Lam Research Corp's Strong FCF Margins From AI-Related Chip Equipment Sales Shows LRCX Stock Is Cheap

/Lam%20Research%20Corp_%20HQ%20sign-by%20Michael%20Vi%20via%20Shutterstock.jpg)

by Michael Vi via Shutterstock

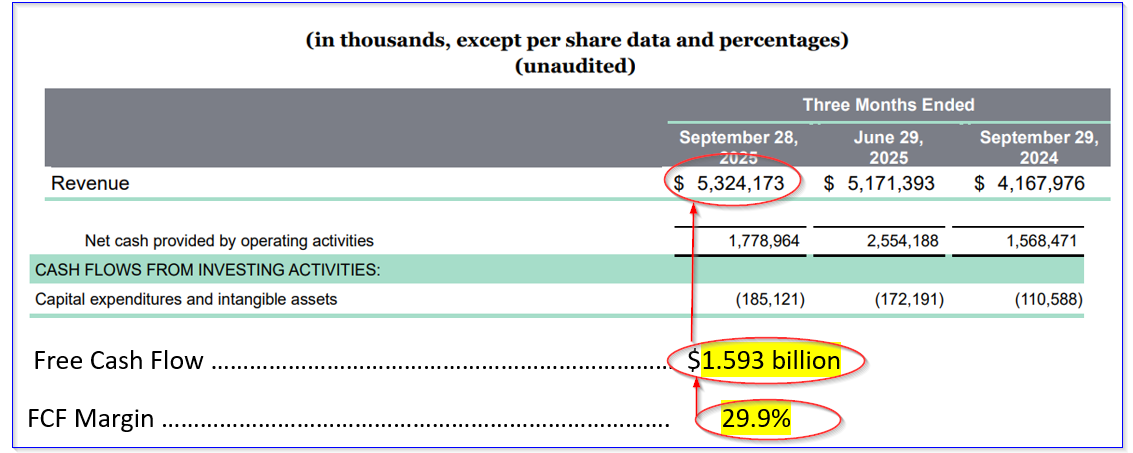

Lam Research Corp. (LRCX) generated a strong 30% FCF margin on semiconductor equipment sales in its latest quarter. That could bode well for LCRX stock, which may be undervalued by almost 19% based on its FCF margins and analysts' revenue estimates.

LRCX is at $156.31 in midday trading on Monday, Oct. 27, with a market capitalization of $197.2 billion according to Yahoo! Finance. The stock has been on a tear in the last 3 months, and should have more to go, as we will see below.

(Click on image to enlarge)

LRCX stock - last 3 months - Barchart - Oct. 27, 2025

Strong FCF Generation

The company reported that revenue rose +3% over its prior quarter from strong demand for its AI-related chip equipment sales. The CEO, Tim Archer, said that Lam Research's innovations were helping its customers “address major AI-driven semiconductor manufacturing infections.”

They are expanding their product portfolio as a result, although they are retreating from investments in China. That may be temporarily hurting their results for now, but it could be beneficial in the long run.

For example, Lam Research now has strong margins. It generated gross and operating margins (50.5% and 35.0% respectively) for the quarter.

Moreover, its operating cash flow (OCF) margin (i.e., operating cash flow, before capex spending) was $1.78 billion, down from $2.55 billion last quarter, but up +13.3% from $1.57 billion a year ago.

(Click on image to enlarge)

Hake analysis of LAM Research Qtrly free cash flow

With higher capex spending this past quarter, this led to lower FCF margins, albeit still at a strong 30% of revenue. Last quarter, the FCF margin was 46%, but a year ago it was 35% (see Stock Analysis data on Lam's quarterly FCF margins).

Over the past year, it has generated $5.55 billion in FCF, representing 28.3% of revenue. Given its higher quarterly margins, it seems likely that we can expect at least 30% FCF margins going forward.

Projecting Free Cash Flow

Analysts are projecting that revenue for the year ending June 30, 2026, will be $21.26 billion and $23.53 billion for the following FY. That leads to a next-12-month (NTM) revenue forecast of about $21.83 billion:

(0.75 x $21.26b) + (0.25 x $23.53b) = $15.945b + $5.8825b = $21.8275 billion

Applying a 33% FCF margin for the NTM revenue:

0.30 x $21.8275 b NTM revenue = $6.55 billion NTM FCF forecast

That is $1 billion more than the $5.55 billion it generated over the past 12 months. That could lead to a significantly higher stock price.

Price Targets for LRCX

For example, over the trailing 12 months (TTM), its $5.55 billion in FCF represents 2.8% of its $197.2 billion market cap today. That means that in one year, looking back, the $6.55 billion in forecasted FCF could also be at that 2.8% FCF yield.

So, applying simple math, we can estimate its NTM market cap:

$6.55 b NTM FCF / 0.028 = $233.93 billion mkt cap

That is +18.6% higher than today's market cap of $197.2 billion

In other words, LRCX could be worth almost 19% more in the next 12 months:

$156.31 x 1.186 = $185.38 target price

Analysts tend to agree that LRCX is undervalued. For example, AnaChart's survey of 24 analysts shows that their average price target is $167.27 per share.

The bottom line is that LAM Research is likely to continue to benefit from AI-driven demand for its products. As a result, its FCF generation could push LRCX stock higher.

Shorting OTM Puts and Buying ITM Calls

One way to play this is to buy in-the-money (ITM) calls that are in longer-dated expiry periods. This can be partially paid for by selling short out-of-the-money (OTM) puts in near-term expiry periods.

