Unusual Put Options Activity In NiSource Stock Signals Buying Opportunity

Bellanatella via iStock

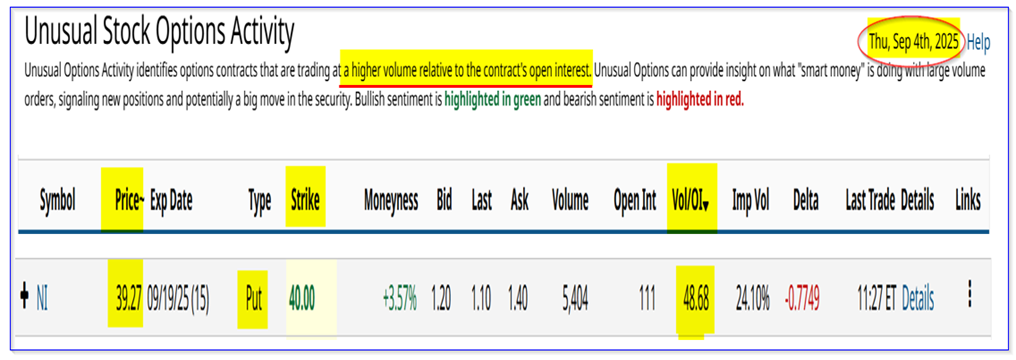

A large, unusual volume in NiSource, Inc. (NI) put options highlights the underlying value of the gas distribution utility stock. A Barchart Report today shows massive volume in at-the-money puts over 48 times normal volume.

This could potentially signal a buying opportunity in NI stock. NI is down today almost 6% to $39.31 per share from $41.80 yesterday, and a recent peak of $42.44 on Aug. 27.

NI stock - last 3 months - Barchart - Sept. 4, 2025

There appears to be no corporate news, and the dip doesn't seem to be due to any dip in natural gas prices.

Moreover, the huge volume in put options, which expires in two weeks, provides a good yield opportunity for short sellers with this at-the-money (ATM) strike price.

The Barchart Unusual Stock Options Activity Report shows that the $40.00 put option expiring in two weeks on Sept. 19 has had over 5,400 contracts traded today. That is over 48 times the prior number of put contracts outstanding at that strike price.

(Click on image to enlarge)

NI puts expiring Sept. 19 - Barchart Unusual Stock Options Activity Report - Sept. 4, 2025

Note that the $40.00 put is only slightly over today's trading price of $39.31. But the premium bid-ask is $1.20 to $1.40, or a midpoint price of $1.30.

That means that buyers expect NI stock to fall below $38.60 ($40-$1.40) just to break even. That assumes a drop of $0.71 from the trading price of $39.31, or -1.81%.

But short-sellers of these NI puts can make an immediate yield of 3.0%, even though the play is already slightly in-the-money (ITM), i.e., $1.20/$40.00 = 3.00%.

The short sellers will be obligated to buy shares at $40.00, but their net breakeven is $40-$1.20, or $$38.80, or 1.30% below today's price. They obviously believe that NI stock will stay over $40.00 before the expiration on Sept. 19.

This could also work well on an expected return (ER) basis, assuming the investor can repeat this play several times. For example, assuming the stock stays over $40.00 before expiration and if the short-put play investor can repeat this yield play 3 times (i.e., over the next 6 weeks), the ER is 3.0% x 3, or 9.0%.

However, even if NI stock stays flat, the short-put player has an implied unrealized profit of 1.31%:

$39.31 trading price / $38.80 breakeven short-put play = 1.01314 -1 = 1.314%

If this can be repeated every two weeks for 6 weeks, the ER is 3.942% (i.e., 1.314% x 3). Moreover, the investor could simply hold the NI shares as a longer term play, given its higher target prices.

NI Stock Target Prices

Dividend Yield-Based Price Target. One way to value NI stock is to assume it will raise its dividend per share (DPS). This is because the company has 13 years of continuously raising its DPS annually. It just declared last month the 4th of 4 DPS payments of $0.28 (i.e., $1.12 annually).

As a result, investors may reasonably expect that the new DPS will be at least 29 cents, and possibly 30 cents. That puts the annual DPS at between $1.16 and $1.20. Let's use $1.18 as our expectation.

The stock has had an average dividend yield of 2.88% in 2024, according to Morningstar. Presently, NI stock has a yield of 2.849%:

$1.12 annual DPS/$39.31 = 0.02849 = 2.849%

That implies that if the new expected DPS is $1.18, the stock could be worth almost $41.00:

$1.18 / 0.0288 = $40.97 per share

That is 4.22% over today's price. This could be one reason why investors in the ATM puts at $40.00 are willing to sell short these puts.

They can then hold on to NI stock, assuming the options are exercised (i.e., the investor has a breakeven price of $38.80 - see above).

Analysts' Price Targets. Moreover, analysts see the stock as undervalued here. For example, Yahoo! Finance shows that the average of 13 analysts is $44.27 per share.

Similarly, Barchart's survey shows an average of $44.85 per share.

However, AnaChart, which covers recent analyst write-ups, shows that 11 analysts have an average price target of $46.20. The average of these surveys is $45.11 per share, or 14.8% higher than today's price.

The bottom line is that based on both its dividend yield average ($40.97) and analysts' target prices ($45.11), NI stock looks undervalued.

So, no wonder the at-the-money puts expiring in two weeks seem to be popular today.

They seem to be providing a good buying opportunity in NI stock, as well as a short-term yield play for short-sellers of these puts.

More By This Author:

Large Unusual Options Activity In Alphabet Options Shows The Stock Is UndervaluedShorting UBER Put Options Yield 2.3% For One Month Out-Of-The-Money Plays

Adobe Looks Cheap Ahead Of Earnings - Short Put Yields Are Juicy

Disclosure: On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and ...

more