Chewy Stock Is Still A Favorite Of Analysts As Its FCF Is Strong

Image by Jonathan Weiss via Shutterstock

Chewy, Inc. (CHWY) stock has moved up from a recent trough, but analysts have significantly higher price targets. Its free cash flow (FCF) and FCF margins are expected to remain strong. People love spending money on their pets. As a result, shorting OTM puts and buying ITM long-expiry calls work here.

CHWY is currently at $37.00, up from a recent low of $35.11 on September 10. But, it's still off from a peak of $42.33 on Sept. 5. My analysis is that CHWY could be worth +16% more at almost $43, based on its FCF.

(Click on image to enlarge)

CHWY stock - last 3 months - Barchart - Oct. 7, 2025

I wrote about this on Sept. 12 ("Chewy Stock Is Down After Strong FCF Results - CHWY Is Worth 15%+ More.") I showed that CHWY could be worth $40.68 per share, and analysts had higher price targets.

My new price target for CHWY is +16% higher at $43 per share. This article will show why.

Price Targets for CHWY Stock

As I wrote last month, Chewy produced strong Q2 revenue and net income growth (up 8.6% and 34.8% respectively). Moreover, its FCF margin rose from 3.20% last year to 3.41%.

I expect it will post at least a 3.75% FCF margin over the next year. Analysts now project about $13.6 billion in sales next year ending Jan. 31, 2027. So, FCF will be:

$13.6b x 0.0375 FCF margin = $510 million FCF

Using a 2.857% FCF margin, which is the same as a 35x multiple, Chewy's market value could rise to $17.85 billion:

$510m x 35 = $17.85 billion mkt cap

This is almost 16% higher than its present market value of $15.42 billion (Yahoo! Finance). In other words, CHWY stock is worth 15.76% more:

$37.00 x 1.1576 = $42.83 price target

Analysts also see a higher price target. Yahoo! Finance is at $45.32 from 28 analysts, and Barchart's survey is $45.96. AnaChart's survey is higher at $48.20 from 20 analysts.

The bottom line is that CHWY still looks undervalued, especially if its upcoming Q3 results show strong FCF margins.

One way to play this is to buy in-the-money (ITM) calls in longer expiry periods and also short out-of-the-money (OTM) puts to help pay for this. Let's look at this.

Shorting OTM Puts and Buying ITM Calls

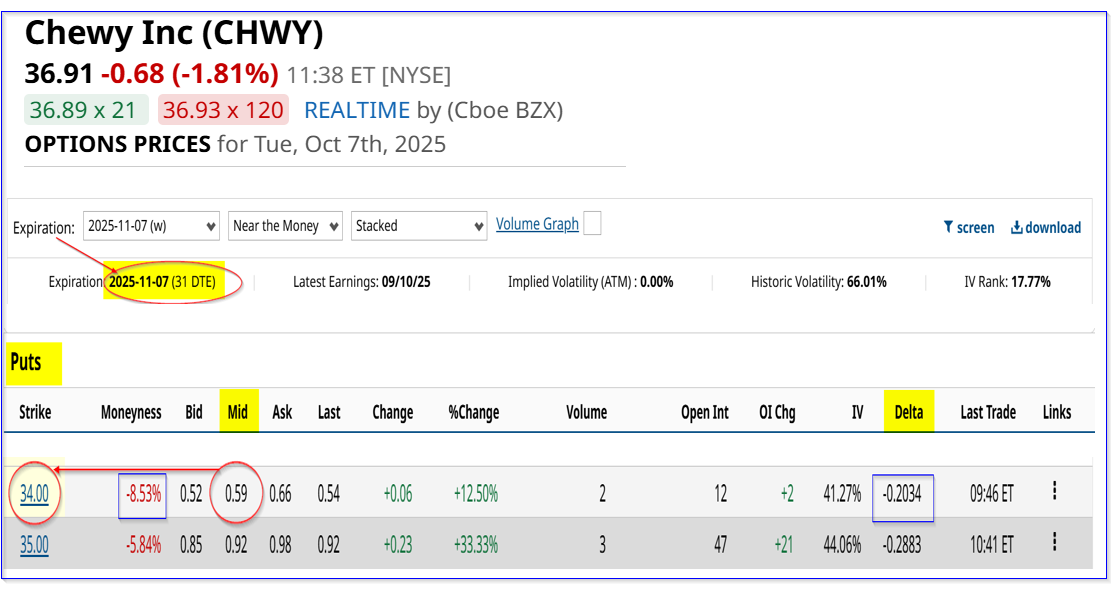

For example, an investor could sell short Nov. 7 puts (1 month away) at the $34.00 strike price (i.e., 8.5% below today's price) for 59 cents. That would give the investor an immediate yield of 1.735% (i.e., $0.59/$34.00).

