 billion, according to Yahoo! Finance.

This means that its TTM FCF of $24.93 billion represents 1.73% of its market cap. That is the same as an FCF multiple of 57.8x.

So, just to be conservative, let's use a 54x multiple (i.e., 1/0.0185):

$33.386 billion FCF FY 2026 x 54 = $1,802.8 billion mkt cap target

That is +25.2% higher than today's market cap:

$1802.8b / $1,440b = 1.2519 -1 = +25.2% upside

In other words, the FCF yield-based target price is 25.2% higher than today's price of $306.10:

$306.10 x 1.252 = $386.30 target price

Analysts are likely to raise their target prices as well. Nevertheless, right now AnaChart shows that the average price of 29 analysts is $340.76.

Summary and How to Play AVGO

The bottom line is that generative AI-related demand continues to drive demand for Broadcom's chips. Moreover, due to operating leverage, the company is experiencing higher FCF margins. This could push the stock significantly higher over the next year.

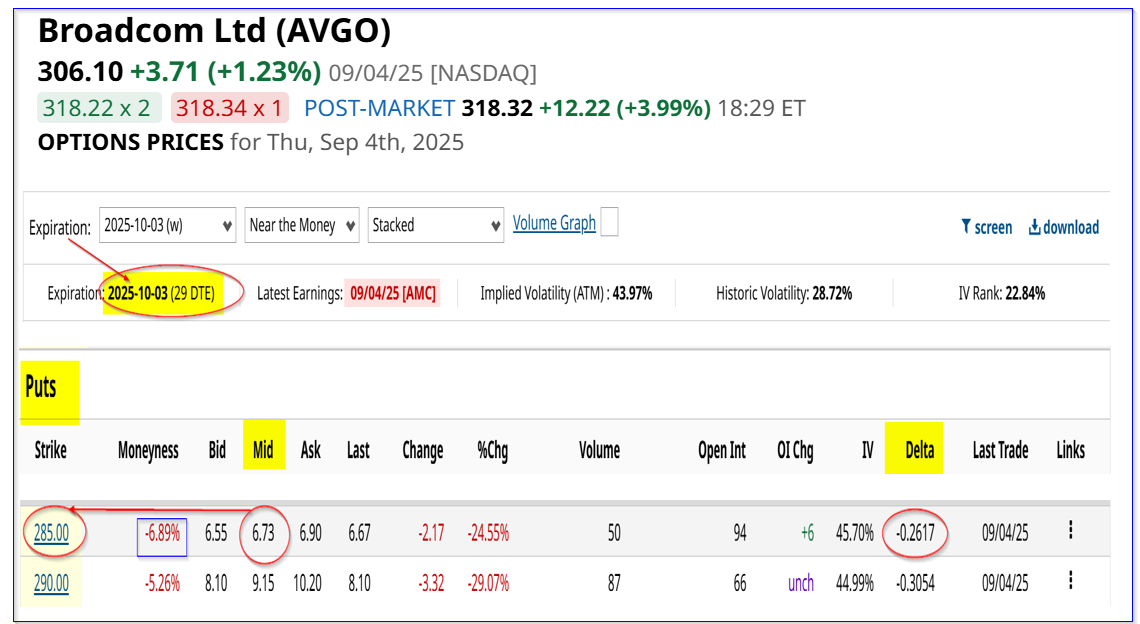

One way to play this is to set a lower buy-in price by selling short out-of-the-money (OTM) puts.

That way, a short-seller can get paid while waiting for AVGO stock to fall. Look for a good opportunity to open up in the area once the stock opens for trading on Friday morning.

For example, as of Thursday close, the Oct. 3 expiration put contracts show that the $285.00 strike price (6.89% below the closing price) has a midpoint premium of $6.73 per put.

(Click on image to enlarge)

AVGO puts expiring Oct. 3, 2025 - Barchart - As of Sept. 4

That means that the short-seller can make an immediate one-month yield of 2.36% (i.e., $6.73/$285.00 = 0.0236). Moreover, the upside is significant, as the breakeven point is $278.27 (i.e., $285-$6.73), if AVGO falls to $285.00:

$386.30 target / $278.27 -1 = 1.388 -1 = +38.8%

But, just keep in mind that if AVGO doesn't fall to this point over the next month, an investor won't be able to buy in at this price. Moreover, these option prices will change once the market opens on Friday morning.

However, the investor may just have to raise the strike price to get a similar distance away from the trading price (i.e., the 6.89% out-of-the-money or moneyness factor). That could result in a similar one-month yield play.

Moreover, investors can also use that income to help buy long-dated in-the-money (ITM) call options that will benefit from any upside in AVGO stock. That way, the investor can benefit from any weakness or upside in AVGO stock from here.

More By This Author:

Unusual Put Options Activity In NiSource Stock Signals Buying OpportunityLarge Unusual Options Activity In Alphabet Options Shows The Stock Is Undervalued

Shorting UBER Put Options Yield 2.3% For One Month Out-Of-The-Money Plays

Disclosure: On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and ...

more