Unusual Activity In Advanced Micro Devices Options Highlight Investors' Enthusiasm - But Is AMD Stock At A Peak?

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

Poetra_RH via Shutterstock

Today, a large volume of Advanced Micro Devices (AMD) call options are trading after it announced a major deal with OpenAI on Monday, Oct. 6. AMD rose over 28.5% in the prior two days and is up 6% again today. To say the least, investors are bullish on its upside. But is all the hype overdone? Is AMD stock close to its price target?

AMD is at $224.13 in midday trading, up +36.1% from $164.67, where it closed on Friday, Oct. 3.

(Click on image to enlarge)

AMD stock - last 3 months - Barchart - Oct. 8, 2025

Is AMD at a Peak?

It's all because AMD cut a deal with OpenAI to produce a large amount of AI chips and data centers over the next several years. The problem is that no one knows if this will be profitable and how much so.

Lisa Su told the WSJ that it would involve tens of billions of new revenue for the company over the next half-decade.

The problem is that most of the good news may already be in the stock price.

For example, analysts now project that revenue next year will rise to $41.3 billion, up from $33.04 billion this year. However, AMD's free cash flow (FCF) margin over the past year has been just 13.66%, compared to Nvidia's 43.59%, according to Stock Analysis.

So, using a 14% FCF margin, Advanced Micro Devices might make $5.78 billion in free cash flow. Using a 3.3% FCF yield (the same as Nvidia), AMD stock might be worth $175 billion (i.e., $5.78 billion / 0.033).

But today, AMD's market cap is twice that level at $362.26 billion, according to Yahoo! Finance.

So, just to be generous, let's assume that revenue in 3 years reaches $60 billion and its FCF margin rises to 20%. That will provide $12 billion in FCF (i.e., $60b x 0.20), which would be valued at a $363 billion valuation, using a 3.3% FCF yield (i.e, $12b/0.033).

In other words, that is the same as today's AMD stock valuation (and never mind discounting it back to the present). And don't forget we are giving AMD the same FCF yield metric as Nvidia, even though AMD has a lower FCF margin.

So, one could make a point that AMD stock could be near a peak today.

Unusual Call Options Volume

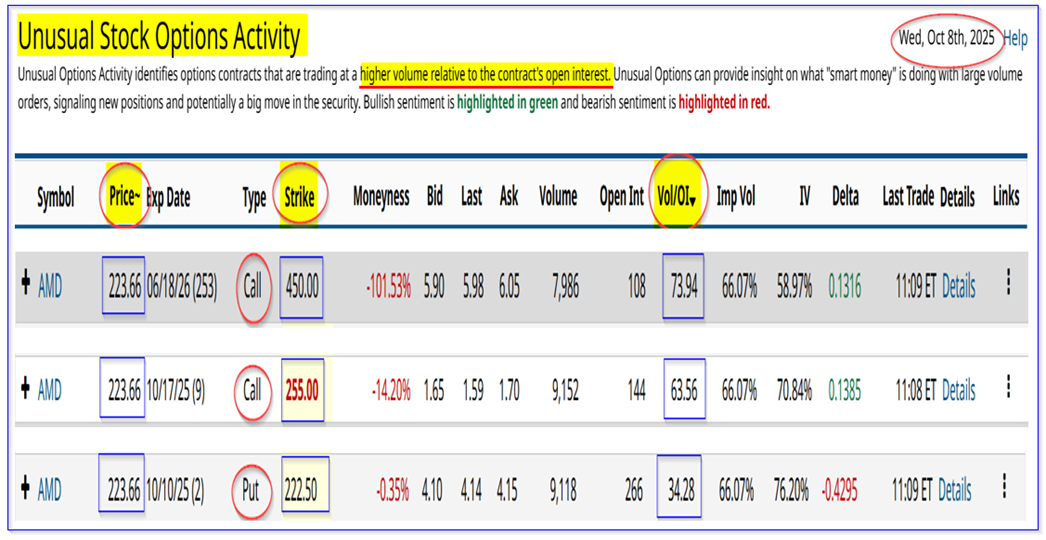

The heavy call option volume can be seen in Barchart's Unusual Stock Options Activity Report today. It shows that almost 8,000 call options contracts have traded at the $450 strike price (i.e., over double today's price) for expiration in about 8 and a half months (June 18, 2026).

That is over 73 times the prior number of call options contracts outstanding for this contract.

And the $255 call option expiring next Friday has had volume over 63 times the prior number of contracts.

(Click on image to enlarge)

AMD call options and one put contract with heavy volume - Barchart Unusual Stock Options Activity Report - Oct. 8, 2025

That shows that investors are still super bullish on AMD stock, but especially for the $450 call option contract next June.

I can see possibly doing the $255 call option, but the $450 call strike price seems excessively bullish for AMD stock. Moreover, the premium of $6.05 raises the intrinsic value cost to $461. But I suspect that the investors are only doing this on a speculative basis - i.e., hoping to sell it later at a higher price.

The point is that if analysts start to raise revenue forecasts and if Advanced Micro Devices can show it is able to raise its FCF margins, maybe the long-dated calls will rise in price.

But that still seems a stretch, as using even generous assumptions, AMD stock looks to be fully valued now.

More By This Author:

Chewy Stock Is Still A Favorite Of Analysts As Its FCF Is StrongCould Broadcom Benefit From The OpenAI AMD Deal? AVGO Stock Could Be Cheap Here

Make A 4.5% One-Month Yield Shorting Shopify Cash-Secured OTM Puts