Could Broadcom Benefit From The OpenAI AMD Deal? AVGO Stock Could Be Cheap Here

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

Poetra_ RH via Shutterstock

Broadcom, Ltd. (AVGO) could benefit from OpenAI's diversification away from its sole reliance on Nvidia Corp (NVDA). This is evident in today's massive AI chip deal with Advanced Micro Devices (AMD). It's possible, especially after the Sept. 4 OpenAI deal with Broadcom. AVGO stock could be an alternative play.

AMD stock is up 27%, and NVDA is down slightly, but AVGO is flat at $339.04.

(Click on image to enlarge)

AVGO stock - last 3 months - Barchart - Oct. 6, 2025

AMD agreed to supply OpenAI hundreds of thousands of AI chips, enough for tens of billions of dollars for AMD, according to Reuters. OpenAI is also taking a 10% stake in AMD as a result of the chip deal through warrants.

So, if OpenAI were to ink a similar deal to have Broadcom supply AI chips on the scale it is doing with AMD, it's possible AVGO stock could move higher as well.

After all, OpenAI is set to produce its own AI chip in partnership with Broadcom, as Reuters said the Financial Times reported on Sept. 4. So, if that leads to a massive production deal just like it now has with AMD, expect to see Broadcom's expected revenue rise.

AMD's market cap is now $351 billion, but Broadcom's is over 4x this at $1.6 trillion. The point is that Broadcom has the resources to potentially an even bigger deal with OpenAI.

Updated AVGO Stock Price Target

I recently raised my price target to $418.58 per share in a Sept. 10 Barchart article, “Huge, Unusual Options Activity in Broadcom Underlines the Value of AVGO Stock.”

That was based on analysts' revenue estimates and expected free cash flow (FCF), using a 1.85% FCF yield metric.

But, since then, sales forecasted for Oct. 2026 have risen to $84.15 billion. I also suspect that analysts will produce higher estimates for Oct. 2027 once this upcoming quarter's revenue is announced around Dec. 11.

As a result, the price target over the next year could be higher. For example, using a 45% FCF margin on $90 billion in the next 12 months (NTM) est. sales by Q4:

$90b x 0.45 = $40.5 billion NTM FCF

The potential for a large production deal with OpenAI would push that estimate even higher.

Using a 2.0% FCF yield metric (i.e., a 50x FCF multiple), Broadcom could be worth over $2 trillion:

$40.5b FCF / 0.02 = $2,025 billion market value

That is 26.5% higher than today's stock price. In other words, AVGO stock is potentially worth 26.5% more:

$338.17 x 1.265 = $427.78 per share

Moreover, if an OpenAI production deal is announced in the next 12 months, like the AMD deal, all bets would be off. It's likely that the market would give AVGO stock a much higher valuation:

$40.5b / 0.018 (i.e., 55.5x) = $2.25 trillion, or +40.2% upside

In that case, AVGO would be worth $474 per share.

The bottom line is that AVGO's valuation could benefit from this AMD deal if OpenAI continues to cut deals with other chip makers, including Broadcom.

Shorting OTM Puts Works Here

I discussed shorting out-of-the-money (OTM) puts in my Sept. 5, Barchart article. That worked out well as I recommended selling short the $285.00 strike price put expiring Oct. 3. AVGO closed at $338.37, and the investor kept the $6.73 premium for a one-month 2.36% yield.

