Chevron Could Raise Its Dividend Next Month - The Stock Looks Too Cheap

Chevron Corp_ gas station- by MattGush via iStock

Chevron Corp (CVX) could raise its dividend per share (DPS) next month, as it has done for the past 38 years. That implies the value of Chevron stock may be 15% too cheap, based on its average yield. Shorting out-of-the-money puts could also work here.

The stock closed at $147.75 on Friday, Dec. 19. It's well off its recent peak of $157.72 from Oct. 31. But, if Chevron raises the DPS by 5% as expected in January, it could be worth $170.27, or over 15% higher than Friday's close. This article will show why and provide some ways to play Chevron.

(Click on image to enlarge)

Image Source: Barchart - Chevron stock over the last six months, as of Dec. 19, 2025

Expected Dividend Hike

I previously discussed how Chevron could afford to raise its dividend in my Nov. 23 article about the stock.

Based on an expected 5% increase (last year's hike was 4.9%), the annual dividend per share could rise from $6.84 to $7.18. That would give Chevron an annual yield of 4.86%. This is well over its average yield over the last five years.

For example, Yahoo! Finance reports that the five-year historical yield has been 4.18%. Morningstar says it's been lower at 4.07%. However, Seeking Alpha says it's been 4.40%.

The average of these surveys is 4.2168%. So, applying this average to the expected DPS of $7.18 results in the following outcome:

- $7.18 / 0.042168 = $170.27 target price

That is over 15% higher than Friday's close:

- $170.27 / $147.75 = 1.1524 -1 = +15.2% upside

In other words, if we assume the stock will revert to its average dividend yield over the next year, it could rise by over 15%.

That makes it easy to either just own Chevron shares or also sell out-of-the-money (OTM) put options, to set a lower potential price. That way, an investor can get paid a monthly income while waiting to buy in at a lower price.

Shorting OTM Chevron Puts

I discussed a similar play in my previous article. I suggested selling short the $140 strike price expiring Dec. 26, 2025 put for a premium of 98 cents. That provided the short-seller an immediate yield of 0.70% over the last month for a strike price about 6% below the trading price.

On Friday, those puts are down to just 7 cents at the midpoint. In other words, it's been a successful short play. It makes sense to roll this over to next month sometime this week.

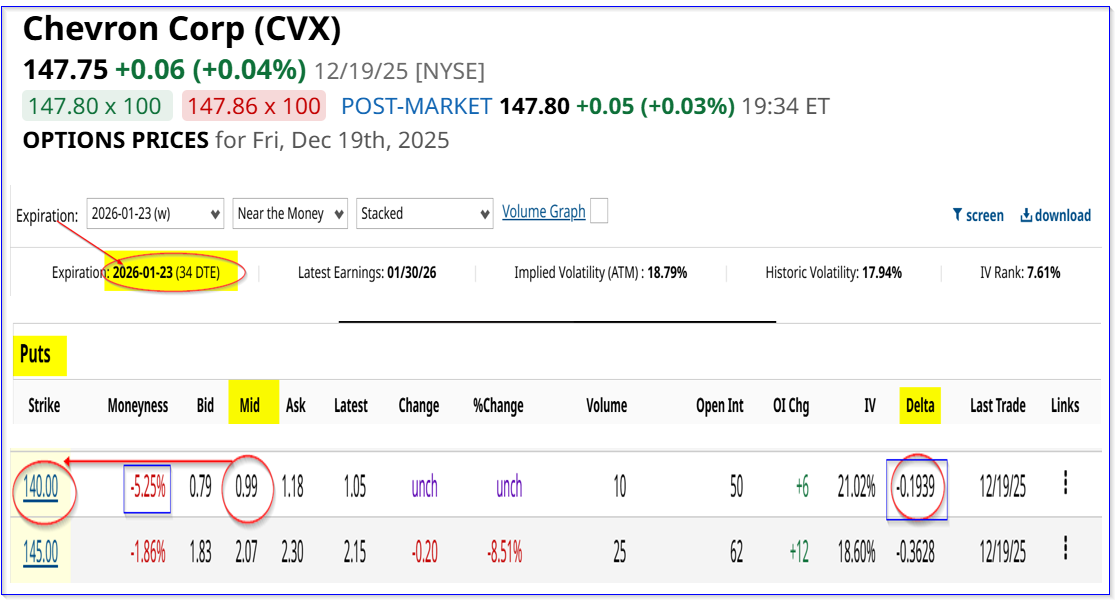

For example, the Jan. 23, 2026, expiry chain shows that the $140 strike price put contract has a midpoint premium of 99 cents. That's close to last month's income.

(Click on image to enlarge)

Image Source: Barchart - Chevron puts expiring Jan. 23, 2026, as of Dec. 19, 2025

This provides an investor who secures $14,000 with their brokerage firm an immediate income of $99. That works out to a one-month yield of 0.707% for the next month.

In other words, if an investor can keep doing this trade each month over the next year, the expected return is 8.4852%. That is over half of the expected 15% upside in Chevron stock.

Downside Risks

Moreover, there appears to low downside here. The delta ratio is only -19.39%, implying less than a 20% chance that Chevron will fall to $140 over the next 34 days. That is based on past volatility patterns.

And even if that occurs, the breakeven point is $139.01 (i.e., $140 - $0.99). That is 5.92% lower than Friday's close. Moreover, it might possibly be lower, depending on how many months the investor has gained income by shorting OTM puts.

The bottom line is the Chevron stock looks cheap here, based on its average dividend yield. One way to play it is to sell short OTM puts for income.

More By This Author:

ConocoPhillips Stock Still Looks 18% Undervalued - How To Play COP Stock?Oracle's Unusual Put Options Activity - A Contrarian Signal - Should Investors Buy ORCL Stock?

PayPal's Strong Free Cash Flow And Margins Could Push PYPL +17% Stock Higher

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more