Palo Alto Networks Stock Is Down But Not Out - Worth Buying PANW Here?

/Palo%20Alto%20Networks%20Inc%20HQ%20sign-by%20Tada%20Images%20via%20Shutterstock.jpg)

Tada Images via Shutterstock

Palo Alto Networks (PANW) reported strong Q3 free cash flow on Nov. 19, 2025. In addition, its FCF margin rose on a trailing 12-month (TTM) basis. As a result, PANW could be worth much more, but the stock is well off its highs. That makes it a strong buy for value investors here.

PANW is at $189.76 in midday trading on Monday, Dec. 22. That's significantly below a recent peak of $221.28. Recently, it has moved up from a trough of.

PANW stock - last 6 months - Barchart - Dec. 22, 2025

Palo Alto Networks Stock Price Targets

I discussed its valuation in a Nov. 24, 2025, Barchart article ("Palo Alto Networks' Stock Has Tanked, But Its FCF is Strong - Price Target is 15% Higher"). My conclusion is that, based on Palo Alto Networks' strong FCF margins and analysts' revenue forecasts, PANW could be worth $212.16 per share.

That price target (PT) is still +11.8% higher than today's price.

Analysts have also been raising their PTs. For example, Yahoo! Finance shows that 55 analysts have an average PT of $225.42. That's up from $224.59 a month ago.

Shorting OTM PANW Puts Works

I discussed shorting out-of-the-money (OTM) puts to set a lower potential buy-in point. That way, an investor can get paid while waiting.

For example, I discussed on Nov. 24 shorting the $180 strike price put option expiring on Dec. 26. At the time, PANW stock was at $185.35, so this $180 strike price was 2.89% below the stock price - i.e., out-of-the-money (OTM).

The premium received then was high at $4.60. That represented a short-put yield of 2.56% (i.e, $4.60/$180.00) for the next month.

Today, the premium has fallen to $0.07. So, this short-put play has been successful. The investor gets to keep the income, and the option is likely to expire worthless, with no obligation to the short seller to buy shares at $180.

Note also that PAWN has only risen 2.379% in the last month. So, shorting the OTM put has actually made more money than owning the shares.

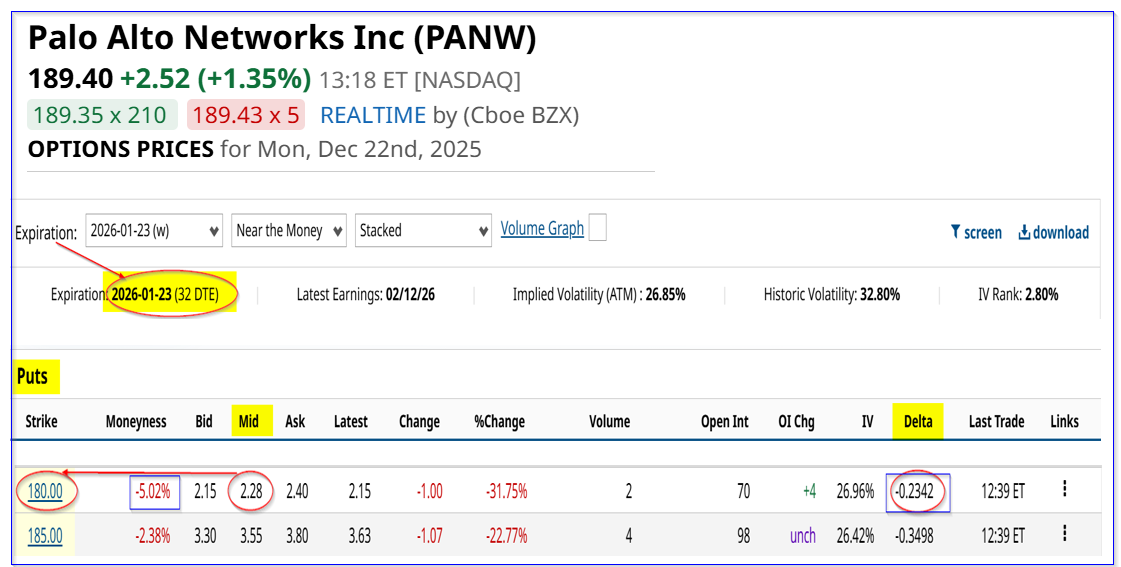

So it makes sense to do this trade again. For example, the Jan. 23, 2026, option expiration period shows that the $180.00 strike price put option has a $2.28 midpoint premium.

That provides a short seller a one-month yield of 1.267% (i.e., $2.28).

(Click on image to enlarge)

PANW puts expiring Jan. 23, 2026 - Barchart - As of Dec. 22, 2025

For less risk-averse investors, shorting the $185.00 put option contract provides $3.55 - i.e., $355 for an investment of $18,500. That works out to a one-month yield of 1.9189%.

Doing a 50/50 mix of these two contracts would provide an investor with a 1.593% yield (i.e., $2.915 avg. income / $182.50) with an OTM distance of 3.825% away from the trading price.

The risk is just 29.2% that PANW will fall to $182.50 on average. That's less than a 30% chance that the investor would have an obligation to buy shares at both of these strike prices.

This shows that shorting OTM puts is a profitable way to set a lower potential buy-in price. For example, the breakeven point with a 50/50 mix is just $179.59 (i.e., $182.50-$2.915).

This provides a potential upside of 18.1% (i.e., $212.16/$179.59-1 = 0.1814).

The bottom line is that Palo Alto Networks looks cheap here. Selling short puts that have strike prices below the trading price is one way to profitably play PANW stock.

More By This Author:

Chevron Could Raise Its Dividend Next Month - The Stock Looks Too CheapConocoPhillips Stock Still Looks 18% Undervalued - How To Play COP Stock?

Oracle's Unusual Put Options Activity - A Contrarian Signal - Should Investors Buy ORCL Stock?

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more