Super Micro Computer Stock Tumbles, But Investors Are Piling Into Its Call Options - Time To Buy SMCI?

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)

by Poetra_RH via Shutterstock

Super Micro Computer, Inc. (SMCI) delivered disappointing quarterly results (for its fiscal Q1 ending Sept. 30) on Nov. 4. SMCI stock has tanked, as investors lost faith in this AI server company. However, large and unusual call option activity in SMCI may indicate that it may be time to buy.

SMCI is at $30.55 in morning trading on Dec. 24. That's well off its Oct. 8 closing peak of $58.68 (-48%) and pre-earnings price of $50.75 on Nov.3 (i.e., down 40%). So, has it been overdone? Today's call option activity may imply that's the case.

(Click on image to enlarge)

SMCI stock - last 6 months - Barchart - Dec. 24, 2025

Is SCMI Stock's Fall Done?

For example, Super Micro Computer claimed that its negative revenue growth and lower net income (EPS was down 53%), along with depressed margins, were due to one customer delaying their AI server and rack orders to the upcoming quarter (i.e., ending Dec. 30).

Moreover, analysts generally expect the company to be profitable. Barchart's survey of analysts shows that the next EPS will rebound to 52 cents per share, up from 35 cents last quarter.

In addition, analysts surveyed by Seeking Alpha have an average EPS for this fiscal year to June 30, 2026, of $2.06. That means that SMCI is trading at a multiple of just 17.2x.

Historically, its 5-yr forward Price/Earnings (P/E) multiple has averaged between 16.7x to 18.7x (GAAP / non-GAAP). Morningstar says the 5-year average has been 18.63x.

The point is, there are good reasons to believe that SCMI stock could be cheap here, and the downdraft has been overdone.

No wonder there has been heavy call option buying.

Unusual Activity in SMCI Call Options

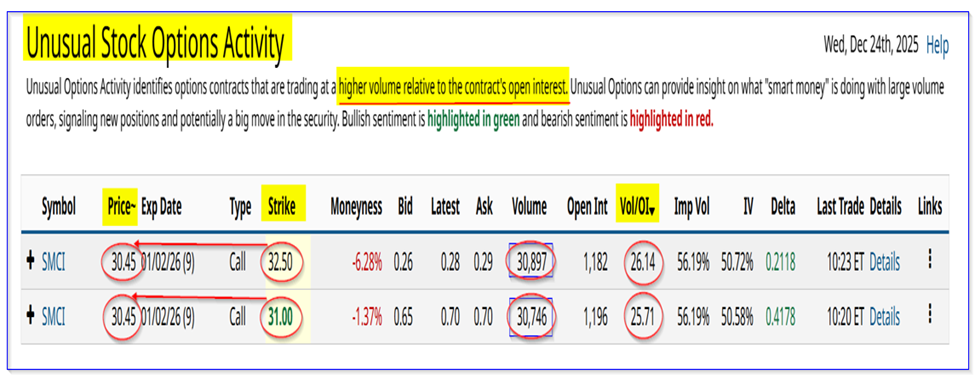

This can be seen today in Barchart's Unusual Stock Options Activity Report. It shows that two large tranches of SCMI call options have traded for expiration on January 2, 2026 (i.e., 9 days to expiry or DTE).

(Click on image to enlarge)

SCMI call options expiring Jan. 2, 2026 - Barchart Unusual Stock Options Activity Report - Dec. 24, 2025

For example, almost 30,900 calls expiring Jan. 2 at the $32.50 call strike price and 30,800 calls at the $31.00 call strike price have traded. Those represent over 26x and 25.7x the prior number of outstanding contracts.

So, it's highly unusual. It represents extreme bullishness on the part of the buyers. They also didn't have to pay much for the premiums. The breakeven points are just $32.78 and $31.70, respectively, or just +3.9% and 0.5% respectively, over the trading price.

The point is that they expect SCMI to rise over the next 9 days. They seem to think SMCI may have bottomed out.

Risk and Opportunity

The problem is that 9 days may not be enough time. It may take months for the market to realize that its fortunes aren't as bad as the stock's fall seems to imply. That means the call options premiums could waste away over the next 9 days if SCMI doesn't jump at least 4% or so.

However, maybe this call option buying may reflect hedging activity from institutional short sellers. They may still be short SMCI stock, but don't want to close out just yet.

So, to hedge their position, they've started to buy call options. They know that the first fund to close out their short positions will push the stock higher.

So, that activity is another catalyst. The bottom line here is that investors should be careful mimicking this call activity. But the potential upside return may outperform the risks.

More By This Author:

Occidental Petroleum Stock Has Tanked - But It May Hike Its Dividend - Time To Buy?Palo Alto Networks Stock Is Down But Not Out - Worth Buying PANW Here?

Chevron Could Raise Its Dividend Next Month - The Stock Looks Too Cheap

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more