A Rising Tide Lifts ARK - For Now

A Rising Tide For ARK

One measure of the craziness of this week was the volume of options traded on Thursday, the day after Fed Chairman Powell’s dovish comments sent markets higher: 68 million contracts traded, an all-time record.

Options trading set a new daily record: More than 68 million contracts traded on Thursday.

— Eric Wallerstein (@ericwallerstein) February 2, 2023

40 millions calls changed hands. For reference, average daily volume last year was less than 45 million *for calls & puts combined*. pic.twitter.com/NmxX8uOVSQ

About 58% of those options were bullish bets (calls), but I was part of the 42%, buying puts on meme stock that rallied after the Fed meeting, as I mentioned I would in my post Wednesday evening.

Jim Cramer gets one right.$GME $PTON $QQQ https://t.co/6eK8WbvOnw

— Portfolio Armor (@PortfolioArmor) February 2, 2023

Another surprising aspect of this week was seeing the ARK Innovation ETF (ARKK) rally in the wake of the Fed meeting—at least it was surprising to those of us who hadn’t noticed its year-to-date performance.

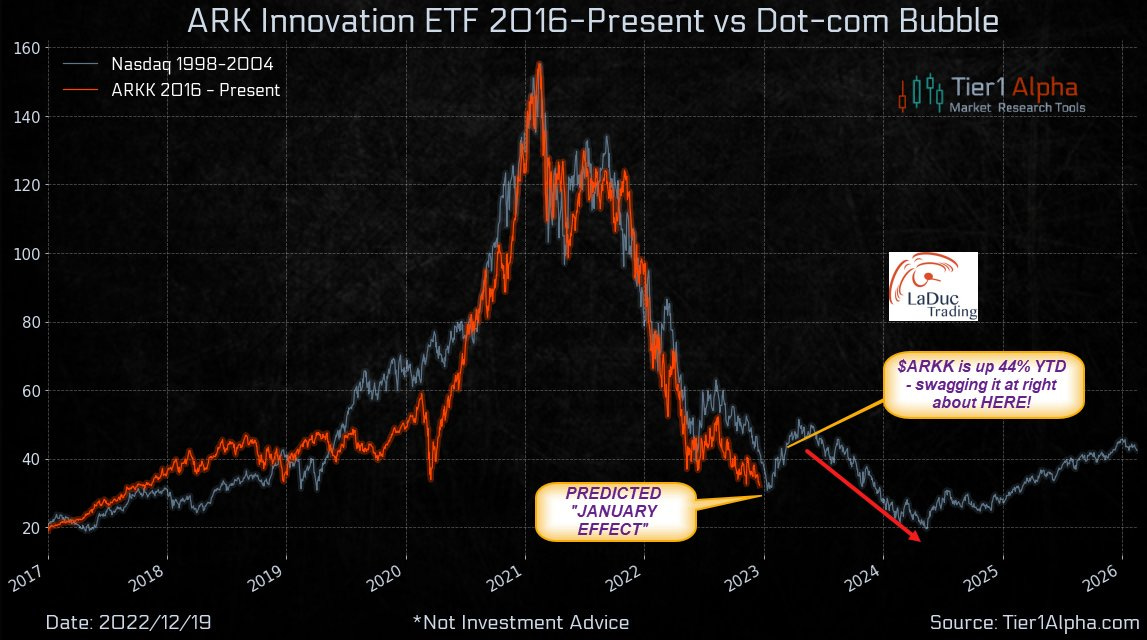

A fund up more than 42% in just over a month seems pretty bubbly. In fact, in the chart below, Samantha LaDuc drew a comparison between ARKK and the NASDAQ during and after the Dot-Com bubble.

Let’s look at a way you can hedge your downside risk if your long ARKK now, and then consider whether it makes sense to short it if you’re not.