(Click on image to enlarge)

CHWY puts expiring Nov. 7 - Barchart - As of Oct. 7, 2025

The delta ratio is low at 20% so there is only a low chance of the stock falling to this point in 31 days. As a result, if this short-put play can be repeated over the next 6 months, these premiums could be used to pay for an in-the-money (ITM) call option.

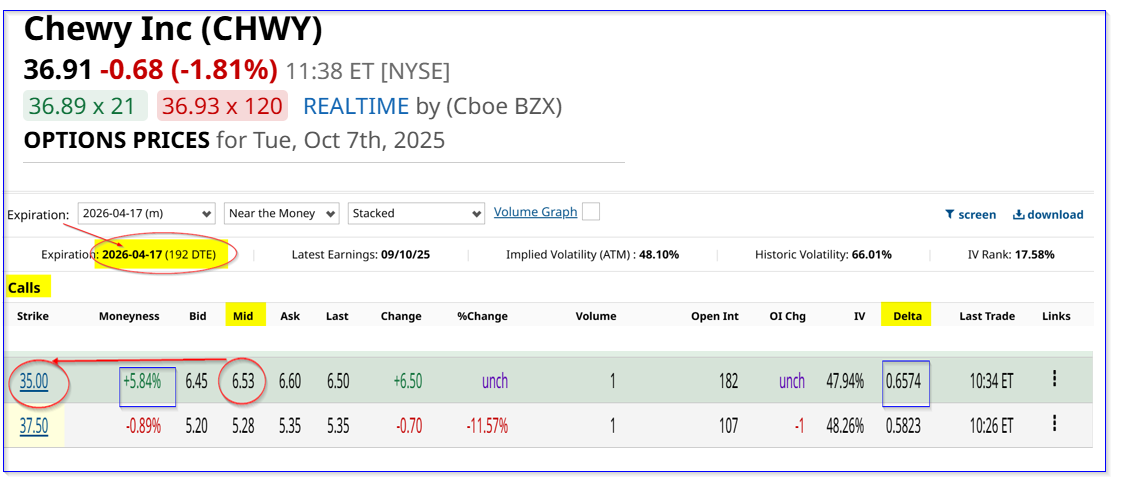

For example, the $35.00 call option expiring April 17, 2026, trades for $6.53 per call option contract. The breakeven point is thus $35.00+$6.53, or $41.53. That is $4.62 (i.e., $41.53-$36.91) or 12% over today's price (i.e., the extrinsic value).

(Click on image to enlarge)

CHWY calls expiring April 17, 2026 - Barchart - As of Oct. 7, 2025

But if an investor keeps making 59 cents for 6 months shorting puts, they could potentially accumulate $3.54. That would lower the extrinsic value paid to just $1.08 and the breakeven point for the long call to just $36.08, slightly lower than today's price (i.e., $36.91-$36.08).

Moreover, to enhance these returns the investor could also short out-of-the-money calls in one-month expiry periods. For example, the $43.00 calls expiring Nov. 7 trade for 32 cents. That provides a yield of just below 1% for the next month (i.e., $0.32/$36.91). If the investor can repeat this over 6 months, the accumulated income would be $1.92.

As a result, even if CHWY stays flat, the total return could still be over 7.6%:

$36.91 - $36.08 breakeven = $0.83 + $1.92 = $2.75

$2.75 / $36.08 = +7.62% over 6 months

Moreover, if CHWY rises to $43, the total return would be $6.92 (i.e., $43.00 - $36.08) + $1.92, or $8.84, or +24.5% (i.e., $8.84/$36.08).

The point is that this is a way to make a leveraged return on CHWY with very low risk compared to just holding CHWY shares.

More By This Author:

Could Broadcom Benefit From The OpenAI AMD Deal? AVGO Stock Could Be Cheap HereMake A 4.5% One-Month Yield Shorting Shopify Cash-Secured OTM Puts

Analysts Keep Raising Price Targets For Microsoft Stock - MSFT Is Still Cheap