Spread Your Wings With An Iron Condor

Being a directional trader is damn hard work.

As a stock trader, you can go long or short. That’s it. Doesn’t that seem like an incredibly limiting way to trade? Surely there’s a better way?

Well, there is.

Today I’m going to share with you a strategy that I use to make consistent monthly income with less risk than traditional stock trading.

Credit spreads for monthly income

Credit spreads are a popular options trading strategy for traders looking to create monthly income. The thing you will LOVE about credit spreads is that you don’t have to be correct on the direction of the stock. You can make money even if you are wrong, and you can structure them to have a built-in money management system in terms of risk and reward.

Let’s look at the two different types of credit spreads:

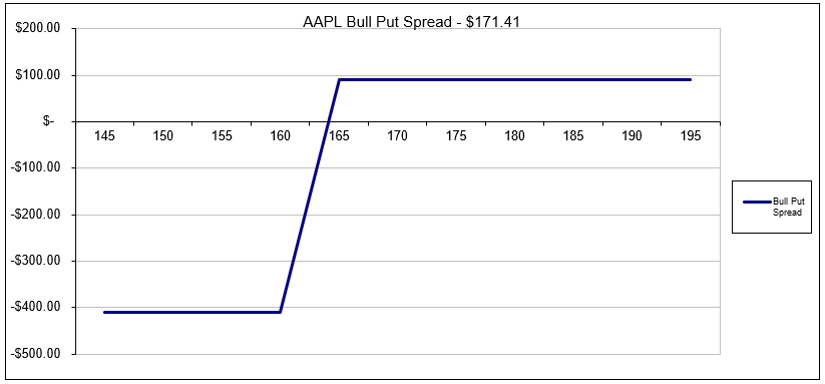

Bull Put Spreads

Bull Put Spreads, as the name suggests is a bullish strategy constructed using puts. You set up the trade by selling a put option and buying a further out-of-the-money put. The trade has a defined maximum gain and a defined maximum loss.

Assume you are bullish on AAPL and have just had an entry signal according to your trading rules. AAPL is currently trading at $171.41. Let’s look at how you could construct your Bull Put Spread.

Date: March 21, 2018

Current Price: $171.41

Trade Set Up: AAPL Bull Put Spread

Sell 1 AAPL April 20th, 165 put @ $2.02

Buy 1 AAPL April 20th, 160 put @ $1.12

Premium: $90 Net Credit. You are receiving money into your account after placing the trade.

Max Loss: $410

Max Gain: $90

Break Even: $164.10

Percentage Decline to Breakeven Point: -4.26%

(Click on image to enlarge)

You can see that if AAPL stays above $165, you will make $90 in profit. AAPL can also decline by 4.26% before losses start to occur. This is the beauty of credit spreads. You are bullish on AAPL, but can still make money if the stock falls less than 4.26%.

With this trade, the most you can lose is $410. Your profit potential on the amount of capital at risk is 21.95%.

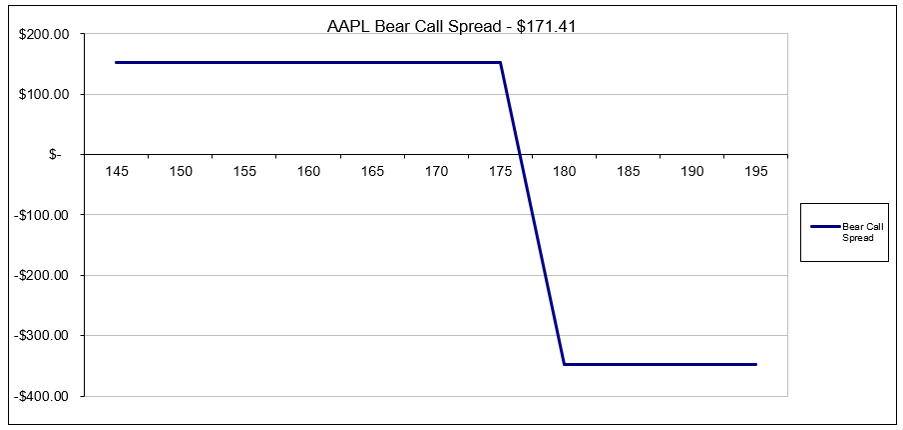

Bear Call Spreads

A Bear Call Spread is basically the opposite of a Bull Put Spread. You set up the trade by selling a call option and buying a further out-of-the-money call. Let’s looks at an example:

Date: March 21, 2018

Current Price: $171.41

Trade Set Up: AAPL Bear Call Spread

Sell 1 AAPL April 20th, 175 call @ $2.80

Buy 1 AAPL April 20th, 180 call @ $1.27

Premium: $153 Net Credit.

Max Loss: $347

Max Gain: $153

Break Even: $176.53

Percentage Increase to Breakeven Point: +2.99%

(Click on image to enlarge)

Here you can see the profit potential in the trade of $153 with a breakeven point of $176.53. The potential return on capital is 44.09%.

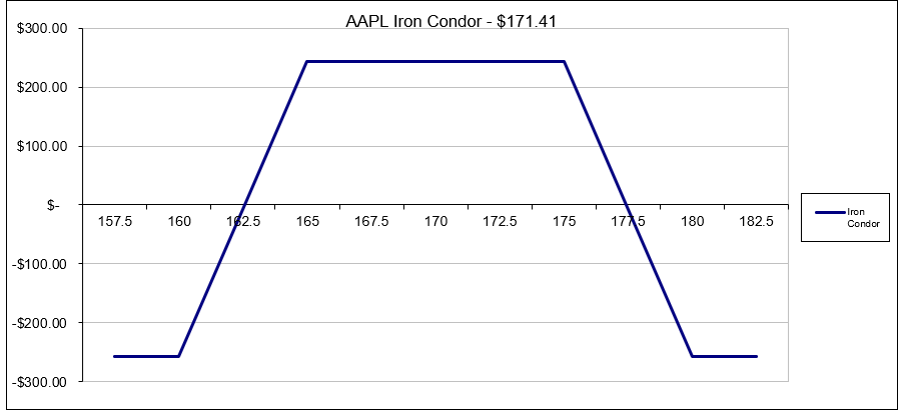

Spread Your Wings With An Iron Condor

With an iron condor, you can get the best of both worlds by combining the two trades. You get to keep the income portion from both sides and will profit if AAPL stays between $165 and $175 By April 20th.

Date: March 21, 2018

Current Price: $171.41

Trade Set Up: AAPL Bull Put Spread

Sell 1 AAPL April 20th, 165 put @ $2.02

Buy 1 AAPL April 20th, 160 put @ $1.12

Sell 1 AAPL April 20th, 175 call @ $2.80

Buy 1 AAPL April 20th, 180 call @ $1.27

Premium: $243 Net Credit.

Max Loss: $257

Max Gain: $243

Break Even: $164.10 and $176.53

The maximum loss in the case of an iron condor is less, because you are receiving two lots of option premium. Iron condors are a great defined risk, defined reward trade on stocks that you think will be range bound over the trade period.

(Click on image to enlarge)

But, Aren’t Options FWMD’s?

Warren Buffet once famously referred to options as “financial weapons of mass destruction”. It’s true, options can be risky, particularly for those that don’t know what they’re doing. But, they can also be an incredibly flexible instrument that allows you to enhance your portfolio risk management.

Warren Buffet uses options regularly, and famously sold puts options (a bullish bet) on major US indexes during the 2008 Financial Crisis. Even one of the world’s greatest investor uses options, despite calling them financial weapons of mass destruction. Maybe you should too?

Disclosure: I do not have any exposure to AAPL.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy ...

more

Interesting strategy.

It's one of the most popular strategies with option traders. Let me know if you want any more info.