Staying Afloat In ARK

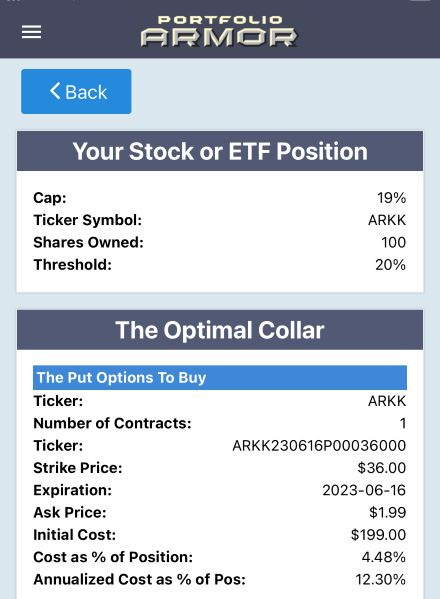

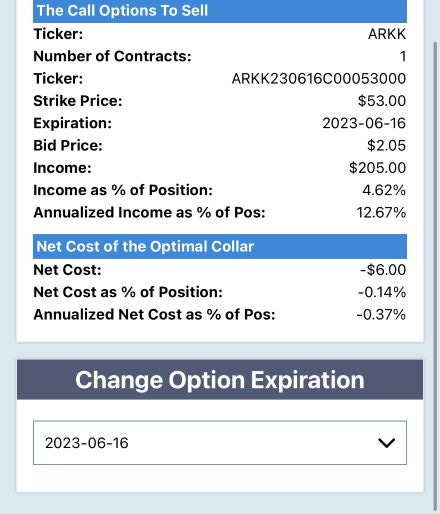

If you own ARKK shares and want to try to grab the additional upside suggested by LaDuc’s chart while limiting your downside risk if it sinks before you get out, here’s a way to do so. As of Thursday’s close, this was the optimal collar to hedge 100 shares of ARKK against a >20% drop without capping your possible upside at less than 19% over the next several months.

Screen captures via the Portfolio Armor iPhone app on 2/2/2023.

ARKK is expensive to hedge with puts, but as you can see above, this optimal collar would have gotten you tiny net credit of $6 instead.

If You Don’t Own ARKK, Should You Short It?

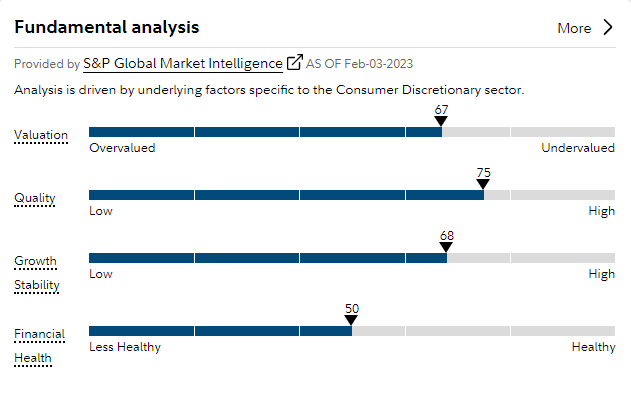

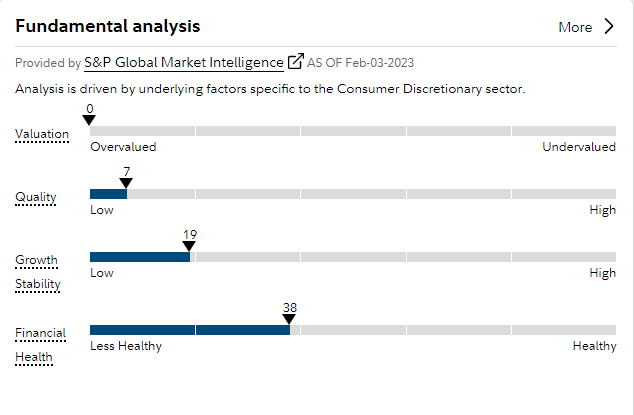

When the market corrects, ARKK almost certainly is going to correct more as a higher beta ETF, but here’s why I wouldn’t bet against it: you can do a lot worse! To see why, consider one of ARRK’s largest components, Telsa, Inc. (TSLA). That’s a volatile name too, but it’s also a profitable company with fairly strong fundamentals, as you can see in this snapshot of S&P Global Market Intelligence.

Compare that to the fundamentals snapshot of the stock my subscribers and I bought puts on Thursday:

Much worse, right? Why bet against a profitable company when you can bet against an overvalued one that’s hemorrhaging money?

More By This Author:

Before KOLD Goes Cold

That Was Unexpected

The Meaning Of The Google Layoffs

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more