Occidental Petroleum Stock Has Tanked - But It May Hike Its Dividend - Time To Buy?

by Poetra_ RH via Shutterstock

Occidental Petroleum Corp (OXY) could hike its dividend in late January or early February. But OXY stock is still well off its highs. Based on its average dividend yield, OXY could be worth over 25% more at $50 per share.

OXY is trading at $39.77 today. That's down from $48.10 on Sept. 29, but up from a recent trough of $38.92 on Dec. 16. Over the last month, it's been treading water.

(Click on image to enlarge)

OXY stock - last 6 months - Barchart - Dec. 23, 2025

Upcoming Dividend Hike

I discussed Occidental's upcoming potential dividend hike in a Nov. 25, 2025, Barchart article ("Occidental Petroleum Could Hike Its Dividend - Price Target is At Least 21% Higher").

I showed that OXY could be worth $50.00 if Occidental raises its dividend per share (DPS) next quarter to $1.00, up from 96 cents annually.

After all, Occidental has consistently increased the DPS after paying out the same DPS for four quarters, which it has already done as of November 5. For example, Seeking Alpha reports that it has done this annually for the past four years.

So, raising the DPS to $1.00 would be just a +4.2% increase. That's well below the +9% 2024 DPS hike from 84 cents to 96 cents.

Let's assume that happens. But what will the dividend yield be?

Valuing OXY Stock By Its Historical Yield

The investment philosophy here is that a stock is tethered to its average yield. The yield will tend to be flexible, but also revert to its average, especially when it's at an extreme. It's called a “mean reversion” effect.

For example, over the last 12 months (LTM), OXY stock has had an average yield of 2.33% according to Yahoo! Finance. But right now, at $39.77, the dividend yield (DY) is higher:

$0.96/$39.77 = 0.02414 = 2.414% present DY

Moreover, over the past 5 years, Yahoo! Finance says it's been as low as 1.16%. In addition, Morningstar's Dividend tab for OXY shows that over the last 2 years, the DY has ranged between 1.78% and 2.38%.

So, just to be conservative, let's assume it will end up with a 2.0% dividend yield, using the mean reversion effect:

$1.00 / 0.02 = $50.00 target price

In other words, if OXY hikes its DPS by 4% to $1.00 in late January or early February, and if OXY stock reverts to a 2.0% dividend yield, from its 2.4% present yield, OXY will rise to $50.00.

That's a potential upside of +25.7% from today's price.

Analysts Agree OXY is Undervalued

For example, Yahoo! Finance's survey of analysts is $49.92, close to my $50.00 target price. Similarly, Barchart's survey shows a mean price of $49.36.

AnaChart, which tracks recent analyst price targets, reports that 18 analysts have an average price target of $50.56.

So, based on its average yield and analysts' write-ups, OXY is at least 25% undervalued.

One way to play this, as mentioned in my last article, is to sell short out-of-the-money (OTM) puts. That way, an investor can gain extra income with an obligation to potentially buy in at a lower price.

Shorting OTM Puts

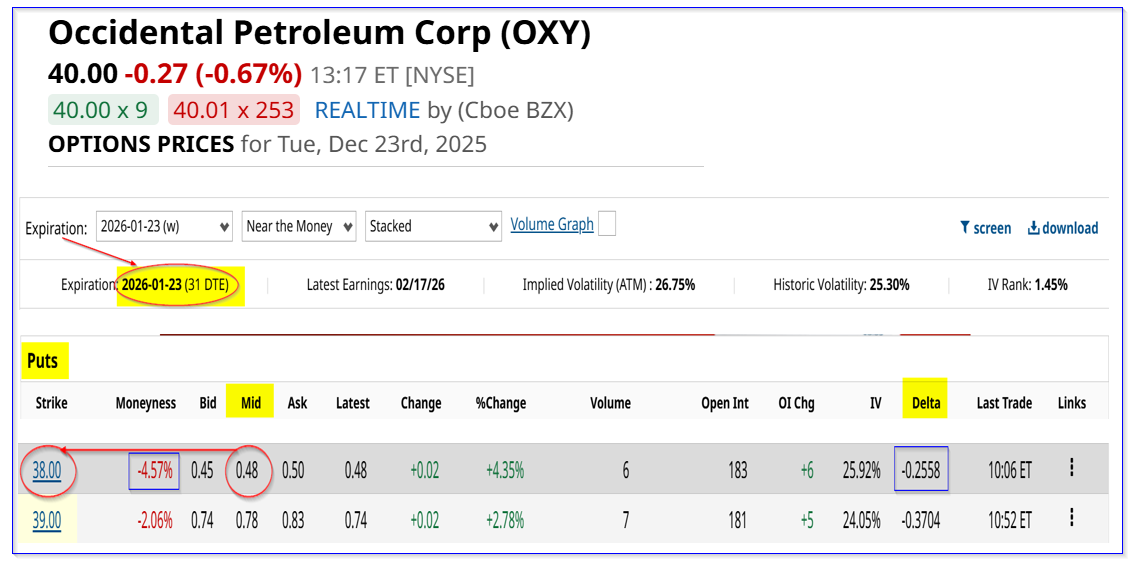

For example, the Jan. 23, 2026, expiry period option chain shows that the $38.00 strike price put has a 48-cent premium. That provides a short-seller an immediate one-month yield of 1.26% (i.e., $0.48/$38.00).

(Click on image to enlarge)

OXY puts expiring Jan. 23, 2025 - Barchart - As of Dec. 23, 2025

This strike price is about 4.4% below today's trading price. And there is a 0.2558 delta ratio, implying a 26% chance that OXY will fall to $38.00.

The bottom line is that OXY looks cheap here and shorting OTM puts is one way to play the stock.

More By This Author:

Palo Alto Networks Stock Is Down But Not Out - Worth Buying PANW Here?

Chevron Could Raise Its Dividend Next Month - The Stock Looks Too Cheap

ConocoPhillips Stock Still Looks 18% Undervalued - How To Play COP Stock?

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more