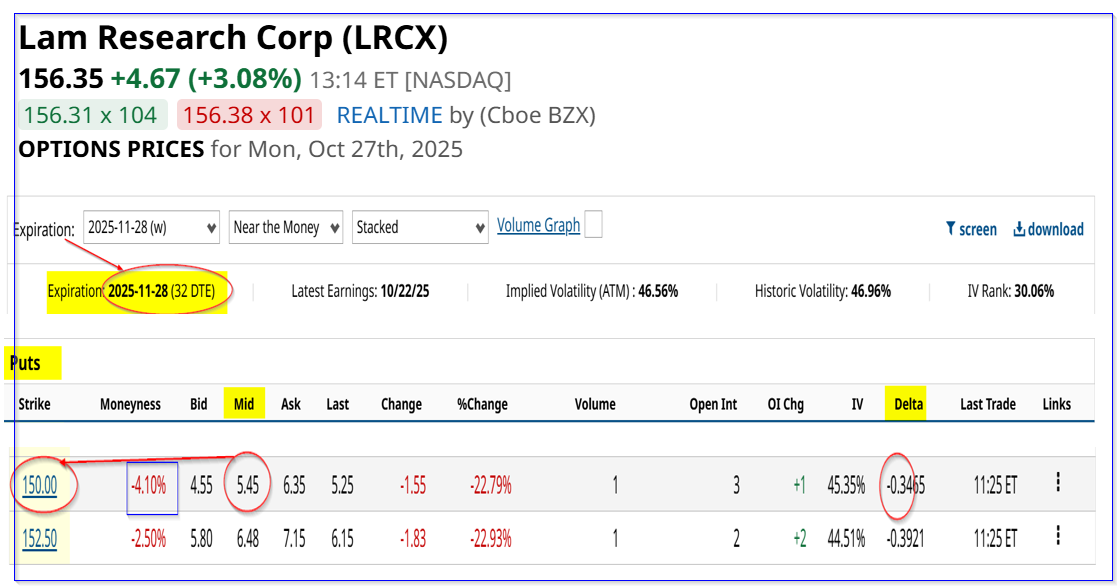

For example, the Nov. 28 expiry period shows that the $150.00 put option strike price has a midpoint premium of $5.45. That represents an immediate yield of 3.63% (i.e., $5.45/$150.00) for a potential buy-in point that is about 4.1% below today's trading price.

(Click on image to enlarge)

LRCX puts expiring Nov. 28 - Barchart - As of Oct. 27

Moreover, the breakeven point ($150-$5.45) of $144.55 is 7.6% below today's price. That assumes that LRCX falls to $150.00 sometime over the next month.

But, if LRCX stock keeps rising, it makes sense to use this short-put income each month to buy in-the-money (ITM) calls. That way, the investor can benefit from the upside in the stock on a leveraged basis, with some downside protection from being ITM.

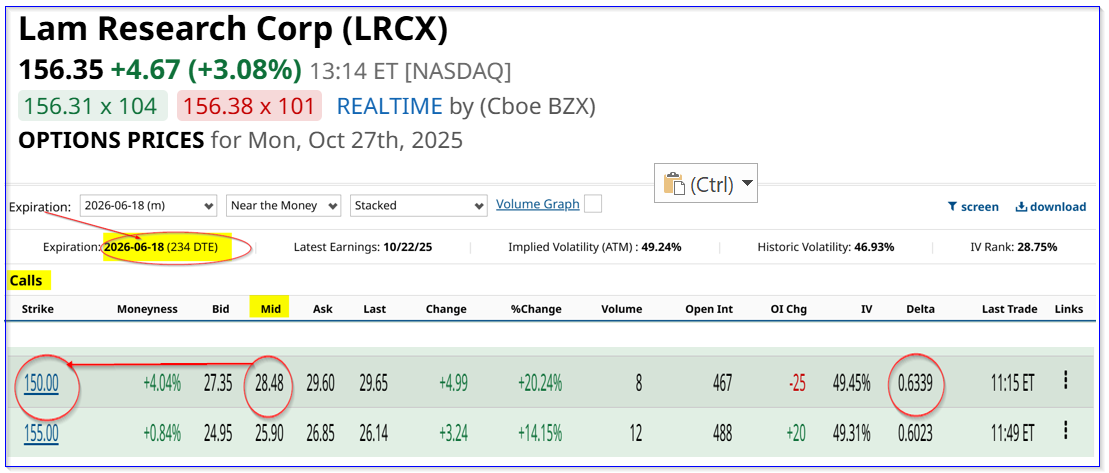

For example, the $150.00 calls expiring June 18, 2026, 234 days or over 7 months from now, have a midpoint premium of $28.48 per call contract.

(Click on image to enlarge)

LRCX calls expiring June 18, 2026 - Barchart - As of Oct. 27, 2025

That means that if an investor can repeatedly short OTM puts for 7 months, theoretically $38.50 in income could be accumulated to pay for this $28.48 call option. In fact, they only have to average $4.07 each month (i.e., a 2.71% yield or $4.07/$150.00) to pay for these calls.

Moreover, if LRCX rises to $185.38, our price target, the calls will have intrinsic value of $35.38:

$185.38 - $150.00 call option strike price = $35.38.

So, let's say that by shorting OTM puts the investor can cut the cost from $28.48 to at least half of this, or $14.24:

$35.38 / $14.24 -1 = +1.485 = +148.5% profit

That is much better than the expected 19% return from just holding LRCX.

Now, the ROI will actually be somewhat lower, however, since it requires capital to both short OTM puts and invest in the ITM calls at the same time. But the point is that this is much better and leveraged way to play LRCX if you agree that the stock is undervalued.

More By This Author:

Tesla's Strong FCF Margins Could Imply TSLA Stock Is Worth Over $500

Netflix Produces Strong FCF Q3 Margins - NFLX Looks 23% Too Cheap

Heavy Activity In Energy Fuels Inc Call Options - A Speculative Play On Rare Earth Elements