Staying In Your Top Names

A Top Ten Name At The End Of 2022

One of our system’s top ten names at the end of last year was the chipmaker Rambus Inc. (RMBS). As of Thursday’s close, it was up 30.84% year-to-date, but unfortunately for me, I got stopped out of it earlier in the week. This highlights a difference in the way we’re handling risk in the Portfolio Armor Substack’s core strategy versus the hedged portfolio method used by the Portfolio Armor website.

Let’s look at the pros and cons of each approach, starting with the website’s approach.

Rambus In The Hedged Portfolio Method

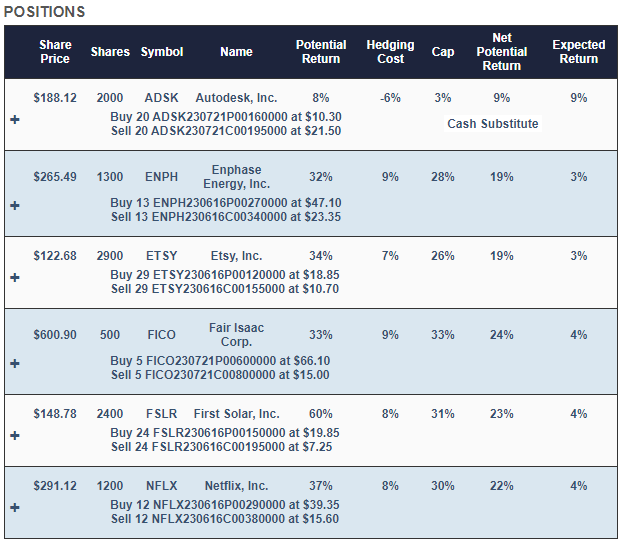

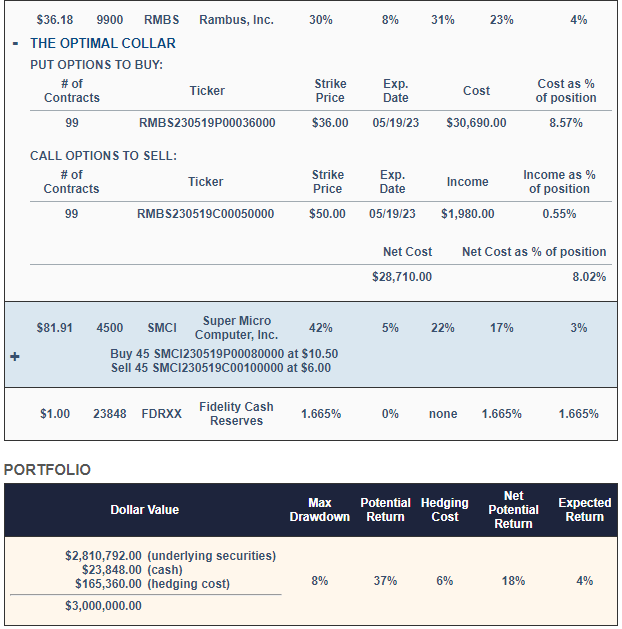

At the end of last year, here’s how Rambus was hedged in a $3 million portfolio hedged against a greater-than-9% drop over the next six months.

Screen captures via Portfolio Armor on 12/30/2022.

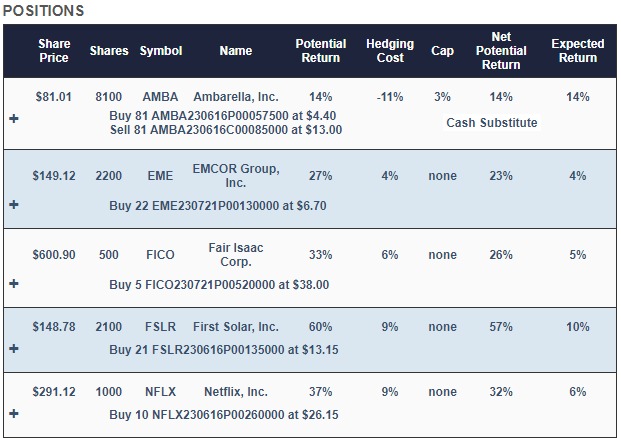

There, Rambus was hedged with an optimal collar. For more aggressive investors willing to risk a >20% decline, it was hedged with optimal puts, as you can see below.

Screen captures via Portfolio Armor on 12/30/2022.

The Pros & Cons of That Approach

The pro of hedging with optimal puts or an optimal collar is that you’re strictly limiting your downside, without the risk of getting stopped out of your position. The con is that you need at least one round lot of each position (100 shares) to make hedging cost effective. Granted, this was less of an issue with Rambus (share price, $36.18 at the time, so 100 shares was $3,618) than another top name at the time, Fair Isaac Corp. (FICO) (share price, $600.90 at the time, so 100 shares was $60,090).

Limiting Risk In Our Core Strategy

In our Substack’s core strategy, we’re buying equal dollar amounts of our top ten names, putting trailing stop orders on them (10% trailing stops, in most cases), and replacing them with new top names as we get stopped out (so, for example, I replaced Rambus with one of our current top ten names today). A pro of this approach is you can apply it to any dollar or share amount: you could put $100 in each top name if you’re starting out with $1,000, for example.

One con of this approach is that you can get stopped out of a stock that then goes on to make new highs, as happened to me this week. Another con is that it doesn’t protect you if a stock gaps down below your trailing stop. Let’s say you had a 10% trailing stop on Lyft, Inc. (LYFT) on Thursday (LYFT has never been a Portfolio Armor top name—just using it here as an example of a stock gapping down). LYFT opened Friday’s trading down ~31% from its Thursday closing price, after its earnings miss after the close, and so your 10% trailing stop would get executed down ~31% instead.

Another con of this approach is it doesn’t by itself protect against market risk, but that can be ameliorated by buying optimal puts on an index ETF such as the SPDR S&P 500 Trust ETF (SPY) instead of hedging each position.

More By This Author:

A Rising Tide Lifts ARK - For Now

Before KOLD Goes Cold

That Was Unexpected