Cisco Systems Stock Is Treading Water - How To Use Puts And Calls To Play CSCO

/Cisco%20Systems%2C%20Inc_%20magnified%20logo-by%20Pavel%20Kapysh%20via%20Shutterstock.jpg)

by Pavel Kapysh via Shutterstock

Cisco Systems, Inc. (CSCO) generated strong free cash flow (FCF) in Q3, and there is every indication that it will continue. But CSCO stock has been flat. Shorting out-of-the-money puts and buying in-the-money calls are two good ways to play CSCO.

CSCO stock closed at $78.02 on December 12, which is close to a month ago on November 26 ($76.07). Moreover, based on a survey of 15 analysts by AnaChart.com, it could be worth $90.39, or over 15% higher.

(Click on image to enlarge)

CSCO stock - last 3 months - Barchart - Dec. 24, 2025

In my Barchart article on Nov. 14, 2025, it makes sense to short OTM puts for income. For example, I discussed selling short the $75.00 put option expiring Dec. 12 for $0.86, i.e., a 1.15% one-month yield.

If CSCO takes time moving higher, it might make sense for long-term investors to repeat this trade. Moreover, they can use that income to buy in-the-money (ITM calls. Let's look at these plays.

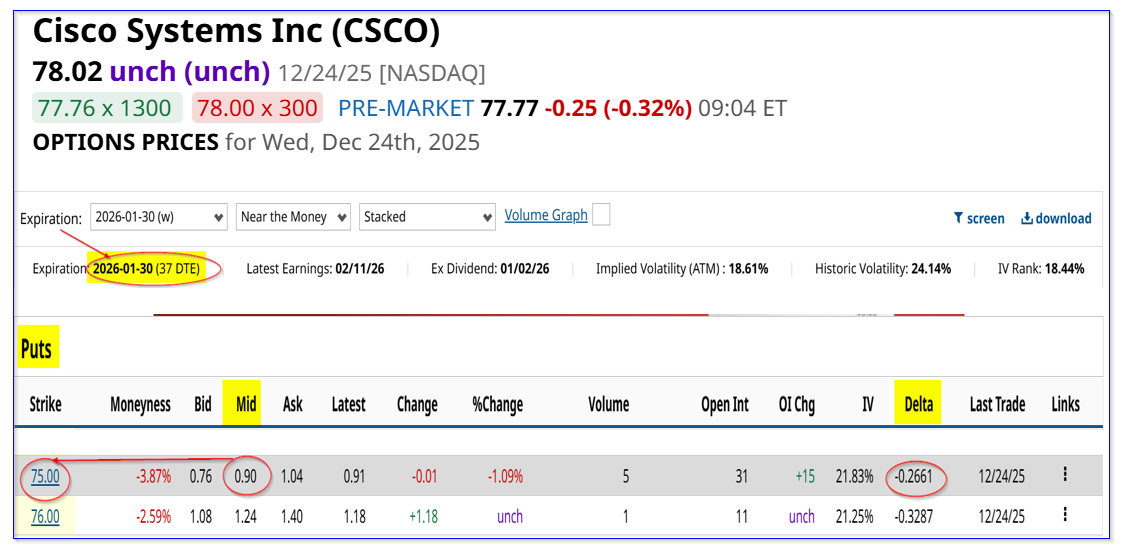

Shorting OTM CSCO Puts

Right now, the Jan. 30, 2026, puts at the $75.00 strike price trade for $0.90. That means that an investor who secures $7,500 with their brokerage firm can make $90 immediately with a trade to “Sell to Open” 1 put contract.

In other words, the investor makes a one-month yield of 1.20% (i.e., $90/$7,500).

(Click on image to enlarge)

CSCO puts expiring Jan. 30, 2026 - Barchart - Dec. 24, 2025

However, these prices could change once premiums trade on Friday, Dec. 26.

Nevertheless, it makes sense to potentially use that income to buy further out expiry in-the-money (ITM) calls. That way, an investor can participate in any upside in CSCO stock.

Buying ITM CSCO Calls

For example, the July 17, 2026, call option expiry period shows that the $77.50 call option has a midpoint premium of $6.75 per call contract. That means that it would cost $675.00 for one contract.

(Click on image to enlarge)

CSCO calls expiring July 17, 2026 - Barchart - Dec. 24, 2025

But if an investor can short CSCO puts for 7 months and make $90 each month (no guarantee here), that would produce income of $630.00 (i.e., $90 x 7).

In other words, the net cost would be just $45.00 (i.e., $0.45 per call contract)

How This Works Out - Expected Return

So, let's look at how that works out. What is the expected return (ER) for this complicated play?

First, the breakeven point is:

$77.50 + $0.45 net premium = $77.95 breakeven

That is close to Wednesday's close of $78.02. In other words, for an “eventual” net cost of just $45.00, the investor gets to control 100 shares of CSCO.

So, for example, if CSCO rises to $90.00 per share, the intrinsic value of the $77.50 call will be:

$90.00 - $77.50 = $12.50 intrinsic value

But, until it expires in 7 months, the premium will be higher. Let's say it is 10% higher, or $13.75. Here if the profit breakdown:

$13.75 x 100 = $1375 - $45 net cost = $1330 profit

However, we must put this in context. The investor had to continuously secure $7,500 each month (which could vary depending on which OTM strike is used).

So, the net expected ROI is:

$1,330 / $7,500 = 17.73%

Moreover, that was for a period of 7 months, or 0.5833 of a year. So, the annualized expected ROI is:

(1+17.73%)^(1/0.5833) -1 = 1.1773 ^(1.71438) -1 = 1.3229 -1 = 32.29% ER annualized

In other words, if this trade is repeated for up to a year, it could produce an expected return (ER) of 32.3%.

The bottom line is this is a great way to play CSCO on a leveraged basis.

It is also reasonably safe to do so. The investor is exposed to upside with the call options and also makes short-put income each month to help pay for the call option purchase.

More By This Author:

Super Micro Computer Stock Tumbles, But Investors Are Piling Into Its Call Options - Time To Buy SMCI?

Occidental Petroleum Stock Has Tanked - But It May Hike Its Dividend - Time To Buy?

Palo Alto Networks Stock Is Down But Not Out - Worth Buying PANW Here?

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more