ConocoPhillips Could Raise Its Dividend - COP Stock Looks Cheap

by helen89 via iStock

ConocoPhillips (COP) could raise its dividend at the end of the month. That implies, based on its average dividend yield, COP stock could be worth over 22% more. Shorting OTM puts is one way to play COP.

COP closed at $91.95 on Thursday, Oct. 9. It's off from a recent peak of $98.99 on Sept. 2, but near the lows of the past 3 months. But the company is making strong free cash flow, which can support a dividend hike at the end of this month. This article will discuss this.

(Click on image to enlarge)

COP stock - last 3 months - Barchart - Oct. 9, 2025

Dividend Hike Possible

ConocoPhillips has paid a 78-cent dividend per share (DPS) for the past four quarters (i.e., $3.12 annually). Could it raise the DPS on or before it releases Q3 earnings on Nov. 6?

The company's CFO, Andy O'Brien, told shareholders last quarter in the earnings call (page 4 of the transcript) that it typically pays out 45% of its cash flow from operations (CFO) to shareholders (probably adjusted for certain working capital items) in both share buybacks and dividends.

For example, in the first half of this year, Conoco spent $4.69 billion on buybacks ($2.722b) and dividends ($1.968b) on $10.15 billion in adj. CFO (i.e., a 46% payout). That means that about 43% of the $4.69 billion in shareholder payouts is made in dividends.

Note that the CFO represented about a 33% operating cash flow margin on $31.2 billion YTD revenue (i.e., $10.15b CFO/$31.228b revenue YTD).

So, we can use that to project revenue next year. For example, analysts now project revenue next year will be about $59 billion. Here is what we might expect:

33% CFO margin x $59 billion rev est. = $19.5 billion operating cash flow

46% payout = $9 billion (buybacks and dividends)

43% dividend payout = 0.43 x $9 billion = $3.87 billion in dividends

That would be about the same as it has done over the last 12 months ($3.789 billion), according to Stock Analysis (as of Q2).

In other words, Conoco could keep the dividend flat or, given its strong cash flow, it could raise the dividend to benefit shareholders.

Target Price for COP Stock

For example, let's say management raises the DPS by 5% to $3.276 per share annually (i.e., 1.05 x $3.12). That would give COP stock a new forward dividend yield of 3.56% (i.e., $3.276/$91.95)

However, based on its average dividend yield for the past 5 years (Yahoo! Finance), it could end up with a 2.59% dividend yield. That assumes the stock reverts to its mean yield. Here is what that would mean for its stock price:

$3.276 DPS / 0.0259 = $126.49 target price

That is +37.6% higher than today's price of $91.95.

Just to be conservative, let's use the COP trailing 12-month dividend (TTM) dividend yield to set a price target. Morningstar says that the TTM yield has been 3.33%. So, here is how that works out for COP:

$3.276 DPS/ 0.0333 = $98.38 target

That is +7.0% higher than Thursday's closing price.

So, the target price range is between $98.38 and $126.49, or $112.44 per share. That is +22.2% over Thursday's price.

This coincides with what other analysts are projecting. For example, Yahoo! Finance's survey of 27 analysts' price targets is $116.00 per share (+26%). Similarly, Barchart's survey is $116.23.

Moreover, AnaChart, which tracks recent analyst recommendations, shows that 16 analysts have an average price target of $119.53 (i.e., +30% upside from here).

The bottom line is that analysts agree that COP stock is well over 22% undervalued and closer to my higher range (+37%).

One way to play this is to sell short out-of-the-money (OTM) puts. That way, an investor can set a potentially lower buy-in price target and also make a good yield.

Shorting OTM Puts

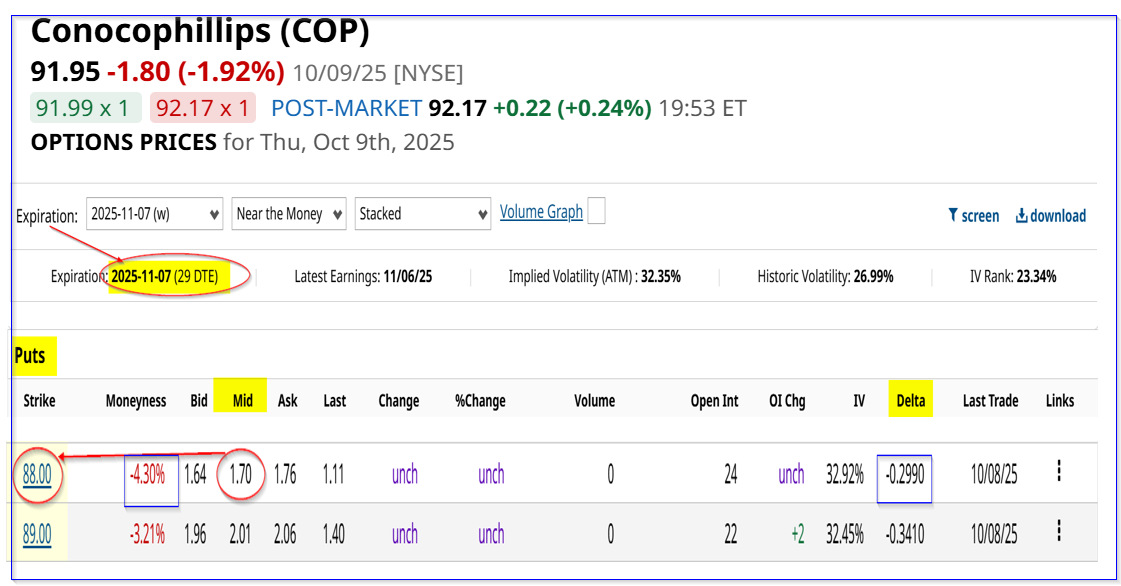

For example, the Nov. 7 expiry period (about a month out) shows that the $88.00 put option contract has a midpoint premium of $1.70 per put contract. This put strike price is 4.3% below the closing price on Oct. 9, i.e., it's out-of-the-money (OTM) and has no intrinsic value yet.

As a result, a short-seller of this put contract can make a one-month yield of 1.93% (i.e., $1.70/$88.00).

(Click on image to enlarge)

COP puts expiring Nov. 7 - Barchart - As of Oct. 9, 2025

This means that an investor who secures $8,800 in cash or buying power with their brokerage firm can enter a trading order to “Sell to Open” this strike price (i.e., a cash-secured put play).

The account will then immediately receive $170 if the trade executes at the midpoint. That is why the investor makes a 1.93% yield (i.e., $170/$8,800).

Moreover, the breakeven point, even if COP falls to $88.00 over the next month, is lower (i.e., $88.00 - $1.70 = $86.30). That is -6.14% below Thursday's close. So, it provides good downside protection to the buyer (assuming the account is assigned to buy shares at $88.00).

This also means the investor would have a much higher forward dividend yield:

$3.276 / $86.30 = 3.80%

That is well over its historical average yield, and provides good potential upside. Moreover, the upside is much better than holding shares:

$112.44 target price / $86.30 breakeven -1 = +30.3% upside

The bottom line is that by shorting OTM puts in COP stock, an investor can set a potentially lower buy-in point with significant upside.

More By This Author:

Unusual Activity In Advanced Micro Devices Options Highlight Investors' Enthusiasm - But Is AMD Stock At A Peak?

Chewy Stock Is Still A Favorite Of Analysts As Its FCF Is Strong

Could Broadcom Benefit From The OpenAI AMD Deal? AVGO Stock Could Be Cheap Here