That Was Unexpected

Dr. Big Short Deletes His Account (Again)

Michael J. Bury, MD, the physician-turned-hedge fund manager who famously bet against the housing market before the 2008 crash (and also successfully bet on the meme stock GameStop Corp. (GME) in 2020), posted a one-word tweet on Tuesday: “Sell”.

After his big "Sell." tweet, @michaeljburry deletes his Twitter.

— r/wallstreetbets (@Official_WSB) February 1, 2023

Looks like Jim Cramer wins this one. pic.twitter.com/lCvDSsIDtT

In the wake of today’s melt-up after Powell’s dovish comments, Dr. Bury deleted his Twitter account. He’s done this before, so presumably, he’ll be back. But it illustrates that timing is a challenge for even the greatest investors. More often than not, you’d be better off listening to Bury than the Wall Street Bets folks cheering this.

The Financial Conditions Disconnect

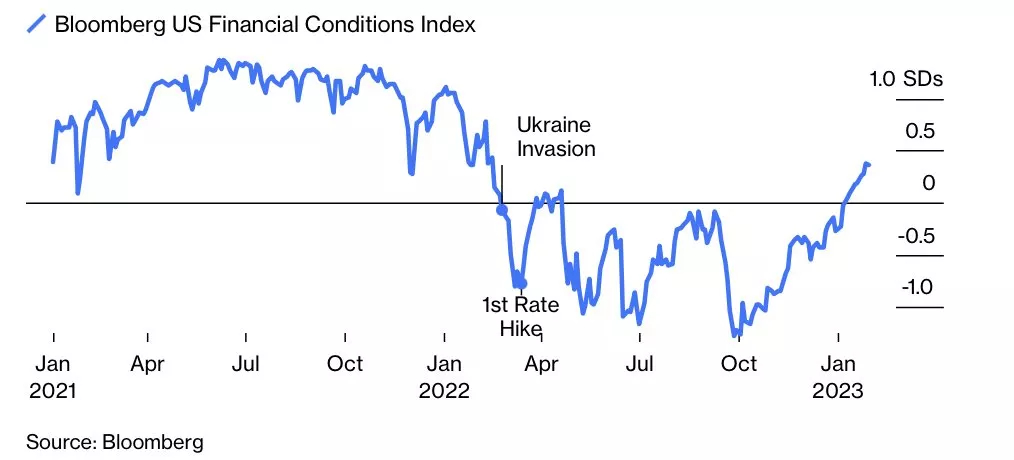

The comment by Fed Chairman Powell that seems to have been the biggest surprise today was about financial conditions tightening, as Sven Henrich notes below.

Powell: "Financial conditions have tightened significantly over the last year."

— Sven Henrich (@NorthmanTrader) February 1, 2023

That's just false. They are looser now compared to when the Fed started. pic.twitter.com/L9ogB8rMsN

My view last year was that Powell would err on the side of hawkishness early this year, to avoid having to pump the breaks at all in 2024, and be accused of interfering in the Presidential election; now, I’m wondering if he’s being pressured to pump the gas ahead of 2024. In theory, the Fed is independent of politics, but as an insightful friend put it today, “Very ‘John Roberts upholds Obamacare’ vibe”.

The Market Reaction

As ZeroHedge summarized it, Bonds, Big-Tech, Bitcoin, and Bullion Blast Off. Some heavily shorted stocks soared as well, including Peloton Interactive, Inc. (PTON):

Peloton reported a revenue beat before the market opened, but it’s unlikely its shares would have spiked this high absent Powell’s dovish comments. A few months ago, I quipped that investors were “fleeing to the safety of Peloton”, and that seems to have worked out well for them.

Investors Flee To The Safety Of Peloton$PTON https://t.co/1Jdg4hTfu2

— Portfolio Armor (@PortfolioArmor) November 4, 2022

What To Do Now

One idea is to consider hedging if you aren’t currently hedged. It tends to be cheaper to do so when the market is rallying. The Nasdaq-100 Index is now up nearly 14% year-to-date; buying optimal puts on the Invesco QQQ ETF (QQQ) might make sense if you own some of the larger index components.

Another idea is to look at overvalued names to bet against. I have a couple of thoughts on that at the bottom of this post for paid subscribers.

More By This Author:

The Meaning Of The Google Layoffs

Netflix Expands Its Moat

Timing The Top On A Trash Stock

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more