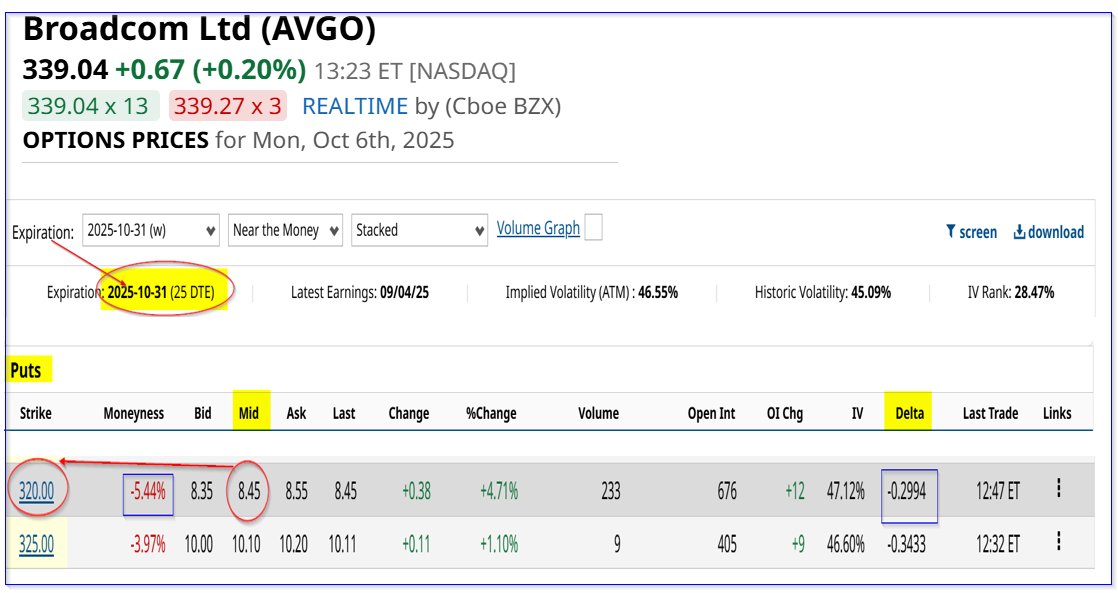

Today, the Oct. 31 expiry period shows that the $320 strike price put option contract, 5.4% below today's trading price or OTM, has a midpoint premium of $8.45.

That provides a short seller an immediate yield of 2.64% (i.e., $8.45/$320.00).

(Click on image to enlarge)

AVGO puts expiring Oct. 31 - Barchart - As of Oct. 6, 2025

This means an investor can make a good yield and also set a potentially lower buy-in price, if AVGO falls to $320 in the next 25 days.

However, a short-put cash-secured investor in this play won't gain any upside in AVGO stock. They can only make a short-put yield.

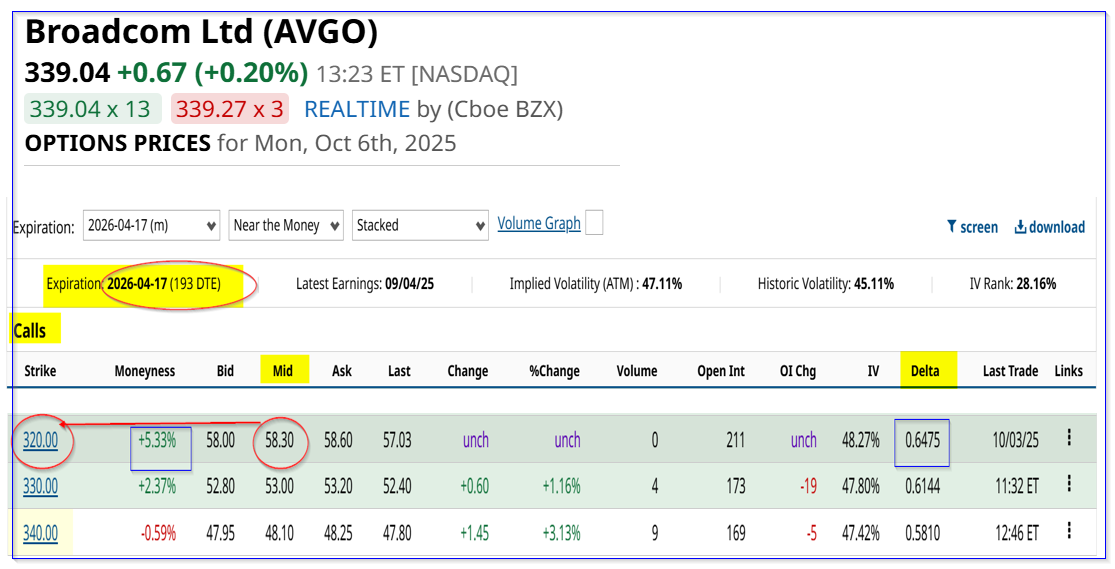

One way around this is to also buy longer-dated in-the-money calls. For example, the $320 call option expiring in over 6 months (April 17, 2026) has a premium of $58.30.

(Click on image to enlarge)

AVGO calls expiring Apri 17, 2026 - Barchart - Oct. 6, 2025

That means the breakeven point is $378.30, or $39.26 (+11.6%) over today's price. The extrinsic is $39.26 than today's price, implying AVGO has to rise 11.6% in six months for these calls to have intrinsic value.

But, if the investor can continuously short OTM puts for $8.45 over 6 months, the investor could potentially accumulate more than that extrinsic value (i.e., $8.45 x 6 = $50.7).

So, this might make a good way to play the upside in AVGO over the next 6 months.

For example, if AVGO rises to $427.78, my price target above, the potential return is as follows:

$427.78-$320.00 call strike price = $107.78 intrinsic value

$107.78 / $58.30 = 1.8487 -1 = +84.87%

Moreover, the accumulated $50.70 in potential short-put income would raise the total return to 172%

$107.78 +$50.7 = $158.48 / $58.30 = 2.718 -1 = +171.8%

The bottom line is that AVGO OTM puts and ITM calls look attractive here for a long-term risk-taking investor.

More By This Author:

Make A 4.5% One-Month Yield Shorting Shopify Cash-Secured OTM PutsAnalysts Keep Raising Price Targets For Microsoft Stock - MSFT Is Still Cheap

Unusual Tesla Call Options Volume Shows Investors Bullish On TSLA